TL;DR

UK 2025 Shock New Data Reveals Over 7 Million Britons Trapped on NHS Waiting Lists for Critical Treatments, Fueling Health Deterioration & Eroding Quality of Life – Is Your PMI Pathway Your Urgent Escape Route to Rapid Treatment & Recovery? The latest figures for 2025 paint a stark and deeply concerning picture of the state of healthcare in the United Kingdom. More than 7.6 million people in England are currently on a waiting list for NHS consultant-led elective care.

Key takeaways

- Total Waiting List (England): The referral to treatment (RTT) waiting list stands at approximately 7.63 million cases.

- Longest Waits: An alarming 350,000 patients have been waiting for over a year (52 weeks) for their treatment to begin. The government's target is to eliminate these waits, but progress remains painfully slow.

- Median Wait Time: The median time a patient waits for treatment is now 15.2 weeks, a significant increase from pre-pandemic levels of around 8 weeks.

- Diagnostic Delays: Over 1.5 million people are waiting for crucial diagnostic tests like MRI scans, CT scans, and endoscopies, creating a bottleneck that prevents timely diagnosis and treatment planning.

- The Self-Employed Builder: Mark, a 48-year-old builder from Manchester, is told he needs a hernia repair. The wait is five months. Every day he continues to work, he's in discomfort and risks making the hernia worse. He can't afford to take five months off unpaid. His income drops, stress on his family mounts, and his physical health declines.

UK 2025 Shock New Data Reveals Over 7 Million Britons Trapped on NHS Waiting Lists for Critical Treatments, Fueling Health Deterioration & Eroding Quality of Life – Is Your PMI Pathway Your Urgent Escape Route to Rapid Treatment & Recovery?

The latest figures for 2025 paint a stark and deeply concerning picture of the state of healthcare in the United Kingdom. More than 7.6 million people in England are currently on a waiting list for NHS consultant-led elective care. This isn't just a number; it's a staggering national crisis representing millions of individual lives put on hold. These are our neighbours, colleagues, family members, and perhaps even you—all waiting in pain, anxiety, and uncertainty for procedures that could restore their health and quality of life.

For many, this wait is not a passive inconvenience. It's an active period of health deterioration, where manageable conditions become complex, pain becomes chronic, and mental well-being plummets. The dream of a swift recovery is replaced by the grim reality of a life constrained by physical limitation and the psychological burden of an unknown future.

In the face of this unprecedented challenge, a growing number of Britons are asking a critical question: Is there another way? Is it possible to bypass these debilitating queues and access the high-quality, rapid treatment needed to get back on your feet?

This guide explores the escalating NHS wait list crisis and investigates the primary alternative: Private Medical Insurance (PMI). We will delve into what PMI is, how it works, what it covers, and critically, whether it represents your most viable escape route to the timely care and recovery you deserve.

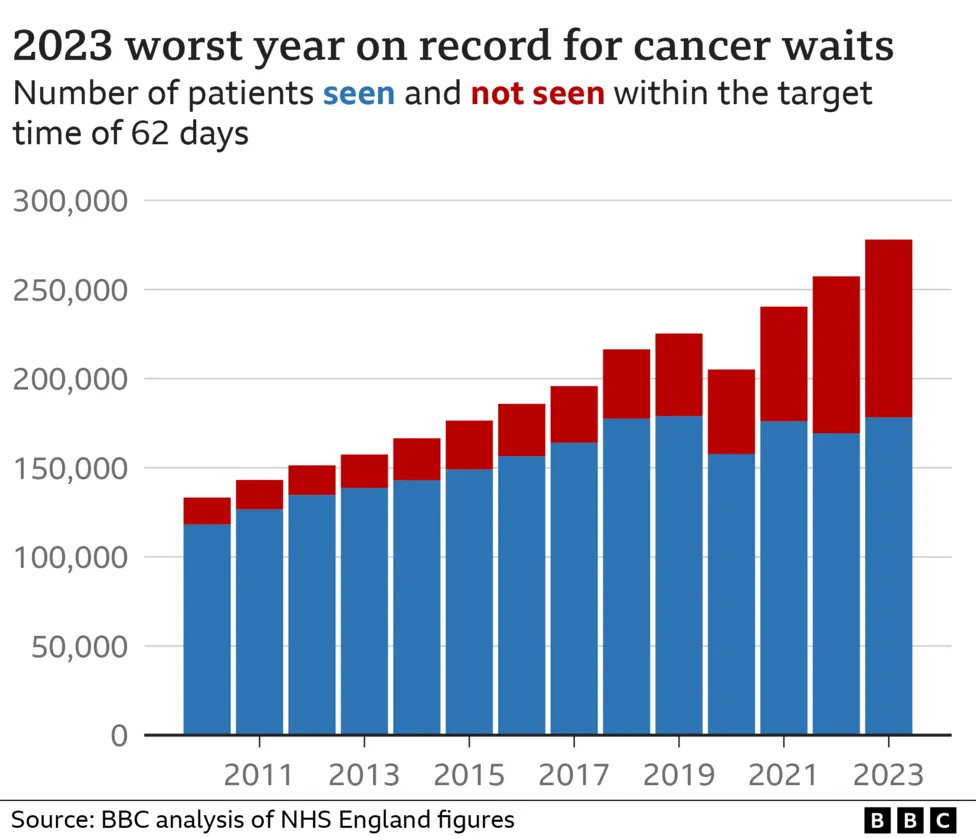

The Stark Reality: Unpacking the 2025 NHS Waiting List Figures

To truly grasp the scale of the problem, we must look beyond the headline figure. The 7.6 million-strong waiting list is not a single queue but a complex web of delays affecting every corner of the NHS. Fresh analysis from NHS England and the Office for National Statistics (ONS) in mid-2025 reveals a system under immense and sustained pressure.

Key Statistics for 2025:

- Total Waiting List (England): The referral to treatment (RTT) waiting list stands at approximately 7.63 million cases.

- Longest Waits: An alarming 350,000 patients have been waiting for over a year (52 weeks) for their treatment to begin. The government's target is to eliminate these waits, but progress remains painfully slow.

- Median Wait Time: The median time a patient waits for treatment is now 15.2 weeks, a significant increase from pre-pandemic levels of around 8 weeks.

- Diagnostic Delays: Over 1.5 million people are waiting for crucial diagnostic tests like MRI scans, CT scans, and endoscopies, creating a bottleneck that prevents timely diagnosis and treatment planning.

The impact is not felt evenly. Certain specialities are experiencing crisis-level delays, leaving patients with life-altering conditions in limbo.

| Medical Speciality | Average NHS Wait Time (Referral to Treatment) 2025 | Common Procedures Affected |

|---|---|---|

| Trauma & Orthopaedics | 22 weeks | Hip replacements, knee replacements, ACL surgery |

| Ophthalmology | 18 weeks | Cataract surgery, glaucoma treatment |

| Gynaecology | 19 weeks | Hysterectomy, endometriosis treatment |

| General Surgery | 17 weeks | Hernia repair, gallbladder removal |

| Cardiology | 16 weeks | Angiography, pacemaker fitting |

| ENT (Ear, Nose, Throat) | 20 weeks | Tonsillectomy, sinus surgery |

These are not just waits for minor ailments. A 22-week wait for a hip replacement means nearly half a year of chronic pain, reduced mobility, reliance on painkillers, and often, an inability to work or live independently. A delayed cataract operation can mean a progressive loss of sight, profoundly impacting a person's safety and confidence.

This is the harsh reality of the NHS in 2025. While its staff work tirelessly, the system's capacity is simply overwhelmed by demand.

The Human Cost: Beyond the Numbers

Statistics can feel abstract. The true cost of the waiting list crisis is measured in human suffering, lost income, and diminished lives. It’s a story told in millions of households across the country.

Consider these scenarios, which are becoming tragically common:

- The Self-Employed Builder: Mark, a 48-year-old builder from Manchester, is told he needs a hernia repair. The wait is five months. Every day he continues to work, he's in discomfort and risks making the hernia worse. He can't afford to take five months off unpaid. His income drops, stress on his family mounts, and his physical health declines.

- The Grandmother with Failing Sight: Eleanor, a 74-year-old from Kent, has been diagnosed with cataracts in both eyes. Her vision is deteriorating rapidly. She's been told the wait for surgery could be up to a year. She's had to stop driving, can no longer read to her grandchildren, and has had two falls at home. Her world is shrinking, and her independence is eroding daily.

- The Young Professional with Endometriosis: Sarah, 32, suffers from severe endometriosis, a condition causing debilitating pelvic pain. She needs laparoscopic surgery to manage the condition. The gynaecology waiting list at her local trust is over 50 weeks. In the meantime, she struggles through her career, reliant on powerful painkillers and frequently taking sick days, impacting her professional growth and mental health.

These stories highlight the three core areas of impact:

- Physical Deterioration: Conditions that are relatively straightforward to treat can become complicated and harder to fix after a long wait. Joints degrade further, pain becomes entrenched, and the risk of surgical complications can increase.

- Mental Health Decline: The uncertainty and powerlessness of being on a waiting list are significant psychological stressors. Anxiety, depression, and feelings of being forgotten are common. 3. Socio-Economic Impact: The inability to work leads to lost income, dependency on benefits, and stalled careers. This doesn't just affect the individual; it has a ripple effect on families and the wider economy through lost productivity.

What is Private Medical Insurance (PMI) and How Can It Help?

Private Medical Insurance, often called private health insurance, is an insurance policy that covers the cost of private healthcare for eligible conditions. In essence, you pay a monthly or annual premium to an insurer, and in return, if you develop a new medical condition, the policy can pay for you to be diagnosed and treated in the private sector.

Its primary and most compelling benefit in the current climate is speed of access. Instead of joining the back of a 7.6 million-person queue, PMI offers a direct pathway to specialist consultations, diagnostic scans, and treatment, often within days or weeks.

Let's compare the journey for a patient needing gallbladder removal (cholecystectomy):

| Stage of Treatment | Typical NHS Pathway (2025) | Typical PMI Pathway |

|---|---|---|

| GP Visit | GP suspects gallstones, refers to a specialist. | GP suspects gallstones, refers to a specialist. |

| Specialist Consultation | Wait 8-12 weeks for an appointment with a consultant. | Appointment with a private consultant within 1-2 weeks. |

| Diagnostic Scans | Wait 6-10 weeks for an ultrasound or MRI scan. | Scan performed at a private hospital within days. |

| Treatment Decision | Consultant confirms surgery is needed. Placed on surgical list. | Consultant confirms surgery is needed. Date is booked. |

| Surgery | Wait 16-24 weeks for the operation. | Operation performed at a private hospital within 2-4 weeks. |

| Total Time (GP to Op) | Approx. 30-46 weeks | Approx. 3-7 weeks |

The difference is stark: a potential wait of almost a year on the NHS versus less than two months privately. For someone in constant pain, this difference is life-changing.

The Golden Rule: PMI is for Acute Conditions, NOT Pre-existing or Chronic Illnesses

This is the single most important concept to understand about private medical insurance in the UK. Failure to grasp this point is the number one source of misunderstanding and disappointment.

Standard UK Private Medical Insurance is designed to cover acute conditions that arise after you have taken out the policy.

- An acute condition is a disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery (e.g., cataracts, hernia, joint replacement, gallstones).

- A chronic condition is a disease, illness, or injury that has one or more of the following characteristics: it needs ongoing or long-term monitoring, it has no known cure, it is likely to recur, or it requires palliative care (e.g., diabetes, asthma, hypertension, Crohn's disease, multiple sclerosis).

- A pre-existing condition is any illness or injury for which you have experienced symptoms, received medication, advice, or treatment before the start date of your policy.

PMI will NOT cover the routine management of chronic conditions like diabetes or hypertension. It will NOT cover treatment for a bad knee you had diagnosed two years before you bought the policy.

Its purpose is to step in for new, unexpected, and treatable health issues, allowing the NHS to focus its resources on emergencies, chronic care, and those without private cover. Think of it as insurance for your future health, not a solution for your past medical history.

A Deeper Dive into PMI: What's Typically Covered (and What's Not)?

While policies vary, most are built around a core offering with optional extras. Understanding this structure is key to choosing the right plan.

| Coverage Type | Typically Included | Typically Excluded |

|---|---|---|

| Core Cover | • In-patient & day-patient treatment (hospital fees, surgery, specialist fees, anaesthetist fees) • Private room in a hospital • Diagnostic tests & scans while an in-patient | • Any pre-existing or chronic conditions • Emergency/A&E treatment • Normal pregnancy and childbirth • Cosmetic surgery |

| Out-patient Cover | • Specialist consultations (before/after surgery) • Diagnostic tests & scans as an out-patient (MRI, CT, X-ray) • Physiotherapy, osteopathy, chiropractic care | • Prescriptions for out-patient use • Monitoring of chronic conditions |

| Common Add-ons | • Comprehensive Cancer Cover • Mental Health Cover • Dental & Optical Cover • Therapies (beyond basic physiotherapy) | • Experimental treatments • Substance abuse rehabilitation • Self-inflicted injuries |

Levels of Cover:

- Basic/Budget: Covers the big expenses of in-patient and day-patient treatment. You would typically use the NHS for your initial diagnosis and consultations and then switch to private care if surgery is required. This is the most affordable option.

- Mid-Range: The most popular choice. It includes everything in the basic plan plus comprehensive out-patient cover up to a set limit (e.g., £1,000 or £1,500). This means the entire diagnostic journey can be handled privately and swiftly.

- Comprehensive: Offers the highest level of protection, often with unlimited out-patient cover and additional benefits like mental health support, alternative therapies, and sometimes dental and optical cover included as standard.

Navigating the PMI Landscape: Key Factors to Consider

Choosing a PMI policy can feel complex. Insurers use specific terminology that you need to understand to make an informed decision. Here are the key concepts:

-

Underwriting: This is how an insurer assesses your medical history to decide what they will and won't cover.

- Moratorium (Most Common): You don't declare your full medical history upfront. Instead, the policy automatically excludes any condition you've had symptoms, treatment, or advice for in the past 5 years. However, if you then go for a continuous 2-year period after your policy starts without any symptoms or treatment for that condition, it may become eligible for cover. It's simpler but has a degree of uncertainty.

- Full Medical Underwriting (FMU): You complete a detailed health questionnaire. The insurer reviews your medical history and provides a definitive list of personal exclusions from day one. It's more paperwork, but you know exactly where you stand.

-

Excess: This is the amount you agree to pay towards the cost of a claim. For example, if you have a £250 excess and your treatment costs £5,000, you pay the first £250 and the insurer pays the remaining £4,750. A higher excess will significantly lower your monthly premium.

-

Hospital List: Insurers have tiered hospital lists. A policy that gives you access to a limited list of local private hospitals will be cheaper than one that includes premium central London clinics like The London Clinic or The Cromwell.

-

No-Claims Discount (NCD): Similar to car insurance, your premium can reduce each year you don't make a claim, up to a maximum discount (often 60-70%). Making a claim will typically reduce your NCD level.

-

The "Six-Week Option": This is a popular cost-saving feature. If the NHS waiting list for the in-patient procedure you need is less than six weeks, you agree to use the NHS. If the wait is longer than six weeks, your private cover kicks in. Given the current state of NHS waits, this option often provides a significant premium reduction with minimal practical risk.

The Cost of Peace of Mind: How Much Does PMI Cost in 2025?

The cost of PMI varies hugely depending on your age, location, lifestyle (smoker vs. non-smoker), and the level of cover you choose. However, it can be more affordable than many people think.

Here are some illustrative monthly premium examples for 2025, based on a mid-range policy with a £250 excess.

| Profile | Location | Illustrative Monthly Premium |

|---|---|---|

| 30-year-old individual | Bristol | £45 - £60 |

| 45-year-old couple | Birmingham | £110 - £150 |

| Family of 4 (40s parents, 2 children) | Leeds | £160 - £220 |

| 60-year-old individual | Outside London | £90 - £130 |

Disclaimer: These are example prices for illustrative purposes only. Your actual premium will depend on your specific circumstances and chosen cover.

Key factors influencing your premium:

- Age: This is the single biggest factor. Premiums rise as you get older.

- Level of Cover: A comprehensive plan costs more than a basic one.

- Excess (illustrative): Choosing a £500 or £1,000 excess can reduce premiums by 20-40%.

- Hospital List: Restricting your choice to local hospitals is cheaper than a nationwide list.

- Your Postcode: Premiums are typically higher in London and the South East.

Why Use an Expert Broker like WeCovr?

The UK private health insurance market is crowded and complex. With major insurers like Bupa, AXA Health, Aviva, and Vitality all offering dozens of policy variations, trying to compare them on a like-for-like basis can be overwhelming. This is where an independent health insurance broker becomes invaluable.

A broker works for you, not the insurance companies. Their role is to be your expert guide, helping you navigate the market to find the best possible cover for your needs and budget.

The advantages of using a specialist broker are clear:

- Whole-of-Market Advice: They compare plans from all the leading insurers, giving you a comprehensive, unbiased view.

- Tailored Recommendations: A good broker takes the time to understand your personal situation, health concerns, and budget before recommending a solution.

- Jargon Busting: They translate the complex policy documents into plain English, ensuring you understand exactly what you are buying.

- No Extra Cost: Brokers are paid a commission by the insurer you choose, so their expert service is free for you to use.

At WeCovr, we leverage our deep market expertise to do the hard work for you. We compare plans from all major UK insurers, ensuring you find the perfect fit without the jargon and complexity, saving you both time and money.

Beyond the Policy: The Added Value of Modern PMI

In a competitive market, today's insurers offer far more than just paying for operations. Modern PMI policies often come packed with added-value services designed to support your day-to-day health and well-being.

- Digital GP Services: This is a game-changer for many. Get 24/7 access to a GP via phone or video call, often with same-day appointments available. This helps with quick diagnoses, prescriptions, and referrals, bypassing the 8am scramble for a local GP appointment.

- Mental Health Support: Recognising the growing mental health crisis, many policies now include access to telephone counselling, referrals for cognitive behavioural therapy (CBT), or dedicated mental health support pathways.

- Wellness and Rewards Programmes: Insurers like Vitality have pioneered a model that rewards you for living a healthy lifestyle. By tracking your activity, you can earn discounts on your premium, free cinema tickets, and coffee.

- Second Medical Opinions: If you receive a life-changing diagnosis, many policies allow you to have your case reviewed by a world-leading expert to confirm the diagnosis and explore all available treatment options.

And because we believe in supporting our clients' holistic health journey, at WeCovr, we go a step further. All our clients receive complimentary access to our proprietary AI-powered calorie and nutrition tracking app, CalorieHero, helping you take proactive control of your well-being long before you might ever need to make a claim.

The Verdict: Is PMI the Right Choice for You in 2025?

The decision to invest in private health insurance is a personal one, weighing cost against the invaluable benefits of speed, choice, and peace of mind. The cherished ideal of the NHS is something we all support, but the practical reality in 2025 is that it can no longer provide timely elective care for all.

Let's summarise the key arguments:

| Pros of Private Medical Insurance | Cons of Private Medical Insurance |

|---|---|

| Rapid Access: Bypass NHS queues for diagnosis and treatment. | Cost: It is an ongoing monthly financial commitment. |

| Choice: Choose your specialist, consultant, and hospital. | Exclusions: CRITICALLY, does not cover pre-existing or chronic conditions. |

| Comfort & Privacy: A private room for overnight stays. | Premium Increases: Premiums rise with age and after claims. |

| Advanced Treatments: Access to drugs/treatments not yet on the NHS. | A&E Not Covered: You still rely on the NHS for emergencies. |

| Peace of Mind: Knowing you have a plan if you fall ill. | Complexity: Policies can be difficult to compare without expert help. |

| Added Benefits: Digital GP, mental health support, wellness perks. | Potential for Shortfalls: Some policies have limits on fees or benefits. |

PMI is not a replacement for the NHS. The NHS is and will remain the bedrock of UK healthcare, providing world-class emergency and chronic care to everyone, regardless of their ability to pay.

However, PMI is a powerful, practical, and increasingly necessary tool to complement the NHS. It empowers you to take control of your health when faced with an acute condition, ensuring that a diagnosis doesn't have to mean a year of pain and uncertainty. It is a plan for your future well-being.

The NHS waiting list is not a political football; it's a crisis affecting millions of real lives. In 2025, waiting is no longer a viable strategy. Don't leave your health, your livelihood, and your quality of life to chance.

Explore your options, understand the pathways available, and make an informed choice. The first step to bypassing the queues and securing your health is knowledge.

Contact the friendly expert team at WeCovr today for a free, no-obligation quote and a clear conversation about how Private Medical Insurance could be your family's vital escape route to rapid treatment and recovery.

Sources

- Department for Transport (DfT): Road safety and transport statistics.

- DVLA / DVSA: UK vehicle and driving regulatory guidance.

- Association of British Insurers (ABI): Motor insurance market and claims publications.

- Financial Conduct Authority (FCA): Insurance conduct and consumer information guidance.