TL;DR

As many of our wonderful customers know, WeCovr is an insurtech with a particular focus on Embedded Insurance, meaning we can build our insurance solutions into clients' offerings to enhance their users' experience and customer value. We do this by using our APIs and insurance expertise and capabilities. We've already launched and are working on launching even more embedded insurance projects.

Key takeaways

- Why we are excited about embedded insurance in 2026

- Embedded insurance is the bundling of coverage or protections within the purchase of a product or service.

- In this post, I’ll explain why tech is so well positioned to offer insurance in this way and why embedded insurance creates a win-win-win outcome for tech, insurance and consumers alike.

- Below is a quick summary we've put together of an excellent thought piece(albion.vc) on Embedded Insurance by Jessica Bartos of AlbionVC.

- The years since have shown that consumers are willing and able to make even very high value or complex purchases online.

As many of our wonderful customers know, WeCovr is an insurtech with a particular focus on Embedded Insurance, meaning we can build our insurance solutions into clients' offerings to enhance their users' experience and customer value. We do this by using our APIs and insurance expertise and capabilities. We've already launched and are working on launching even more embedded insurance projects.

Below is a quick summary we've put together of an excellent thought piece(albion.vc) on Embedded Insurance by Jessica Bartos of AlbionVC.

Why we are excited about embedded insurance in 2026

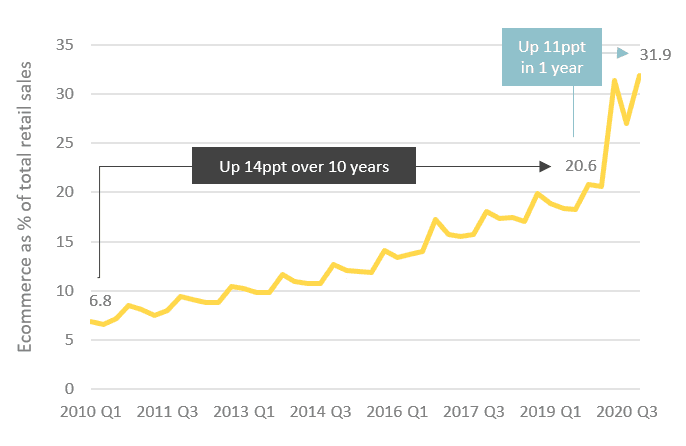

The pandemic-era shift, which saw online sales as a percent of total retail reach 32% in the UK back at Christmas 2020, cemented a new baseline for e-commerce, advancing nearly a decade's worth of penetration in just one year. The years since have shown that consumers are willing and able to make even very high value or complex purchases online. For instance, the success of companies like Cazoo in the early 2020s proved that even notoriously offline purchases like cars could be done successfully online at scale.

A knock-on effect of society’s accelerated consumption of digital services has been a similar acceleration towards embedding insurance into digital offerings. Embedded insurance is the bundling of coverage or protections within the purchase of a product or service. The insurance product is not sold to the customer ad hoc but is instead provided as a native feature. In this post, I’ll explain why tech is so well positioned to offer insurance in this way and why embedded insurance creates a win-win-win outcome for tech, insurance and consumers alike.

To set out the problem: a system in which the insurance purchase is separate from the purchase of the product or service associated with the underlying risk is ineffective and inefficient. Insurance is an afterthought or rejected as an unappealing hassle, resulting in protection gaps, estimated to be c. $2 trillion globally. The size of this gap continues to grow, having nearly doubled over the last two decades due to urbanisation, digitisation, climate change and lack of innovation.

When consumers do buy insurance, the customer journey is poor and often still fragmented. For instance, while over 80% of consumers now research their insurance online (expressing their intent to buy digitally), only around 40% are able to complete their purchase online seamlessly.

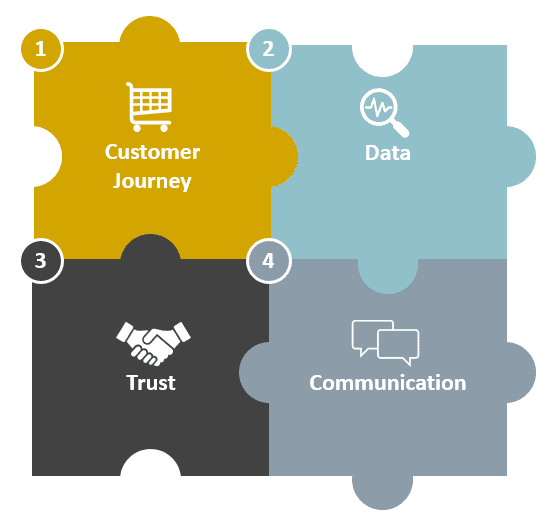

But embedding insurance in digital services can fix what’s wrong with insurance today. Embedded insurance offers insurance when the risk is top of mind for the buyer. And it brings insurers closer to the underlying risks. Tech players — whether ecommerce, SaaS or digital services — are well suited to embed insurance into their platforms because, in our online world, they control four critical pieces of the insurance puzzle: 1) customer journey, 2) data, 3) trust, and 4) communication

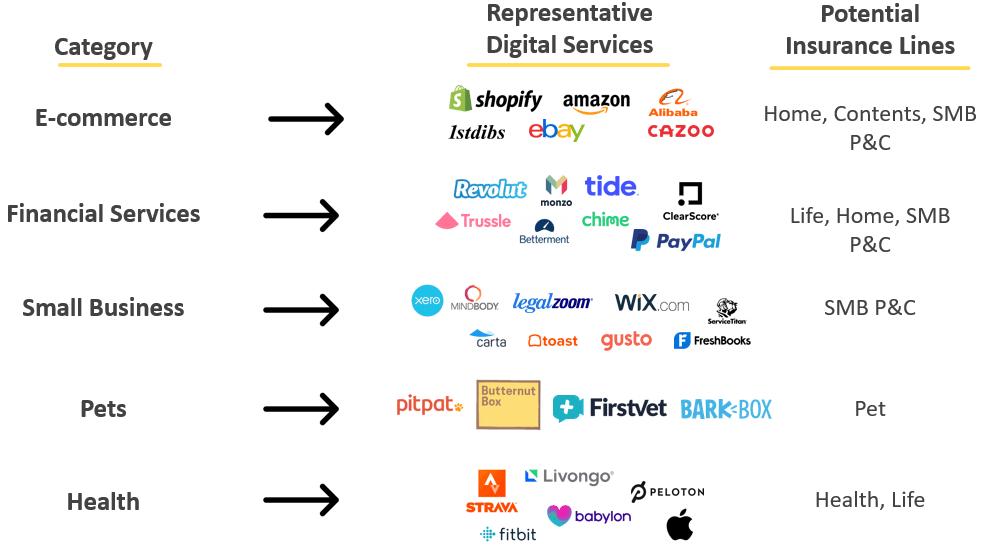

The biggest tech ecosystems, such as Amazon, Apple, Google and Alibaba, that bring together services, marketplaces and devices into one trusted experience, will be especially powerful in embedded insurance. But those who can play in embedded insurance is broader than just the largest tech giants. It could also encompass an array of digital-first disruptors in various verticals:

I’d argue that if your digital business has control of the customer, the data, the trust and the communications, you’re well-placed to embed insurance.

- Customer Journey

First, as more of life happens online, tech players control the customer journey. They can serve an insurance offering to a buyer exactly when it is most relevant to them, increasing conversion rates compared to a separate purchase of insurance. Meeting the customers where they are should expand the amount of insurance that is purchased in the first place, closing protection gaps. Digital players can easily weave the insurance purchase into the customer workflow to reduce friction, as compared to incumbent insurers’ failed attempts to build functioning, pleasant online purchase journeys.

For tech players, embedded insurance adds a high margin revenue stream. For example, one of the best penetrated embedded insurance categories is insurance into the rental car customer journey – selling extra insurance at the checkout counter. In car rentals, there is intense price competition leading to razor thin margins on the standalone car bookings. But the add-on insurance is extremely high margin. In these businesses, the insurance and other ancillary services often drive over 100% of the profits.

- Data

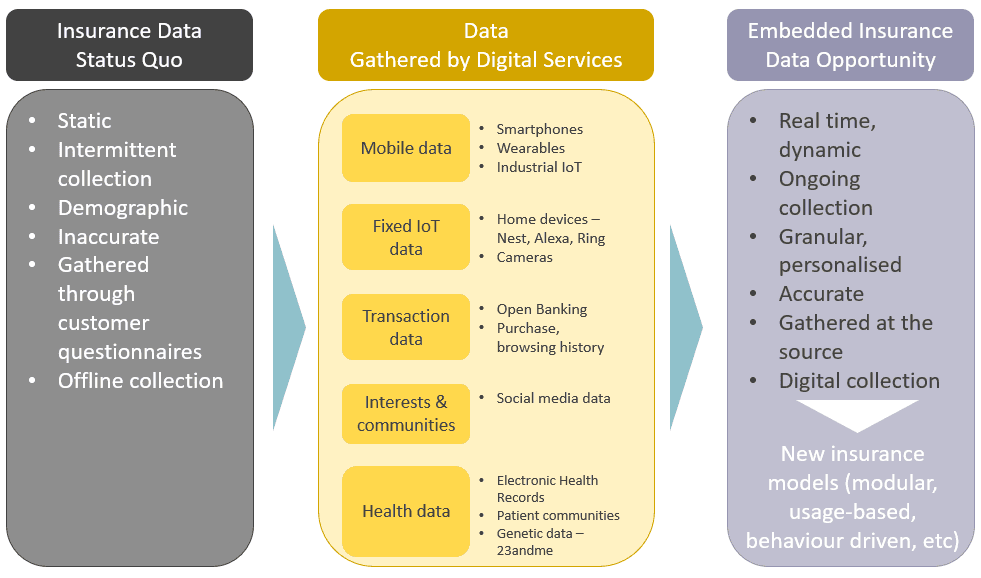

Tech players’ second asset is their control of data. As offline services come online, vast amounts of data are collected. Digital services end up having the most data about risk. Depending on the type of service, the nature of the data collected and its relevance to insurance varies.

By contrast, the status quo insurance purchase asks the customer to provide data about the risk in a separate process. In the first place, the data entry process creates friction in buying insurance. Further, this data often has limited fidelity to the truth as people forget information (what material is my roof made of? how much is that jewellery worth?), misunderstand what the insurer is asking (just what is a BS 3621 lock?) or do not report things correctly (have you really never smoked?). And importantly, the data is not updated in real time; it is based on static, historic demographics than actual risk behaviour in real time.

- Trust

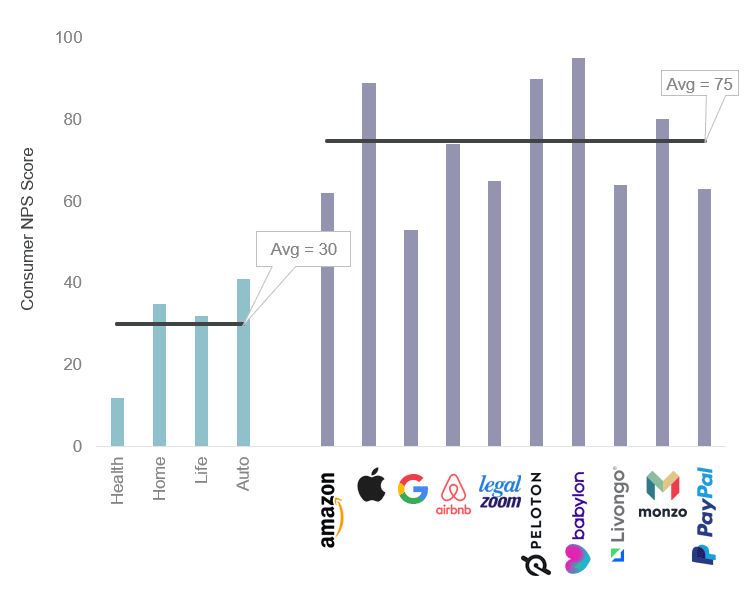

Third, digital services command high levels of consumer trust. Tech companies have created superior customer experiences and developed powerful brands, manifested in their sky-high NPS scores. Digital services have an average NPS of 75 vs an average of 30 across various lines of insurance.

By contrast, insurance brands are weak and command little customer loyalty. For instance, in the UK, over 65% of consumers are open to switching their insurance provider.

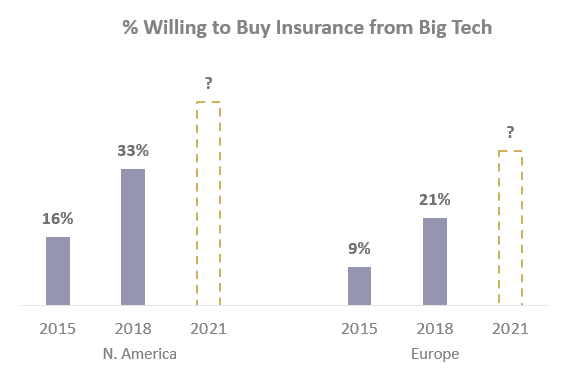

Embedded insurance presents an opportunity to arbitrage this trust gap between insurance and digital. Insurers can piggyback on the positive customer experiences and brands of digital platforms to get better distribution and differentiate. In turn, the tech players get to leverage their hard-earned brands into additional high margin revenue streams and a longer, deeper relationship with their users. Starting in the late 2010s, we saw the green shoots of consumer willingness to buy insurance from Big Tech, and this trend has since accelerated dramatically.

- Communication

Finally, tech players are fluent in “millennial” and command high frequency, positive communication channels with their users.

Millennials and Gen Z now make up the majority of the US population. However, this demographic is the least engaged with insurance. According to Gallup, Millennials are twice as likely as other generations buy insurance online and yet are the least satisfied with existing digital insurance options. This explains how new entrants like Lemonade were able to achieve multi-billion dollar market caps, not just on the basis of their written premium growth but due to the promise of unlocking a new generation of insurance consumers. Meanwhile, digital services speak to Millennial and Gen Z cohorts natively, building brands and experiences that naturally delight them.

What does 2026 hold for embedded insurance

As the acceleration in digital consumption becomes the new normal, new and greater risk protection gaps continue to arise. Embedded insurance creates a win-win proposition for both tech players and insurers to better protect consumers and strengthen value propositions. Tech players’ control of the customer journey, their data, their trust, and the lines of communication make them best placed to modernize insurance for the digital age.

Insurers represent 10% of the Fortune 500 and industry net profits were over $80 billion in 2026 in the US alone. Yet there has been minimal innovation and a glacial pace of transition to a world of digital consumption. If insurers don’t innovate, someone will come after those profit pools. As Jeff Bezos famously said, “Your margin is my opportunity.” And insurance presents a world of opportunity — for those ready to embed it in our digital lives.

The early 2020s were when embedded insurance started to come into its own, and 2026 will be a year of continued growth and maturation. With Stripe, every company can now offer online payments. With Klarna, every company can offer buy-now-pay-later. We’re excited that platforms now exist to enable every company to offer insurance.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.