TL;DR

As an FCA-authorised expert with over 900,000 policies of various kinds issued, WeCovr understands the UK’s private medical insurance market inside out. For female athletes, from grassroots enthusiasts to semi-professionals, an injury can be a devastating setback. Private health cover offers a crucial advantage, providing a fast track to recovery and helping you get back to the sport you love sooner.

Key takeaways

- Anatomy: Women typically have a wider pelvis, which can alter the alignment of the knee and increase strain on the ACL.

- Hormones: Fluctuations in oestrogen levels during the menstrual cycle can affect ligament laxity, making them more prone to injury.

- Neuromuscular Control: Differences in landing and cutting mechanics can place greater stress on the knee joint.

- Patellofemoral Pain Syndrome (Runner's Knee): Pain around the kneecap, often caused by muscle imbalances and anatomical alignment.

- Stress Fractures: Particularly in the feet and shins, linked to factors like training load and bone density, which can be influenced by diet and hormonal health (the "female athlete triad").

As an FCA-authorised expert with over 900,000 policies of various kinds issued, WeCovr understands the UK’s private medical insurance market inside out. For female athletes, from grassroots enthusiasts to semi-professionals, an injury can be a devastating setback. Private health cover offers a crucial advantage, providing a fast track to recovery and helping you get back to the sport you love sooner.

Private health plans help bypass NHS delays, ensuring speedier access to diagnosis, surgery, and physio after injury

The rise of women's sport in the UK is a phenomenal success story. From the Lionesses' triumphs to packed-out netball arenas and record-breaking rugby crowds, female athletes are finally getting the recognition they deserve. But with increased participation and intensity comes a higher risk of injury. When a player is sidelined, every single day counts.

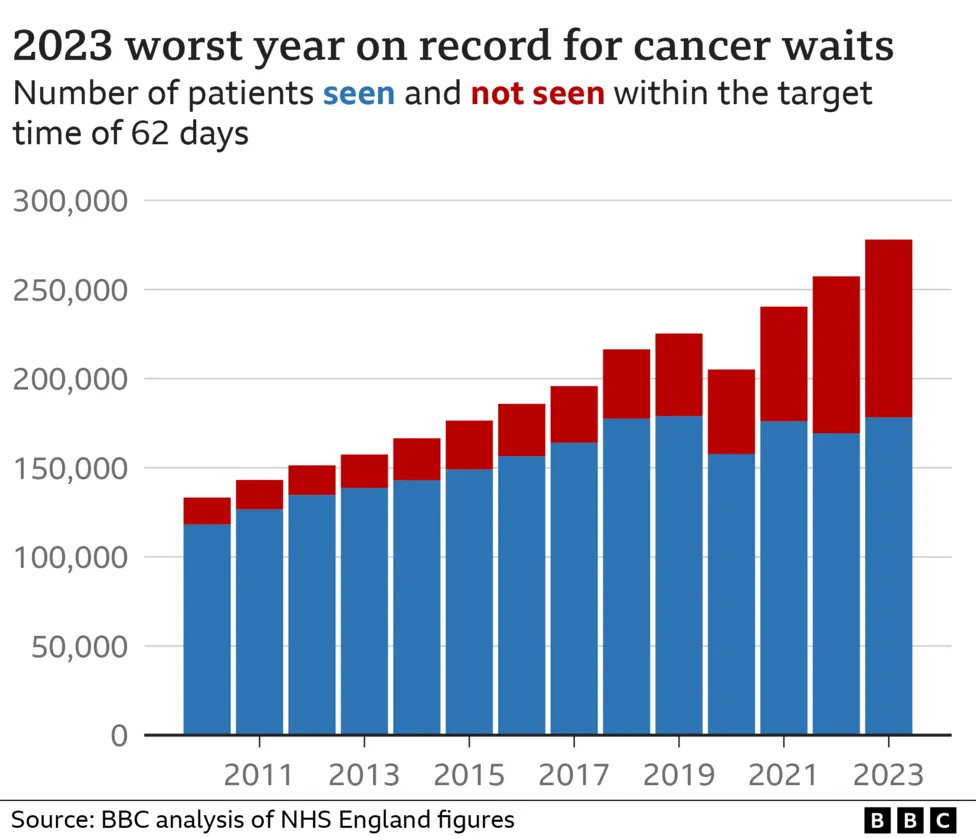

Unfortunately, the reality for many is a long and frustrating wait for care on the NHS. While the National Health Service provides exceptional emergency treatment, the waiting lists for diagnostics, specialist consultations, and elective surgery can stretch for months, even years.

According to the latest NHS England data (projected to late 2025 based on current trends), the referral-to-treatment (RTT) waiting list stands at over 7.5 million cases. The target is for 92% of patients to wait no more than 18 weeks, but this target has not been met for years.

| NHS Waiting List Snapshot (Projected to Q3 2025) | Statistic |

|---|---|

| Total Waiting List | ~7.5 million |

| Waiting over 18 weeks | ~3.1 million |

| Waiting over 52 weeks | ~300,000 |

| Median Wait Time (RTT) | ~15 weeks |

Source: Projections based on NHS England Referral to Treatment (RTT) data trends.

For an athlete, a 15-week median wait just to start treatment is a career-threatening delay. During this time, muscles can weaken, fitness can decline, and the psychological toll can be immense. This is where private medical insurance (PMI) provides a game-changing alternative.

The Unique Injury Risks for Female Athletes

While injuries are a part of any sport, biological and biomechanical differences mean female players are more susceptible to certain types of injuries than their male counterparts. Understanding these risks highlights why swift access to specialist care is so vital.

Anterior Cruciate Ligament (ACL) Tears

This is one of the most common and debilitating knee injuries in sports like football, netball, and rugby. Female athletes are two to eight times more likely to tear their ACL than male athletes in the same sports.

Why the higher risk?

- Anatomy: Women typically have a wider pelvis, which can alter the alignment of the knee and increase strain on the ACL.

- Hormones: Fluctuations in oestrogen levels during the menstrual cycle can affect ligament laxity, making them more prone to injury.

- Neuromuscular Control: Differences in landing and cutting mechanics can place greater stress on the knee joint.

An ACL tear almost always requires surgery to return to sport. An NHS wait of many months for surgery, followed by a limited number of physiotherapy sessions, can jeopardise a full recovery.

Other Common Injuries

- Patellofemoral Pain Syndrome (Runner's Knee): Pain around the kneecap, often caused by muscle imbalances and anatomical alignment.

- Stress Fractures: Particularly in the feet and shins, linked to factors like training load and bone density, which can be influenced by diet and hormonal health (the "female athlete triad").

- Concussion: Growing awareness has shown that women may experience different symptoms and potentially longer recovery periods from head injuries compared to men.

Prompt diagnosis and a tailored rehabilitation programme are essential for all these conditions. Delays can turn a manageable injury into a chronic problem.

How Private Medical Insurance Gives You the Edge

PMI is designed to work alongside the NHS, offering you choice, speed, and access to a wider range of treatments when you need them for new, acute conditions. Think of it as your personal fast track to recovery.

Here’s a step-by-step look at how the process works for a sports injury:

Step 1: The GP Referral

Your journey typically starts with your NHS GP. If they believe you need to see a specialist, they can provide an 'open referral'. This means they recommend a type of specialist (e.g., an orthopaedic surgeon) rather than a specific individual. With this referral, you can contact your PMI provider.

Step 2: Ultra-Fast Diagnostics

This is where PMI first demonstrates its power. While you might wait weeks or months for an MRI, CT, or ultrasound scan on the NHS, a private provider can often arrange it within a few days.

| Diagnostic Scan | Typical NHS Wait Time | Typical PMI Wait Time |

|---|---|---|

| MRI Scan | 6–10 weeks | 2–5 days |

| Ultrasound | 4–8 weeks | 1–4 days |

| CT Scan | 5–9 weeks | 2–5 days |

Getting a clear diagnosis quickly means your consultant can create a treatment plan immediately, preventing your condition from worsening while you wait.

Step 3: Choice of Leading Specialists and Hospitals

PMI gives you control over your care. Instead of being assigned to a hospital and consultant with the longest waiting list, you can choose from a network of leading specialists and state-of-the-art private hospitals across the UK. You can research surgeons who specialise in your specific injury, ensuring you get the very best care.

Step 4: Prompt Surgery and Treatment

Once a diagnosis is confirmed and surgery is recommended, you won’t be put at the back of a long queue. Private surgery can typically be scheduled in a matter of days or weeks, not months or years. This speed is critical for athletes, as it allows rehabilitation to begin almost immediately, maximising the chances of a successful outcome.

Step 5: Comprehensive Rehabilitation

Recovery doesn't end with surgery. This is another area where PMI excels. While the NHS might offer a limited number of post-op physiotherapy sessions, a good PMI policy will provide extensive cover for therapies.

This can include:

- Physiotherapy: A comprehensive course of treatment to restore strength, mobility, and function.

- Osteopathy & Chiropractic: To address musculoskeletal alignment.

- Hydrotherapy: Using water-based exercises to reduce strain on joints during early rehabilitation.

- Podiatry: For foot and ankle issues.

This level of dedicated, one-on-one rehabilitation is crucial for getting you back to peak performance safely.

What PMI Covers – And Crucially, What It Doesn’t

It is vital to understand that standard private medical insurance in the UK is designed for new, treatable (acute) conditions that arise after you take out your policy.

The Golden Rule: Acute vs. Chronic Conditions

- Acute Condition: A disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery. A torn ligament, a broken bone, or appendicitis are classic examples. This is what PMI covers.

- Chronic Condition: A disease, illness, or injury that is long-lasting and has no known cure. It can be managed but not resolved. Examples include diabetes, asthma, arthritis, and high blood pressure. Standard PMI does not cover the ongoing management of chronic conditions.

The Issue of Pre-Existing Conditions

Insurers will not cover conditions you had before your policy began. This includes any ailment for which you have experienced symptoms, sought advice, or received treatment.

There are two main ways insurers handle this:

- Moratorium Underwriting: This is the most common type. The insurer will automatically exclude any condition you've had in the five years before your policy starts. However, if you go for a continuous two-year period after your policy begins without any symptoms, treatment, or advice for that condition, it may become eligible for cover.

- Full Medical Underwriting (FMU): You declare your full medical history on an application form. The insurer then reviews it and tells you upfront exactly what is and isn't covered. This provides certainty from day one but may result in permanent exclusions.

| Feature | Generally Covered by PMI | Generally Excluded by PMI |

|---|---|---|

| Condition Type | Acute conditions (e.g., joint injury, hernia) | Chronic conditions (e.g., diabetes, arthritis) |

| Timing | Conditions arising after policy start | Pre-existing conditions |

| Treatments | Diagnosis, surgery, specialist fees, physio | Routine check-ups, cosmetic surgery, normal pregnancy |

| Emergencies | No – A&E is handled by the NHS | Yes – You should always call 999 in an emergency |

An expert PMI broker like WeCovr can help you navigate these complexities and find the right underwriting option for your circumstances.

Tailoring a PMI Policy to an Athlete’s Needs

No two policies are the same. You can customise your private health cover to balance your needs with your budget. For a female athlete, certain features are particularly important.

Essential Policy Options

- Outpatient Cover: This is one of the most crucial elements. It pays for your initial specialist consultations and diagnostic tests (like MRI scans) that don't require a hospital bed. Without outpatient cover, you'd have to pay for these yourself or wait on the NHS. You can choose a limit (e.g., £1,000 per year) or opt for a fully comprehensive plan with unlimited cover.

- Therapies Cover: This covers your rehabilitation, such as physiotherapy. For an athlete, this is non-negotiable. Ensure the policy provides a generous number of sessions.

- Mental Health Cover: The frustration and anxiety of being unable to play can be overwhelming. Many policies now offer excellent support for mental health, including access to counselling or psychiatric treatment, helping you stay resilient through recovery.

- Hospital List: Insurers offer different tiers of hospitals. A national list gives you the widest choice but costs more. A more restricted local list can reduce your premium.

How WeCovr Can Help

Choosing the right combination of options can be daunting. As an independent broker, WeCovr compares plans from all the UK's leading insurers to find the perfect fit for you. We listen to your needs as an athlete, explain the jargon, and build a policy that gives you robust protection without paying for features you don't need. And our service is completely free to you.

The Cost of Private Health Cover in the UK

The price of a PMI policy is influenced by several factors:

- Age: Premiums increase as you get older.

- Location: Cover is typically more expensive in London and the South East.

- Level of Cover: A comprehensive plan with unlimited outpatient cover and a national hospital list will cost more than a basic plan.

- Excess (illustrative): This is the amount you agree to pay towards any claim (e.g., the first £250). A higher excess will lower your monthly premium.

- Smoker Status: Non-smokers pay less.

Here are some illustrative monthly costs for a non-smoking female seeking a mid-range policy with £1,000 outpatient cover and a £250 excess.

| Age | Location: Manchester | Location: London |

|---|---|---|

| 25 | £45 - £60 | £55 - £75 |

| 35 | £55 - £75 | £70 - £90 |

| 45 | £75 - £100 | £95 - £125 |

These are estimates only. Your actual premium will depend on your specific circumstances and chosen insurer.

While it's an additional monthly expense, many athletes see it as a vital investment in their health and playing career. The cost of being out of action for six months longer than necessary—in terms of lost opportunities, fitness, and well-being—is far greater.

Beyond Injury: The Everyday Wellness Benefits of PMI

Modern private health cover is about more than just reacting to injury. The best PMI providers now include a wealth of proactive wellness benefits to help you stay healthy.

- Digital GP: Get a video consultation with a GP 24/7, often within hours. Perfect for getting quick advice or a prescription without waiting for an appointment at your local surgery.

- Wellness Programmes: Many insurers offer rewards and discounts for staying active, tracked via an app. You can get reduced gym memberships, free cinema tickets, or even discounts on your premium.

- Mental Health Support: Access to telephone helplines, therapy apps, and counselling sessions, even if you don't have a full mental health claim.

- Nutrition and Health Advice: Helplines staffed by nurses and other health professionals to answer your everyday questions.

As a WeCovr client, you also get complimentary access to CalorieHero, our exclusive AI-powered calorie and nutrition tracking app, to help you optimise your diet for performance and recovery. Furthermore, PMI customers often receive discounts on other types of cover, like life insurance.

A Tale of Two Recoveries: A Real-Life Scenario

To see the dramatic difference PMI can make, let’s imagine two 28-year-old semi-professional netball players, Sarah and Emily, who both suffer a suspected ACL tear in the same week.

Sarah's Journey (Relying on the NHS)

- Week 1: Visits her GP, who refers her to an orthopaedic specialist.

- Week 9: Gets an appointment with the NHS specialist, who confirms an MRI is needed.

- Week 16: Finally has her MRI scan.

- Week 19: Follow-up appointment to confirm a full ACL rupture. She is placed on the surgical waiting list.

- Week 45: Has her ACL reconstruction surgery. She has been unable to play or train properly for almost a year.

- Week 47 onwards: Begins a course of NHS physiotherapy, limited to six sessions. Her progress is slow.

Total Time to Return to Play: ~18-20 months.

Emily's Journey (Using Her PMI Policy)

- Week 1: Visits her GP and gets an open referral. She calls her PMI provider, who authorises a consultation.

- Week 1 (Day 4): Sees a top private knee surgeon.

- Week 1 (Day 6): Has a private MRI scan.

- Week 2: The surgeon confirms the ACL rupture and schedules surgery.

- Week 4: Has her ACL reconstruction surgery in a private hospital.

- Week 4 (post-op): Begins an intensive, unlimited course of private physiotherapy tailored to her sport.

Total Time to Return to Play: ~9-10 months.

Emily is back on the court and playing a full season while Sarah is still in the early stages of her NHS-led recovery. For an athlete, this difference is everything.

Does private medical insurance cover sports injuries?

Do I still need the NHS if I have private medical insurance?

What is an 'excess' on a PMI policy?

Why should I use a PMI broker like WeCovr instead of going direct to an insurer?

An injury shouldn’t mean the end of your season, or worse, your playing career. By investing in the right private medical insurance, you give yourself the best possible chance of a swift and complete recovery. You gain an invaluable edge: peace of mind and the speed to get back in the game.

Ready to find the right private health cover for you? Get your free, no-obligation quote from WeCovr today and let our experts help you stay at the top of your game.

Sources

- Office for National Statistics (ONS): Mortality, earnings, and household statistics.

- Financial Conduct Authority (FCA): Insurance and consumer protection guidance.

- Association of British Insurers (ABI): Life insurance and protection market publications.

- HMRC: Tax treatment guidance for relevant protection and benefits products.