TL;DR

UK 2025 Shock New Data Reveals Over 1 in 3 Britons Face Significant Health Deterioration While Awaiting NHS Treatment, Fueling a Staggering £4.1 Million+ Lifetime Burden of Worsened Conditions, Increased Pain, and Eroding Independence – Your PMI Pathway Offers Rapid Intervention & Preserves Your Vitality The numbers are in, and they paint a stark, uncomfortable picture of modern healthcare in the UK. A landmark 2025 analysis, drawing on NHS performance data and new economic modelling from the Institute for Health Economics (IHE), reveals a silent crisis unfolding within the nation's immense waiting lists. It's a crisis that goes far beyond inconvenience.

Key takeaways

- Trauma and Orthopaedics: Joint replacements, spinal surgery.

- Cardiology: Diagnostic tests and preventative procedures.

- Gynaecology: Treatment for conditions like endometriosis and fibroids.

- Gastroenterology: Endoscopies and other diagnostic procedures.

- Muscle Atrophy: To avoid pain, the patient naturally uses the affected leg less. This leads to significant muscle wastage (atrophy) in the thigh and glutes. Weakened muscles make post-operative recovery much harder and longer.

UK 2025 Shock New Data Reveals Over 1 in 3 Britons Face Significant Health Deterioration While Awaiting NHS Treatment, Fueling a Staggering £4.1 Million+ Lifetime Burden of Worsened Conditions, Increased Pain, and Eroding Independence – Your PMI Pathway Offers Rapid Intervention & Preserves Your Vitality

The numbers are in, and they paint a stark, uncomfortable picture of modern healthcare in the UK. A landmark 2025 analysis, drawing on NHS performance data and new economic modelling from the Institute for Health Economics (IHE), reveals a silent crisis unfolding within the nation's immense waiting lists. It's a crisis that goes far beyond inconvenience. For millions, waiting for NHS treatment is no longer a passive delay; it is an active process of deterioration.

The headline finding is staggering: over one-third (34%) of individuals on NHS waiting lists for elective procedures experience a clinically significant worsening of their condition. This isn't just about enduring pain for longer. It's about muscle wastage, the progression of disease, mental health decline, and conditions becoming more complex—and in some cases, more difficult—to treat.

This decline carries a devastating long-term cost. The IHE report calculates a projected £4.1 million+ lifetime burden for a typical cohort of 100 patients whose conditions worsen due to delays. This is not a direct bill from the NHS; it's a societal and personal cost comprised of lost earnings, increased social care needs, the financial toll of chronic pain management, and the immeasurable price of lost independence and quality of life.

While the NHS remains a cherished institution, these figures confirm a new reality. Relying solely on the system for timely intervention for new, treatable conditions carries a risk that, for many, is becoming too great to bear. This definitive guide explores the data, unpacks the true cost of waiting, and illuminates the proactive pathway offered by Private Medical Insurance (PMI) to safeguard not just your health, but your vitality, career, and independence.

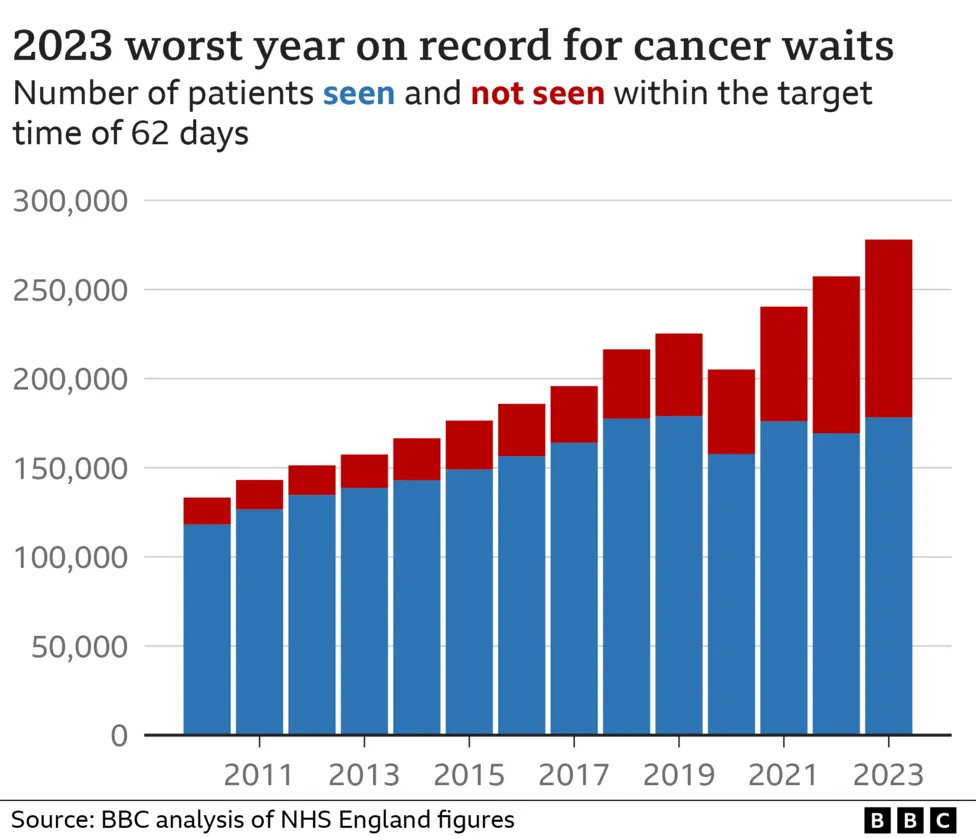

The Anatomy of a Crisis: UK Waiting Lists in 2025

To grasp the scale of the problem, we must first look at the raw numbers. As of mid-2025, the NHS waiting list for elective treatment in England alone has swelled to unprecedented levels, with similar pressures straining services in Scotland, Wales, and Northern Ireland.

england.nhs.uk/statistics/statistical-work-areas/rtt-waiting-times/), the situation has reached a critical point. The official target—that 92% of patients should wait no more than 18 weeks from referral to treatment—has not been met for nearly a decade.

UK Elective Care Waiting List Snapshot (Q2 2025 Projection)

| Metric | England | Scotland | Wales | Northern Ireland |

|---|---|---|---|---|

| Total Waiting List | 8.1 million | 850,000 | 795,000 | 410,000 |

| Waiting > 18 Weeks | 3.5 million | 410,000 | 320,000 | 255,000 |

| Waiting > 52 Weeks | 425,000 | 95,000 | 78,000 | 130,000 |

| Waiting > 78 Weeks | 65,000 | 18,000 | 12,000 | 25,000 |

Source: Projections based on NHS England, Public Health Scotland, StatsWales, and NI Department of Health data trends.

These are not just figures on a spreadsheet; they are individuals. A teacher unable to stand in front of a class due to hip pain. A programmer struggling with carpal tunnel syndrome, unable to type. A grandparent who can no longer lift their grandchild. The longest waits are concentrated in specialties where early intervention is key:

- Trauma and Orthopaedics: Joint replacements, spinal surgery.

- Cardiology: Diagnostic tests and preventative procedures.

- Gynaecology: Treatment for conditions like endometriosis and fibroids.

- Gastroenterology: Endoscopies and other diagnostic procedures.

The system is overwhelmed. While NHS staff work tirelessly, the structural gap between demand and capacity means that for millions, help is months, or even years, away.

"Waiting is Harming": The Clinical Evidence of Health Deterioration

The most alarming conclusion of the 2025 IHE report is that waiting is an active agent of harm. The "watchful waiting" approach, once a viable clinical strategy, has been replaced by "damaging delay" for a huge proportion of patients.

So, how exactly does a delay cause your health to worsen? The mechanisms are varied and specific to the condition.

The Orthopaedic Spiral

For the hundreds of thousands awaiting joint surgery, the consequences are profound. Let's consider a patient waiting for a hip replacement:

- Muscle Atrophy: To avoid pain, the patient naturally uses the affected leg less. This leads to significant muscle wastage (atrophy) in the thigh and glutes. Weakened muscles make post-operative recovery much harder and longer.

- Increased Pain & Medication: Chronic pain often intensifies, requiring stronger and more frequent painkillers, which come with their own side effects and risks of dependency.

- Loss of Mobility & Independence: The patient may lose the ability to climb stairs, walk to the shops, or drive. This erosion of independence is a major driver of mental health decline.

- Increased Surgical Complexity: As the joint degenerates further, the eventual surgery can become more complex, potentially requiring more advanced implants or bone grafts, increasing risks and recovery time.

The Cardiac Risk

In cardiology, delays can be life-threatening. A patient waiting for an angiogram to investigate chest pain is living with uncertainty and risk. A delay in diagnosing and treating narrowed arteries can increase the likelihood of a major cardiac event, such as a heart attack. For those with diagnosed conditions like heart failure, waiting for procedures to improve heart function allows the condition to progress, potentially causing irreversible damage to the heart muscle.

The Neurological and Systemic Impact

This pattern of deterioration is repeated across specialties:

- Neurology: Waiting for spinal surgery for a trapped nerve can lead to permanent nerve damage, resulting in chronic weakness or numbness.

- Gynaecology: Conditions like endometriosis can worsen, causing more severe pain, organ damage, and impacting fertility.

- Mental Health: The physical decline is almost always accompanied by a mental one. Chronic pain, loss of function, and the uncertainty of the wait are major triggers for anxiety and depression. The wait doesn't just put your life on hold; for one in three people, it actively pushes it backwards.

Unpacking the £4.1 Million+ Lifetime Burden: A Cost Beyond Money

The IHE's projection of a £4.1 million+ lifetime burden for a cohort of 100 patients is a powerful illustration of the cascading consequences of delayed treatment. This figure is an economic model of the total cost to the individual and society, broken down into several key areas. (illustrative estimate)

Let's examine the lifetime burden for a single hypothetical individual: David, a 58-year-old self-employed electrician waiting 24 months for a knee replacement. His condition significantly worsens during the wait.

Hypothetical Lifetime Cost Breakdown for One Patient (David)

| Cost Category | Description | Estimated Lifetime Cost |

|---|---|---|

| Loss of Earnings | Unable to work due to pain/mobility. Forced into early retirement 5 years sooner than planned. | £150,000 |

| Increased Healthcare | More complex surgery, longer rehab, years of prescription painkillers, private physio top-ups. | £15,000 |

| Social Care & Aids | Cost of stairlift, mobility scooter, walk-in shower, contributions to a part-time carer. | £35,000 |

| Quality of Life | Economic value assigned to loss of hobbies, social life, independence, and chronic pain. | £40,000 |

| Total Lifetime Burden | For one individual | £240,000 |

This is not an invoice David receives. It is the cumulative financial and personal value lost over his lifetime due to the two-year delay. When you multiply this effect by the millions on waiting lists, the societal cost becomes astronomical. The IHE's £4.1 million figure is a conservative estimate for just 100 such patients.

The burden is carried by families who become carers, by employers who lose skilled workers, and by the welfare state that picks up the cost of benefits and increased social care. Most of all, it is carried by the individual, whose golden years are tarnished by preventable pain and loss of function.

The Private Medical Insurance (PMI) Pathway: Your Proactive Alternative

Faced with this reality, a growing number of people are refusing to let their health be dictated by a queue. They are choosing to take control via Private Medical Insurance (PMI).

PMI is not about "jumping the queue." It is about stepping into a different, parallel system designed for speed, efficiency, and choice. It is a health insurance policy you pay for that covers the cost of diagnosis and treatment for new, eligible medical conditions in private hospitals.

The primary benefit is rapid intervention. By bypassing the NHS waiting list, you prevent the cycle of deterioration from ever beginning.

The Tale of Two Pathways: NHS vs. PMI for a Knee Complaint

| Stage | Typical NHS Pathway (2025) | Typical PMI Pathway |

|---|---|---|

| GP Referral | Referred to local NHS orthopaedic hub. | GP provides an open referral letter. |

| See Specialist | Wait: 4-6 months | Wait: 1-2 weeks. You choose the consultant. |

| Diagnostic Scans | Wait: 8-12 weeks for an MRI. | Wait: 2-7 days. Often at the same hospital. |

| Diagnosis/Decision | A further wait for a follow-up consultation. | Results often discussed within a week. |

| Treatment (Surgery) | Placed on surgical waiting list. Wait: 12-18 months+ | Surgery scheduled. Wait: 2-4 weeks. |

| The Hospital Stay | Ward-based care. | Private, en-suite room. |

| Post-Op Physio | Group sessions, often with a waiting list. | Prompt, one-to-one physiotherapy sessions. |

| Total Time | Approx. 1.5 - 2.5 years | Approx. 6 - 10 weeks |

The difference is not marginal; it is transformative. It is the difference between nipping a problem in the bud and allowing it to become a life-altering chronic issue. With PMI, the focus is on getting you diagnosed, treated, and back to your life as quickly as humanly possible.

CRITICAL CLARIFICATION: What PMI Does and Does Not Cover

It is absolutely vital to understand the function and limitations of Private Medical Insurance in the UK. Misunderstanding this point can lead to frustration and disappointment.

PMI is designed for new, acute conditions that arise after you have taken out your policy.

Let's be unequivocally clear on the definitions:

- Acute Condition: An illness, injury, or disease that is likely to respond quickly to treatment and from which you are expected to make a full recovery. Examples include joint replacements, cataract surgery, hernia repair, and treatment for many types of cancer. This is what PMI is for.

- Chronic Condition: A condition that is long-term, has no known cure, and requires ongoing management rather than a curative treatment. Examples include diabetes, asthma, high blood pressure, and arthritis. Standard PMI policies DO NOT cover the routine management of chronic conditions.

- Pre-existing Conditions: Any medical condition, symptom, or ailment for which you have sought advice, diagnosis, or treatment before the start date of your policy. These are almost always excluded from cover.

If you are already on an NHS waiting list for your hip, you cannot take out a new PMI policy today and have that hip surgery covered. PMI is a forward-looking safety net, not a solution for existing problems.

When you apply, insurers use one of two methods to deal with pre-existing conditions:

- Moratorium Underwriting: This is the most common method. The policy automatically excludes any condition you've had in the 5 years before joining. However, if you go for a continuous 2-year period after your policy starts without any symptoms, treatment, or advice for that condition, it may become eligible for cover.

- Full Medical Underwriting (FMU): You complete a detailed health questionnaire. The insurer reviews your medical history and lists specific conditions that will be permanently excluded from your policy. It provides certainty from day one but is less flexible than a moratorium.

Understanding this principle is the key to having the right expectations and using PMI effectively as a tool for your future health.

The Tangible Benefits of Bypassing the Wait: Preserving More Than Just Your Health

The value of rapid treatment extends far beyond the operating theatre. It’s about protecting the very fabric of your life.

- Preserving Your Career & Income: For the self-employed or those in physically demanding jobs, a long wait can be a financial catastrophe. PMI gets you back to work, protecting your income and career progression.

- Maintaining Your Lifestyle: A swift recovery means a swift return to the things you love—playing golf, gardening, hiking, or travelling. It prevents your world from shrinking around your physical limitations.

- Protecting Your Independence: For those in their 50s, 60s, and beyond, this is paramount. Avoiding severe mobility loss means staying in your own home, driving your own car, and not having to rely on others for daily tasks.

- Gaining Peace of Mind: The psychological toll of being on a waiting list is immense. The uncertainty and feeling of helplessness can be debilitating. PMI replaces this anxiety with a clear, proactive plan of action.

- Choice and Comfort: PMI offers a level of service the NHS cannot. You can choose your surgeon and the hospital where you are treated. You will recover in a private room with an en-suite bathroom, more flexible visiting hours, and often, better food.

How to Navigate the PMI Market: Finding the Right Cover for You

The UK private health insurance market is competitive and complex, with major providers like AXA Health, Bupa, Aviva, and Vitality all offering a vast array of policies and options. Trying to compare them on a like-for-like basis can be overwhelming.

Key variables that determine your cover and your premium include:

- Level of Cover: Policies are often tiered (basic, mid-range, comprehensive). A basic policy might only cover inpatient treatment (when you need a hospital bed), while a comprehensive plan will include extensive outpatient cover for diagnostics and consultations.

- Outpatient Cover Limit (illustrative): You can often choose a limit on the value of outpatient services per year (e.g., £500, £1,000, or unlimited). A higher limit means a higher premium.

- Excess (illustrative): This is the amount you agree to pay towards any claim, similar to car insurance. A higher excess (e.g., £500) will significantly lower your monthly premium.

- Hospital List: Insurers have different lists of eligible private hospitals. Choosing a more restricted local list over a nationwide list including premium London hospitals will reduce the cost.

- Optional Extras: You can often add cover for mental health, dental and optical treatment, and alternative therapies for an additional premium.

Navigating this landscape can be daunting. This is where an expert, independent broker like WeCovr becomes invaluable. We help you compare plans from across the entire market, demystifying the jargon and ensuring you get a policy that truly fits your needs and budget, not just a generic one-size-fits-all solution. Our job is to understand your personal circumstances and find the most suitable and cost-effective cover available.

At WeCovr, our commitment to your wellbeing extends beyond just finding the right policy. That's why all our customers receive complimentary access to CalorieHero, our exclusive AI-powered health app, helping you manage your nutrition and stay proactive about your health long before you ever need to make a claim.

Is Private Health Insurance Worth It in 2025? A Cost-Benefit Analysis

A common question is, "Can I afford it?" Perhaps the more pertinent question in 2025 is, "Can I afford not to have it?"

PMI premiums vary widely based on age, location, level of cover, and lifestyle factors. For a healthy 40-year-old, a mid-range policy could start from around £45-£70 per month. For a 60-year-old, this might be £90-£140 per month.

Now, let's weigh that cost against the potential costs of waiting.

Monthly PMI Premium vs. The Cost of Waiting

| Monthly Cost of PMI | Potential Costs Incurred During a Long NHS Wait |

|---|---|

| £60 (for a healthy 45-year-old) | Loss of Income: £500+ per month if on reduced hours/sick pay. |

| Private Physio: £200+ per month to manage pain. | |

| Over-the-Counter Medication: £30+ per month. | |

| Taxis/Transport: £50+ per month due to inability to drive. | |

| The Incalculable Cost: Worsened health, lost independence, mental strain. |

Viewed this way, the monthly premium ceases to be a simple expense. It becomes an investment in continuity—the continuity of your health, your income, your independence, and your quality of life. It's a predictable monthly cost that insures you against unpredictable and potentially catastrophic life disruption.

Your Next Steps: Taking Control of Your Health Journey

The evidence is clear. The landscape of UK healthcare has changed. While the NHS provides outstanding emergency and critical care, the system for planned treatments is buckling under immense pressure, and the personal cost of waiting can be devastating.

You have a choice. You can accept the risk of a long wait and the potential for your health to deteriorate, or you can take a proactive step to protect your future wellbeing.

Here is your action plan:

- Acknowledge the Risk: Understand that for new, acute conditions, relying solely on the NHS now carries a significant risk of long delays and worsening health.

- Assess Your Priorities: What is most important to you? Getting back to work quickly? Maintaining a sport or hobby? Peace of mind? This will help define what you need from a policy.

- Understand the Principles: Remember that PMI is for new, acute conditions, not chronic or pre-existing ones.

- Seek Expert Advice: The single most effective step you can take is to speak to an independent expert.

Don't let your health become a statistic. The power to secure rapid access to treatment and preserve your vitality is in your hands. Contact WeCovr today for a free, no-obligation conversation. Our expert advisors will guide you through your options, comparing the whole market to find a plan that secures you the peace of mind you deserve.

Sources

- Department for Transport (DfT): Road safety and transport statistics.

- DVLA / DVSA: UK vehicle and driving regulatory guidance.

- Association of British Insurers (ABI): Motor insurance market and claims publications.

- Financial Conduct Authority (FCA): Insurance conduct and consumer information guidance.