TL;DR

Martin Lewis(en.wikipedia.org)), the renowned financial expert and consumer champion, has provided invaluable insights on private health insurance in the UK. As healthcare costs continue to rise and NHS treatment wait times remain a concern, more and more individuals are exploring private health insurance options. This comprehensive guide, tailored for WeCovr, will help you navigate the complex world of medical insurance and make informed decisions about your healthcare needs.

Review: Martin Lewis' In-depth Guide to Private Health Insurance in the UK

Martin Lewis(en.wikipedia.org)), the renowned financial expert and consumer champion, has provided invaluable insights on private health insurance in the UK. Through his website MoneySavingExpert.com(MoneySavingExpert.com), TV shows like 'The Martin Lewis Money Show', numerous media appearances, and best-selling books, Lewis has offered essential guidance to those considering private health insurance.

As healthcare costs continue to rise and NHS treatment wait times remain a concern, more and more individuals are exploring private health insurance options. This comprehensive guide, tailored for WeCovr, will help you navigate the complex world of medical insurance and make informed decisions about your healthcare needs.

About Martin Lewis

Most UK households are familiar with Martin Lewis, primarily from his ITV finance show, 'The Martin Lewis Money Show'(en.wikipedia.org), co-hosted with Angellica Bell(en.wikipedia.org). Lewis is also a regular guest on other ITV programs like This Morning(en.wikipedia.org)) and Good Morning Britain(en.wikipedia.org)), where he discusses various financial topics including mortgages and insurance such as this episode where he explains the key features of life insurance:

Martin Lewis is a renowned financial journalist and campaigner who has been dedicated to supporting consumers for over two decades. One of his most notable achievements was his successful campaign against the mis-selling of Payment Protection Insurance (PPI)(moneysavingexpert.com).

Through his work, Lewis has established himself as a trusted source of financial information and advice for consumers. In 2008, he founded the MSE Charity(msecharity.com), which provides funding to UK-based non-profit organisations that offer financial education.

In addition to his charitable work, Lewis is also the founder and executive chair of the Money and Mental Health Policy Institute(moneyandmentalhealth.org), which aims to break the link between financial difficulties and mental health problems.

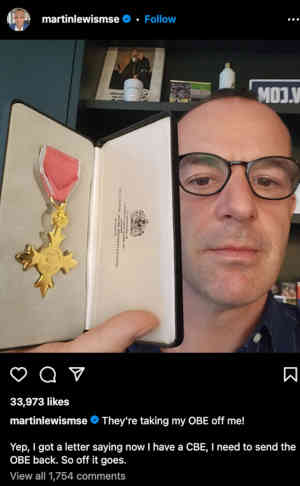

Lewis' contributions to consumer rights and charitable causes were recognised in 2014 when he was awarded an OBE. In 2022, he announced that he had received a letter informing him that his OBE had been upgraded to a CBE. This upgrade was officially confirmed in recognition of his services to consumer rights and broadcasting.

What Does Martin Lewis Say About Private Health Insurance?

According to Lewis, private health insurance is a "lifestyle choice, and it ain't cheap." He emphasises that while the NHS provides comprehensive care, some individuals may prefer the additional peace of mind and quicker access to treatment that private insurance offers.

The assessment of private health insurance on the The Martin Lewis private health insurance review(moneysavingexpert.com) on MoneySavingExpert.com is not as critical as some of his other evaluations of insurance products.

"The NHS provides comprehensive treatment to anyone, regardless of their ability to pay. Yet if you want to opt for private care, it can be costly, so that's where health insurance comes in. It covers planned consultations, treatments and operations – be it hips, cataracts or ears."

It's important to make sure that you do your research whenever you're thinking about any major financial decision, and especially one that impacts your family. Private health insurance plans can be confusing because of the number of options and different levels of cover that are available.

Lewis acknowledges that private health insurance can be expensive, especially for older individuals or those with pre-existing conditions. However, he also recognises the potential value it can provide in terms of faster access to specialists, private hospitals, and advanced treatments that may not be readily available on the NHS(nhs.uk).

Understanding What Private Health Insurance Covers

One of the most crucial aspects of Lewis' advice is clarifying what private health insurance does and does not cover. He emphasises that these policies primarily cover acute conditions, which are diseases or injuries that can be treated or cured. Examples include:

- Cancer

- Heart attack

- Stroke

- Musculoskeletal problems (e.g., back, neck, or joint pain)

- Some mental health conditions

However, chronic conditions, which are lifelong and have no known cure, are generally not fully covered by private health insurance. These include:

- Diabetes

- Asthma

- Epilepsy

- Certain mental illnesses

- Multiple Sclerosis

"Health insurance is designed to cover you for non-routine tests and treatment for acute conditions. These are those that are serious but curable and usually short-lived, which start after your policy begins.

Therefore many chronic conditions (often incurable, long-term issues such as arthritis or asthma), as well as those that exist before you take out a policy, are excluded as standard."

Lewis emphasises that private health insurance is intended to complement, not replace, NHS services. It can provide quicker diagnosis, access to private hospitals and specialists, and additional support for conditions like cancer or musculoskeletal issues. However, the NHS will still be responsible for the majority of care for chronic conditions.

Should You Get Private Health Insurance? Martin Lewis' Advice

Deciding whether to invest in private health insurance is a personal decision that depends on various factors. Lewis suggests asking yourself three key questions:

-

Are you comfortable with NHS care? For most people, the NHS provides adequate treatment, but some may prefer the additional peace of mind and potential quicker access to care that private insurance offers.

-

Would you consider self-insuring? For less serious conditions, you could opt to pay for private treatment out-of-pocket. However, Lewis warns that more invasive treatments can be extremely expensive, potentially costing tens of thousands of pounds.

-

Are you covered by your employer? Some employers offer private health insurance as a benefit, which can be more affordable than a personal policy. However, Lewis cautions that this coverage may be inflexible and tied to your employment.

"Check if you're already covered by your employer... There is a 'but' though... If you need treatment, claim, and then later decide to leave your employer, will you be able to continue your membership with the healthcare firm on the same terms? If not, you may then be stuck without being able to get a new insurer to cover an existing condition (or need to pay huge premiums every month to keep it covered)."

Lewis emphasises that private health insurance is not a one-size-fits-all solution. It's crucial to assess your personal circumstances, healthcare needs, and financial situation before making a decision.

The Rise of Private Health Insurance in the UK

While the NHS remains a cornerstone of the British healthcare system, private health insurance has seen a surge in popularity in recent years. According to the Association of British Insurers (ABI), the number of individuals covered by private medical insurance policies in the UK reached 5.8 million in 2022, the highest number we've seen since 2008. And payouts for health insurance claims also hit a record high, reaching almost £3 billion overall.

This growth can be attributed to several factors, including:

-

Longer NHS waiting times: As the NHS grapples with increased demand and resource constraints, wait times for non-emergency procedures and specialist appointments have lengthened, prompting some individuals to seek private alternatives.

-

Access to cutting-edge treatments: Private healthcare providers often have access to the latest medical technologies and treatments, which may not be immediately available on the NHS due to funding constraints or approval processes.

-

Increased health consciousness: With greater awareness of preventative care and early intervention, some individuals opt for private health insurance to gain quicker access to diagnostic tests and screenings.

-

Employer-sponsored plans: Many companies, particularly in competitive industries, offer private health insurance as part of their employee benefits package to attract and retain top talent.

While private health insurance may not be a viable option for all Britons, its growing popularity highlights the desire for alternatives and complementary services to the NHS.

Martin Lewis' "Need-to-Knows" for Private Health Insurance

In his review, Lewis highlights several important points to consider when evaluating private health insurance options:

-

Flexibility and tailoring: Private health insurance can be tailored to your needs by adding or removing benefits, adjusting coverage limits, and choosing different excess levels.

-

Higher excess reduces premiums: Opting for a higher excess (the amount you pay upfront for claims) can lower your monthly premiums, but you'll need to pay more if you make a claim.

-

Exclusions and limits: Most policies exclude pre-existing conditions and have other limitations, so it's crucial to review the terms and conditions carefully.

-

Claims processes: Each insurer has its own claims process, which must be followed for a valid claim. Failure to do so could result in rejected claims.

-

Full medical or moratorium: When applying for health insurance, you can choose between providing your full medical history upfront, which means you'll know what's covered or excluded, and moratorium underwriting: no health questionnaire is required, and it's usually cheaper and quicker to obtain. However, if you need to claim within the first two years, you'll often need to prove you haven't had the condition before, which could slow down the process.

-

Switching providers: While switching insurers can sometimes save money, be cautious if you've had recent treatment, as your new policy may exclude ongoing conditions.

Tailoring Your Private Health Insurance Coverage

One of the key advantages of private health insurance, according to Lewis, is the ability to tailor your coverage to your specific needs and budget. Many insurers offer a range of optional benefits and coverage levels, allowing you to customise your policy.

Some common optional benefits include:

- Outpatient cover: Covers the cost of diagnostic tests, consultations, and treatments that don't require an overnight hospital stay.

- Therapies: Covers the cost of physiotherapy, chiropractic treatment, and other therapies for musculoskeletal issues.

- Dental and optical cover: Covers the cost of routine dental and vision care, as well as more extensive treatments like orthodontics or laser eye surgery.

- Mental health cover: Covers the cost of therapy, counseling, and inpatient treatment for mental health conditions like depression or anxiety.

- Travel insurance: Provides medical coverage while travelling abroad.

By selecting the appropriate optional benefits, you can ensure that your private health insurance policy aligns with your healthcare needs and priorities.

In addition to optional benefits, many insurers offer different levels of coverage, ranging from basic plans to comprehensive policies with higher annual limits and fewer exclusions. By working with a knowledgeable insurance broker or advisor, you can navigate these options and find the right balance between coverage and affordability.

The Role of Excess in Private Health Insurance

Another key consideration when evaluating private health insurance policies is the excess, or the amount you'll need to pay out-of-pocket before your insurance coverage kicks in. Lewis emphasises that choosing a higher excess can significantly reduce your monthly premiums, but it also means you'll need to pay more if you make a claim.

Most insurers offer a range of excess options, typically starting at around £100 and going up to £5,000 or more. The higher the excess, the lower your monthly premiums will be. However, it's important to balance the potential savings against your ability to cover the excess amount should you need to make a claim.

"One strategy some consider is to combine a policy with a high excess (£1,000+) with self-insuring – where you put cash in savings to use for basic private treatments but also have the ability to claim for expensive treatment." (illustrative estimate)

Lewis also highlights an important distinction between two types of excess: "excess per claim" and "excess per year." With an excess per claim, you'll only pay the excess amount once for each separate condition or illness, regardless of how long the treatment lasts. With an excess per year, you'll pay the excess amount for each policy year in which you make a claim, even if the treatment spans multiple years.

Additionally, some insurers offer a "shared responsibility" option, where you pay a percentage of the claim cost rather than a fixed excess amount. This option can be beneficial for those seeking a balance between predictable out-of-pocket costs and premium savings.

Pre-Existing Conditions and Underwriting Methods

One of the most significant challenges when obtaining private health insurance is dealing with pre-existing medical conditions. Most policies exclude coverage for conditions that existed before the policy's start date, and insurers often require applicants to disclose their full medical history during the underwriting process.

Lewis emphasises the importance of understanding the different underwriting methods used by insurers:

-

Moratorium underwriting: This is the quickest and easiest method, as it doesn't require any medical questions or evidence. However, it excludes any conditions for which you've received treatment or experienced symptoms in the past few years (typically three to five years) before applying.

-

Full medical underwriting: This method involves completing a detailed medical questionnaire and potentially providing medical records or undergoing examinations. It can be more beneficial for those with chronic or pre-existing conditions, as any exclusions will be factored into the pricing, potentially resulting in more affordable premiums.

It's worth speaking to a health insurance expert if you need more information about this and to understand what the most suitable option for you might be.

Switching Private Health Insurance Providers

As with many insurance products, Lewis recommends periodically reviewing your private health insurance policy and shopping around for better deals or more comprehensive coverage. Many insurers offer incentives or discounts for new customers switching from another provider, such as a "switch and save" discount.

However, Lewis cautions that switching providers can be more complex if you've recently received treatment or have an ongoing condition. Your new policy may exclude coverage for pre-existing conditions or ongoing treatment, effectively nullifying any benefits you had with your previous insurer.

If you've had treatment with your previous cover and this is still ongoing, then this is likely to be excluded and you might lose some of that benefit. If you have a condition that is within the terms of your existing cover, then you could be locked into that policy.

To avoid any disruptions in care or loss of coverage, Lewis advises carefully reviewing the terms and conditions of any new policy before making a switch, and consulting with a knowledgeable insurance broker or advisor if necessary.

Seeking Expert Advice and Comparing Providers

The Martin Lewis private health insurance guide mentions using price comparison sites to potentially save hundreds of pounds, but only "if you know what you want (and don't need advice)".

However, not everyone would necessarily agree that this is the best approach for everyone, as lack of advice could result in choosing the wrong cover or selecting a cheaper policy that may not provide adequate protection.

It's also important to note the financial connection between MoneySuperMarket.com and MoneySavingExpert, which are essentially part of the same company.

Therefore, it's worth exploring other options to ensure that you're getting the best policy and the most affordable private health insurance for your needs.

Exercise caution when using comparison websites for private health insurance, especially if you are unfamiliar with the different options available. It's important to carefully consider your choices to ensure you find the right policy for your needs.

Lewis also emphasises the value of working with a qualified insurance broker or advisor who can guide you through the process, compare policies from multiple providers, and help you find the best coverage for your needs and budget.

At WeCovr, our qualified health insurance experts can guide you through the entire process, from assessing your healthcare needs to comparing prices from our extensive panel of providers.

Our experts do not charge you any fees and will work closely with you to ensure you understand the various policy options, coverage levels, and potential exclusions, helping you make an informed decision that aligns with your lifestyle, budget, and healthcare priorities.

In addition to our expert guidance, it is worth to consider providers that offer incentives or rewards programs to offset the cost of private health insurance. For example, Vitality, a well-known provider in the UK, offers discounts and rewards for individuals who engage in regular exercise and maintain a healthy lifestyle.

Complaints and Consumer Protection

Despite the best efforts of insurers and advisors, disputes or issues may arise with private health insurance policies. In such cases, Lewis emphasises the importance of following the proper complaints procedures and understanding your rights as a consumer.

Each insurance provider is required by regulation to have a comprehensive complaints process in place. If you have an issue with claims procedures, policy changes, unfair charges, or any other aspect of your coverage, you should first contact your insurer directly and give them an opportunity to resolve the matter.

If you're unsatisfied with the insurer's response or believe you've suffered financial loss due to their actions, you can escalate your complaint to the Financial Ombudsman Service (FOS)(financial-ombudsman.org.uk). The FOS is an impartial and free service that can investigate disputes between financial services providers and their customers, potentially ruling in favour of compensation if appropriate.

"It's always worth trying to call your provider first, but, if not, then you can use free complaints tool Resolver(resolver.co.uk)."

By understanding your rights and following the proper channels, you can ensure that any concerns or disputes with your private health insurance provider are addressed fairly and in accordance with consumer protection regulations.

The Future of Private Health Insurance in the UK

As the demand for private healthcare services continues to grow, the private health insurance industry in the UK is likely to evolve to meet changing consumer needs and expectations. Emerging trends and potential developments include:

-

Increased integration with digital health technologies: Many insurers are exploring ways to incorporate wearable devices, telemedicine, and other digital health solutions into their policies and services, potentially improving access to care and preventative healthcare.

-

Personalised and data-driven policies: With the advent of big data and advanced analytics, insurers may be able to offer more personalised policies tailored to individual risk profiles, lifestyle factors, and healthcare needs.

-

Expanded coverage for mental health: Recognising the importance of mental well-being, some insurers are already offering more comprehensive coverage for mental health services, and this trend is expected to continue.

-

Partnerships and collaboration: To better serve their customers, private health insurance providers may seek partnerships with healthcare providers, technology companies, and other stakeholders in the healthcare ecosystem.

-

Regulatory changes: As the healthcare landscape evolves, regulatory bodies may introduce new rules or guidelines that could impact the structure, pricing, and offerings of private health insurance policies.

While the future of private health insurance in the UK remains uncertain, one thing is clear: Martin Lewis' guidance and expertise will continue to be invaluable for consumers navigating this complex and ever-changing landscape.

Key Takeaways and Final Thoughts

Martin Lewis' comprehensive advice on private health insurance in the UK serves as a valuable resource for individuals seeking to understand their options and make informed decisions about their healthcare needs. From clarifying what private insurance covers to highlighting the importance of tailoring policies and seeking expert guidance, Lewis's insights provide a solid foundation for navigating the world of medical insurance.

By following Lewis's recommendations, such as carefully reviewing policy terms, understanding underwriting methods, and considering the role of excess and optional benefits, consumers can ensure that their private health insurance coverage aligns with their unique circumstances and provides the protection they need.

Additionally, Lewis's emphasis on seeking expert advice and comparing providers underscores the value of working with knowledgeable professionals like the experts at WeCovr. Our qualified health insurance experts are ready to provide a free no-obligation advice and assist you in making an informed decision when choosing your private health insurance.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.