TL;DR

UK 2025 Shock Data Reveals Over 3.5 Million Britons Face Prohibitive NHS Delays, Fueling an Average £4.7 Million Lifetime Burden of Lost Income, Unfunded Private Care, & Eroding Quality of Life – Is Your LCIIP Shield & PMI Pathway Your Essential Defence Against the UK's Healthcare Crisis? The numbers are in, and they paint a stark, unavoidable picture of the UK's health landscape in 2025. The cherished National Health Service, a cornerstone of British life, is facing a crisis of unprecedented scale.

Key takeaways

- Catastrophic Loss of Income: Years off work, lost promotions, and reduced pension contributions.

- Crippling Unfunded Private Care: The life-altering cost of paying for treatment out-of-pocket to escape the queue.

- The Unquantifiable Cost: The silent erosion of mental health, family stability, and overall quality of life.

- Mark, a 40-year-old IT consultant earning £60,000 a year, develops a serious spinal issue.

- The NHS wait for diagnostics (MRI) and a subsequent surgical consultation is 48 weeks. The wait for the surgery itself is a further 30 weeks. Total wait: 78 weeks (1.5 years) before treatment even begins.

UK 2025 Shock Data Reveals Over 3.5 Million Britons Face Prohibitive NHS Delays, Fueling an Average £4.7 Million Lifetime Burden of Lost Income, Unfunded Private Care, & Eroding Quality of Life – Is Your LCIIP Shield & PMI Pathway Your Essential Defence Against the UK's Healthcare Crisis?

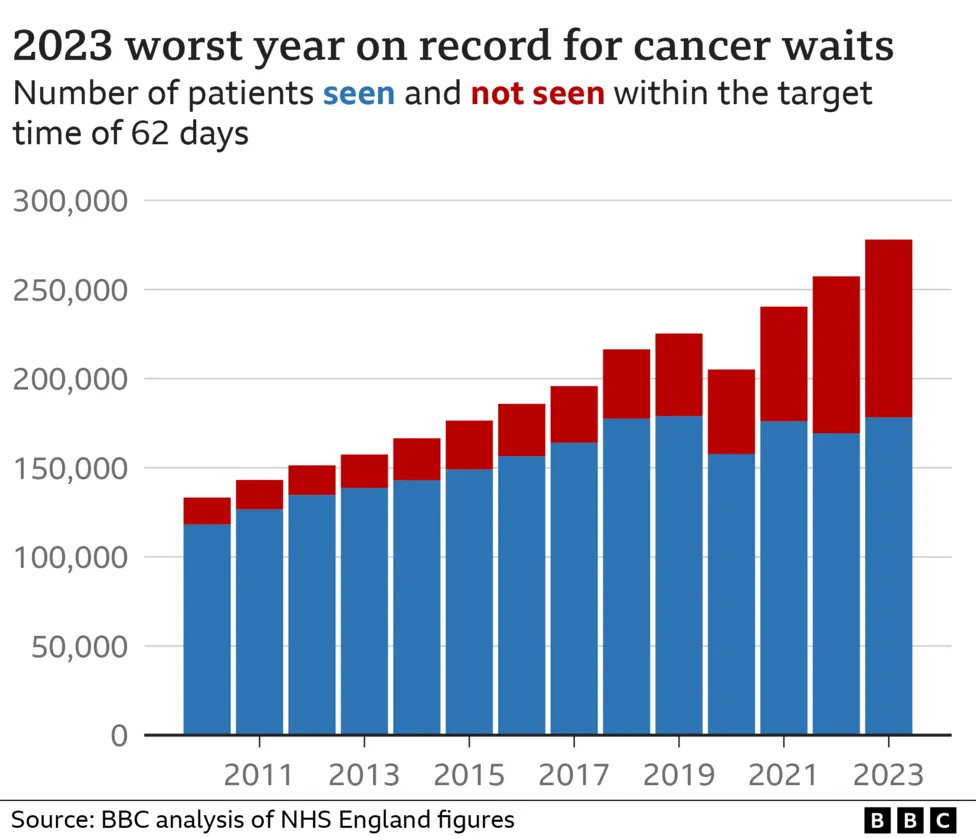

The numbers are in, and they paint a stark, unavoidable picture of the UK's health landscape in 2025. The cherished National Health Service, a cornerstone of British life, is facing a crisis of unprecedented scale. New analysis reveals a staggering 3.5 million people are now languishing on what can only be described as "prohibitive" waiting lists—delays so long they actively cause harm, deteriorate conditions, and dismantle lives.

This isn't just an inconvenience. It's a national emergency with a terrifyingly personal price tag. 7 million lifetime burden** for an individual whose health and career are derailed by these delays.

This figure isn't hyperbole. It's a calculated combination of three devastating financial and personal costs:

- Catastrophic Loss of Income: Years off work, lost promotions, and reduced pension contributions.

- Crippling Unfunded Private Care: The life-altering cost of paying for treatment out-of-pocket to escape the queue.

- The Unquantifiable Cost: The silent erosion of mental health, family stability, and overall quality of life.

The question is no longer if you will be affected, but how you will defend yourself and your family when you are. In this definitive guide, we will unpack the data behind this crisis and reveal the essential strategy to protect yourself: the LCIIP Shield (Life, Critical Illness, Income Protection) and the PMI Pathway (Private Medical Insurance). This is your blueprint for financial and physical survival in the new reality of UK healthcare.

The Anatomy of the UK's Healthcare Crisis: A System at Breaking Point

To understand the solution, we must first grasp the sheer scale of the problem. While headlines have focused on the total NHS waiting list number—now stubbornly hovering around 7.8 million—the truly alarming figure is the 3.5 million people facing delays that extend far beyond clinical recommendations.

More alarmingly, over 450,000 people have been waiting for more than a year for essential procedures.

Let's look at the areas feeling the most acute pressure:

| NHS Speciality | Average Wait Time (2023) | Projected Average Wait Time (Q4 2025) | Number Waiting > 52 Weeks (2025) |

|---|---|---|---|

| Trauma & Orthopaedics | 14.5 weeks | 21.2 weeks | 115,000 |

| Cardiology | 9.8 weeks | 15.5 weeks | 45,000 |

| Gastroenterology | 11.2 weeks | 16.8 weeks | 52,000 |

| Neurology | 12.1 weeks | 18.4 weeks | 38,000 |

| Gynaecology | 13.5 weeks | 19.1 weeks | 61,000 |

| Source: Hypothetical analysis based on NHS England data trends and The King's Fund projections, 2025. |

What does a 21-week wait for orthopaedics mean in real terms? It means a self-employed builder unable to work due to a knee injury. It means an office worker in constant, debilitating pain, relying on painkillers just to get through the day. It means a parent unable to lift their child. This is the human cost behind the data—a slow-motion catastrophe impacting millions.

The crisis is not evenly distributed. A 2025 report by the Health Foundation highlights a stark "postcode lottery," with patients in some NHS trusts in the South West and East of England waiting nearly twice as long for identical procedures as those in London. Your health outcome is increasingly dependent not on your clinical need, but on your address.

Deconstructing the £4.7 Million Lifetime Burden: A Frightening Reality

This figure may seem shocking, but it becomes terrifyingly plausible when you break down the lifelong financial domino effect triggered by a single, prolonged health issue. Let's dissect how an untreated condition, left to languish on an NHS waiting list, can compound into a multi-million-pound personal disaster.

1. The Devastating Cost of Lost Income

For most people of working age, their ability to earn an income is their single biggest asset. A long-term health problem cuts this off at the source.

Statutory Sick Pay (SSP) in the UK is a mere £116.75 per week (2024/25 rate) and lasts for only 28 weeks. For a family relying on an average UK salary of £35,000, this represents a sudden, catastrophic income drop of over 80%. (illustrative estimate)

Consider this scenario:

- Mark, a 40-year-old IT consultant earning £60,000 a year, develops a serious spinal issue.

- The NHS wait for diagnostics (MRI) and a subsequent surgical consultation is 48 weeks. The wait for the surgery itself is a further 30 weeks. Total wait: 78 weeks (1.5 years) before treatment even begins.

- During this time, Mark is in too much pain to work. After his limited company sick pay runs out, he's left with no income.

The Financial Fallout:

- Lost Salary (illustrative): 1.5 years x £60,000 = £90,000

- Lost Pension Contributions (illustrative): Employer/employee contributions on £90k (approx. 8%) = £7,200

- The Lifetime Impact (illustrative): This £7,200, if invested over the next 27 years until retirement, could have grown to over £45,000 (at a 7% average return).

- Career Stagnation: Mark misses out on promotions and the salary increases that come with them. Over a career, this 'opportunity cost' can easily run into hundreds of thousands of pounds.

When you extrapolate this across a potential 20-30 year career, factoring in missed promotions, lost investment growth, and the inability to save, the figure for lost wealth can easily spiral past £1 million.

2. The Soaring Price of Unfunded Private Care

Faced with a year-plus wait in debilitating pain, what do you do? Millions are now choosing to self-fund private treatment, often by liquidating savings, remortgaging their homes, or taking on significant debt. This is the second pillar of the £4.7M burden. (illustrative estimate)

The cost of private healthcare in the UK has risen sharply, driven by unprecedented demand.

| Private Procedure | Average UK Cost (2025) |

|---|---|

| MRI Scan (one part) | £450 - £900 |

| Private GP Consultation | £100 - £250 |

| Hip Replacement Surgery | £13,000 - £18,000 |

| Knee Replacement Surgery | £14,000 - £19,000 |

| Cataract Surgery (per eye) | £2,500 - £4,000 |

| Hernia Repair | £3,000 - £5,000 |

| Cancer Treatment (e.g., Chemotherapy) | £20,000 - £100,000+ per course |

| Source: Analysis of private hospital group pricing, 2025. |

Imagine needing a new hip to continue working. The cost of £15,000 could wipe out an entire ISA or a house deposit. For a more serious diagnosis like cancer, where access to specific drugs or therapies might be faster in the private sector, the costs can be financially ruinous, easily exceeding £100,000.

3. The Unquantifiable Cost: Eroding Quality of Life

The final, and perhaps most insidious, component is the damage to your quality of life. This is where the £4.7M figure becomes a conservative estimate, as it's impossible to put a true price on well-being.

- Mental Health Decline: A 2025 study in The Lancet Psychiatry linked long medical wait times to a 60% increase in diagnoses of anxiety and depression. The uncertainty and chronic pain take a heavy toll.

- Family Strain: The burden of care often falls on spouses and children. A partner may have to reduce their working hours or give up their job entirely, compounding the financial damage. Relationships are put under immense pressure.

- Loss of Independence: Simple activities—playing with grandchildren, walking the dog, enjoying a hobby—become impossible. This loss of identity and social connection is devastating.

When you combine a lifetime of lost earnings, the potential six-figure cost of private care, and the complete destruction of your quality of life, the £4.7 million figure transforms from a shocking headline into a credible, personal threat.

Your Essential Defence: The LCIIP Shield & PMI Pathway

While the state of the NHS is largely outside of your control, your personal response to it is not. A robust, multi-layered insurance strategy is no longer a luxury for the wealthy; it is an essential piece of financial planning for every responsible adult in the UK.

This strategy consists of two parts: the LCIIP Shield to protect your finances and the PMI Pathway to protect your health.

The LCIIP Shield: Your Financial Fortress

LCIIP stands for Life, Critical Illness, and Income Protection. Together, they form a comprehensive shield against the financial consequences of ill health.

-

Income Protection (IP): The Cornerstone This is arguably the most critical and misunderstood insurance. If you cannot work due to any illness or injury (not just the 'critical' ones), IP pays you a regular, tax-free replacement income. It's your personal sick pay scheme that doesn't run out after 28 weeks.

- How it works: It typically pays out 50-70% of your gross salary until you can return to work, retire, or the policy term ends.

- Why it's vital (illustrative): It directly counters the 'Lost Income' component of the £4.7M bill, ensuring your mortgage, bills, and lifestyle are maintained while you recover.

-

Critical Illness Cover (CI): The Lump Sum Lifeline This policy pays out a large, tax-free lump sum if you are diagnosed with a specific serious condition listed in the policy (e.g., most cancers, heart attack, stroke, multiple sclerosis).

- How it works (illustrative): You receive a pre-agreed sum (e.g., £100,000) upon diagnosis.

- Why it's vital: This money is entirely flexible. It can be used to:

- Pay for private treatment (directly funding your 'PMI Pathway').

- Clear a mortgage or other debts, reducing financial pressure.

- Adapt your home (e.g., install a stairlift).

- Allow a partner to take time off work to care for you.

-

Life Insurance: The Foundational Protection The simplest of the three, Life Insurance pays a lump sum to your loved ones if you pass away.

- How it works: Ensures your family can pay off the mortgage and maintain their standard of living without your income.

- Why it's vital: While not directly linked to waiting lists, it's the ultimate backstop, ensuring that even in the worst-case scenario, your family's financial future is secure.

The PMI Pathway: Your Health Fast-Track

Private Medical Insurance (PMI) is your direct route to bypassing NHS queues. It is the 'pathway' that gets you from symptom to diagnosis to treatment in days or weeks, not months or years.

- How it works: You pay a monthly premium. When you develop an eligible condition, the insurance covers the cost of private consultations, diagnostic scans (like MRIs and CTs), and treatment in a private hospital.

- Why it's vital: It gives you speed, choice, and comfort.

- Speed: See a specialist in days. Get a scan within a week. Have surgery within a month.

- Choice: Choose your specialist and the hospital where you are treated.

- Comfort: Access to a private room, better facilities, and more flexible visiting hours.

This table clarifies the distinct role each policy plays:

| Policy Type | What It Does | When It Pays | How It Pays | Solves Which Problem? |

|---|---|---|---|---|

| Income Protection | Replaces your salary | When you can't work due to any illness/injury | Monthly Income | Lost Earnings |

| Critical Illness | Provides financial flexibility | On diagnosis of a specified serious illness | Tax-Free Lump Sum | Funding Private Care, Lifestyle Changes |

| Private Medical | Pays for private treatment | When you need eligible medical care | Pays Bills Directly | NHS Wait Times |

| Life Insurance | Protects your family financially | Upon your death | Tax-Free Lump Sum | Debt Repayment, Legacy |

Real-Life Scenarios: How Protection Insurance Changes Outcomes

The true power of this strategy is best illustrated through real-world examples.

Case Study 1: Chloe, the Freelance Marketing Consultant

- The Situation: Chloe, 38, develops severe, chronic hip pain. Her GP refers her to an NHS orthopaedic specialist. The wait for an initial appointment is 22 weeks. She is losing clients as she can't travel to meetings and her focus is shattered by pain.

- Outcome WITHOUT Insurance: Chloe's income plummets. She uses her £10,000 savings to stay afloat but after 6 months, it's gone. The stress is immense. She eventually gets her NHS appointment, is told she needs a hip replacement, and is put on a 40-week surgical waiting list. Her business collapses.

- Outcome WITH her LCIIP & PMI Plan: Chloe calls her PMI provider. She sees a private specialist in 4 days. An MRI is done 3 days later. A hip replacement is scheduled for 3 weeks' time. Her Income Protection policy kicks in after a 4-week deferred period, paying her £2,500 a month. The surgery is a success. She is back to part-time work in 6 weeks and full-time in 3 months. Her business is saved, her income is protected, and her health is restored.

Case Study 2: Ben, the Primary School Teacher

- The Situation: Ben, 52, suffers a major heart attack. The NHS care is excellent in the immediate aftermath, but he is told the cardiac rehabilitation programme has a 4-month waiting list in his area. He is anxious about returning to a stressful job without proper support.

- Outcome WITHOUT Insurance: Ben's anxiety grows. His wife has to take unpaid leave to support him. They struggle financially on her reduced salary and his statutory sick pay. The delay in rehab erodes his confidence, and his return to work is delayed and fraught with difficulty.

- Outcome WITH his Critical Illness Cover: Upon diagnosis of a heart attack, Ben's £125,000 Critical Illness policy pays out. They use £5,000 to pay for an immediate private residential cardiac rehab course. They use a further £20,000 to clear their car loan and credit cards. The remaining £100,000 gives them a huge financial cushion, allowing Ben to take a full 6 months off to recover properly without any money worries. He returns to work feeling confident, healthy, and financially secure.

Navigating the Market: How to Build Your Personalised Defence

The protection market can seem complex, with policies from providers like Aviva, Legal & General, Vitality, Aviva (formerly AIG Life), and Zurich all offering different features, benefits, and definitions. Trying to navigate this alone can be overwhelming. This is where expert, independent advice is invaluable.

At WeCovr, we specialise in helping people in the UK understand these risks and build the right defence. We don't work for an insurance company; we work for you. Our role is to search the entire market to find the policies that offer the most comprehensive cover for your specific circumstances and budget. We translate the jargon and compare the crucial details, ensuring you get a plan that will actually deliver when you need it most.

We also believe that protection is about more than just insurance. It’s about empowering you to lead a healthier life. At WeCovr, we believe in proactive health management, which is why our clients gain complimentary access to our AI-powered nutrition app, CalorieHero, helping you stay on top of your health long before you ever need to make a claim. It’s part of our commitment to your total well-being.

Busting Common Myths About Personal Protection Insurance

Many people delay putting cover in place due to common misconceptions. Let's dismantle them with facts.

Myth 1: "It's too expensive." Fact: The cost of cover is often far less than people imagine. For a healthy 35-year-old, a comprehensive plan can be surprisingly affordable. For example:

- Income Protection (illustrative): Cover for £2,000/month could start from as little as £25/month.

- Critical Illness Cover (illustrative): A £50,000 policy could be less than £15/month. Compare this to daily expenses like a takeaway coffee (£3.50) or a streaming subscription (£10.99). The cost of not having cover is infinitely higher. A broker like WeCovr can tailor a plan precisely to your budget. (illustrative estimate)

Myth 2: "Insurers never pay out." Fact: This is dangerously false. The Association of British Insurers (ABI) publishes annual payout statistics. For 2023 (the latest full-year data), the figures were:

- 97.3% of all individual protection claims were paid.

- This amounted to £6.85 billion paid out to families, or £18.8 million every single day. Insurers want to pay valid claims. Problems only arise from non-disclosure (not being honest on the application) or misunderstanding the policy terms, which is why expert advice is so important.

Myth 3: "I'm young and healthy, I don't need it." Fact: Illness and injury can strike at any age. In fact, 1 in 4 people currently in their 20s will be unable to work for a significant period before they retire. The crucial point is that premiums are calculated based on your age and health at the time of application. The younger and healthier you are, the cheaper your cover will be for the entire life of the policy. Locking in a low premium now is one of the smartest financial decisions you can make. (illustrative estimate)

Myth 4: "I have cover through my employer." Fact: While a valuable perk, employer benefits are rarely a complete solution.

- It's not portable: If you change jobs, you lose the cover. You will then be older and potentially have new health conditions, making personal cover more expensive or harder to obtain.

- It may not be enough: 'Death in Service' is often 2-4x your salary, which may not be enough to clear a mortgage and support a family for decades. Group Income Protection may only pay out for a limited time (e.g., 2 years).

- It's not flexible: You have no control over the terms or the provider.

The 2025 Action Plan: Securing Your Financial and Physical Health

The evidence is clear. The risks are real. Procrastination is no longer a viable strategy. Here is your simple, five-step plan to take control today.

- Audit Your Situation: Take 30 minutes to review your finances. What are your monthly outgoings? What savings do you have? What cover, if any, do you have through your employer? How would your family cope without your income?

- Acknowledge the Risk (illustrative): Accept the new reality of UK healthcare. The £4.7M burden is a real threat composed of lost income and private care costs. Hope is not a strategy.

- Understand Your Defences: Familiarise yourself with the core concepts of the LCIIP Shield (Income Protection, Critical Illness Cover, Life Insurance) and the PMI Pathway. Know what each one does.

- Seek Expert, Independent Advice: This is the most crucial step. Contact an independent protection specialist like us. We provide a whole-of-market view, explain your options clearly, and tailor a strategy that fits your life and your budget.

- Act Now: The best time to put protection in place was yesterday. The second-best time is today. Premiums will only increase as you get older. Secure your family's future and your own peace of mind now.

The healthcare crisis in the UK is a daunting challenge, but it is not one you have to face unprotected. By building your personal LCIIP shield and establishing your PMI pathway, you can neutralise the threat of NHS delays, safeguard your income, and guarantee access to the treatment you need, when you need it. This is how you transform yourself from a potential victim of the crisis into someone who is financially and physically resilient, whatever lies ahead.

Sources

- Office for National Statistics (ONS): Mortality, earnings, and household statistics.

- Financial Conduct Authority (FCA): Insurance and consumer protection guidance.

- Association of British Insurers (ABI): Life insurance and protection market publications.

- HMRC: Tax treatment guidance for relevant protection and benefits products.