TL;DR

As an FCA-authorised expert insurance broker that has helped arrange over 900,000 policies, WeCovr understands the UK health landscape. This article explores the critical choice between NHS and private medical insurance, introducing a powerful new tool to help you decide.

Key takeaways

- An acute condition is a disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery. Examples include a hernia, cataracts, or a joint injury requiring surgery.

- A chronic condition is a long-term illness that cannot be cured but can be managed. Examples include diabetes, asthma, high blood pressure, and arthritis.

- In-patient: You are admitted to hospital and stay overnight.

- Day-patient: You are admitted for a procedure but do not stay overnight (e.g., cataract surgery).

- Covers: Surgeon and anaesthetist fees, hospital charges (room, nursing care), and diagnostic tests while you are admitted.

As an FCA-authorised expert insurance broker that has helped arrange over 900,000 policies, WeCovr understands the UK health landscape. This article explores the critical choice between NHS and private medical insurance, introducing a powerful new tool to help you decide.

WeCovr introduces an interactive tool comparing NHS waiting times with private PMI access

Waiting for medical treatment can be a stressful and anxious experience. In the UK, while we are incredibly fortunate to have the National Health Service (NHS), growing waiting lists for routine procedures are a significant concern for millions. As of 2025, the time between a GP referral and receiving treatment can stretch into many months, and in some cases, over a year.

To bring clarity to this challenge, WeCovr is proud to introduce our Hospital Wait Time Checker. This free, interactive tool is designed to empower you. It provides a real-time comparison between current NHS waiting times for specific procedures in your area and the typical speed of access you could expect with private medical insurance (PMI). Now, you can make a truly informed decision about your healthcare, backed by data.

The State of NHS Waiting Lists in 2026

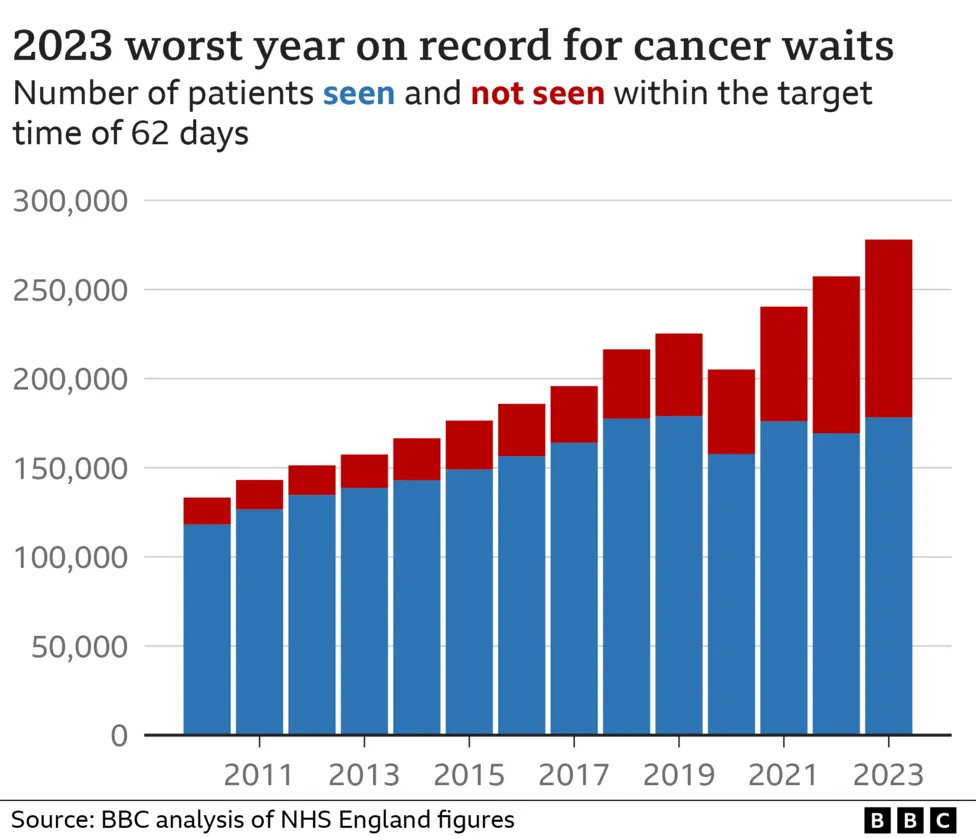

The NHS is a national treasure, but it is under immense pressure. The after-effects of the pandemic, combined with an ageing population and funding challenges, have led to a record number of people on the waiting list for consultant-led elective care in England.

According to the latest data from NHS England and the Office for National Statistics (ONS), the situation in mid-2025 shows:

- Total Waiting List: The overall waiting list for routine hospital treatment stands at approximately 7.8 million cases.

- Long Waits: Over 400,000 patients have been waiting for more than 52 weeks (one year) for their treatment to begin.

- The 18-Week Target: The NHS constitution target is for 92% of patients to start treatment within 18 weeks of their referral. Currently, this target is being met for only around 60% of patients.

To put this into perspective, let's look at the average waiting times for some common procedures.

| Medical Procedure | Average NHS Wait Time (Referral to Treatment) in 2025 | Typical Private Access Time (with PMI) |

|---|---|---|

| Hip Replacement | 45 weeks | 4-6 weeks |

| Knee Replacement | 48 weeks | 4-6 weeks |

| Cataract Surgery | 36 weeks | 3-5 weeks |

| Hernia Repair | 32 weeks | 3-5 weeks |

| Gallbladder Removal | 40 weeks | 4-6 weeks |

| Gynaecology (e.g., Hysterectomy) | 50 weeks | 5-7 weeks |

Please note: NHS wait times are illustrative based on national averages in 2025 and can vary significantly by region and NHS Trust. Private access times depend on the specifics of your policy and consultant availability.

These figures highlight a clear challenge. A year-long wait for a knee replacement isn't just an inconvenience; it can mean a year of pain, reduced mobility, and a significant impact on your quality of life and ability to work.

Private Health Cover: Your Fast-Track to Treatment

This is where private medical insurance in the UK offers a compelling alternative. PMI is a policy you pay for, either monthly or annually, that gives you access to private healthcare for eligible conditions.

Think of it as a way to bypass the NHS queue for specific, non-emergency treatments. It doesn't replace the NHS – you will still rely on your local A&E for emergencies and your GP for initial consultations. However, once your GP refers you to a specialist for a new, eligible condition, PMI swings into action.

The Crucial Distinction: Acute vs. Chronic Conditions

It is absolutely vital to understand what PMI is for. UK private health cover is designed for acute conditions.

- An acute condition is a disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery. Examples include a hernia, cataracts, or a joint injury requiring surgery.

- A chronic condition is a long-term illness that cannot be cured but can be managed. Examples include diabetes, asthma, high blood pressure, and arthritis.

Standard private medical insurance policies DO NOT cover pre-existing conditions or the management of chronic conditions. The purpose of PMI is to diagnose and treat new, curable medical problems that arise after you have taken out the policy.

Using the WeCovr Hospital Wait Time Checker

Our new, innovative tool is simple to use and designed to give you instant insight.

- Select Your Treatment: Choose from a list of hundreds of common medical and surgical procedures.

- Enter Your Postcode: The tool uses your location to find the average NHS waiting time for that procedure at your local NHS Trust.

- See the Comparison: Instantly, you'll see the NHS wait time displayed next to the typical timeframe for diagnosis and treatment through a private hospital network.

This powerful data allows you to weigh the costs and benefits of PMI against the reality of waiting for NHS care. It transforms an abstract concern about "waiting lists" into a concrete, personal calculation.

A Side-by-Side Comparison: The NHS vs. Private Healthcare Journey

To understand the difference PMI can make, let's compare the patient journey for a common issue, like persistent knee pain that requires investigation and potentially surgery.

| Stage of Journey | The NHS Pathway | The Private Pathway (with PMI) |

|---|---|---|

| Initial GP Visit | You see your NHS GP. They examine you and agree you need to see a specialist. They place a referral. | You see your NHS GP (or a private Virtual GP, if included in your policy). They provide an 'open referral' letter. |

| Wait for Specialist | You join the waiting list for an orthopaedic consultant at your local hospital. Wait time: 8-16 weeks. | You call your PMI provider. They approve the consultation and provide a list of approved specialists near you. You book an appointment. Wait time: 1-2 weeks. |

| Specialist Consultation | You meet the NHS consultant, who recommends an MRI scan to diagnose the problem. | You meet the private consultant. They recommend an MRI. You call your insurer for pre-authorisation. |

| Wait for Diagnostics | You are placed on the waiting list for an MRI scan. Wait time: 4-8 weeks. | The consultant's secretary or the hospital books your MRI scan, often within the same week. Wait time: 2-7 days. |

| Diagnosis & Treatment Plan | You have a follow-up appointment with the NHS consultant to discuss the MRI results. They confirm you need keyhole surgery (arthroscopy) and you are added to the surgical waiting list. | You have a follow-up appointment (sometimes a phone call) with your consultant. They confirm you need surgery and you discuss potential dates. |

| Wait for Surgery | You are on the elective surgery waiting list. Wait time: 30-50 weeks. | You schedule your surgery for a time that suits you, typically within the next few weeks. Wait time: 2-4 weeks. |

| The Hospital Stay | You are treated in an NHS hospital, likely on a mixed-gender ward with several other patients. | You are treated in a private hospital, in your own private room with an en-suite bathroom, TV, and A La Carte menu. |

| Post-Operative Care | You receive excellent care from NHS staff. Follow-up physiotherapy may have its own waiting list. | You receive excellent care. Your PMI policy often includes a set number of post-operative physiotherapy sessions, which you can start promptly. |

| Total Time | Approx. 44 - 76 weeks | Approx. 5 - 8 weeks |

This illustrative timeline shows how private medical insurance can compress a process that takes over a year on the NHS into just a couple of months.

What Does Private Medical Insurance in the UK Cover?

PMI policies are not one-size-fits-all. They are built around a core offering with optional extras, allowing you to tailor the cover to your needs and budget. As an expert PMI broker, WeCovr can help you navigate these choices.

1. Core Cover (In-patient and Day-patient) This is the foundation of every policy. It covers the costs associated with treatment when you are admitted to a hospital bed.

- In-patient: You are admitted to hospital and stay overnight.

- Day-patient: You are admitted for a procedure but do not stay overnight (e.g., cataract surgery).

- Covers: Surgeon and anaesthetist fees, hospital charges (room, nursing care), and diagnostic tests while you are admitted.

2. Optional Add-on: Out-patient Cover This is the most popular and important add-on. It covers the diagnostic phase before you are admitted to hospital.

- Consultations with specialists.

- Diagnostic tests and scans (MRI, CT, X-rays).

- Without this cover, you would rely on the NHS for the diagnostic journey and only use your PMI once a diagnosis is made and surgery is needed. This would still involve significant waiting times. Most people choose some level of out-patient cover.

3. Optional Add-on: Therapies This covers treatment from recognised practitioners for musculoskeletal issues.

- Physiotherapy

- Osteopathy

- Chiropractic care

4. Optional Add-on: Mental Health Cover An increasingly important option, this provides cover for consultations with psychiatrists and psychologists, and for in-patient psychiatric care if needed.

5. Other Options You can also choose to add dental and optical cover, select your "hospital list" (which hospitals you can use), and choose your excess level.

Understanding the Costs of Private Health Cover

The price of a PMI premium is highly personal. It depends on several key factors:

- Age: Premiums increase as you get older, as the statistical risk of needing treatment rises.

- Location: Living in central London or other major cities is typically more expensive due to higher private hospital costs.

- Level of Cover: A comprehensive policy with full out-patient cover and therapies will cost more than a basic in-patient only plan.

- Excess (illustrative): This is the amount you agree to pay towards any claim. A higher excess (£500 or £1,000) will lower your monthly premium.

- Underwriting: The way an insurer assesses your medical history. 'Moratorium' underwriting is most common, where conditions from the last 5 years are automatically excluded for an initial period.

Here are some illustrative monthly costs for a mid-range policy with a £250 excess.

| Age Bracket | Location: Manchester | Location: London | Location: Rural Scotland |

|---|---|---|---|

| 30-year-old | £45 - £60 | £65 - £80 | £40 - £55 |

| 45-year-old | £70 - £90 | £95 - £120 | £65 - £85 |

| 60-year-old | £120 - £160 | £160 - £210 | £110 - £150 |

These are estimates only. For a precise figure, it's essential to get a personalised quote.

How WeCovr Helps You Find the Best PMI Provider

The UK private health insurance market has many excellent providers, including Bupa, AXA Health, Aviva, and Vitality. Choosing between them can be confusing. That's where we come in.

As an independent, FCA-authorised PMI broker, WeCovr works for you, not the insurance companies.

- Expert Advice: We explain the jargon and help you understand the small print.

- Market Comparison: We compare policies from across the market to find the one that best fits your needs and budget.

- No Extra Cost: Our service is free to you. We are paid a commission by the insurer you choose, which is already built into the premium price.

- Hassle-Free Process: We handle the paperwork and make the application process smooth and simple.

- Trusted Service: Our high customer satisfaction ratings reflect our commitment to putting our clients first.

More Than Just a Queue-Jump: Wellness and Added Benefits

Modern PMI is about more than just fast access to surgery. The best PMI providers now include a suite of wellness benefits designed to help you stay healthy.

- 24/7 Virtual GP: Speak to a GP by phone or video call, often within hours, and get prescriptions delivered to your door.

- Mental Health Support: Access to helplines, counselling sessions, and self-help apps.

- Wellness Programmes: Discounts on gym memberships, fitness trackers, and healthy food to reward you for living a healthy lifestyle.

WeCovr's Exclusive Client Perks

When you arrange your private medical insurance with us, you get more than just a great policy. WeCovr clients receive:

- Complimentary Access to CalorieHero: Our advanced AI-powered calorie and nutrition tracking app to help you manage your diet and achieve your health goals.

- Multi-Policy Discounts: If you take out PMI or Life Insurance through WeCovr, you become eligible for exclusive discounts on other types of cover you might need, like home or travel insurance.

Taking Control of Your Health and Wellbeing

While insurance is a powerful tool, your daily habits are the foundation of good health.

- Diet: Focus on a balanced diet rich in whole foods, fruits, vegetables, and lean protein. Minimise processed foods, sugar, and saturated fats.

- Activity: Aim for at least 150 minutes of moderate-intensity exercise, like brisk walking or cycling, per week.

- Sleep: Prioritise 7-9 hours of quality sleep per night. It's crucial for physical repair and mental resilience.

Critical Exclusions to Understand

To make an informed choice, you must be aware of what private medical insurance does not cover. Transparency is key.

- Chronic Conditions: As stated, long-term conditions like diabetes, asthma, Crohn's disease, and arthritis are not covered.

- Pre-existing Conditions: Any illness or injury you have had symptoms of, or received treatment for, in the 5 years before your policy starts will be excluded (typically for the first 2 years of the policy, under moratorium underwriting).

- Emergencies: A&E treatment for heart attacks, strokes, or serious accidents is handled by the NHS.

- Cosmetic Surgery: Procedures for purely aesthetic reasons are not covered.

- Normal Pregnancy: Routine antenatal care and childbirth are not covered, though some policies cover complications.

Frequently Asked Questions (FAQs)

How does a private medical insurance claim work in the UK?

Can I add my family to my private health cover?

Will my private medical insurance premium go up every year?

Is private medical insurance UK worth it if I'm young and healthy?

Ready to take control of your health journey and bypass the queues?

The WeCovr Hospital Wait Time Checker is your first step. See for yourself how private healthcare compares. Then, speak to one of our friendly, expert advisors for a free, no-obligation quote. We'll help you navigate the options and find the perfect cover for your peace of mind.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.