TL;DR

The warning lights on the UK's healthcare dashboard are flashing red. As we look ahead to 2025, the picture for NHS waiting times is not just concerning; it's a looming crisis with profound implications for every individual and the nation's economic stability. Projections from leading think tanks and health economists paint a stark scenario: the number of people in England waiting for routine hospital treatment is on a trajectory to surpass an unprecedented 8 million.

Key takeaways

- Legacy of the Pandemic: The COVID-19 pandemic forced the NHS to postpone millions of non-urgent appointments and procedures. While the health service worked heroically, clearing this "elective care backlog" is a monumental task that continues to strain resources.

- Chronic Funding & Efficiency Pressures: For the decade leading up to the pandemic, UK health spending grew at a much slower rate than its historic average. This has left the NHS with fewer beds, scanners, and staff per capita than many comparable European countries, limiting its ability to ramp up activity.

- Workforce Shortages & Industrial Action: The NHS is grappling with over 120,000 staff vacancies. Burnout is rampant, and recurring industrial action over pay and conditions, while understandable, has led to the cancellation of over a million appointments, further exacerbating delays.

- A Changing Demographic: The UK's population is ageing. Older patients often have multiple, complex health needs, requiring more resources and longer hospital stays, which puts additional pressure on a system with limited capacity.

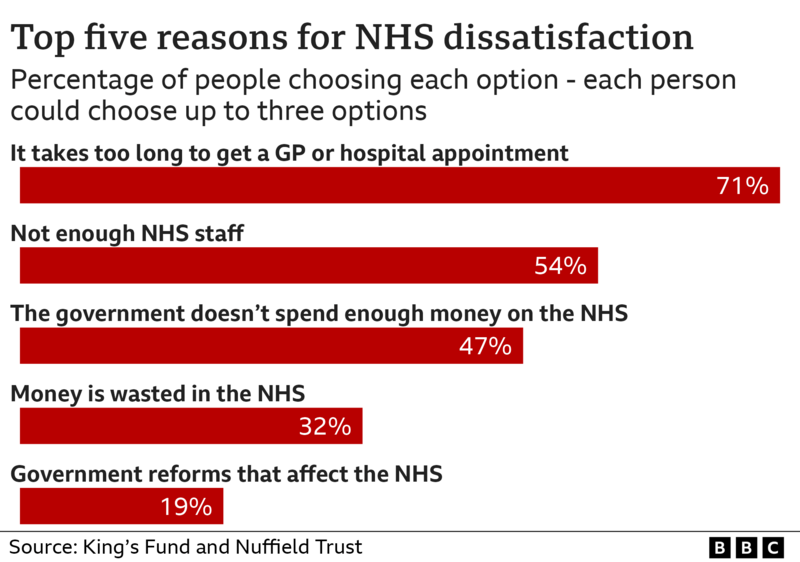

- The "Front Door" Problem: Access to primary care is a growing challenge. When people can't see a GP easily, conditions can worsen before they are referred, making them more complex and expensive to treat. This also pushes more people towards already overburdened A&E departments.

NHS Wait Times the 2025 Forecast

The warning lights on the UK's healthcare dashboard are flashing red. As we look ahead to 2025, the picture for NHS waiting times is not just concerning; it's a looming crisis with profound implications for every individual and the nation's economic stability. Projections from leading think tanks and health economists paint a stark scenario: the number of people in England waiting for routine hospital treatment is on a trajectory to surpass an unprecedented 8 million.

This isn't merely a statistic. Behind this number lies a story of delayed diagnoses, prolonged pain, and mounting anxiety for millions. It represents careers stalled, savings depleted, and lives put on hold. The economic ripple effect is equally devastating, with estimates suggesting that the cost of health-related economic inactivity could drain over £12 billion annually from the UK economy.

In this challenging landscape, passively waiting is no longer a viable strategy for many. The uncertainty of when you might receive essential care for a new, acute condition can be as debilitating as the illness itself.

This comprehensive guide will unpack the reality of the 2025 NHS waiting list forecast, explore the deep-seated causes, and quantify the true cost to your health and finances. More importantly, it will illuminate a powerful alternative: Private Health Insurance (PMI). We will demystify how PMI works, what it covers, and how it can provide you with rapid access to the high-quality diagnostics and treatment you need, precisely when you need them most – empowering you to safeguard your health, protect your income, and secure your future.

The Stark Reality: Unpacking the 2026 NHS Waiting List Crisis

The sheer scale of the NHS waiting list is difficult to comprehend, but understanding the numbers is the first step to appreciating the gravity of the situation. The challenge is not just the headline figure but the complex, multi-layered delays that patients face at every stage of their healthcare journey.

The Numbers Don't Lie: A System Under Unprecedented Strain

Official data from NHS England, coupled with analysis from organisations like the Institute for Fiscal Studies (IFS) and The Health Foundation, confirms a relentless upward trend. While the waiting list stood at a significant 4.4 million before the pandemic in February 2020, it has since ballooned.

As of early 2025, the Referral to Treatment (RTT) waiting list in England has consistently hovered above 7.5 million. Worryingly, projections show that without a radical intervention, breaching the 8 million mark is a near certainty by the end of the year.

| Period | Official NHS Waiting List (England) |

|---|---|

| Pre-Pandemic (Feb 2020) | 4.43 million |

| Post-Pandemic Peak (2023) | 7.77 million |

| Early 2025 Status | ~7.6 million |

| End of 2025 Projection | Over 8 million |

Source: NHS England, Institute for Fiscal Studies (IFS) projections.

But the headline RTT figure only tells part of the story. It doesn't include the "hidden" backlogs for crucial community services, mental health support, or key diagnostic tests. In 2025, over 1.6 million people are waiting for diagnostic scans like MRI, CT, and ultrasounds, a critical bottleneck that delays diagnoses and treatment plans.

Beyond the Headlines: What These Delays Mean for You

For the individual, these national statistics translate into very personal and often distressing realities. An 18-week RTT standard is now a distant memory for many. In 2025, hundreds of thousands of patients have been waiting for over a year for their treatment to begin.

Let's consider a common, real-world scenario:

Meet David, a 52-year-old self-employed electrician. David develops persistent, debilitating hip pain.

- GP Visit: He struggles to get a timely GP appointment, waiting three weeks. The GP suspects osteoarthritis and refers him for an X-ray and to an orthopaedic specialist.

- Diagnostic Wait: The wait for a routine X-ray is 6 weeks.

- Specialist Wait: The wait to see the NHS orthopaedic consultant is 9 months.

- Treatment Wait: After the consultation, David is told he needs a total hip replacement. He is placed on the surgical waiting list, with an estimated wait time of 12-15 months.

From the first GP visit to the operating table, David's total wait could be over two years. During this time, his mobility declines, his pain worsens, and crucially, his ability to work and earn a living is severely compromised. This is the human cost behind the 8-million-person figure.

The Economic Fallout: A £12 Billion Drain on the UK

The impact extends far beyond individual suffering. A sick workforce is an unproductive workforce. The Office for National Statistics (ONS) has highlighted a dramatic rise in long-term sickness as the primary driver of economic inactivity.

This figure is composed of:

- Lost Productivity: Individuals unable to work or working at reduced capacity.

- Increased Welfare Costs: Higher demand for state benefits.

- Informal Care Burden: Family members taking time off work to care for sick relatives.

When millions are waiting in pain and uncertainty, the engine of the national economy begins to sputter. Protecting individual health is, therefore, an act of protecting national prosperity.

Why Are NHS Waiting Lists So Long? The Root Causes Explained

The current crisis is not the result of a single failure but a "perfect storm" of interconnected challenges that have been brewing for over a decade. Understanding these root causes is key to appreciating why a quick fix is unlikely and why individuals must consider their own contingency plans.

| Driving Factor | Impact on Waiting Lists |

|---|---|

| Pandemic Backlog | Millions of elective procedures were cancelled, creating an enormous backlog. |

| Funding Pressures | Decades of funding increases below the historic average have limited capacity. |

| Workforce Shortages | Critical vacancies for doctors, nurses, and specialists; compounded by strikes. |

| Ageing Population | Increased demand for complex treatments for multiple long-term conditions. |

| GP Access Issues | Difficulty in seeing a GP leads to later referrals and more A&E visits. |

-

Legacy of the Pandemic: The COVID-19 pandemic forced the NHS to postpone millions of non-urgent appointments and procedures. While the health service worked heroically, clearing this "elective care backlog" is a monumental task that continues to strain resources.

-

Chronic Funding & Efficiency Pressures: For the decade leading up to the pandemic, UK health spending grew at a much slower rate than its historic average. This has left the NHS with fewer beds, scanners, and staff per capita than many comparable European countries, limiting its ability to ramp up activity.

-

Workforce Shortages & Industrial Action: The NHS is grappling with over 120,000 staff vacancies. Burnout is rampant, and recurring industrial action over pay and conditions, while understandable, has led to the cancellation of over a million appointments, further exacerbating delays.

-

A Changing Demographic: The UK's population is ageing. Older patients often have multiple, complex health needs, requiring more resources and longer hospital stays, which puts additional pressure on a system with limited capacity.

-

The "Front Door" Problem: Access to primary care is a growing challenge. When people can't see a GP easily, conditions can worsen before they are referred, making them more complex and expensive to treat. This also pushes more people towards already overburdened A&E departments.

The Personal Cost of Waiting: How Delays Impact Your Health and Finances

Waiting for healthcare isn't a passive, benign experience. It's an active period of physical, mental, and financial decline for many. The consequences can be profound and long-lasting.

Deteriorating Health

- Conditions Worsen: A manageable joint problem can become a source of chronic, debilitating pain. A small hernia can grow, increasing the risk of surgical complications. Early-stage concerns can progress, making treatment less effective when it finally arrives.

- Psychological Toll: Living with uncertainty, pain, and disability takes a huge mental toll. Anxiety and depression are common among those on long waiting lists, creating a secondary health crisis.

- Loss of Fitness: Long periods of immobility while waiting for procedures like knee or hip replacements lead to muscle wastage and a general decline in cardiovascular health, making recovery from surgery harder.

Crippling Financial Consequences

For many, the biggest immediate impact is financial. The inability to work due to a health condition can quickly spiral into a personal financial crisis.

- Loss of Earnings: If you're self-employed, no work means no pay. If you're employed, your company sick pay may be limited.

- The Statutory Sick Pay (SSP) Reality (illustrative): Once company sick pay ends, you are reliant on SSP. In 2025, this is just £116.75 per week. This is a fraction of the average UK weekly wage, making it impossible for most people to cover their mortgage, rent, and bills.

- The "Self-Funding" Trap (illustrative): Faced with a long wait and dwindling income, many feel forced to dip into their life savings, pensions, or even go into debt to pay for private treatment. A private hip replacement can cost upwards of £15,000, while cataract surgery can be £3,000 per eye. This is a desperate measure that can derail long-term financial plans.

| Income Source | Approximate Weekly Amount (2025) | Financial Viability |

|---|---|---|

| Average UK Full-Time Salary | ~£700 | Covers typical living costs |

| Statutory Sick Pay (SSP) | £116.75 | Insufficient for most households |

This stark contrast highlights the financial cliff edge that many face when unable to work due to a health condition.

Private Health Insurance: Your Fast-Track to Diagnosis and Treatment

In this environment of unprecedented NHS delays, Private Health Insurance (PMI) has shifted from a perceived luxury to an essential tool for financial and physical wellbeing. It offers a clear, reliable, and swift path back to health.

What is Private Medical Insurance (PMI)?

Simply put, Private Medical Insurance is a policy you pay for that covers the costs of private healthcare for eligible, acute conditions that arise after your policy begins.

It is designed to complement, not replace, the NHS. The NHS remains vital for accident and emergency care, GP services, and the management of chronic illnesses. PMI's role is to step in for new, treatable conditions, allowing you to bypass the long waiting lists for specialist consultations, diagnostic scans, and elective surgery.

The Core Benefit: Speed of Access

This is the primary reason people choose PMI. The difference in waiting times between the NHS and the private sector is dramatic and life-changing.

| Procedure / Scan | Typical NHS Wait Time (2025) | Typical Private Wait Time (with PMI) |

|---|---|---|

| MRI Scan | 6 - 12 weeks | 3 - 7 days |

| Specialist Consultation | 6 - 12 months | 1 - 3 weeks |

| Hip/Knee Replacement | 12 - 24 months | 4 - 6 weeks |

| Cataract Surgery | 9 - 18 months | 3 - 5 weeks |

| Hernia Repair | 9 - 15 months | 4 - 6 weeks |

Note: NHS wait times can vary significantly by region and trust. Private wait times are from GP referral to treatment.

This speed means a diagnosis is made faster, treatment begins sooner, and you can get back to your life, work, and family with minimal disruption.

How Does It Work? The Patient Journey

The process of using PMI is typically straightforward and efficient:

- Visit Your NHS GP: You still see your GP for an initial diagnosis. If they feel you need to see a specialist, they will provide you with an open referral letter. While some insurers now offer a digital GP service, a referral from your own GP is the most common starting point.

- Contact Your Insurer: You call your PMI provider's claims line, explain the situation, and provide your referral details.

- Claim Authorisation: The insurer checks your policy coverage and authorises the claim, usually providing a pre-authorisation number.

- Choose Your Specialist & Hospital: Your insurer will provide a list of approved specialists and high-quality private hospitals in your area. You have the freedom to choose, often allowing you to select a leading consultant in their field.

- Receive Treatment: You attend your appointments and receive treatment promptly. All the bills are sent directly to your insurance company for settlement.

Navigating the options can seem complex, which is where an expert broker like WeCovr comes in. We help you understand the process from start to finish and compare plans from all major UK insurers to find the perfect fit for your needs and budget.

What Does Private Health Insurance Actually Cover?

PMI policies are flexible and can be tailored to your specific needs. Coverage is typically split into a core offering with optional extras you can add on.

Core Coverage (usually included as standard):

- In-patient and Day-patient Treatment: This covers costs when you are admitted to a hospital for a bed overnight (in-patient) or just for the day (day-patient). This includes surgery, nursing care, accommodation, and medication.

- Specialist Consultations: Fees for the consultant surgeon and anaesthetist.

- Comprehensive Cancer Care: This is a cornerstone of most modern PMI policies. It often includes access to the latest cancer drugs and treatments, some of which may not yet be available on the NHS.

- Diagnostic Scans & Tests: When related to an in-patient or day-patient stay.

Popular Optional Extras:

- Out-patient Cover: This is a highly recommended add-on. It covers the costs of diagnostic tests and specialist consultations before you are admitted to hospital. Without this, you would rely on the NHS for the initial diagnostic phase, which can still involve long waits.

- Mental Health Support: Provides access to private counsellors, therapists, and psychiatrists, bypassing long NHS waiting lists for mental health services.

- Therapies Cover: Covers treatments like physiotherapy, osteopathy, and chiropractic care, which are crucial for recovery from surgery or musculoskeletal injuries.

- Dental and Optical Cover: Contributes towards the cost of routine check-ups, treatments, and new eyewear.

The Crucial Exclusion: Pre-existing and Chronic Conditions

This is the single most important rule to understand about private medical insurance in the UK. It must be stated with absolute clarity.

Standard UK private medical insurance is designed to cover acute conditions – illnesses or injuries that are short-term and likely to respond to treatment – that arise after you take out your policy. It does not cover chronic or pre-existing conditions.

- A Chronic Condition is an illness that cannot be cured, only managed. This includes conditions like diabetes, hypertension (high blood pressure), asthma, Crohn's disease, and most forms of arthritis. The day-to-day management of these conditions will always remain with your NHS GP.

- A Pre-existing Condition is typically defined as any disease, illness, or injury for which you have experienced symptoms, received medication, advice, or treatment in the five years before your policy start date.

Insurers manage this through a process called underwriting. The two most common types are:

- Moratorium Underwriting: This is the most popular method. The insurer does not ask for your full medical history upfront. Instead, they automatically exclude any condition you've had in the last 5 years. However, if you go for a set period (usually 2 years) without any symptoms, treatment, or advice for that condition after your policy starts, it may become eligible for cover.

- Full Medical Underwriting (FMU): You complete a detailed health questionnaire when you apply. The insurer assesses your medical history and explicitly lists any conditions that will be permanently excluded from cover. This provides certainty from day one but can be a more intrusive process.

Understanding this principle is key to having the right expectations of what PMI can do for you. It's for the new, the unexpected, and the curable.

How Much Does Private Health Insurance Cost in 2026?

There is no one-size-fits-all price for PMI. The premium is highly personalised and based on a range of factors. However, for many, it is far more affordable than they assume, especially when weighed against the potential cost of lost earnings or self-funding.

Key Factors That Influence Your Premium:

- Age: This is the most significant factor. The older you are, the higher the statistical likelihood of claiming, so premiums increase.

- Location: Treatment costs, particularly in Central London, are higher, so policies that include London hospitals are more expensive.

- Level of Cover: A basic, core policy will be cheaper than a comprehensive policy with all the optional extras.

- Excess (illustrative): This is the amount you agree to pay towards the cost of any claim. Choosing a higher excess (e.g., £250 or £500) will significantly reduce your monthly premium.

- Hospital List: Insurers offer different tiers of hospital lists. A list that excludes the most expensive city-centre hospitals will lower your premium.

- No-Claims Discount: Similar to car insurance, you build up a discount for every year you don't make a claim, which can reduce your renewal premium.

- Lifestyle: Some insurers, like Vitality, offer lower premiums and rewards for living a healthy lifestyle.

Estimated Monthly Premiums in 2026

The table below provides an illustrative guide to potential costs. These are for a non-smoker with a £250 excess.

| Age | Basic Cover (Core, no out-patient) | Mid-Range Cover (Core + limited out-patient) | Comprehensive Cover (Full out-patient, therapies) |

|---|---|---|---|

| 30s | £35 - £50 | £55 - £75 | £80 - £110 |

| 40s | £45 - £65 | £70 - £95 | £100 - £140 |

| 50s | £60 - £90 | £90 - £130 | £140 - £200 |

| 60s | £95 - £140 | £150 - £220 | £230 - £350+ |

Disclaimer: These are illustrative estimates only. Your actual quote will depend on your individual circumstances and the insurer chosen.

Is Private Health Insurance Worth It? A Cost-Benefit Analysis

When you see the monthly cost, it's natural to ask: "Is it worth it?". The best way to answer this is to compare the cost of the policy against the potential financial and physical cost of not having it.

Let's revisit our self-employed electrician, David, aged 52, who needs a hip replacement.

| Scenario | Financial & Health Impact |

|---|---|

| With PMI | Cost: A monthly premium of around £120. Total for the year: £1,440. Outcome: Sees a specialist in 2 weeks, has surgery in 6 weeks. Back to work within 3-4 months. Minimal income loss. Health restored quickly. |

| Without PMI (NHS Wait) | Cost: No premium. Outcome: Waits 18 months for surgery. Unable to work for most of this time. Loses an estimated £40,000+ in earnings. Health deteriorates, pain increases, mental strain is immense. |

| Without PMI (Self-Funded) | Cost: No premium, but a one-off payment of ~£15,000 from savings for private surgery. Outcome: Gets treated quickly, but his life savings or pension pot is severely depleted, impacting his future financial security. |

This analysis makes the value proposition clear. The relatively small, predictable monthly cost of a PMI policy acts as a shield against catastrophic, unpredictable financial loss and prolonged physical suffering.

At WeCovr, we believe in empowering you with this kind of information. By understanding these trade-offs, you can make a decision that protects both your health and your financial future. We provide transparent quotes from across the market, so you can see the exact costs and benefits for your circumstances. Furthermore, we show our commitment to our clients' long-term wellbeing by providing complimentary access to our exclusive AI-powered calorie tracking app, CalorieHero, helping you stay on top of your health goals from day one.

Choosing the Right Policy: A Step-by-Step Guide

The UK health insurance market is competitive, with excellent providers like Bupa, AXA Health, Aviva, and Vitality offering a wide range of plans. Finding the right one is crucial.

-

Assess Your Needs and Budget: What is most important to you? Is it comprehensive cancer care? Fast access to physiotherapy? Mental health support? Be honest about what you can comfortably afford each month. Remember that a basic policy that gets you treated quickly is better than no policy at all.

-

Understand the Jargon: Get familiar with key terms. 'Excess' is what you pay per claim. 'Hospital List' dictates where you can be treated. 'Underwriting' determines how pre-existing conditions are handled.

-

Compare Insurers and Policies: Don't just look at the headline price. Compare the details. Does the out-patient cover have a financial limit? Is the cancer cover comprehensive? What is the insurer's reputation for customer service and claims handling?

-

Use an Independent Broker: This is, without doubt, the most effective way to buy private health insurance. A specialist broker doesn't just sell you a policy; they provide expert advice. This is where using a specialist health insurance broker like us at WeCovr is invaluable. We do the hard work for you, comparing policies from all the leading UK insurers to find cover that's tailored to your unique needs and budget, saving you time and ensuring you get the right protection at the best possible price. Our service comes at no extra cost to you.

Securing Your Future in an Uncertain Healthcare Landscape

The forecast for NHS waiting times in 2025 and beyond is a sobering call to action. While our national love and appreciation for the NHS are unwavering, the reality is that the system is operating under pressures that are unsustainable. The consequence is a direct threat to the nation's health and economic productivity.

Relying solely on a system with a projected 8-million-person waiting list is a gamble that few can afford to take, both physically and financially. Prolonged waits lead to deteriorating health, lost income, and immense personal stress.

Private Health Insurance offers a proven, affordable, and effective solution. It provides a parallel track to rapid diagnosis and treatment for new, acute conditions, giving you control over your healthcare journey. It's not about abandoning the NHS; it's about using a complementary tool to safeguard your most valuable assets: your health and your ability to earn a living.

In these uncertain times, taking proactive steps to protect yourself and your family is not just a sensible precaution; it is a fundamental part of modern financial and life planning. By getting informed, assessing your options, and considering a private health insurance plan, you can build a more secure, healthy, and prosperous future.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.