TL;DR

Comprehensive guide to UK and European tax rules, residence tests, double taxation, and legal optimisation strategies covering all 27 EU countries plus EEA states for UK citizens relocating to Europe.

Key takeaways

- Traditional destinations like Spain, France, or Germany

- Emerging digital nomad hubs like Estonia, Portugal, or Croatia

- Low-tax havens like Cyprus, Malta, or Monaco

- High-quality Nordic countries like Denmark, Sweden, or Norway

- Eastern European opportunities like Bulgaria, Romania, or Czech Republic

Moving to Europe from UK Complete Guide

Comprehensive guide to UK and European tax rules, residence tests, double taxation, and legal optimisation strategies covering all 27 EU countries plus EEA states for UK citizens relocating to Europe.

Table of Contents

- Executive Summary

- UK Foundations Before You Move

- Living Arrangements & Tax Exposure

- Legal Tax-Optimisation Strategies

- Complete EU Countries Analysis

- EEA Countries Deep Dive

- Other European Opportunities

- Digital Nomad Paradise: Country Rankings

- Cross-Country Comparisons

- Healthcare & Insurance Abroad

- Compliance & Risk

- Step-by-Step Planning Checklist

- Frequently Asked Questions

- Call-to-Action

- Sources & Citations

Executive Summary

Who This Guide Is For

This guide is designed for UK citizens—including employees, contractors, company founders, high-net-worth individuals (HNWIs), remote workers, and retirees—who are planning a permanent or long-term move to any country within the European Union (EU), European Economic Area (EEA), or Switzerland. It is intended for the diligent planner who seeks a comprehensive understanding of the tax, residency, and healthcare implications before engaging professional advisors. Whether you're considering:

- Traditional destinations like Spain, France, or Germany

- Emerging digital nomad hubs like Estonia, Portugal, or Croatia

- Low-tax havens like Cyprus, Malta, or Monaco

- High-quality Nordic countries like Denmark, Sweden, or Norway

- Eastern European opportunities like Bulgaria, Romania, or Czech Republic

This guide provides the detailed analysis you need to make informed decisions.

Key Decisions That Matter

Your tax liability and overall financial position when moving from the UK to Europe will depend on five critical factors:

- Timing of departure - When you leave can trigger or defer significant tax liabilities

- Country choice - Each European nation has vastly different tax regimes and special incentives

- Work structure - Whether you remain employed, become self-employed, or establish a business

- Property decisions - Buy vs rent impacts wealth taxes, transaction costs, and flexibility

- Healthcare arrangements - International private medical insurance becomes crucial for comprehensive coverage

Top Tax Optimisation Opportunities by Region

Western Europe (Traditional Destinations):

- Spain: Beckham Law (24% flat rate for 6 years)

- Portugal: NHR 2.0/ITS (20% professional income rate)

- Italy: HNW Flat Tax (€200,000 annual payment)

- Netherlands: 30% Ruling (30% tax-free allowance)

Eastern Europe (Emerging Opportunities):

- Bulgaria: 10% flat tax (lowest in EU)

- Estonia: Deferred corporate taxation system

- Cyprus: Non-dom status (0% on foreign income for 17 years)

- Malta: Non-dom remittance basis (unlimited duration)

Nordic Region (High Quality/High Tax):

- Denmark: Comprehensive social system (55.9% top rate)

- Sweden: Excellent infrastructure (57% top rate)

- Norway: Oil wealth benefits (47.4% top rate)

Digital Nomad Havens:

- Estonia: E-residency program and digital-first infrastructure

- Portugal: D7 visa and favorable tax treatment

- Croatia: Digital nomad visa with moderate taxation

- Czech Republic: Low cost of living with reasonable taxes

Compliance Disclaimer

Important: This guide provides general information only and does not constitute tax, legal, or financial advice. Tax rules change frequently, and individual circumstances vary significantly. You must seek personalised advice from qualified professionals in both the UK and your destination country before making any decisions. The authors and publishers accept no responsibility for any losses arising from the use of this information.

UK Foundations Before You Move

Understanding the UK Statutory Residence Test (SRT)

The Statutory Residence Test determines your UK tax residency status through a systematic approach involving three tests applied in sequence:

Automatic Overseas Test

You're automatically non-resident if you meet any of these conditions:

- Present in the UK for fewer than 16 days in the tax year (or 46 days if you were non-resident in the previous three years)

- Working full-time overseas with UK presence limited to fewer than 91 days and no more than 30 work days in the UK

- Dying in the year having been non-resident in the previous tax year and present for fewer than 46 days

Automatic UK Resident Test

You're automatically UK resident if:

- Present in the UK for 183 days or more in the tax year

- Your only home is in the UK (available for at least 91 days and you're present on at least 30 days)

- Working full-time in the UK (unless significant overseas work time applies)

Sufficient Ties Test

If neither automatic test applies, your residency depends on UK ties combined with days spent in the UK:

UK Ties include:

- Family tie - spouse/civil partner or minor children resident in the UK

- Accommodation tie - accessible accommodation in the UK

- Work tie - substantive work in the UK (more than 3 hours on more than 40 days)

- 90-day tie - spent 90+ days in the UK in either of the previous two tax years

- Country tie - UK is the country where you spend the most time

Day Thresholds by Ties:

- Previously resident: 16-45 days (4+ ties), 46-90 days (3+ ties), 91-120 days (2+ ties), 121-182 days (1+ tie)

- Not previously resident: 46-90 days (4+ ties), 91-120 days (3+ ties), 121-182 days (2+ ties)

Domicile vs Residence: The 2026 Revolution

Major Change Alert: From 6 April 2026, the UK abolished the concept of domicile for tax purposes, replacing it with a residence-based system. This represents the most significant change to UK international tax rules in decades.

Post-2026 Residence-Based System

Foreign Income and Gains (FIG) Regime:

- New UK residents get 100% relief on foreign income and gains for first 4 years

- Must not have been UK resident in any of the 10 consecutive years before arrival

- Overseas Workday Relief retained for qualifying assignments

Inheritance Tax Changes:

- Long-term residents (10+ years) face UK inheritance tax on worldwide assets

- Temporary repatriation facility allows former remittance basis users to bring offshore funds to UK at reduced tax rates

UK Departure Checklist: Forms, Deadlines, and Pitfalls

Your departure from the UK triggers several administrative requirements with significant penalty risks for non-compliance:

Form P85: Leaving the UK

When to use P85:

- You're leaving the UK permanently or indefinitely

- You'll work abroad full-time for at least one tax year

- You're not required to file a Self Assessment return

What the P85 achieves:

- Claims tax refund on employment income for departure year

- Updates your contact details with HMRC

- May trigger NT (no tax) coding for continuing UK employment

Complete EU Countries Analysis

Western European Powerhouses

Spain: Beyond the Beckham Law

Residency Rules:

- Automatic residency: 183+ days in any calendar year

- Centre of vital interests: Family or main economic activities in Spain

- 2026 updates: Enhanced enforcement of "sporadic absence" rules

Tax Structure:

- Personal Income Tax: 19% to 47% (plus regional variations up to 3.5%)

- Beckham Law: 24% flat rate for qualifying expatriates (6 years maximum)

- Wealth Tax: 0.2-3.5% (varies by autonomous community)

- Property Tax: 0.4-1.1% of cadastral value

Special Considerations for 2026:

- Solidarity Contribution: Additional levy on global income exceeding €600,000

- Split-year treatment: Tax residency begins from arrival date, not calendar year beginning

- Digital Nomad Visa: New visa category allowing remote work for non-Spanish employers

France: Navigating Complex Fiscal Residency

Residency Determination - Four-Point Test:

- Family home (foyer) in France or principal place of stay

- Professional activity in France (unless ancillary)

- Centre of economic interests in France

- 183+ days in France per year

Tax Landscape 2026:

- Income Tax: 0% to 45% progressive rates

- Social Charges: 17.2% on investment income for residents

- Wealth Tax (IFI): 0.5-1.5% on real estate wealth over €1.3m

- Capital Gains: 19% + 17.2% social charges = 36.2% total

Germany: The Economic Engine

Dual Residence Framework:

- Domicile (Wohnsitz): Place available for regular use

- Habitual Abode: Physical presence over 183 days

Tax Advantages:

- No tax on private capital gains for passive investors

- Cryptocurrency gains tax-free after 1-year holding period

- Real estate gains tax-free after 10-year holding for private use

Italy: The €200,000 Flat Tax Revolution

2026 Updates:

- Flat tax increased to €200,000 annually (from €100,000)

- Family members can join for additional €25,000 per person

- 15-year duration with no minimum income requirement

Northern European Excellence

Denmark: The Nordic Model

Tax Structure:

- Top Rate: 55.9% (including municipal and labour market taxes)

- Comprehensive Benefits: Free healthcare, education, generous parental leave

- Quality of Life: Consistently ranked among world's happiest countries

Sweden: Innovation Hub

Tax Framework:

- Top Rate: 57% (including municipal taxes)

- Special Considerations: 3-year exemption for certain foreign employees

- Innovation Incentives: Strong support for tech and startups

Finland: The Foreign Expert Programme

Special Regime:

- Foreign Expert Tax: 32% flat rate on Finnish salary income

- Standard Rates: 0% to 44.25% progressive

- Residency: Physical presence over 6 months or permanent home

Eastern European Opportunities

Estonia: The Digital Pioneer

Revolutionary Tax System:

- Corporate Tax: Only on distributed profits (22% rate)

- Personal Tax: 22% flat rate (increased from 20% in 2026)

- E-Residency: Fully digital company management

Digital Nomad Benefits:

- Visa Available: 12-month renewable

- Tax Rate: 20% for qualifying nomads

- Infrastructure: World-class digital government services

Bulgaria: The EU's Tax Haven

Competitive Advantages:

- Corporate Tax: 10% flat rate (lowest in EU)

- Personal Tax: 10% flat rate

- Social Security: 27.1% total burden

- EU Benefits: Full access to single market

Czech Republic: Central European Hub

Residency Rules:

- 183+ days in calendar year, OR

- Permanent home in Czech Republic

Tax Benefits:

- Reasonable rates: 15% to 23% personal income tax

- Low costs: Excellent value for money

- Strategic location: Heart of Europe

Hungary: The Flat Tax Leader

Tax Structure:

- Personal Income Tax: 15% flat rate (one of EU's lowest)

- Residency: Hungarian citizenship, EEA nationals with 183+ days, or vital interests

Poland: The Economic Powerhouse

Growing Opportunities:

- Personal Tax: 17% to 32% rates

- Digital Nomad Visa: Available with competitive requirements

- Economic Growth: One of EU's fastest-growing economies

Croatia: Adriatic Paradise

Residency Framework:

- Real estate ownership: 183+ days over 2 consecutive calendar years

- Physical presence: 183+ days alternative

- Tax Rates: 15% to 30% (with municipal variations)

Southern European Gems

Cyprus: The 17-Year Non-Dom Paradise

Exceptional Benefits:

- 0% tax on dividends, interest, capital gains (except Cyprus real estate)

- 60-day rule: Minimum physical presence

- 17-year duration for non-domiciled status

Malta: Unlimited Non-Dom Benefits

Remittance Basis System:

- No tax on foreign income kept offshore

- 15% tax on foreign income remitted to Malta

- €5,000 minimum annual tax (if foreign income >€35,000)

- No time limit on benefits

Slovenia: Recent Reforms

Digital Nomad Focus:

- New visa programme launched in 2026

- Recent tax reforms attract EU tech startups

- Reduced bureaucracy and streamlined compliance

Greece: The Pensioner Paradise Extended

Special Programmes:

- 7% flat tax on foreign-source income for 15 years

- Golden Visa: €250,000+ real estate investment

- Quality of life: Mediterranean lifestyle with low costs

Atlantic European Destinations

Portugal: Post-NHR Era

NHR 2.0/ITS Programme:

- 20% tax rate on qualifying Portuguese professional income

- 10-year duration with stricter eligibility

- Professional requirement: Must qualify as highly skilled

Ireland: The Corporate Haven

Advantages:

- Corporate tax: 12.5% on trading income

- 280-day rule: Unique two-year residency test

- English-speaking: No language barrier for UK relocators

Baltic Innovation Hub

Latvia: Progressive Yet Competitive

Tax Structure 2026:

- 25.5% for income up to €105,300

- 33% for income above €105,300

- Additional 3% on income exceeding €200,000

Lithuania: The Baltic Tiger

Competitive Framework:

- 15% on income up to €253,065.60

- 20% on income exceeding threshold

- Digital nomad friendly with growing tech sector

Romania: The Micro-Enterprise Haven

Special Programmes:

- Micro-enterprise tax: 1-3% for qualifying businesses

- Standard corporate: 16% flat rate

- Growing economy with EU benefits

Slovakia: Central European Value

Tax Benefits:

- Progressive rates: Competitive with regional neighbours

- EU access: Full single market participation

- Strategic location: Gateway to Eastern and Western Europe

EEA Countries Deep Dive

Norway: Oil-Funded Excellence

Tax Structure:

- Top Rate: 47.4% (including municipal taxes)

- Wealth Tax: 1% on net wealth over NOK 20 million

- 2026 Changes: Amendments to exit tax rules

Quality of Life:

- Oil Fund Benefits: Sovereign wealth fund supports social programs

- High Living Standards: Among world's highest GDP per capita

- Natural Beauty: Fjords, northern lights, midnight sun

Iceland: Nordic Island Paradise

Tax Framework:

- Progressive rates: Up to 46.24%

- Unique Benefits: Geothermal energy, pristine environment

- Strategic Location: Gateway between Europe and North America

Liechtenstein: The Alpine Financial Centre

Exclusive Benefits:

- Lump Sum Taxation: Available for qualifying individuals

- Banking Secrecy: Strong financial privacy protections

- Low Taxes: Competitive rates for high-net-worth individuals

- EU Access: EEA membership provides single market access

Other European Opportunities

Monaco: The Ultimate Tax Haven

Zero Tax Paradise:

- Personal Income Tax: 0% for residents

- Capital Gains: 0% on most investments

- Inheritance Tax: 0% for direct line succession

Requirements:

- Physical Presence: 183+ days annually

- Financial Proof: €500,000+ bank deposit

- Property Investment: Purchase or rental (average €2M+ for purchase)

Important Caveat: French nationals remain subject to French income tax even with Monaco residency

Switzerland: Precision Tax Planning

Lump Sum Taxation:

- Cantonal Variations: Each canton sets own terms

- Living Expenses Method: Tax on 5x annual living costs

- Minimum Requirements: Typically €200,000+ annually

- No Employment: Cannot work in Switzerland under this regime

Andorra: The Pyrenees Paradise

Low Tax Haven:

- Maximum 10% personal income tax

- No wealth, gift, or inheritance tax

- 90+ days physical presence required

- Investment Options: €600,000 passive residence or €50,000 active business

Digital Nomad Paradise: Country Rankings

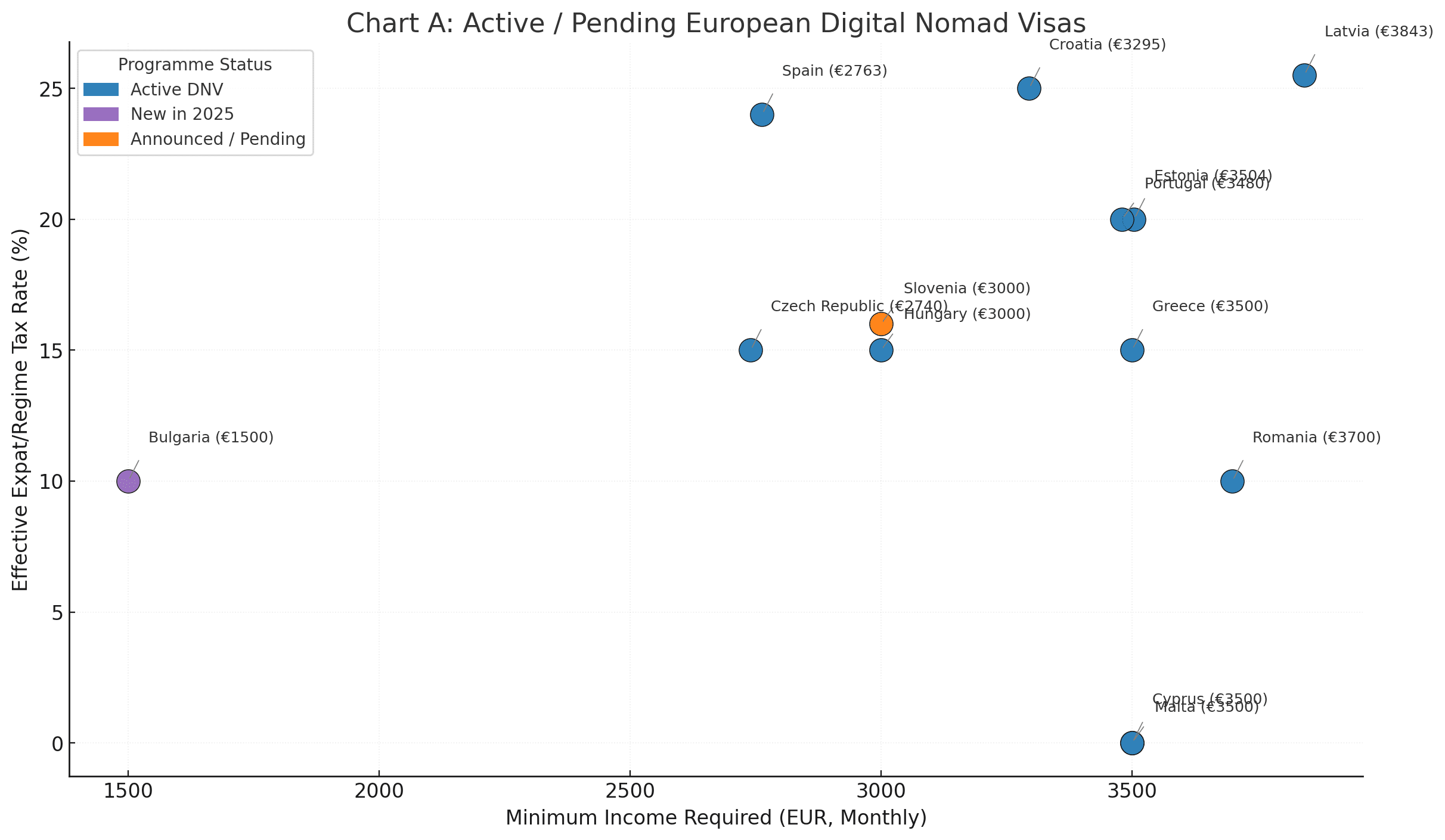

European Digital Nomad Visas & Special Regimes (2026)

| Country | Category | Programme Status | Min. Income Required (EUR/month) | Effective Tax Rate (%) |

|---|---|---|---|---|

| Spain | Digital Nomad Visa | Active | 2763 | 24 |

| Portugal | Digital Nomad Visa | Active | 3480 | 20 |

| Croatia | Digital Nomad Visa | Active | 3295 | 25 |

| Greece | Digital Nomad Visa | Active | 3500 | 15 |

| Estonia | Digital Nomad Visa | Active | 3504 | 20 |

| Cyprus | Digital Nomad Visa | Active | 3500 | 5 |

| Malta | Digital Nomad Visa | Active | 3500 | 5 |

| Czech Republic | Digital Nomad Visa | Active | 2740 | 15 |

| Hungary | Digital Nomad Visa | Active | 3000 | 15 |

| Latvia | Digital Nomad Visa | Active | 3843 | 25.5 |

| Romania | Digital Nomad Visa | Active | 3700 | 10 |

| Slovenia | Digital Nomad Visa | Active | 3000 | 16 |

| Bulgaria | Digital Nomad Visa | Active | 1500 | 10 |

| Lithuania | Digital Nomad Visa | No | 3000 | 15 |

| Poland | Digital Nomad Visa | No | 3000 | 17 |

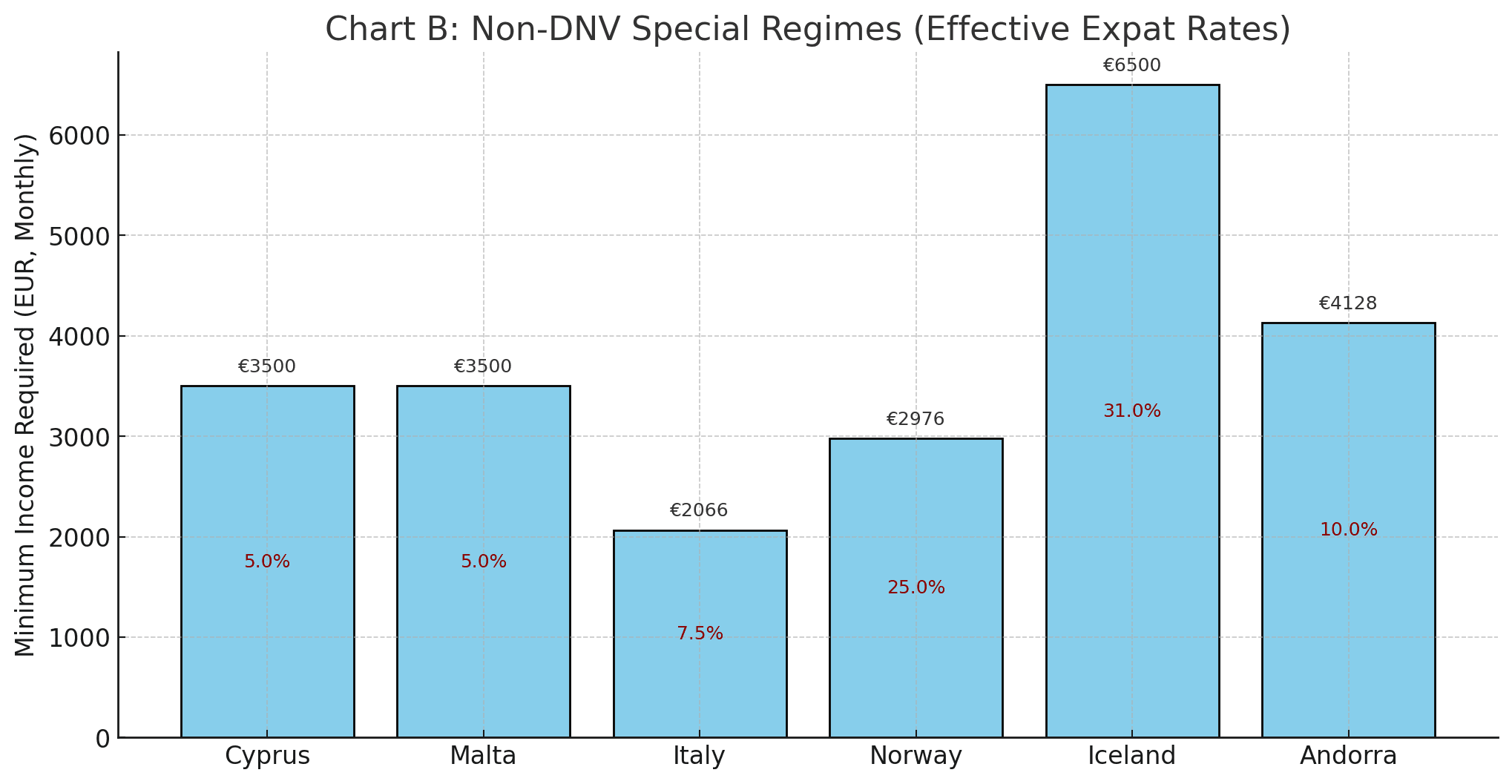

| Italy | Special Regime (Non-DNV) | Impatriate Reg. | 2066 | 5–10 |

| Cyprus | Special Regime (Non-DNV) | Non-Dom | 3500 | 5 |

| Malta | Special Regime (Non-DNV) | Non-Dom | 3500 | 5 |

| Andorra | Special Regime (Non-DNV) | Low Tax Residence | 3333 | 10 |

| Norway | Special Regime (Non-DNV) | No DNV | 2976 | 25 |

| Iceland | Special Regime (Non-DNV) | No DNV | 6500 | 31 |

Top Digital Nomad Destinations

Tier 1: Premium Options

- Estonia - €3,500 income requirement, 20% tax rate, very easy application

- Cyprus - €3,500 income requirement, 0% tax on foreign income, easy application

- Malta - €2,700 income requirement, 0% tax on foreign income, easy application

- Portugal - €2,800 income requirement, 20% tax rate under ITS, easy application

Tier 2: Balanced Value

- Czech Republic - €2,500 income requirement, 15% tax rate, easy application

- Hungary - €2,000 income requirement, 15% tax rate, easy application

- Croatia - €2,300 income requirement, 25% tax rate, moderate application

- Latvia - €2,500 income requirement, 25.5% tax rate, easy application

Tier 3: Budget-Friendly

- Bulgaria - €1,500 income requirement, 10% tax rate, very easy application

- Lithuania - €3,000 income requirement, 15% tax rate, easy application

- Slovenia - €3,000 income requirement, 16% tax rate, moderate application

- Poland - €3,000 income requirement, 17% tax rate, easy application

Digital Nomad Tax Considerations

Key Factors to Consider:

- Permanent Establishment Risk: Working 30+ days may create tax obligations for your employer

- Social Security Coordination: A1 certificates for EU work assignments

- Day Counting: Different countries have different presence rules

- Double Taxation: Treaty tie-breaker rules when dual resident

Cross-Country Comparisons

Complete European Tax Rate Analysis

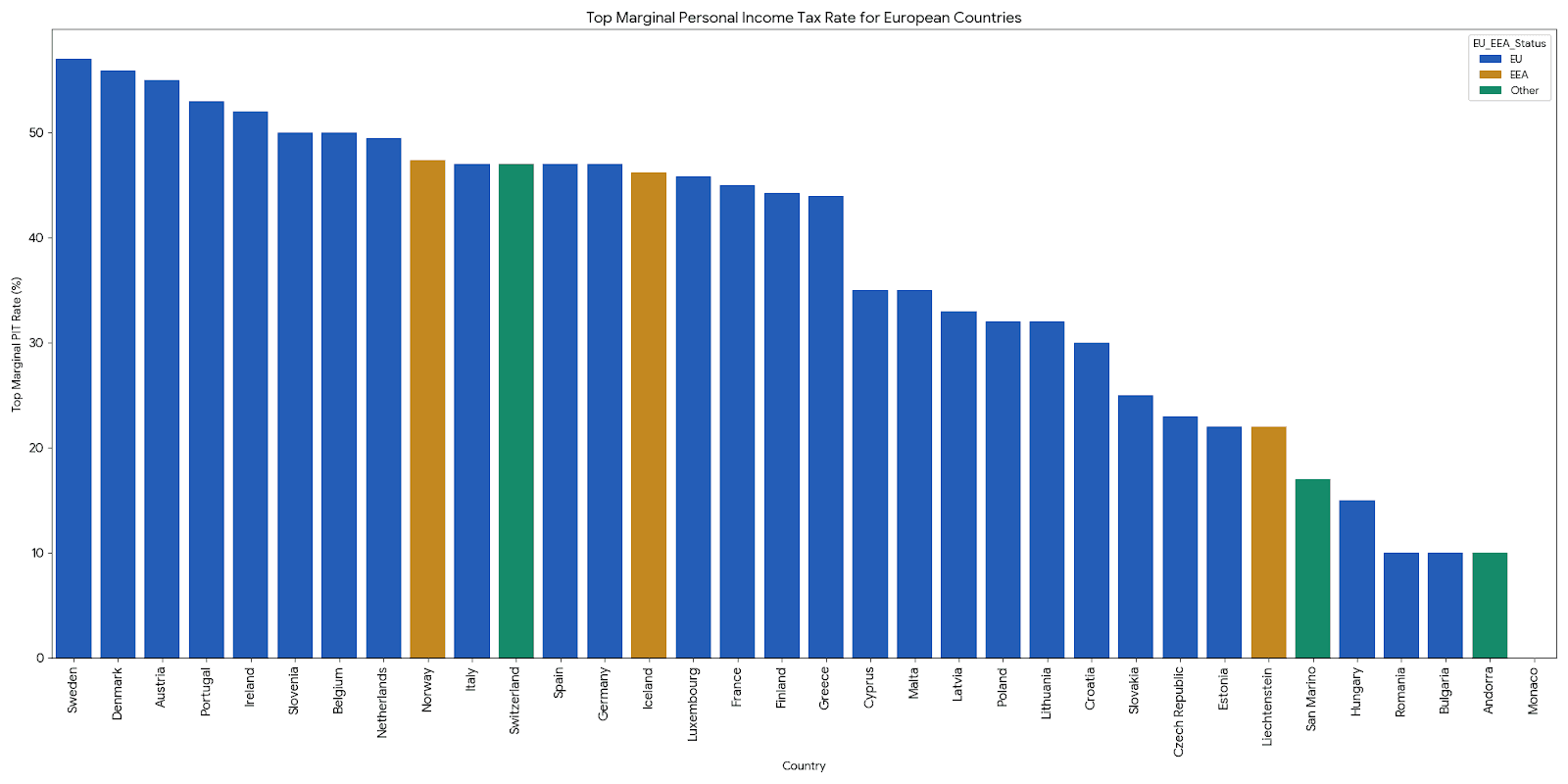

Complete European Tax Rates Comparison

Master Comparison Table - All European Countries

| Country | EU/EEA Status | Top PIT Rate | Dividend Rate | CGT Rate | Wealth Tax | Property Purchase | Annual Property Tax |

|---|---|---|---|---|---|---|---|

| Western Europe | |||||||

| Austria | EU | 55.0% | 27.5% | 27.5% | No | 9.5% | 0.5% |

| Belgium | EU | 50.0% | 30.0% | 33.0% | No | 12.0% | 1.25% |

| France | EU | 45.0% | 30.0% | 30.0% | Yes | 8.0% | 1.5% |

| Germany | EU | 47.0% | 26.4% | 26.4% | No | 10.5% | 0.6% |

| Luxembourg | EU | 45.8% | 15.0% | 0.0% | No | 7.5% | 0.6% |

| Netherlands | EU | 49.5% | 26.9% | 31.0% | No | 6.0% | 0.8% |

| Switzerland | Other | 47.0% | 35.0% | 0.0% | Cantonal | 4.0% | 0.3% |

| Southern Europe | |||||||

| Cyprus | EU | 35.0% | 0.0% | 0.0% | No | 8.0% | 0.6% |

| Greece | EU | 44.0% | 15.0% | 15.0% | No | 9.0% | 0.8% |

| Italy | EU | 47.0% | 26.0% | 26.0% | No | 9.0% | 0.9% |

| Malta | EU | 35.0% | 0.0% | 0.0% | No | 5.0% | 0.55% |

| Portugal | EU | 53.0% | 28.0% | 28.0% | No | 7.0% | 0.5% |

| Slovenia | EU | 50.0% | 25.0% | 25.0% | No | 2.0% | 0.6% |

| Spain | EU | 47.0% | 26.0% | 23.0% | Yes | 10.0% | 1.1% |

| Eastern Europe | |||||||

| Bulgaria | EU | 10.0% | 5.0% | 10.0% | No | 3.0% | 0.15% |

| Croatia | EU | 30.0% | 12.0% | 12.0% | No | 5.0% | 0.6% |

| Czech Republic | EU | 23.0% | 23.0% | 23.0% | No | 9.0% | 1.0% |

| Estonia | EU | 22.0% | 22.0% | 22.0% | No | 2.0% | 0.1% |

| Hungary | EU | 15.0% | 15.0% | 15.0% | No | 11.0% | 1.0% |

| Latvia | EU | 33.0% | 25.5% | 25.5% | No | 2.0% | 0.2% |

| Lithuania | EU | 32.0% | 15.0% | 15.0% | No | 0.5% | 0.5% |

| Poland | EU | 32.0% | 19.0% | 19.0% | No | 2.0% | 0.8% |

| Romania | EU | 10.0% | 5.0% | 10.0% | No | 1.5% | 0.1% |

| Slovakia | EU | 25.0% | 25.0% | 25.0% | No | 4.0% | 0.25% |

| Nordic Countries | |||||||

| Denmark | EU | 55.9% | 42.0% | 42.0% | No | 4.0% | 1.0% |

| Finland | EU | 44.25% | 30.0% | 30.0% | No | 4.0% | 0.6% |

| Sweden | EU | 57.0% | 30.0% | 30.0% | No | 4.5% | 0.75% |

| Iceland | EEA | 46.24% | 22.0% | 22.0% | Yes | 3.0% | 1.3% |

| Norway | EEA | 47.4% | 31.7% | 31.7% | Yes | 3.5% | 0.7% |

| Special Jurisdictions | |||||||

| Liechtenstein | EEA | 22.0% | 4.0% | 0.0% | No | 1.0% | 0.05% |

| Monaco | Other | 0.0% | 0.0% | 0.0% | No | 5.0% | 0.0% |

| Andorra | Other | 10.0% | 0.0% | 0.0% | No | 4.5% | 0.0% |

| Ireland | EU | 52.0% | 51.0% | 33.0% | No | 7.0% | 0.2% |

Sources: National tax authorities, KPMG, PwC, EY, Deloitte 2026 editions - Last checked August 2026

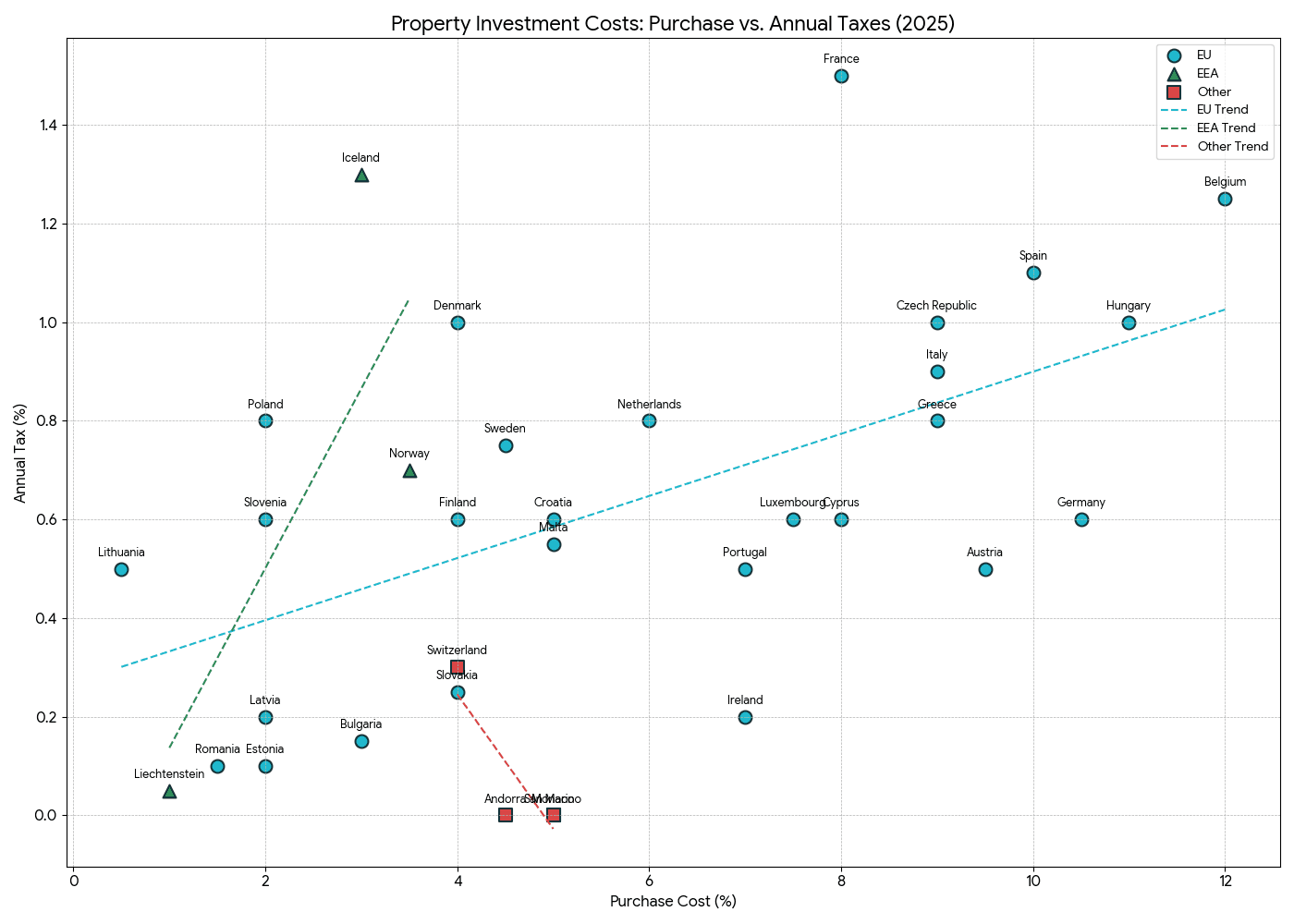

Property Investment Analysis by Region

Key Insights by Region:

Most Expensive Markets:

- Belgium: 12% purchase + 1.25% annual = highest total cost

- Hungary: 11% purchase costs despite low income taxes

- Germany: 10.5% purchase costs but strong rental yields

Best Value Markets:

- Lithuania: 0.5% purchase + 0.5% annual = lowest total cost in EU

- Estonia: 2% purchase + 0.1% annual = excellent for tech workers

- Romania: 1.5% purchase + 0.1% annual = exceptional value

Tax Haven Advantages:

- Monaco: No annual property taxes

- Andorra: No annual property taxes

- Cyprus: 0% CGT (except local real estate) + reasonable costs

Healthcare & Insurance Abroad

Understanding Your Coverage Options in All European Countries

When relocating from the UK to any European destination, your healthcare coverage becomes significantly more complex, especially when considering the differences between EU, EEA, and non-EU countries.

EHIC/GHIC Coverage Across Europe

Full Coverage Countries (EU + EEA):

- All 27 EU countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden

- EEA countries: Iceland, Liechtenstein, Norway

- Additional: Switzerland (through separate agreement)

Limited/No Coverage:

- Monaco: No EHIC/GHIC coverage (private insurance required)

- Andorra: No EHIC/GHIC coverage (private insurance required)

- San Marino: Limited reciprocal arrangements

International Private Medical Insurance (IPMI)

IPMI becomes essential when living in any European country long-term, providing comprehensive coverage that EHIC/GHIC cannot match.

Why IPMI Matters:

- Comprehensive coverage: Routine care, specialists, dental, optical

- Choice of providers: Access to private healthcare systems

- Multi-country living: Essential for digital nomads

- Emergency evacuation: Return to UK or appropriate medical facility

- Pre-existing conditions: Coverage after underwriting period

Specialist brokers like WeCovr can arrange international PMI to keep you covered when living abroad, including multi-country living arrangements across the EU and EEA.

Healthcare Quality by Region

Nordic Excellence (Universal Systems):

- Denmark, Sweden, Finland: World-class universal healthcare

- Norway, Iceland: Comprehensive coverage with minimal wait times

Western European Standards:

- Germany, France, Netherlands: Mixed public-private systems with high quality

- Switzerland: Private insurance mandatory but world-class care

- Austria: Strong public system with private options

Southern European Mixed Systems:

- Spain, Italy: Good public systems, private supplements common

- Portugal, Greece: Basic public coverage, private recommended

- Cyprus, Malta: Developing systems, international insurance advisable

Eastern European Developing Systems:

- Czech Republic, Estonia: Rapidly improving, EU standards

- Poland, Hungary: Basic public, private supplementation recommended

- Bulgaria, Romania: Limited public systems, private insurance essential

Special Jurisdictions:

- Monaco: Premium private healthcare required

- Liechtenstein: Swiss-standard system

- Andorra: Mixed system with French/Spanish coordination

Compliance & Risk

Multi-Country Compliance Challenges

When considering any European destination, several compliance risks become particularly important:

Permanent Establishment Risks by Country Type

High-Risk Countries (Strict PE Rules):

- Germany: Aggressive interpretation of management and control

- France: Complex rules around centre of economic interests

- Netherlands: Strict substance requirements

- Belgium: Enhanced beneficial ownership reporting

Moderate-Risk Countries:

- Spain, Italy, Portugal: Standard EU approaches with some flexibility

- Austria, Luxembourg: Business-friendly but EU-compliant

- Nordic countries: Clear rules, predictable application

Lower-Risk Countries:

- Estonia: Digital-first approach, clear guidelines

- Cyprus, Malta: International business friendly

- Czech Republic, Poland: Pragmatic application

- Bulgaria, Romania: Developing enforcement

Record-Keeping Requirements

Essential for All European Destinations:

- Travel records: Entry/exit stamps, flight bookings, accommodation receipts

- Residence evidence: Rental agreements, utility bills, bank statements

- Professional ties: Employment contracts, business registrations

- Social connections: School enrollments, healthcare registrations, club memberships

When to Engage Professional Advisers

Country-Specific Specialist Requirements

Complex Tax Systems (Require Local Experts):

- Germany: Transfer pricing, CFC rules, trade tax variations

- France: Wealth tax, social charges, complex residency rules

- Netherlands: Box system, 30% ruling eligibility

- Switzerland: Cantonal variations, lump sum taxation

Moderate Complexity (Regional Expertise Sufficient):

- Spain, Portugal, Italy: Well-established expat advisory industry

- Nordic countries: Clear rules but high rates require optimisation

- Eastern EU countries: Growing expertise, EU compliance

Straightforward Systems (Basic Advice Often Sufficient):

- Cyprus, Malta: Non-dom regimes well-established

- Estonia: Digital processes, clear guidelines

- Bulgaria: Simple flat tax system

- Czech Republic: Standard EU approaches

Step-by-Step Planning Checklist

Universal Pre-Move Checklist (All European Destinations)

90-180 Days Before Departure

UK Tax Position Review:

- Assess SRT position for all potential destinations

- Review 2026 domicile changes and their impact

- Plan asset disposal timing around departure

- Consider pension arrangements and QROPS transfers

- Review trust structures if applicable

Destination Research:

- Compare tax rates across shortlisted countries

- Research special regimes available to newcomers

- Understand visa/residency requirements for non-EU nationals

- Assess healthcare systems and insurance needs

- Evaluate education systems if children involved

30-90 Days Before Departure

Administrative Preparation:

- Complete P85 if applicable

- Notify HMRC of departure

- Arrange international banking facilities

- Research local tax registration requirements

- Plan healthcare transition and arrange IPMI

Upon Arrival (All Countries)

Universal Registration Steps:

- Register with local authorities (timeframes vary by country)

- Apply for tax identification number

- Open local bank account

- Register with healthcare system

- Begin residence evidence collection

Country-Specific Variations

EU Countries (Freedom of Movement)

- No visa required for UK citizens (may need residence registration)

- 3-6 months to register residence in most countries

- Automatic healthcare access in most systems after registration

EEA Countries (Norway, Iceland, Liechtenstein)

- Residence permits may be required for UK citizens post-Brexit

- Work permits necessary for employment

- Separate healthcare arrangements needed

Other European Countries

- Specific visa requirements (Monaco, Switzerland, Andorra)

- Investment thresholds may apply

- Private insurance typically mandatory

Frequently Asked Questions

Country-Specific Questions

Q1: Which European country has the lowest taxes overall?

A: The answer depends on your income type and amount:

Lowest Personal Income Tax:

- Monaco: 0% (but expensive residency requirements)

- Bulgaria and Romania: 10% flat rate (EU countries)

- Andorra: Maximum 10% (non-EU)

- Hungary: 15% flat rate

Lowest Capital Gains Tax:

- Cyprus, Malta, Monaco, Andorra: 0% on foreign assets

- Switzerland: 0% for private investors

- Luxembourg: 0% after 6-month holding period

Lowest Overall Tax Burden (including social security):

- Cyprus: With non-dom status

- Estonia: For retained business profits

- Bulgaria: 10% income + 27.1% social security

- Monaco: 0% income tax but high living costs

Q2: Can I maintain EU benefits if I move to a non-EU European country?

A: It depends on the specific country:

EEA Countries (Norway, Iceland, Liechtenstein):

- Most EU benefits maintained through EEA Agreement

- Freedom of movement for goods, services, people, capital

- Single market access for businesses

- EHIC coverage continues

Switzerland:

- Bilateral agreements provide some EU-like benefits

- Freedom of movement for persons (with limitations)

- No customs union membership

Other Countries (Monaco, Andorra, San Marino):

- No EU benefits - treated as third countries

- Separate agreements may exist for specific areas

- Higher barriers for business and personal mobility

Q3: What about the best countries for digital nomads?

A: Based on our analysis, the top tiers are:

Tier 1 (Best Overall):

- Estonia: €3,500 income requirement, 20% tax, excellent digital infrastructure

- Cyprus: €3,500 income requirement, 0% foreign tax, Mediterranean lifestyle

- Portugal: €2,800 income requirement, 20% tax under ITS, great quality of life

Tier 2 (Great Value):

- Czech Republic: €2,500 income requirement, 15% tax, Central European base

- Hungary: €2,000 income requirement, 15% tax, Budapest hub

- Malta: €2,700 income requirement, 0% foreign tax, English-speaking

Tier 3 (Budget Options):

- Bulgaria: €1,500 income requirement, 10% tax, very low costs

- Croatia: €2,300 income requirement, 25% tax, beautiful coastline

- Romania: Growing tech scene, reasonable requirements

Q4: How do property investment costs compare across Europe?

A: Our comprehensive analysis shows:

Highest Purchase Costs:

- Belgium: 12% upfront costs

- Hungary: 11% upfront costs

- Germany: 10.5% upfront costs

Lowest Purchase Costs:

- Lithuania: 0.5% upfront costs

- Romania: 1.5% upfront costs

- Estonia: 2.0% upfront costs

Highest Annual Taxes:

- France: 1.5% annual property tax

- Iceland: 1.3% annual property tax

- Belgium: 1.25% annual property tax

Lowest Annual Taxes:

- Estonia: 0.1% annual property tax

- Romania, Bulgaria: 0.1-0.15% annual property tax

- Monaco, Andorra: 0% annual property tax

Q5: What are the healthcare implications of moving to different European regions?

A: Healthcare quality and access varies significantly:

Excellent Universal Systems:

- Nordic countries: World-class, tax-funded systems

- Germany, France, Netherlands: Mixed systems with high quality

- Austria: Strong public system

Good Systems with Private Supplements:

- Spain, Italy: Decent public, private recommended

- Czech Republic, Estonia: Rapidly improving EU-standard systems

Systems Requiring Private Insurance:

- Eastern Europe (Bulgaria, Romania): Basic public systems

- Cyprus, Malta: Developing systems

- Monaco, Switzerland: Private insurance mandatory

IPMI Recommendations:

- Essential for multi-country living

- Recommended for Eastern Europe

- Advisable as supplement in Southern Europe

- Optional but valuable in Nordic/Western Europe

For comprehensive healthcare coverage across all European destinations, speak with WeCovr to compare international PMI options for your specific needs.

Brexit-Related Questions

Q6: How has Brexit affected my options for moving to Europe?

A: Brexit significantly changed UK citizens' status:

EU Countries:

- No longer EU citizens - now "third country nationals"

- Visa-free visits: Up to 90 days in 180-day period

- Residence permits: Required for longer stays

- Work permits: Necessary for employment (with exceptions for some countries)

EEA Countries:

- Separate agreements negotiated post-Brexit

- Generally favorable treatment for UK citizens

- Work rights often more restricted than pre-Brexit

Impact on Taxes:

- Double taxation treaties remain in force

- No change to tax residency rules

- Some countries offer special visas for UK citizens

Q7: Which countries are most welcoming to UK citizens post-Brexit?

A: Several countries actively court UK relocators:

Most Welcoming:

- Portugal: D7 visa for remote workers and retirees

- Spain: Various visa categories, large UK expat community

- Netherlands: Continues to welcome skilled UK workers

- Cyprus, Malta: Non-dom programmes attractive to UK tax planning

Moderately Welcoming:

- Germany, France: Standard EU immigration rules

- Italy: Golden visa and flat tax programs

- Eastern Europe: Generally pragmatic approach

Special Arrangements:

- Ireland: Common Travel Area maintains special relationship

- Gibraltar: Unique arrangements due to sovereignty issues

Call-to-Action

Moving from the UK to any European destination involves navigating complex tax, legal, and healthcare considerations across 34 different countries, each with unique rules, opportunities, and challenges. This comprehensive guide covers every EU and EEA country plus key European destinations, but successful international relocation requires personalised professional advice tailored to your specific circumstances and chosen destination.

Professional Tax and Legal Advice

Given the complexity of cross-border taxation across multiple jurisdictions and the significant penalties for non-compliance, we strongly recommend engaging qualified advisers in both the UK and your destination country. The investment in professional advice typically saves multiples of its cost through tax optimisation and penalty avoidance, especially when navigating the different systems across 34 countries.

International Healthcare Coverage

Whether you're moving to the tax-efficient environments of Cyprus and Malta, the digital nomad havens of Estonia and Portugal, the traditional powerhouses of Germany and France, or exploring opportunities in emerging markets like Bulgaria and Romania, comprehensive healthcare coverage is essential.

For complete healthcare coverage across all European destinations, including multi-country living arrangements and access to private healthcare standards throughout Europe, speak with WeCovr to compare international PMI options for your move. Their FCA-authorized experts understand the nuances of healthcare systems across all EU and EEA countries and can ensure you have appropriate protection before departing the UK.

Taking the Next Steps

Your journey from UK to European residence should be planned carefully with professional guidance, whether you're attracted to:

- The sophistication of Monaco and Switzerland

- The innovation of Estonia and Finland

- The lifestyle of Spain and Portugal

- The opportunities of Eastern Europe

- The quality of Nordic countries

- The tax efficiency of Cyprus and Malta

Proper planning ensures you maximize the benefits while minimizing the risks and costs of your international move across any of the European destinations covered in this guide.

Disclaimer: This guide contains general information only and should not be relied upon as tax, legal, or financial advice. Tax laws change frequently, and individual circumstances vary across 34 different European jurisdictions. Always consult qualified professionals in both the UK and your chosen destination before making any decisions. The authors accept no responsibility for any losses arising from the use of this information.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.