TL;DR

Beyond the GP: Uncovering Hidden Specialist Wait Times & Network Bottlenecks in UK Private Health Insurance UK Private Health Insurance Navigating the Hidden Specialist Wait Times & Network Bottlenecks Beyond the Initial GP Referral For many in the UK, private medical insurance (PMI) is seen as a sanctuary from the well-documented pressures on the National Health Service (NHS). The promise is clear: quicker access to diagnostics, specialist consultations, and treatments, offering a much-needed alternative to the often-lengthy NHS waiting lists. Indeed, in an era where over 7.However, the journey through private healthcare is not always as straightforward as securing an initial GP referral.

Key takeaways

- Faster Access: Bypassing lengthy NHS waiting lists for consultations, diagnostics, and procedures.

- Choice of Consultant: The ability to choose your specialist, often based on reputation, experience, or specific expertise.

- Comfort and Privacy: Access to private hospitals with en-suite rooms, flexible visiting hours, and a more personalised experience.

- Access to Treatments: Potentially gaining access to treatments or drugs not routinely available on the NHS (though this is becoming less common).

- Convenience: Flexible appointment times and locations.

Beyond the GP: Uncovering Hidden Specialist Wait Times & Network Bottlenecks in UK Private Health Insurance

UK Private Health Insurance Navigating the Hidden Specialist Wait Times & Network Bottlenecks Beyond the Initial GP Referral

For many in the UK, private medical insurance (PMI) is seen as a sanctuary from the well-documented pressures on the National Health Service (NHS). The promise is clear: quicker access to diagnostics, specialist consultations, and treatments, offering a much-needed alternative to the often-lengthy NHS waiting lists. Indeed, in an era where over 7.However, the journey through private healthcare is not always as straightforward as securing an initial GP referral. Beneath the surface of expedited access lies a complex web of specialist wait times, insurer network intricacies, and administrative hurdles that can introduce their own unexpected delays. These "hidden" bottlenecks often emerge after your initial private GP consultation, when you're seeking to see a specific consultant or undergo a diagnostic test.

This comprehensive guide delves deep into these often-overlooked aspects of UK private health insurance. We'll unmask the realities of specialist wait times beyond the GP, illuminate the workings of insurer networks, and equip you with the knowledge and strategies to navigate these potential obstacles effectively, ensuring you maximise the true value of your private medical cover.

The Core Promise of Private Health Insurance: Speed and Choice

Private Medical Insurance fundamentally offers a contractual agreement with an insurer to cover the costs of private medical treatment for acute conditions that arise after your policy begins. The emphasis here is crucial: standard UK private medical insurance does not cover chronic conditions (those that are long-term or recurring, such as diabetes, asthma, or some forms of arthritis) nor does it typically cover pre-existing conditions (any illness, injury, or symptom that you've experienced before taking out the policy). PMI is designed for new, acute medical conditions that can be treated and cured, or for which the underlying cause can be resolved.

The primary drivers for purchasing PMI are often:

- Faster Access: Bypassing lengthy NHS waiting lists for consultations, diagnostics, and procedures.

- Choice of Consultant: The ability to choose your specialist, often based on reputation, experience, or specific expertise.

- Comfort and Privacy: Access to private hospitals with en-suite rooms, flexible visiting hours, and a more personalised experience.

- Access to Treatments: Potentially gaining access to treatments or drugs not routinely available on the NHS (though this is becoming less common).

- Convenience: Flexible appointment times and locations.

While PMI undoubtedly delivers on many of these promises, particularly when compared to the stretched resources of the NHS, it's vital to understand that "faster" doesn't always mean "instant." The real complexities often begin once you've received your private GP referral.

Understanding the UK Healthcare Landscape: NHS vs. Private Sector

To truly appreciate the nuances of private healthcare wait times, it's essential to grasp the fundamental differences and points of interaction between the NHS and the private sector in the UK.

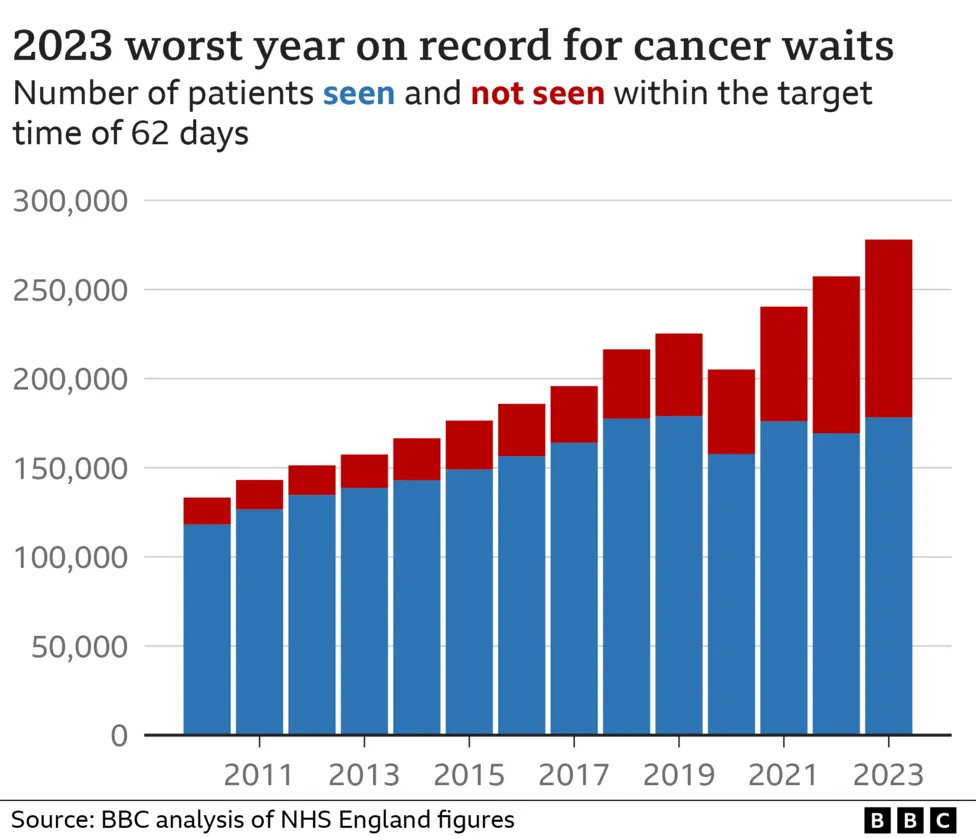

The NHS, funded by general taxation, provides universal healthcare free at the point of use. It's a national treasure but is perpetually under immense pressure. Recent data from NHS England highlights this strain, with the total number of people waiting for routine hospital treatment remaining stubbornly high, hovering around the 7.6 million mark. This includes significant waits for first outpatient appointments with specialists, diagnostic tests, and surgical procedures. For instance, in April 2024, over 300,000 patients had been waiting over a year for treatment.

The private sector, on the other hand, operates on a fee-for-service basis, largely funded by private medical insurance or direct patient payments. While it runs parallel to the NHS, it often shares the same medical professionals. Many leading private consultants also work within the NHS, balancing their commitments across both systems. This dual role can be a contributing factor to the private sector's own capacity limitations.

The initial gateway to both systems, for most medical issues, remains the General Practitioner (GP). Whether you're seeking NHS or private care, your GP is typically the first port of call, assessing your condition and referring you to a specialist if necessary. For private care, this means getting a private GP referral letter, which is almost always a prerequisite for your insurer to authorise specialist consultations or investigations.

The Hidden Truth: Specialist Wait Times Beyond the Initial Referral

The common misconception is that once you have a private GP referral, your access to a specialist is immediate. Unfortunately, this is not always the case. While certainly quicker than the NHS for many specialities, private wait times for specialist consultations, and particularly for complex diagnostic tests like MRIs or CT scans, can still be significant, varying widely based on several factors.

Why does this happen? Several elements contribute to these less-publicised delays:

- Specialist Availability: High-demand consultants, especially those with niche expertise or who are highly recommended, often have busy private practices. Their diaries fill up quickly, leading to weeks, or sometimes even months, before the next available slot. This is particularly true for in-demand specialities like orthopaedics, cardiology, and gastroenterology.

- Diagnostic Test Availability: While private hospitals generally offer quicker access to diagnostic equipment, there can still be bottlenecks. High-tech scans like MRI or CT require specific machine time and specialist technicians/radiologists to operate and interpret them. A sudden surge in demand or machine maintenance can lead to delays.

- Clinic and Hospital Capacity: Even with private facilities, there's a finite number of consultation rooms, operating theatres, and beds. During peak times, or for very popular facilities, securing an appointment can take longer.

- Geographical Disparities: Access to specialists and diagnostic facilities can vary significantly across the UK. Major cities typically offer more choice and potentially faster access, while rural areas might have fewer options, leading to longer waits.

- Complexity of the Condition: More complex or unusual conditions might require a specialist who is harder to find, or a sequence of diagnostic tests, naturally extending the timeline.

To illustrate, consider this illustrative comparison of potential waiting times, acknowledging that these are averages and can vary wildly:

| Stage of Care | Typical NHS Waiting Time (Post-GP Referral) | Typical Private Waiting Time (Post-GP Referral) | Potential Bottleneck in Private Care |

|---|---|---|---|

| First Specialist Consultation | 6-18+ weeks (some over a year) | 1-4 weeks (highly sought-after: 6-12+ weeks) | Consultant's busy schedule |

| Diagnostic Scans (MRI/CT) | 4-12+ weeks | 1-3 weeks (peak demand: 4-6 weeks) | Machine availability, radiologist interpretation |

| Minor Procedure/Outpatient | 8-24+ weeks | 2-6 weeks | Clinic capacity |

| Major Surgery | 18-52+ weeks (some over a year) | 4-12 weeks (complex: 12-20+ weeks) | Theatre availability, specific surgeon's schedule |

| Follow-up Consultation | 4-12+ weeks | 1-4 weeks | Consultant's availability |

Navigating Insurer Networks and Their Bottlenecks

One of the most significant factors influencing your speed of access to private care is the insurer's "network" of approved consultants and hospitals. Understanding these networks is crucial, as they can either smooth your path or introduce unforeseen delays and limitations.

Insurers typically operate various types of networks, each with different implications for your choice and access:

- Open Referral / Unrestricted Network: Historically, many policies offered this. You could see almost any consultant and use any private hospital, provided they charged within the insurer's "reasonable and customary" rates. This offers maximum choice but often comes with a higher premium. The bottleneck here usually relates to the consultant's own availability.

- Restricted / Directory / Guided Networks: This is now the most common model. Insurers have established lists (directories) of approved consultants and hospitals. You must choose a specialist from this list to ensure your treatment is covered in full. The consultants on these lists have agreed to specific fee schedules with the insurer.

- Bottlenecks:

- Limited Choice: Your preferred consultant might not be on the insurer's approved list, forcing you to choose someone else.

- Network Capacity: While a consultant is on the list, their available slots within the network's agreed capacity might be limited, leading to internal waits.

- Geographic Gaps: In some areas, the network might not have a wide selection of specialists for a particular condition, or the closest approved facility might be inconveniently far.

- Pre-authorisation Dependence: You must often gain pre-authorisation for every step of your treatment, ensuring the chosen consultant and facility are covered and within the insurer's fee limits.

- Bottlenecks:

Let's break down the common types of insurer networks and their typical impact:

| Network Type | Description | Implications for Patient | Potential Bottlenecks |

|---|---|---|---|

| Open Referral / Unrestricted | Policy covers treatment by most specialists and hospitals, provided charges are "reasonable & customary." Limited by the insurer's defined fee scales. | Pros: Maximum choice of consultant & hospital. Cons: Higher premiums. Risk of "shortfall" if consultant charges exceed insurer's limit, leaving patient to pay the difference. | Individual consultant's availability. Financial risk of shortfalls if not confirmed beforehand. |

| Guided / Directory Network | Insurer provides a pre-approved list of specialists & hospitals. Patients must choose from this list for full cover. Consultants have agreed fee schedules. | Pros: Clear list of covered providers, no unexpected shortfalls. Often lower premiums than unrestricted. Streamlined pre-authorisation for listed providers. Cons: Limited choice; preferred consultant might not be on the list. Geographic limitations in choice. | If the limited number of specialists on the directory is overbooked. Geographical gaps in network coverage. |

| Specific Hospital Lists | Policy covers a defined list of hospitals, often grouped by price/quality (e.g., "Premier," "Essential"). Consultant choice within those hospitals. | Pros: Can significantly reduce premiums by opting for a smaller or regional hospital list. Clear understanding of covered facilities. Cons: Restricts choice of hospitals. Might exclude major city centre hospitals. | Availability within the selected hospital list. If a specific specialist only practices at a hospital not on your list, you cannot see them. |

| Trust/Company-Specific Networks | For corporate policies, an insurer might create a bespoke network based on employer's location or preferences. | Pros: Tailored to employee needs/location. Can offer good local access. Cons: Highly restricted to specific providers agreed for the group. | Limited flexibility outside of the pre-defined employer network. |

When we at WeCovr help clients compare policies, understanding these network variations is a primary focus. It's not just about the headline premium; it's about whether the network aligns with your expectations for choice and convenience.

The Pre-Authorisation Hurdle: A Necessary Evil?

Once your GP has referred you to a specialist and you've identified a consultant within your insurer's network, the next critical step is almost always pre-authorisation. This is the process where you (or sometimes your GP or the private hospital) contact your insurer to get approval for the proposed treatment, consultation, or diagnostic test before it takes place.

Why do insurers require pre-authorisation?

- Cost Control: It allows insurers to verify that the proposed treatment is medically necessary and falls within the terms and limits of your policy. They can also ensure the consultant's fees and hospital charges are within their agreed schedules.

- Policy Compliance: It's their way of ensuring the condition is acute, not pre-existing or chronic, and that the chosen provider is within their network.

- Guidance and Support: It can also be a point where the insurer offers guidance on network consultants or clarifies policy benefits.

Common Delays and Pitfalls with Pre-Authorisation:

- Incomplete Information: If the referral letter or information provided is vague or lacks sufficient detail, the insurer might request more, causing delays.

- Queries about Medical Necessity: Insurers may have their medical teams review the request. If they deem a procedure or test not medically necessary at that stage, they might decline or ask for further justification.

- Network Mismatches: If you attempt to book with a consultant or hospital not on your policy's approved network, the pre-authorisation will be denied, forcing you to restart the process.

- High Value Procedures: For expensive scans (like PET scans) or complex surgeries, the scrutiny during pre-authorisation might be higher, leading to longer processing times.

- Administrative Delays: The sheer volume of requests, especially during peak periods, can mean calls are queued, or online requests take longer to process. While many insurers aim for quick turnaround (24-48 hours), this isn't always met.

- Transfer of Care: If you initially saw an NHS consultant and then switch to private, the insurer will need a comprehensive private referral to start the pre-authorisation process, which can take time.

Impact on the Patient Journey:

A delayed pre-authorisation means a delayed appointment. You cannot usually book and attend a specialist consultation or diagnostic test until you have received explicit approval from your insurer. This can be incredibly frustrating, especially when you're already in pain or anxious about a diagnosis.

Decoding Your Policy: What Affects Your Access to Care?

Beyond networks and pre-authorisation, the specific terms and conditions of your private medical insurance policy play a monumental role in determining your access to care. Understanding these elements before you need to make a claim is paramount.

Crucial Point: Acute vs. Chronic & Pre-existing Conditions

Let's reiterate this fundamental principle: Standard UK private medical insurance is designed to cover acute conditions that develop after your policy's start date.

- An acute condition is a disease, illness, or injury that is likely to respond quickly to treatment and that is likely to return you to the state of health you were in immediately before suffering the disease, illness, or injury. Examples include a broken bone, appendicitis, or a new cancer diagnosis.

- Chronic conditions are ongoing or long-term conditions that cannot be cured, or which require long-term management. This includes conditions like diabetes, asthma, hypertension, epilepsy, and most forms of degenerative arthritis. These are generally not covered by standard PMI. While your insurer might cover the initial diagnosis or an acute flare-up, ongoing management and medication for chronic conditions usually revert to the NHS.

- Pre-existing conditions are any diseases, illnesses, or injuries for which you have received advice, treatment, or had symptoms before taking out your policy (or within a specified look-back period, typically 2-5 years). These are almost universally excluded by standard PMI. This is why honesty during the application process is critical.

This distinction is the single most important aspect of any PMI policy and a frequent source of confusion and disappointment for policyholders.

Beyond this, other policy elements significantly impact your access and financial outlay:

- Outpatient Limits: Many policies have annual limits on outpatient consultations with specialists, diagnostic tests (like blood tests, X-rays), and physiotherapy sessions. Exceeding these limits means you pay out-of-pocket, even if the condition is acute.

- Excesses and Co-payments: An excess is a fixed amount you agree to pay towards each claim or per policy year. A co-payment means you pay a percentage of the total claim cost. Both reduce your premium but increase your out-of-pocket expenses, potentially affecting your willingness to seek private care for smaller issues.

- Hospital List: As discussed, your policy might only cover a specific list of hospitals, often impacting access to major central London facilities or specific regional hospitals.

- Therapies Coverage: While many policies include physiotherapy, osteopathy, or chiropractic treatment, there might be limits on the number of sessions, and often a GP referral is required first (even if direct access is marketed).

- Mental Health Coverage: While improving, mental health cover often has separate, lower limits than physical health, or may exclude certain conditions or types of therapy. Always check the specifics.

- Underwriting Method:

- Full Medical Underwriting (FMU): You provide a detailed medical history upfront. This gives you clarity on what's covered and what's excluded from day one, potentially streamlining future claims.

- Moratorium Underwriting: This is more common. You don't declare your full medical history upfront. Instead, the insurer automatically excludes any pre-existing conditions from the last 5 years. If you go 2 consecutive years after policy inception without symptoms, treatment, or advice for a particular condition, it may then become covered. This can lead to delays and uncertainty if you develop symptoms related to a past issue.

Understanding these details is where an expert broker like WeCovr becomes invaluable. We can help you decipher the small print and ensure the policy you choose genuinely meets your likely needs, rather than just offering a low premium.

Practical Strategies to Minimise Delays and Navigate Bottlenecks

While some delays are unavoidable, a proactive and informed approach can significantly streamline your private healthcare journey.

-

Research and Compare Policies Thoroughly (Pre-Purchase):

- Don't just look at the premium. Understand the hospital lists, network types (open vs. restricted), outpatient limits, and mental health provisions.

- Consider the underwriting method: FMU offers certainty, Moratorium offers simplicity upfront but potential later complexities.

- Think about your likely usage: Do you need extensive outpatient cover? Do you live in an area with good network coverage for your preferred specialists?

- This is where WeCovr truly adds value. We work with all major UK insurers and can provide impartial advice, helping you compare diverse policies side-by-side to find the right fit for your specific requirements and budget.

-

Understand Your Policy Inside Out:

- Once purchased, read your policy documents. Familiarise yourself with your benefit limits, excesses, and, critically, the pre-authorisation process.

- Know your insurer's contact details for claims and pre-authorisation.

-

Communicate Proactively with Your GP and Insurer:

- With your GP: When discussing a private referral, ensure your GP includes as much detail as possible in the referral letter. The more information, the smoother the pre-authorisation. Ask them to suggest a few consultant names if they have preferences, but be aware you might need to check if they are on your insurer's network.

- With your Insurer: Always get pre-authorisation before any consultation, test, or treatment. Provide all requested information promptly. If there's a delay, call them to follow up. Don't assume approval; always get it in writing.

-

Be Flexible with Consultant Choices (if on a network policy):

- If your preferred consultant has a long waiting list, ask your insurer or the hospital reception if there are other approved consultants with sooner availability. Sometimes, being flexible can shave weeks off your wait time.

- Consider less-known but equally qualified consultants within your network.

-

Utilise Virtual GP Services:

- Many private policies now include access to virtual GP services. These can often provide quick, convenient initial consultations and can issue private referral letters efficiently, kickstarting the process faster than waiting for an in-person NHS GP appointment.

-

Ask About Direct Access Pathways:

- Some policies offer "direct access" for certain therapies like physiotherapy, meaning you don't need a GP referral for the first few sessions. Check if your policy has this, as it can speed up initial treatment for musculoskeletal issues.

-

Keep Detailed Records:

- Document every interaction: dates of calls, who you spoke to, what was discussed, reference numbers, and approvals. This is invaluable if there are any discrepancies or challenges later.

- Keep copies of all referral letters, pre-authorisation codes, and consultant reports.

-

Challenge Delays or Denials (Respectfully):

- If you face a significant, unexplained delay or a denial of pre-authorisation, understand the reason.

- If you believe it's an error or misunderstanding, present your case calmly with supporting documentation. Most insurers have an internal complaints process.

- Remember, WeCovr can also act as your advocate, assisting with claims and navigating insurer processes on your behalf, leveraging our expertise and relationships.

Here's a handy table of key questions you should ask your insurer or broker:

| Category | Key Questions to Ask |

|---|---|

| Policy Scope & Coverage | * What are the annual limits for outpatient consultations, diagnostics (scans, blood tests), and therapies (physiotherapy, mental health)? * Is there an excess, and how does it apply (per claim, per year, per person)? * What is the maximum benefit for inpatient treatment? * Does the policy cover cancer treatment fully, including advanced therapies? * Are there any specific exclusions beyond pre-existing and chronic conditions? * What is the maximum number of physiotherapy/osteopathy/mental health sessions covered? Do I need a GP referral for these? |

| Networks & Choice | * Which hospital list applies to my policy? (e.g., Central London, full UK, restricted regional) * Is this an 'open referral' policy or a 'guided/directory' network? If guided, how extensive is the consultant list in my area for common specialities? * Can I choose any consultant, or only those on your approved list? * What happens if a consultant I want to see isn't on your list, or their fees exceed your limits? (shortfalls) * How can I access the approved consultant/hospital directory? |

| Pre-Authorisation & Claims | * What is the process for pre-authorisation? (phone, online, via GP/hospital) * How long does pre-authorisation typically take? * What information do you need from my GP for a referral to be authorised? * How do I submit a claim? * What is the average turnaround time for claims payments? * What support do you offer if there's a dispute over a claim or treatment? |

| Underwriting | * Is my policy on a Full Medical Underwriting (FMU) or Moratorium basis? * If Moratorium, what is the look-back period for pre-existing conditions, and how does the two-year symptom-free period work? * If FMU, how long will it take for my medical history to be assessed, and will I receive a clear list of exclusions upfront? |

| Added Benefits | * Does the policy include access to a virtual GP? * Are there any wellness benefits or health apps included? * Is travel insurance or second opinion services included? |

The Role of Your GP: The Crucial First Step (Again)

While this article focuses on the journey beyond the initial GP referral, it’s critical to re-emphasise the GP's indispensable role. They are not just the gatekeepers but also your primary medical advocate.

-

The Private Referral Letter: For almost all private medical insurance claims to be authorised, you will need a referral letter from your GP. This letter must clearly state:

- Your symptoms and medical history.

- The reason for the referral.

- The specialist area required (e.g., orthopaedics, dermatology).

- (Optionally) a named consultant, though you should confirm their network status with your insurer. A well-written, detailed referral can significantly speed up the pre-authorisation process.

-

NHS GP vs. Private GP: While most NHS GPs are happy to provide a private referral, some patients opt for a private GP service for their initial consultation. This can be quicker to access and potentially offers more in-depth initial discussion, leading to a more comprehensive referral letter. Many PMI policies now include virtual private GP services, making this even more accessible.

-

Open vs. Named Referrals:

- An "open referral" means your GP refers you to a speciality (e.g., "a gynaecologist") without naming a specific consultant. This gives you flexibility to find a consultant with the shortest waiting list within your insurer's network.

- A "named referral" means your GP recommends a specific consultant by name. While helpful if your GP knows a particular expert, you must check that consultant is on your insurer's approved list and that their fees are covered, otherwise your claim may be denied or you could face a shortfall.

Maintaining a good relationship with your GP and ensuring they understand your decision to use private healthcare can facilitate smoother referrals and information exchange when needed.

Case Studies: Real-World Scenarios and Lessons Learned

To bring these points to life, let's explore some hypothetical but realistic scenarios:

Case A: Sarah's Smooth Sailing with a Shoulder Injury

Sarah, 45, played netball and experienced sudden, sharp shoulder pain. She had a comprehensive PMI policy with a large insurer.

- Initial Step: She used her policy's virtual GP service. Within hours, she had a video consultation. The GP suspected a rotator cuff issue and provided a detailed private referral letter to "Orthopaedics."

- Pre-authorisation & Booking: Sarah called her insurer's claims line with the referral. The insurer checked their network and offered three orthopaedic consultants in her area with availability within 5-7 days. She chose one, and the insurer provided immediate pre-authorisation for the initial consultation and an MRI scan if needed.

- Diagnosis & Treatment: Sarah saw the consultant the following week. An MRI was booked for two days later. The consultant diagnosed a tear and recommended surgery. Sarah's insurer authorised the surgery quickly as it was a covered acute condition and the hospital/consultant were within their network.

- Outcome: Sarah had surgery within three weeks of her initial GP consultation and commenced physiotherapy shortly after, covered by her policy's generous outpatient limits.

Lesson Learned: Comprehensive policy, proactive use of virtual GP, understanding of network, and good communication with the insurer led to a swift resolution.

Case B: David's Unexpected Network Bottleneck

David, 58, developed persistent knee pain. He had a PMI policy with a restricted network, chosen for its lower premium.

- Initial Step: His NHS GP provided a private referral to "Orthopaedics," recommending a renowned knee specialist they knew.

- Network Challenge: David contacted his insurer for pre-authorisation. He discovered his preferred specialist was not on his policy's restricted network. The insurer provided a list of approved consultants, but many had limited availability or were far from his home.

- Delay: The closest available consultant on the approved list had a 4-week wait. When he finally saw them, they recommended an MRI. Again, a 2-week wait for the scan at an approved facility.

- Outcome: While eventually treated, David experienced an additional 6-week delay compared to his initial expectation, purely due to the limitations of his restricted network and the specific availability within it.

Lesson Learned: Cheaper policies often come with more restrictive networks. Understanding these limitations upfront is vital. Flexibility and willingness to travel or see alternative consultants within the network can mitigate delays.

Case C: Eleanor's Pre-Authorisation Hiccup

Eleanor, 32, experienced sudden and severe abdominal pain. Her private GP suspected gallstones and referred her for a specialist consultation and ultrasound.

- Initial Step: Eleanor booked directly with a private consultant after her GP named them. She attended the consultation, where an ultrasound was ordered.

- Pre-Authorisation Error: Eleanor then tried to get pre-authorisation for the ultrasound after the consultation. Her insurer queried why she hadn't sought pre-authorisation before the initial consultation. They also asked for more detailed clinical notes from the consultant, delaying approval for the scan.

- Retroactive Approval Complications: While the initial consultation was eventually approved (as it was an acute condition), the delay in getting the ultrasound meant further discomfort and anxiety. If the condition had been deemed chronic or pre-existing during the insurer's review, she might have faced an uphill battle for any coverage.

- Outcome: Eleanor eventually had her scan and subsequent treatment, but the process was more stressful and drawn out than necessary due to not following the pre-authorisation protocol precisely from the outset.

Lesson Learned: Always secure pre-authorisation for every step of your treatment journey, from the first consultation. Insurers can be very strict on this.

Choosing the Right Policy: More Than Just Price

The stories above highlight that choosing the right private medical insurance policy is far more nuanced than simply comparing premiums. A cheap policy might leave you frustrated by network limitations or unexpected out-of-pocket costs.

When considering a policy, think holistically:

- Your Health Needs: Are you generally healthy, or do you have a family history that makes you more likely to need certain specialities? (Remember: not for pre-existing conditions).

- Location: How important is it to you to have access to specific hospitals or consultants near your home or work?

- Budget: While premiums are important, balance them against the benefits, excesses, and potential for shortfalls.

- Level of Choice: Do you value the freedom to choose almost any consultant (open referral), or are you comfortable with a more restricted but often cheaper network?

- Underwriting Method: Do you prefer the upfront clarity of Full Medical Underwriting, or are you comfortable with Moratorium's automatic exclusions and the possibility of future clarity?

This is precisely where the expertise of a specialist insurance broker like WeCovr comes into play. We don't just present quotes; we provide a deep dive into what each policy truly offers, explaining the subtle differences in network access, outpatient limits, and underwriting terms. Our goal is to empower you to make an informed decision, ensuring your PMI policy truly delivers on its promise of swift and effective private medical care when you need it most. We simplify the complex comparisons, helping you understand the trade-offs and find a policy that aligns with your specific needs and priorities, preventing those hidden wait times and bottlenecks from derailing your health journey.

| Feature | Description | Importance in Avoiding Bottlenecks |

|---|---|---|

| Network Type (Open vs. Guided) | Defines the range of specialists and hospitals you can access. Open networks offer more choice but are pricier. Guided networks restrict choice to an approved list but are often more affordable. | Crucial: A wider network (Open) often means more available consultants, potentially reducing wait times for your preferred specialist. A restricted network (Guided) means you're limited to specific providers, which can lead to bottlenecks if those providers are overbooked. Ensure the network has sufficient specialists in your area for common conditions. |

| Outpatient Limits | The maximum amount the policy will pay for outpatient consultations, diagnostic tests (e.g., blood tests, X-rays, MRI, CT scans), and therapies (e.g., physiotherapy) per policy year. | High Impact: If your outpatient limits are low, you might hit them quickly after just a few consultations and scans, forcing you to pay out-of-pocket for further diagnostics or follow-ups. This can deter you from getting necessary tests promptly, effectively creating a financial bottleneck. Adequate outpatient cover ensures continued access to diagnostics and specialist advice. |

| Excess Level | The amount you agree to pay towards the cost of your treatment before the insurer pays the rest. Can be per claim or per policy year. | Moderate Impact: A high excess reduces your premium but increases your immediate out-of-pocket cost. For less severe conditions or recurring issues that require multiple claims, a high excess might make you hesitate to use your private cover, implicitly leading to delays as you might resort to NHS waits or delay seeking care. |

| Hospital List/Band | Specifies which private hospitals you can use. Some policies have broad lists (e.g., all UK private hospitals), while others have tiered lists (e.g., "Standard," "Mid," "Premium" bands, or specific regional lists), with different levels of access and cost. | Significant: If your policy excludes major central hospitals or specific regional facilities that have shorter wait times or specialist units, you might be forced to travel further or wait longer for an available bed/slot at a covered hospital. Ensure the list includes hospitals conveniently located to you and capable of handling a broad range of procedures. |

| Underwriting Method | Full Medical Underwriting (FMU): You provide a detailed medical history upfront, leading to clear exclusions from day one. Moratorium: You declare less upfront; pre-existing conditions are automatically excluded for a period (e.g., 2 years symptom-free), after which they may become covered. | Critical for Clarity: With FMU, you know precisely what's excluded from the start, reducing future surprises and potential claim denials/delays. Moratorium can lead to delays as the insurer investigates past medical history at the point of claim to determine if a condition is pre-existing, potentially denying claims or prolonging the approval process, thereby creating a bottleneck in accessing immediate care for a new condition that might be confused with a past one. |

| Direct Access Benefits | Policy feature allowing direct access to certain services (e.g., physiotherapy, mental health support) without a GP referral, often for a limited number of sessions. | Time Saving: For common issues like musculoskeletal pain or initial mental health support, direct access can bypass the initial GP appointment, saving valuable time and getting you to a specialist much faster. This directly addresses the "hidden wait time" for initial specialist consultation in certain categories. |

| Pre-Authorisation Process | The insurer's specific requirements and typical turnaround times for approving claims before treatment begins. | Administrative Bottleneck: A complex or slow pre-authorisation process can delay every step of your private care journey. Opt for insurers known for efficient, streamlined pre-authorisation processes (e.g., online portals, quick phone approvals). Clarity on what information is needed (e.g., detailed GP referral) can also speed up the process. |

The Future of UK Private Healthcare and Wait Times

The landscape of UK healthcare is constantly evolving, and this will undoubtedly impact private health insurance and wait times.

- Continued NHS Pressures: With an aging population and increasing demand for healthcare, NHS waiting lists are unlikely to shrink dramatically in the near future. This sustained pressure will likely continue to drive demand for private options.

- Technological Advancements:

- Telemedicine and Virtual Consultations: The pandemic significantly accelerated the adoption of virtual GP and specialist consultations. These can drastically reduce initial wait times and geographical barriers.

- AI and Diagnostics: Artificial intelligence is beginning to assist in diagnostic imaging interpretation, potentially speeding up report turnaround times.

- Remote Monitoring: Wearable tech and remote monitoring can enable proactive management of conditions, potentially reducing the need for in-person visits.

- Insurer Innovations: Insurers are increasingly investing in digital platforms for claims submission, pre-authorisation, and access to services. Many are also focusing on preventative health programmes to keep policyholders healthier and reduce claims.

- Integrated Care Pathways: A growing trend towards more integrated care pathways, where diagnosis, treatment, and follow-up are coordinated efficiently, could help streamline the patient journey across both NHS and private sectors.

While challenges remain, the private health insurance market is adapting, seeking to enhance its value proposition by improving access, convenience, and efficiency through technology and refined service models.

Conclusion: Empowering Your Private Healthcare Journey

Private medical insurance offers a valuable alternative to the NHS, promising quicker access and greater choice. However, as we've explored, the journey isn't always seamless. Hidden specialist wait times and network bottlenecks can emerge beyond the initial GP referral, turning the promise of rapid care into a frustrating waiting game if not properly managed.

The key to unlocking the true value of your PMI lies in being an informed, proactive policyholder. Understand that standard PMI is for acute conditions that arise after your policy begins, and explicitly excludes chronic and pre-existing conditions. Beyond this fundamental rule, familiarise yourself with your policy's specifics – its network type, outpatient limits, excesses, and pre-authorisation process. Choose a policy that truly aligns with your needs, not just your budget, and don't hesitate to ask questions.

By understanding the nuances of the private healthcare ecosystem, leveraging your policy's benefits, and communicating effectively with your GP and insurer, you can navigate these potential pitfalls with confidence. Empower yourself with knowledge, and ensure your private medical insurance truly delivers on its promise of prompt, high-quality care when you need it most.

Sources

- Office for National Statistics (ONS): Inflation, earnings, and household statistics.

- HM Treasury / HMRC: Policy and tax guidance referenced in this topic.

- Financial Conduct Authority (FCA): Consumer financial guidance and regulatory publications.