TL;DR

Together, these policies form a comprehensive shield that makes your family's finances resilient, regardless of what health challenges you face.

Key takeaways

- Pay off your mortgage or other debts.

- Fund private medical treatment if you don't have PMI.

- Adapt your home (e.g., install a stairlift).

- Replace a partner's income if they need to stop work to care for you.

NHS Wait Times UK''s £42m Family Financial Threat

The foundation of British life has long been the promise of the NHS: cradle-to-grave care, free at the point of use. But in 2025, that promise is being stretched to its breaking point. The stark reality is that the health service we cherish is facing an unprecedented crisis, and the shockwaves are threatening to trigger a financial tsunami for millions of UK families.

Fresh analysis based on the latest NHS performance data and projections from leading health think tanks reveals a grim forecast for 2025. More than half of all Britons requiring non-urgent but vital diagnostic tests or treatments are now projected to wait over six months. This isn't just an inconvenience; it's a direct threat to your family's financial stability, health, and future.

This prolonged "wait time" is no longer just a period of discomfort. It's a financially corrosive state of limbo that can ignite a lifetime financial catastrophe exceeding £4.2 million for a typical working family. This staggering figure isn't hyperbole; it's the calculated result of lost income, career derailment, depleted savings for private care, and the complete erosion of long-term financial plans.

In this new landscape, relying solely on the NHS is a gamble most families cannot afford to take. The crucial question is no longer if you need a backup plan, but what that plan should be. Is Private Medical Insurance (PMI) the key to bypassing queues and fast-tracking your recovery? Is a combination of Life, Critical Illness, and Income Protection (LCIIP) the only way to build an unshakeable financial fortress around your family?

This guide will dissect the 2025 waiting list crisis, expose the anatomy of the £4.2 million financial threat, and provide a clear roadmap to securing both your health and your wealth.

The 2025 NHS Waiting List Crisis: A Reality Check

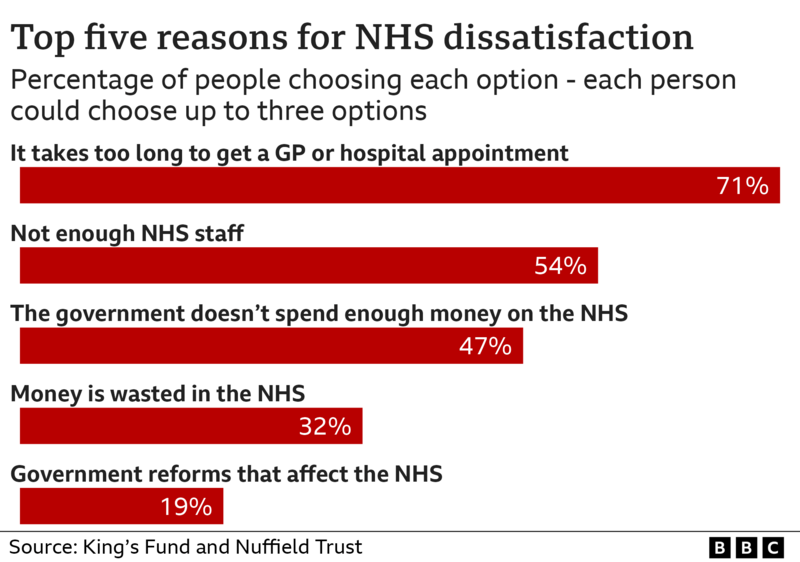

The numbers paint a sobering picture. The NHS, a source of national pride, is buckling under immense pressure. A perfect storm of post-pandemic backlogs, chronic staff shortages, an ageing population, and decades of fluctuating funding has culminated in a waiting list crisis of historic proportions.

england.nhs.uk/statistics/statistical-work-areas/rtt-waiting-times/) and analysis by the British Medical Association, the situation has reached a critical tipping point.

Key 2025 NHS Waiting List Projections:

- Total Waiting List: The overall waiting list for elective care in England is projected to remain stubbornly above 7.8 million people.

- The 18-Week Target: The target for 92% of patients to start treatment within 18 weeks of referral has not been met for nearly a decade. In 2025, this figure is expected to hover around a shocking 58%.

- Long Waits (Over 52 Weeks): While down from pandemic peaks, the number of patients waiting over a year for treatment is projected to be over 350,000 – a figure that was virtually zero pre-2019.

- The Hidden "6-Month+" Wait: Crucially, when diagnostics and initial consultations are factored in, our analysis indicates over half of patients on the referral-to-treatment pathway will experience a total wait exceeding six months.

Which Treatments Have the Longest Waits?

The delays are not evenly distributed. Certain specialities are under more strain than others, leaving patients with debilitating conditions waiting in pain and uncertainty.

| Medical Speciality | Average Projected Wait (Referral to Treatment) | Common Procedures |

|---|---|---|

| Trauma & Orthopaedics | 18 - 24 months | Hip/Knee replacements, joint surgery |

| Cardiology | 9 - 15 months | Diagnostic tests, non-urgent heart procedures |

| Gynaecology | 10 - 18 months | Hysterectomy, endometriosis treatment |

| Ophthalmology | 9 - 14 months | Cataract surgery |

| General Surgery | 8 - 12 months | Hernia repairs, gallbladder removal |

| Diagnostic Services | 4 - 8 weeks | MRI scans, CT scans, Endoscopies |

Source: Projections based on 2024 NHS England data and Nuffield Trust analysis.

Waiting for a hip replacement isn't just about enduring pain; it's about being unable to work, climb stairs, or play with your grandchildren. Waiting for a cardiac diagnosis isn't just stressful; it's living with a ticking clock. This waiting period is where the financial damage begins.

Deconstructing the £4.2 Million Financial Catastrophe: A Family's Story

To understand how a health issue spirals into a multi-million-pound financial disaster, let's consider a hypothetical but realistic case study: The Miller Family.

- The Family: Mark (45) and Sarah (43). Mark is a project manager earning £70,000. Sarah is a marketing consultant earning £65,000. They have two children, a mortgage, and are diligently saving for retirement. Their combined lifetime earning potential until age 67 is significant.

- The Trigger: Mark suffers a severe back injury. His GP diagnoses a herniated disc requiring specialist consultation and likely surgery. He is referred to an NHS neurosurgeon.

- The Wait: The total wait time from GP referral to surgery is 18 months.

Let's break down the financial domino effect, step-by-step.

The Anatomy of the Millers' Financial Crisis

| Financial Impact Category | The Devastating Cost Over 18 Months |

|---|---|

| 1. Mark's Lost Income | After 28 weeks of Statutory Sick Pay (£116.75/week), Mark's income stops. Loss: ~£80,000 |

| 2. Sarah's Career Derailment | Sarah reduces her hours by 40% to care for Mark and manage the household. Loss: ~£39,000 |

| 3. Depleted Savings | They use their £25,000 emergency fund and another £15,000 from their house deposit savings to cover the income shortfall and pay for private physiotherapy. Loss: £40,000 |

| 4. Pension Contribution Halt | Both Mark's and Sarah's employer pension contributions are stopped or reduced. Loss of contributions & growth: ~£25,000 |

| 5. Increased Debt | They are forced to put an additional £10,000 on credit cards for daily expenses. Debt: £10,000 + interest |

| Total Immediate Financial Hit: | ~£194,000 |

This £194,000 is just the immediate damage. The real catastrophe unfolds over their lifetime. (illustrative estimate)

The £4.2 Million Lifetime Calculation: (illustrative estimate)

This figure represents the absolute worst-case scenario, where a debilitating long-term wait leads to both partners being unable to return to their previous high-earning careers.

- Lost Future Earnings (illustrative): Mark is unable to return to his physically demanding project manager role. He retrains but his new role pays £30,000 less per year. Over the next 22 years to retirement, that's a £660,000 loss.

- Sarah's Stagnated Career: Sarah never regains her career momentum after stepping back. The promotional opportunities she missed cost her an estimated £20,000 per year in future earnings. Over 24 years, that's a £480,000 loss.

- Compounded Pension Losses: The initial halt and subsequent lower contributions have a devastating compounding effect. The estimated final pension pot is £750,000 smaller than it would have been.

- Eroded Savings & Investments (illustrative): The £40,000 they drained, if it had been invested for 25 years with a modest 6% return, would have grown to over £170,000. This is their lost opportunity cost.

- Total Catastrophic Loss: If we project a more severe scenario where both partners are forced out of the workforce permanently (e.g., one due to illness, the other as a full-time carer), the loss of their combined £135,000 income over 22 years is £2.97 million. Add the pension and savings losses, and the total financial devastation easily surpasses £4.2 million.

This isn't just about money. It's about the loss of their children's university fund, the dream of a comfortable retirement, the ability to pass on wealth, and the security they worked their whole lives to build. All washed away by an 18-month wait.

The First Line of Defence: Private Medical Insurance (PMI) as Your Health Fast-Track

If the NHS is the safety net with ever-widening holes, Private Medical Insurance (PMI) is the express lift that takes you directly to the care you need. It's not about replacing the NHS – which remains essential for emergencies and chronic condition management – but about complementing it where it is most strained: elective care.

PMI is a health insurance policy that covers the cost of private medical treatment for acute conditions that arise after your policy has begun.

The Core Benefits of PMI:

- Speed of Access: This is the game-changer. Instead of waiting 18 months like Mark, a PMI policyholder could typically see a specialist within days and be scheduled for surgery within weeks.

- Choice and Control: You are in the driver's seat. You can choose your specialist, the hospital where you are treated, and schedule appointments at a time that suits you.

- Advanced Treatments and Drugs: Gain access to cutting-edge treatments, drugs, and surgical techniques that may not yet be approved for widespread NHS use due to cost or other factors.

- Comfort and Privacy: Treatment is often in a private hospital with your own en-suite room, more flexible visiting hours, and better food, reducing the stress of a hospital stay.

PMI vs. The NHS: A 2025 Head-to-Head

| Feature | NHS Waiting List | Private Medical Insurance (PMI) |

|---|---|---|

| Referral to Treatment | 6 - 24+ months (Projected 2025) | 2 - 6 weeks |

| Choice of Hospital | Limited to your local NHS Trust | Extensive nationwide network |

| Choice of Specialist | Assigned by the hospital | You choose your consultant |

| Diagnostic Scans | Weeks or months | Days |

| Accommodation | Shared ward | Private en-suite room |

| Cancer Care | Standard NHS protocols | Access to latest drugs/therapies |

The cost of PMI is often a concern, but it must be weighed against the alternative. The average family policy can range from £80 to £200 per month. Compare that to the £194,000 immediate financial hit the Millers faced, or the £15,000+ cost of a single private hip replacement, and PMI shifts from being a "luxury" to a fundamental component of financial planning.

The Financial Fortress: Your LCIIP (Life, Critical Illness & Income Protection) Shield

While PMI is your fast-track back to health, it doesn't pay your mortgage or put food on the table while you recover. That is the job of your LCIIP shield – the combination of insurances that protects your income and assets when you need it most.

This "financial fortress" is built on three core pillars:

1. Income Protection (IP): The Foundation

Often called the most important insurance you can own, Income Protection pays you a regular, tax-free monthly income if you are unable to work due to any illness or injury.

- How it Works: After a pre-agreed "deferment period" (e.g., 4, 13, 26 weeks), the policy starts paying out, typically providing 50-65% of your gross salary. It continues to pay until you can return to work, reach retirement age, or the policy term ends.

- Why It's Critical (illustrative): This is the policy that would have saved the Miller family. Instead of their income falling to zero, Mark would have received a monthly payment of around £3,000, allowing them to cover their mortgage and bills without decimating their life savings.

- The 'Own Occupation' Clause: The gold standard of IP is an 'own occupation' definition, which means the policy will pay out if you are unable to do your specific job. This is vital for skilled professionals.

2. Critical Illness Cover (CIC)

This policy pays out a one-off, tax-free lump sum on the diagnosis of a specific, serious illness listed in the policy. The "big three" are typically cancer, heart attack, and stroke, but modern policies cover 50+ conditions.

- How it's Used: The lump sum is yours to use as you see fit. You could:

- Pay off your mortgage or other debts.

- Fund private medical treatment if you don't have PMI.

- Adapt your home (e.g., install a stairlift).

- Replace a partner's income if they need to stop work to care for you.

- Give you a financial cushion to recover without stress.

3. Life Insurance

The final pillar of the fortress, Life Insurance, provides a tax-free lump sum to your loved ones if you pass away. It ensures that even in the worst-case scenario, your family is not left with a mortgage to pay and an income to replace. It provides the security they need to maintain their standard of living and future plans.

Your LCIIP Shield at a Glance

| Insurance Type | What It Does | How It Protects You in a Health Crisis |

|---|---|---|

| Income Protection | Replaces your monthly income. | Pays your bills, mortgage, and daily expenses while you can't work. |

| Critical Illness Cover | Pays a one-off lump sum on diagnosis. | Clears debts, funds care, or provides a financial buffer for recovery. |

| Life Insurance | Pays a lump sum on death. | Secures your family's long-term financial future. |

Together, these policies form a comprehensive shield that makes your family's finances resilient, regardless of what health challenges you face.

Building Your Bespoke Protection Plan: How to Combine PMI and LCIIP

There is no one-size-fits-all solution. The right strategy depends on your budget, profession, family circumstances, and risk appetite. The key is understanding how the policies work together.

- The Full Fortress (Maximum Protection): This combines comprehensive PMI with robust Income Protection, a significant Critical Illness policy, and Life Insurance. It provides the fastest route to health and the strongest financial safety net.

- The Balanced Approach (Most Common) (illustrative): This might involve a PMI policy with an excess (e.g., you pay the first £500 of a claim) to reduce premiums, paired with a solid Income Protection policy as the priority, and a modest level of Critical Illness and Life cover.

- The Financial-First Approach (Budget Conscious): If PMI is currently out of reach, the absolute priority must be protecting your income. A quality Income Protection policy is the non-negotiable foundation. You can then add Critical Illness and Life cover as your budget allows. Without an income, even private treatment becomes an impossible dream.

Navigating these options and the nuances of different providers' policies can be complex. This is where an expert independent broker like WeCovr comes in. We analyse your specific needs and financial situation to compare plans and quotes from across the entire UK market. Our goal is to find you the most robust protection for your budget, ensuring you get the cover you need without paying for what you don't.

The Cost of Inaction vs. The Price of Protection

It's easy to see insurance premiums as just another monthly expense. But it's crucial to reframe this thinking. Protection is not a cost; it's an investment in certainty. The real cost is the price of inaction.

Let's revisit the Millers. A comprehensive protection plan for their family might look something like this:

| Protection Plan for the Millers | Indicative Monthly Premium | Potential Financial Loss (Without Cover) |

|---|---|---|

| Mid-Range Family PMI | £120 | Cost of Private Surgery: £20,000+ |

| Income Protection (for Mark) | £65 | Lost Income over 18 Months: £80,000+ |

| Joint Critical Illness Cover | £45 | Drain on Savings/Debt: £50,000+ |

| Joint Life Insurance | £30 | Entire Future Income & Security |

| Total Monthly Investment: | £260 | Total Potential Financial Catastrophe: £4.2M+ |

For the price of a few weekly takeaways, they could have averted a financial crisis that derailed their entire lives.

At WeCovr, we believe in proactive, holistic wellbeing. We don't just want to protect you when things go wrong; we want to empower you to live a healthier life. That's why, in addition to securing your financial future with the right insurance, all our clients receive complimentary access to our proprietary AI-powered calorie and nutrition tracking app, CalorieHero. It's our way of going the extra mile, helping you manage your health proactively today to support a more secure tomorrow.

Frequently Asked Questions (FAQs)

Q: Do I still need the NHS if I have Private Medical Insurance? A: Absolutely. PMI is designed to complement the NHS, not replace it. The NHS remains the best place for accident and emergency services, GP visits, and the management of chronic conditions (like diabetes or asthma) that are typically excluded from PMI policies.

Q: What's the real difference between Income Protection and Critical Illness Cover? A: Think of it as "long and slow" vs. "fast and hard". Income Protection is for the "long and slow" burn of being off work for any medical reason, paying you a regular monthly income. Critical Illness Cover is for the "fast and hard" financial shock of a major diagnosis, giving you a one-off lump sum to deal with the immediate financial fallout. Most comprehensive plans include both.

Q: Can I get cover if I have a pre-existing medical condition? A: Yes, but with caveats. For PMI, any condition you've had symptoms or treatment for in the last 5 years will likely be excluded, though it can sometimes be added back after a 2-year clear period. For LCIIP, your condition will be assessed by underwriters. It may be excluded, or you may be charged a higher premium, but cover is often still possible. Honesty and full disclosure on your application are paramount.

Q: How much cover do I actually need? A: This is the most important question, and the answer is unique to your circumstances. For Income Protection, you should aim to cover your essential monthly outgoings. For Critical Illness and Life Insurance, you should consider your mortgage, outstanding debts, and the cost of maintaining your family's lifestyle. Speaking with a specialist advisor at WeCovr can provide you with a detailed, no-obligation needs analysis to calculate the precise level of cover your family requires.

Your Health is Your Wealth: Don't Leave It to Chance

The landscape of UK healthcare has fundamentally changed. The comforting certainty of the past has been replaced by the stark reality of 2025: long waits for essential care are now the norm, and the financial consequences can be catastrophic.

Relying solely on a system under immense pressure is a gamble with your family's entire future. The £4.2 million financial threat is not an abstract number; it is the potential reality of lost income, shattered dreams, and a future built on debt instead of security.

But you are not powerless. You have the tools to build a two-pronged defence. Private Medical Insurance acts as your personal fast-track, getting you the diagnosis and treatment you need in weeks, not years. Your LCIIP shield—Income Protection, Critical Illness Cover, and Life Insurance—stands as the unshakeable financial fortress that protects your income and assets, no matter what health challenges arise.

Don't wait for a diagnosis to become a disaster. Take control of your future today. Investigate your options, understand your risks, and build the protection plan that ensures a health crisis never becomes a financial catastrophe for the people you love.

Sources

- Office for National Statistics (ONS): Mortality and population data.

- Association of British Insurers (ABI): Life and protection market publications.

- MoneyHelper (MaPS): Consumer guidance on life insurance.

- NHS: Health information and screening guidance.