TL;DR

With over 8 million Britons now navigating the UK's longest ever NHS waiting lists, discover how private health insurance offers immediate access to expert consultations, rapid diagnostics, and timely treatment, ensuring your health is never compromised by delay The National Health Service (NHS) is a national treasure, a cornerstone of British society providing remarkable care to millions. Yet, it is currently facing its greatest challenge. Unprecedented demand, funding pressures, and the lingering effects of the pandemic have culminated in record-breaking waiting lists, leaving millions of people in a state of anxious uncertainty.

Key takeaways

- The 18-Week Target: This target has not been met nationally since 2016. The current reality is that the average (median) wait time is approaching 15 weeks, with hundreds of thousands waiting far longer.

- The Longest Waits: Over 400,000 patients have been waiting for more than a year (52 weeks) for treatment. This is a staggering increase from the pre-pandemic figure, which was typically under 2,000.

- Diagnostic Delays: The wait for crucial diagnostic tests like MRI scans, CT scans, and endoscopies is a major bottleneck. The target is for 99% of patients to wait less than 6 weeks for a diagnostic test. Currently, over 20% of patients are waiting longer, delaying diagnosis and subsequent treatment plans.

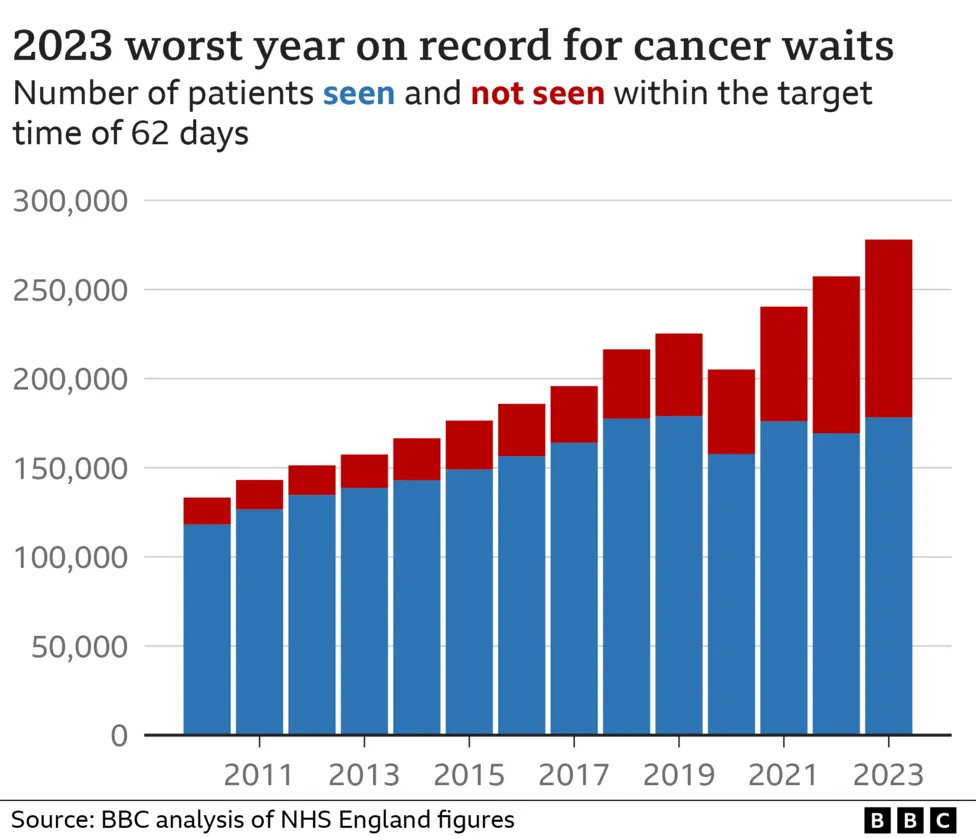

- Cancer Care: While urgent cancer referrals are prioritised, the system is still under strain. The operational standard is that 85% of patients should start their first treatment for cancer within 62 days of an urgent GP referral. This target is consistently being missed, creating immense anxiety for patients at their most vulnerable.

- Deteriorating Health: Conditions can worsen over time. A treatable knee issue can develop into chronic pain requiring more complex surgery and a longer recovery.

With over 8 million Britons now navigating the UK's longest ever NHS waiting lists, discover how private health insurance offers immediate access to expert consultations, rapid diagnostics, and timely treatment, ensuring your health is never compromised by delay

The National Health Service (NHS) is a national treasure, a cornerstone of British society providing remarkable care to millions. Yet, it is currently facing its greatest challenge. Unprecedented demand, funding pressures, and the lingering effects of the pandemic have culminated in record-breaking waiting lists, leaving millions of people in a state of anxious uncertainty.

As of early 2025, the number of people in England waiting for routine hospital treatment has surged past the 8 million mark. This isn't just a statistic; it represents individuals living with pain, mobility issues, and the profound mental strain of not knowing when they will receive the care they need. For many, a referral from their GP is the start of a long and frustrating journey, measured not in weeks, but in months or even years.

In this climate, a growing number of Britons are exploring a parallel path to healthcare: private medical insurance (PMI). Far from being a replacement for the NHS, PMI acts as a powerful complement, offering a solution to the single most pressing issue for patients today—delay. It provides a direct route to prompt specialist consultations, swift diagnostic tests, and timely surgery, empowering you to take back control of your health journey.

This definitive guide will unpack the stark reality of current NHS wait times and explore exactly how private health insurance can provide a vital lifeline, ensuring your health and wellbeing are prioritised, without the wait.

The Stark Reality: Understanding the NHS Waiting List Crisis in 2025

To fully appreciate the value of an alternative, we must first grasp the scale of the challenge within the NHS. The figures are sobering and paint a picture of a system stretched to its absolute limit. While the dedication of NHS staff remains unwavering, the structural delays are undeniable.

A Deep Dive into the Data

The headline figure of over 8 million people on the waiting list is just the tip of the iceberg. The crucial metric is how long people are waiting. The NHS Constitution for England sets a target that over 92% of patients should wait no more than 18 weeks from their GP referral to receiving treatment (the Referral to Treatment or RTT pathway).

- The 18-Week Target: This target has not been met nationally since 2016. The current reality is that the average (median) wait time is approaching 15 weeks, with hundreds of thousands waiting far longer.

- The Longest Waits: Over 400,000 patients have been waiting for more than a year (52 weeks) for treatment. This is a staggering increase from the pre-pandemic figure, which was typically under 2,000.

- Diagnostic Delays: The wait for crucial diagnostic tests like MRI scans, CT scans, and endoscopies is a major bottleneck. The target is for 99% of patients to wait less than 6 weeks for a diagnostic test. Currently, over 20% of patients are waiting longer, delaying diagnosis and subsequent treatment plans.

- Cancer Care: While urgent cancer referrals are prioritised, the system is still under strain. The operational standard is that 85% of patients should start their first treatment for cancer within 62 days of an urgent GP referral. This target is consistently being missed, creating immense anxiety for patients at their most vulnerable.

To put this into context, let's look at the average waiting times for some common elective procedures.

| Procedure | NHS Target Wait (RTT) | 2025 Average NHS Wait | Typical Private Sector Wait |

|---|---|---|---|

| Hip Replacement | 18 Weeks | 45-50 Weeks | 4-6 Weeks |

| Knee Replacement | 18 Weeks | 48-55 Weeks | 4-6 Weeks |

| Cataract Surgery | 18 Weeks | 30-35 Weeks | 2-4 Weeks |

| Hernia Repair | 18 Weeks | 35-40 Weeks | 3-5 Weeks |

| Gallbladder Removal | 18 Weeks | 38-42 Weeks | 3-5 Weeks |

Source: Analysis of NHS England RTT data and private hospital network estimates, 2025.

The Human Cost of Waiting

Behind these statistics are real people whose lives are put on hold. The consequences of long waits extend far beyond the physical symptoms:

- Deteriorating Health: Conditions can worsen over time. A treatable knee issue can develop into chronic pain requiring more complex surgery and a longer recovery.

- Mental Health Impact: The uncertainty and anxiety of waiting for a diagnosis or treatment can be debilitating, leading to stress, depression, and a significant decline in overall wellbeing.

- Inability to Work: For many, living with a painful condition means being unable to perform their job, leading to a loss of income and financial hardship. This is particularly acute for the self-employed or those in manual labour.

- Reduced Quality of Life: Simple daily activities—playing with grandchildren, walking the dog, enjoying a hobby—can become impossible, leading to social isolation and a loss of independence.

Consider the case of a 55-year-old self-employed electrician with severe hip pain. An NHS wait of a year for a hip replacement means a year of being unable to work, a year of lost earnings, and a year of living in constant pain. With private health insurance, that same person could potentially be back on their feet and earning again within three to four months. This is the transformative power of timely access.

What is Private Medical Insurance (PMI) and How Does It Work?

Private Medical Insurance, often called private health insurance, is a policy you pay a monthly or annual premium for. In return, it covers the costs of eligible private medical care for specific health conditions that arise after you take out the policy.

It's designed to work in partnership with the NHS. You will still rely on your NHS GP for initial consultations and the NHS for A&E services and the management of long-term health issues. PMI is your key to unlocking faster access to specialist care and treatment when you are diagnosed with a new, treatable condition.

The Absolute Rule: Acute vs. Chronic Conditions

This is the single most important concept to understand about UK private health insurance. Standard policies are designed to cover acute conditions, not chronic ones.

- Acute Condition: A disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery. Examples include cataracts, hernias, joint problems requiring replacement, gallstones, and most forms of cancer.

- Chronic Condition: A disease, illness, or injury that is long-lasting. It may have no known cure and requires ongoing management or monitoring. Examples include diabetes, asthma, hypertension, arthritis, and Crohn's disease.

To be unequivocally clear: Standard UK private health insurance does not cover the routine management of chronic conditions. If you have diabetes, your policy will not pay for your regular check-ups or insulin. If you have asthma, it will not cover your inhalers. PMI is for new, curable conditions that start after your policy begins.

The Barrier: Pre-Existing Conditions

Insurers will also not cover medical conditions you have had symptoms of, or received treatment, medication, or advice for, in the years immediately before you took out the policy. This is known as a pre-existing condition. How insurers handle this is determined by the type of underwriting you choose.

Understanding Your Underwriting Options

| Underwriting Type | How It Works | Pros | Cons |

|---|---|---|---|

| Moratorium (Most Common) | You don't declare your medical history upfront. The insurer automatically excludes any condition you've had in the last 5 years. | Quick and easy to set up. | Can be uncertainty at the point of claim. |

| If you then go for a continuous 2-year period after your policy starts with no symptoms, treatment, or advice for that condition, the insurer may cover it in the future. | Less initial paperwork. | You may not know if a condition is covered until you need to claim. | |

| Full Medical Underwriting (FMU) | You complete a detailed health questionnaire, declaring your full medical history. | Provides certainty from day one. | Application process is longer and more involved. |

| The insurer assesses your history and tells you precisely what is and isn't covered, usually in the form of permanent exclusions. | You know exactly where you stand. | Exclusions for past conditions are often permanent. |

The Private Patient Journey: A Step-by-Step Example

So, how does it work in practice? Let's follow a typical journey:

- The Symptom: You develop a persistent, painful shoulder.

- The GP Visit: You visit your NHS GP, who examines you and suspects a torn rotator cuff. They refer you to an orthopaedic specialist. While some insurers now offer a digital GP service, a referral from your own GP is the most common starting point.

- The Crossroads: At this point, you have two choices:

- NHS Pathway: You are added to the NHS waiting list for an orthopaedic consultation, which could be several months away. Following that, you'll join another queue for an MRI scan, and then a final, long queue for surgery.

- Private Pathway: You call your insurance provider's helpline.

- Authorisation: You provide your insurer with the details of your GP referral. They check your policy cover and authorise a private consultation. They may give you a list of approved specialists in your area.

- Swift Consultation: You book an appointment and see the private orthopaedic specialist, often within a week or two.

- Rapid Diagnostics: The specialist confirms an MRI is needed. You get authorisation from your insurer and have the scan done at a private clinic, sometimes within 48 hours.

- Timely Treatment: The scan confirms a tear requiring surgery. Your insurer pre-authorises the procedure. You book the surgery at a private hospital of your choice at a time that suits you, usually within a few weeks.

- Recovery: You have the operation in a private hospital, often with an en-suite room and more flexible visiting hours, and begin your rehabilitation.

This streamlined process is the core promise of private health insurance: bypassing the queues to get you from symptom to solution as quickly as possible.

The Tangible Benefits: How PMI Directly Tackles Waiting Times

The primary advantage of private health insurance is speed. It directly addresses each of the bottlenecks in the public system, giving you tangible benefits that can dramatically improve your health outcome and quality of life.

1. Rapid Access to Specialist Consultants

An initial consultation with a specialist is the gateway to any diagnosis and treatment plan. A long wait here is a long wait for answers. While the NHS aims for urgent cancer referrals to be seen within two weeks, referrals for most other conditions can take many months. With PMI, you can typically see a leading consultant in their field within a matter of days or weeks. This speed provides immense peace of mind and gets the ball rolling on your treatment immediately.

2. Swift Diagnostics

The NHS is facing a "diagnostic bottleneck," with demand for scans like MRIs and CTs far outstripping capacity. Waiting weeks or months for a scan means waiting weeks or months for a definitive diagnosis, leaving you in limbo. Private healthcare providers have their own dedicated diagnostic facilities, allowing you to get these crucial tests done incredibly quickly.

Typical NHS vs. Private Wait Times for Key Diagnostics (2025 Estimates)

| Diagnostic Test | Typical NHS Wait | Typical Private Wait with PMI |

|---|---|---|

| MRI Scan | 8 - 12 Weeks | 2 - 7 Days |

| CT Scan | 6 - 10 Weeks | 2 - 7 Days |

| Ultrasound | 6 - 8 Weeks | 3 - 10 Days |

| Endoscopy / Colonoscopy | 14 - 20 Weeks | 1 - 3 Weeks |

This speed is not just about convenience; it's about clinical necessity. For conditions like cancer, an early, precise diagnosis is critical to successful treatment.

3. Timely Treatment and Surgery

This is the ultimate benefit. Once a diagnosis is made and a treatment plan is agreed upon, PMI allows you to schedule your surgery or procedure without delay. You can book it at a time that minimises disruption to your work and family life, rather than having to accept a date given to you many months in the future. This puts you in control and ensures your condition is treated before it has a chance to worsen.

4. Enhanced Comfort and Choice

While speed is the main driver, the patient experience is also a significant factor. Private hospitals typically offer:

- A private, en-suite room

- More flexible visiting hours for family and friends

- A wider choice of food from an à la carte menu

- Free TV and Wi-Fi

Furthermore, many policies give you a choice of consultant and a list of high-quality private hospitals to choose from, giving you greater control over where and by whom you are treated.

5. Access to Specialist Drugs and Treatments

Occasionally, there are new, innovative drugs or treatments that have been approved for use by the National Institute for Health and Care Excellence (NICE) but are not yet widely available on the NHS due to commissioning or funding delays. Many comprehensive PMI policies include cover for these treatments, giving you access to the very latest medical advancements.

Demystifying the Costs: Is Private Health Insurance Affordable?

The cost of private health insurance is a key consideration for most people. There is no one-size-fits-all price; your premium is a personalised calculation based on several key factors. Understanding these factors is the first step to finding a policy that provides the cover you need at a price you can afford.

Key Factors Influencing Your Premium

- Age: This is the most significant factor. The likelihood of needing medical treatment increases as we get older, so premiums rise with age.

- Location: Where you live matters. The cost of private treatment varies across the country, with Central London being the most expensive. Your postcode will influence your premium.

- Level of Cover: Policies are typically tiered, allowing you to choose how comprehensive you want your cover to be.

- Basic/Essential: Covers the most expensive treatments, focusing on in-patient and day-patient care (i.e., when you need a hospital bed). Out-patient cover is usually not included.

- Mid-Range: The most popular choice. It includes full in-patient cover plus a set limit for out-patient services like specialist consultations and diagnostic scans (e.g., up to £1,000 per year).

- Comprehensive: Offers full in-patient cover and extensive (or unlimited) out-patient cover. These plans often include additional benefits like mental health support, dental, and optical cover.

- The Excess: This is the amount you agree to pay towards the cost of a claim. For example, if you have a £250 excess and your treatment costs £5,000, you pay the first £250 and the insurer pays the remaining £4,750. Choosing a higher excess will significantly lower your monthly premium.

- Hospital List: Insurers have different lists of hospitals where you can receive treatment. Choosing a more limited list that excludes the most expensive city-centre hospitals can be a very effective way to reduce your premium.

- No-Claims Discount: Similar to car insurance, you can build up a no-claims discount over time, which can lead to lower renewal premiums if you don't make a claim.

Illustrative Monthly Premiums

The table below gives an indication of what you might expect to pay. These are for illustrative purposes only, for a non-smoker on a mid-range plan with a £250 excess.

| Age | Estimated Monthly Premium |

|---|---|

| 30-year-old | £40 - £60 |

| 45-year-old | £65 - £90 |

| 60-year-old | £110 - £160 |

Finding the right balance of cost and cover can be complex. That's where an expert broker like WeCovr comes in. We compare plans from all the UK's leading insurers—including Bupa, AXA Health, Aviva, and Vitality—to find a policy that fits your specific needs and budget, ensuring you don't pay for cover you don't need.

What's Covered and What's Not? A Closer Look at PMI Policies

Managing your expectations is crucial. While PMI offers incredible benefits, it is not designed to cover every eventuality. It is vital to be clear on what is typically included and what is always excluded.

| What's Typically Covered? | What's Typically Excluded? | |

|---|---|---|

| Core Cover | ✅ Surgery and treatment as an in-patient or day-patient | ❌ Pre-existing conditions |

| ✅ Specialist consultations and diagnostic tests (out-patient) | ❌ Chronic conditions (long-term management) | |

| ✅ Comprehensive cancer care (a cornerstone of most policies) | ❌ Emergency services (A&E visits) | |

| ✅ Private hospital room and nursing care | ❌ Normal pregnancy and childbirth | |

| Common Add-ons | ✅ Mental health support (therapy and counselling) | ❌ Cosmetic surgery (unless medically necessary) |

| ✅ Physiotherapy and complementary therapies | ❌ Organ transplants | |

| ✅ Dental and optical cover | ❌ Treatment for addiction (alcohol/drugs) |

The Indispensable Role of the NHS

It cannot be stressed enough: PMI works alongside the NHS. It does not replace it. You will always need the NHS for:

- Accidents and Emergencies: If you have a heart attack, a stroke, or are in a serious accident, you go to your local A&E.

- GP Services: Your NHS GP remains your first point of contact for any health concern.

- Chronic Condition Management: The NHS will continue to manage any long-term conditions like diabetes or high blood pressure.

Think of PMI as your express lane for planned, specialist care for new, acute conditions, while the NHS provides the comprehensive, cradle-to-grave safety net for everything else.

Choosing the Right Policy: A Step-by-Step Guide

Navigating the private health insurance market can feel daunting. By following a structured approach, you can simplify the process and find the perfect policy for you.

Step 1: Assess Your Needs and Budget

Start by asking yourself some key questions:

- What is my maximum monthly budget?

- Is comprehensive cancer cover my top priority?

- Do I want cover for therapies like physiotherapy?

- Am I happy with a local hospital list, or do I want nationwide access?

- How much excess could I comfortably afford to pay if I needed to claim?

Step 2: Understand the Jargon

Familiarise yourself with the key terms: excess, out-patient limit, hospital list, moratorium vs. full medical underwriting. Having a grasp of this language will empower you to compare policies effectively.

Step 3: Compare Insurers and Policies

The UK market is home to several excellent, established insurers. While they all offer similar core products, they differ in their specific benefits, hospital networks, and approach to customer service. Don't just look at the headline price; look at the detail of what's included.

Step 4: Use an Independent, Expert Broker

This is the single most effective way to get the right cover at the best price. An independent broker works for you, not the insurance company.

At WeCovr, our expert advisors take the time to understand your unique circumstances. We don't just sell you a policy; we find the right solution for you from across the entire market. We can explain the nuances between insurers, help you navigate the complexities of underwriting, and ensure there are no hidden surprises in your policy. Our service costs you nothing but can save you time, money, and stress.

As a thank you to our clients, we also provide complimentary access to our exclusive AI-powered calorie and nutrition tracking app, CalorieHero. It's just one of the ways we show our commitment to your long-term health and wellbeing, going beyond the policy itself.

Real-World Scenarios: How PMI Makes a Difference

Let's look at how this works in real life.

Case Study 1: Mark, the Builder Mark, a 62-year-old self-employed builder, develops debilitating knee pain. His GP diagnoses severe osteoarthritis and refers him for a knee replacement. The NHS waiting list in his area is 14 months. For Mark, this means over a year without income. Fortunately, he has a PMI policy. He sees a specialist in ten days, has his surgery six weeks later, and after a three-month recovery, he is back at work. His insurance turned a year of lost earnings and pain into a manageable three-month interruption.

Case Study 2: Priya, the Accountant Priya, a 38-year-old accountant, finds a worrying lump and her GP makes an urgent two-week-wait referral. The anxiety is overwhelming. Using her company's PMI plan, she sees a private breast specialist in three days. A mammogram and biopsy are performed the next day. A week later, she receives her results—the lump is a benign cyst. Her PMI didn't just buy speed; it bought her immediate peace of mind and saved her weeks of agonising worry.

Frequently Asked Questions (FAQ)

Q: Can I still use the NHS if I have private health insurance? A: Yes, absolutely. PMI is designed to complement the NHS. You will continue to use your NHS GP and NHS emergency services. You can choose to use the NHS for any treatment, even if it's covered by your policy.

Q: Does private health insurance cover cancer? A: Yes, comprehensive cancer care is a cornerstone of most modern PMI policies. Cover is often extensive, including diagnosis, surgery, chemotherapy, radiotherapy, and even monitoring after treatment. Always check the specifics of the cancer cover in any policy you consider.

Q: What happens if I develop a chronic condition after taking out my policy? A: This is an excellent question. Typically, the policy will cover the initial diagnosis and treatment needed to investigate the symptoms and stabilise your condition (the 'acute' phase). Once the condition is diagnosed as chronic, the ongoing, long-term management will usually revert to the NHS.

Q: Is it worth it if I'm young and healthy? A: Taking out a policy when you are young and healthy is the cheapest it will ever be. It gives you a lower starting premium and protects you against unexpected illnesses or injuries. It is insurance against the unknown, providing peace of mind that if something does happen, you won't have to wait for care.

Q: Do I need a GP referral to use my insurance? A: In almost all cases, yes. The NHS GP acts as the gatekeeper. Their referral is what initiates the process and confirms to the insurer that specialist care is medically necessary.

Conclusion: Taking Control of Your Health in Uncertain Times

The NHS remains one of the UK's proudest achievements. But in the face of unprecedented waiting lists, we must have an honest conversation about the devastating impact these delays are having on millions of lives.

Waiting months or even years for treatment is not a benign inconvenience. It is a period of pain, anxiety, and deteriorating health that can rob you of your livelihood and quality of life.

Private medical insurance offers a proactive, powerful, and increasingly necessary solution. It empowers you to bypass the queues and access the expert medical care you need, when you need it. It puts you back in control of your health journey, providing the speed, choice, and peace of mind that is so often missing in the current climate. It is not about replacing the NHS, but about having a plan B that ensures your health is never put on hold.

In an era of uncertainty, taking control of your health is one of the most important investments you can make. Don't let a waiting list dictate your future. Explore your options today.

Sources

- Department for Transport (DfT): Road safety and transport statistics.

- DVLA / DVSA: UK vehicle and driving regulatory guidance.

- Association of British Insurers (ABI): Motor insurance market and claims publications.

- Financial Conduct Authority (FCA): Insurance conduct and consumer information guidance.