Embedded Insurance: a $3 Trillion market opportunity

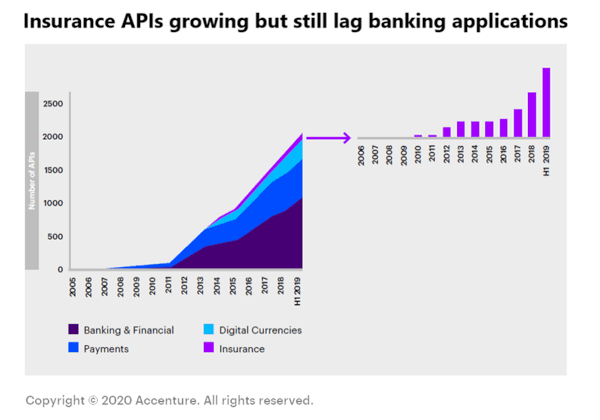

As many of our wonderful customers know, WeCovr is an insurtech with a particular focus on Embedded Insurance, meaning we can build our insurance solutions into clients' offerings to enhance their users' experience and customer value. We do this by using our APIs and insurance expertise and capabilities. We've already launched and are working on launching even more embedded insurance projects.

Embedded Insurance trends in 2024

Below is a quick summary we've put together of an excellent on Embedded Insurance by Simon Torrance published recently on LinkedIn.

Insurance is something that nobody wants but everyone needs

Simon Torrance's focal point of the article is that insurance is needed more than ever today as the ‘protection gap’ – the gap between the amount of insurance that is economically and socially beneficial for individuals, households and firms and the amount of coverage actually bought – is getting wider and wider.

Swiss Re Institute noted that in the last 10 years this gap has doubled, driven by global trends in digitisation, urbanisation, climate change and a lack of effective innovation.

McKinsey found that 80% of insurers made negligible or negative economic profit in the years running up to the Covid crisis and, projecting forward, the situation is likely to get worse, indicating a fundamental weakness in the business model:

- on the demand side, insurance products are complicated, inflexible, expensive, regularly mis-sold, difficult and annoying to buy (all those forms to fill in), and the benefits to customers are uncertain and distant and

- on the supply side, related to these issues, the costs of distribution (of selling products to customers who don’t understand, trust or want them) are enormous at roughly 50% of total industry costs.

Insurers are expert at managing risk, but their underwriters lack enough rich, real-time data to be able to create affordable and personalised products that can keep pace with market demands, accelerating trends and the new risks that go with them. Laws and regulations designed for a pre-digital age restrain them further.

Embedded Insurance – to affinity and beyond…

Embedded insurance is emerging as a new way to distribute insurance services efficiently. It doesn’t solve the protection gap, but it addresses many of the supply and demand issues and could act as a catalyst for wider industry business model transformation.

Embedded Insurance means abstracting insurance functionality into technology to enable any third-party product or service provider or developer in any sector to seamlessly integrate innovative insurance solutions into their customer propositions and experiences, either as complementary add-ons to their core offerings or as new native components.

For end users - individuals or businesses - it means simpler and more affordable solutions at the touch of a button, at a moment when it is most relevant. For third parties it means a new way to differentiate, attract or retain users, or generate new sources of revenue.

Examples of Ant Group and Uber provide insurers with access to a large new market, with very low distribution costs. There is clearly a win, win, win - for users, insurers and platforms.

For retailers and product manufacturers with razor thin margins are looking to offer add-on services like theft and damage protection at point of sale. For some, these sorts of ancillary service can equate to up to 50% of their net profits.

In the past, due to the technical and contractual complexity of dealing with traditional providers, only the very largest retailers and merchants and could afford to integrate these types of extended warranties and only on large value items.

For example, Amazon has found that offering warranties even for $40 backpacks increases their purchase rate. New insurtech intermediaries are making it easier and cost effective for any online merchant to create similar offers.

B2B Software-as-a-Service companies are also in a perfect position to add personalised insurance solutions to the range of other financial services they already provide with virtually no customer acquisition costs.

While retailers, manufacturers, airlines, banks, professional associations and others have been distributors of insurance products for a long time, Embedded Insurance has the potential to take this to another level.

BIMA is a great example of embedding affordable health insurance into the mobile telephony ecosystem, closing the protection gap for 35 million Africans today.

New framework emerging

Customers – individuals and businesses – are generally underserved by the insurance industry today. Customers have the closest relationships with organisations they interact with regularly or at important moments in their lives, and these are rarely insurance companies.

As digitisation blurs the boundaries between traditional market sectors new digital ecosystems, orchestrated by powerful platform businesses, are emerging.

McKinsey estimates that 30% of global economic activity - $60 Trillion - will be mediated within these new ecosystems by 2025.

Platform businesses are emerging in every conceivable walk of life, B2B as well as B2C. At scale they generate huge datasets and insights in real time about the activities and interests of their users, creating ideal markets for embedding insurance.

Amazon Pay, for example, announced this week that it was selling auto insurance in India, promising a two-minute sign-up process and no paperwork. «This, coupled with services like hassle-free claims with zero paperwork, one-hour pick-up, 3-day assured claim servicing and 1 year repair warranty in select cities, as well as an option for instant cash settlements for low value claims, making it beneficial for customers» said a spokesperson.

PingAn is by far the leading exponent of the platform business model today amongst insurers. It has established a portfolio of its own platform ventures in adjacent sectors like telemedicine, automotive sales and real estate. These have attracted huge new user bases and created ideal environments in which to embed its financial services products. They have become dominant channels now for originating and maintaining customer relationships, driving 40% of new sales.

Covid has accelerated the move to digital services for organisations in all sectors, and increased the attractiveness of end user fintechs and insurtech apps.

Physical products, machines and, in the not-so-distant future, human bodies are becoming more connected and smart, generating new levels of data that, combined with AI, can support, for example, the wider adoption of parametric insurance .

At a Tesla earnings call earlier this year Elon Musk said: «We’re building a great, major insurance company. If you’re interested in building a revolutionary insurance company, please join Tesla. Especially if you want to change things. This is the place to be. We want revolutionary actuaries.»

He said that insurance could deliver 30-40% of Tesla’s total value in the future. «Insurance is a good example of a product that’s made by our internal applications team. We make the insurance product and connect it to the car, look at the data, calculate the risk. This is all done internally — basically internal software application».

Banks, auto manufacturers, retailers, professional associations, travel companies have long been distribution partners for insurers. While they have been big enough to absorb lengthy contract negotiations and technical integrations, they too are coming under increased pressure to be more responsive to their customer’ needs in terms of personalisation and price.

John Lewis, one of the UK’s best loved retail brands, is re-vamping its financial services offerings. Working with reinsurer MunichRe and its network of fintech partners, it is looking to create more innovation solutions for its customers. This is part of a new five year strategy to generate 40% of profits from non-retail services. Ikea has launched new digital home insurance services in Europe and South East Asia.

Some traditional insurance intermediaries like brokers and agents are also upping their game, to interact with customers in more effective and digital ways.

A new breed of MGA is emerging to fill the gaps between the needs of digital platforms like Uber, a long tail of underserved merchants and brands, as well and the primary insurers who want to reach them. Unlike brokers MGAs manage claims, borrow underwriting authority from ‘fronting insurers’, and offload risk to primary insurers and/or reinsurers. They bring technical efficiency to underwriting, customer acquisition, claims processing and policy retention.

Brokers are increasingly interested in this model and some are setting up their own MGAs attracted by their margins and ability and control over sales processes.

‘Neo Insurers’, the equivalents of Neo Banks have dramatically improved the end customer experience of buying and engaging with insurance, use modern technology to dramatically reduce their operational costs and APIs to easily connect with third parties. Primarily they sell directly to customers and, as a result, have very high customer acquisition costs.

‘Specialist Insurtechs’ are those focused on selling specific enabling capabilities into the insurance industry today. In the context of Embedded Insurance, they may increasingly look to other sectors too as the market develops.

Incumbent’s point of view

From an incumbent’s point of view, Swiss Re’s iptiQ venture exemplifies this trend. Established in 2016 as a digital venture focused on traditional insurance distributors it now targets multiple types.

Reinsurers are under price pressure from increasing volumes of ‘alternative capital’ entering the insurance market: hedge funds, sovereign wealth funds, pensions and mutual funds looking for new low-risk investment yields as interest rates stick at zero.

As part of their response reinsurers are moving up the stack in search of new revenue streams and to get closer to the risk. Most large Venture Capital arms, looking increasingly to partner with insurtechs to take combined reinsurers today also own primary insurance businesses and are making more investments via their Corporate propositions to market, disintermediating primary insurers. Swiss Re recently announced a JV with Daimler to create an auto insurance MGA called Movinx.

IoT technology

What’s particularly interesting is a focus on IoT technology, as well as insurtech. Embedding protection into industrial systems and everyday products is a big market opportunity and a key enabler for many new business models.

Alternative capital

What would happen if Alternative Capital could directly support the insurance activities of digital platforms, enabled by developer platforms, specialist agencies or MGAs? Risk data, for example, could be collected by mobility-as-a-service platform in real time from multiple sources and put on a blockchain. Capital providers, insurers and reinsurers could bid to cover different risk types to creating a more fluid supply of cost effective and customised protection.

Data is the key to enabling all the scenarios we’ve discussed here. Accessing new sources of data, combining them, making sense of them and embedding them into new solutions will be key. One of the richest sources is bank account data, increasingly exploitable due to the move towards Open Banking around the world.

To avoid monopolies forming, regulators across more and more sectors are looking to enable data to become more ‘portable and mobile’ – i.e. allowing them to move between different consumer domains in fair, transparent and controllable ways that stimulate innovation and consumer value.

Market sizing

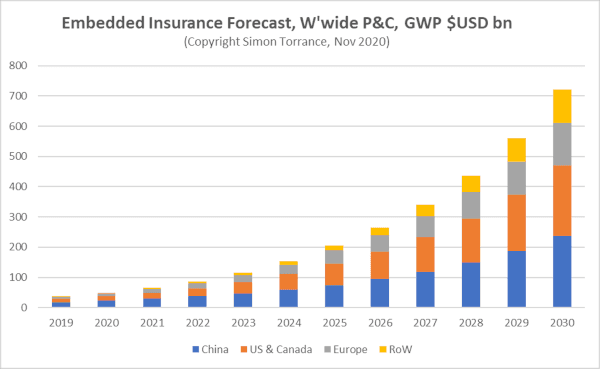

Personal and Commercial P&C lines combined represented just under $1.7 Trillion of Gross Written Premiums in 2019, roughly a third of the overall insurance market which was above $5 Trillion. Western markets currently represent about 80% of premiums, highlighting the magnitude of the protection gap in emerging markets.

Some other things to note: P&C insurance is a very local business, even within individual countries. It is highly fragmented, with 2500 P&C insurers in the US alone of which. The top 10 companies control only about 40% of the market. There are different types of distribution for different types of products, but in general sales in most countries today are still dominated by face to face and phone interactions.

Since Embedded Insurance is a tech-centric distribution channel, based on current valuation multiples of leading insurtechs of 5-7 times GWP today, businesses that enable Embedded Insurance could be worth $3-5 Trillion in ten years’ time or, in other words, more valuable than the Top 30 financial institutions today, and this is P&C alone.

New ventures

In terms of how to win, Simon concludes that all players in the market will need to consider whether to build things internally, collaborate with others or create completely new ventures.

There are pros and cons of each, depending on levels of ambition and capabilities.

Taking a portfolio approach and making bold moves works best. Doing nothing, or doing things half-heartedly, are not good options.

Want to offer embedded insurance to your customers?

WeCovr already works with a number of great companies who have been able to offer insurance products to their users by leveraging our technology and insurance expertise.

Please don't hesitate to reach out to us to discuss your particular requirements and use case. We'd be delighted to assist.