TL;DR

The landscape of healthcare in the United Kingdom has undergone a dramatic transformation in recent years. With NHS waiting lists reaching a staggering 7.36 million cases in May 2025, an increasing number of Britons are turning to private healthcare as a viable alternative. This comprehensive guide provides everything you need to know about private medical costs across the UK, from initial consultations to complex surgeries, helping you make informed decisions about your healthcare journey.

Key takeaways

- Hip replacement: £11,000-£17,000 (average £14,000) (illustrative)

- Knee replacement: £12,000-£16,000 (average £13,500) (illustrative)

- ACL repair: £6,000-£12,000 (average £8,300) (illustrative)

- Gallbladder removal: £5,500-£8,500 (average £6,900) (illustrative)

- Hernia repair: £3,200-£5,500 (average £3,800) (illustrative)

The Complete Guide to Private Medical Treatment Costs in the UK: 2026 Edition

The landscape of healthcare in the United Kingdom has undergone a dramatic transformation in recent years. With NHS waiting lists reaching a staggering 7.36 million cases in May 2025, an increasing number of Britons are turning to private healthcare as a viable alternative. This comprehensive guide provides everything you need to know about private medical costs across the UK, from initial consultations to complex surgeries, helping you make informed decisions about your healthcare journey.

The Current State of Private Healthcare in the UK

The private healthcare market in the UK has experienced unprecedented growth, valued at a record-breaking £12.4 billion in 2023. This surge reflects a fundamental shift in how Britons approach healthcare, with record levels of private medical cover now protecting over 8.06 million people - representing 11.8% of the UK population.

The numbers tell a compelling story: private medical insurance claims reached £3.57 billion in 2023, representing a 21% increase from the previous year. This dramatic rise isn't merely about preference - it's about necessity. With NHS waiting times for non-urgent treatments often exceeding 52 weeks, private healthcare has evolved from luxury to lifeline.

Key Market Trends in 2026

Recent data reveals several critical trends shaping the private healthcare landscape:

- Record hospital admissions: Private hospitals reported 238,000 admissions in Q1 2024 alone

- Insurance uptake surge: 58% of private healthcare users now pay through PMI, up from 49% in 2023

- Employer benefits expansion: 4.7 million people now receive private medical cover through workplace schemes

- Self-pay market growth: Out-of-pocket expenditure increased by 10% in 2021, outpacing insurance growth

Understanding Private Healthcare Costs: The Complete Breakdown

Initial Consultation Fees

The first step in any private healthcare journey begins with a consultation. The average cost of seeing a private consultant in the UK is £195, though this varies significantly based on speciality and location.

Consultation costs by speciality:

- Psychiatrists: £300 (the most expensive specialty) (illustrative)

- General consultations: £120-£500 (illustrative)

- Physiotherapists: £67 (the most affordable) (illustrative)

- Practice Plus Group: Fixed £95 (includes X-rays, blood tests, and swabs) (illustrative)

Regional variations are substantial, with London consultations costing on average 27% more than the rest of the UK. For instance, a private ophthalmology consultation in Manchester averages £250, whilst the same service in Northern Ireland costs approximately £150. (illustrative estimate)

Diagnostic Services: The Foundation of Private Care

Diagnostic services represent one of the most accessible entry points into private healthcare, often providing rapid results that can significantly expedite treatment decisions.

Diagnostic imaging costs:

- MRI scans: £249-£2,000 (average £800) (illustrative)

- CT scans: £355-£850 (average £600) (illustrative)

- X-rays: £100-£300 (average £200) (illustrative)

- Blood tests: £43-£377 (average £150) (illustrative)

- Echocardiogram: £225 (illustrative)

- Ultrasound: £225

The speed advantage is remarkable: whilst NHS diagnostic waiting times can extend 6-18 weeks, private scans are typically available within 1-3 days.

Major Surgery Costs: A Comprehensive Analysis

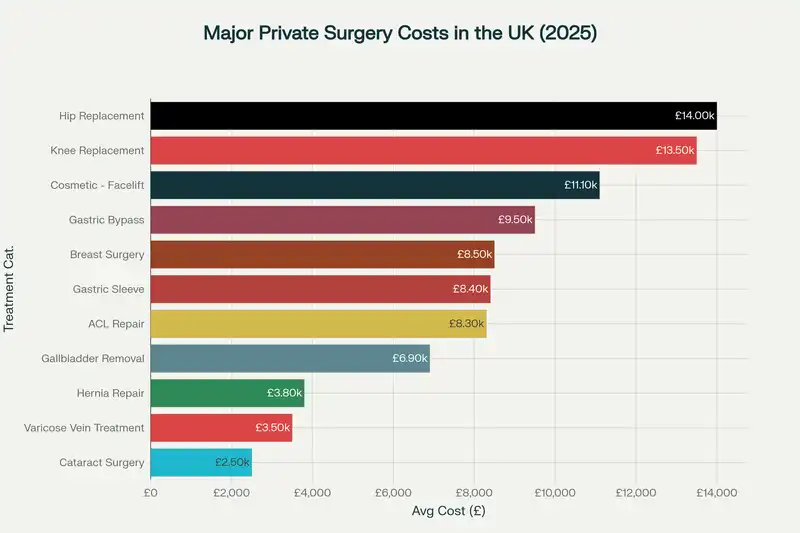

Major private surgery costs in the UK showing average prices for common procedures in 2025

The chart above illustrates the substantial investment required for major private surgeries. These procedures represent the most significant healthcare expenses but also offer the greatest time savings compared to NHS alternatives.

Orthopaedic procedures dominate the high-cost category:

- Hip replacement: £11,000-£17,000 (average £14,000) (illustrative)

- Knee replacement: £12,000-£16,000 (average £13,500) (illustrative)

- ACL repair: £6,000-£12,000 (average £8,300) (illustrative)

General surgery encompasses a broad range of procedures:

- Gallbladder removal: £5,500-£8,500 (average £6,900) (illustrative)

- Hernia repair: £3,200-£5,500 (average £3,800) (illustrative)

- Varicose vein treatment: £1,800-£4,500 (average £3,500) (illustrative)

Bariatric surgery offers life-changing procedures:

- Gastric bypass: £8,000-£12,000 (average £9,500) (illustrative)

- Gastric sleeve: £7,000-£10,000 (average £8,400) (illustrative)

Specialist Treatment Areas

Ophthalmology services:

- Cataract surgery: £1,995-£4,000 per eye (average £2,500) (illustrative)

- Private providers like Practice Plus Group offer cataract surgery from £1,995, significantly less than competitors charging £3,000-£4,000 (illustrative)

Cosmetic and reconstructive surgery:

- Facelift and necklift: £9,000-£15,000 (average £11,100) (illustrative)

- Breast enlargement: £7,549 (illustrative)

- Tummy tuck: £9,314 (illustrative)

- Rhinoplasty: £7,439 (illustrative)

Dental surgery:

- Simple tooth extraction: £200-£700 (illustrative)

- Surgical wisdom tooth removal: £1,150-£2,500 (illustrative)

- Full dental clearance: £1,749 (illustrative)

Regional Cost Variations Across the UK

The cost of private healthcare varies dramatically across different regions of the United Kingdom, reflecting local economic conditions, competition levels, and operational expenses.

London: The Premium Healthcare Hub

London commands the highest private healthcare costs in the UK, with premiums averaging 22.9% above the national average. Chiswick specifically represents the most expensive location, with costs 30.18% higher than the national average.

London-specific pricing examples:

- Private GP consultation: £298-£596 (The London General Practice) (illustrative)

- House calls: £525-£595 per hour door-to-door (illustrative)

- Health screening packages: £1,560-£9,000 (illustrative)

Regional Price Variations

Most affordable regions:

- Newcastle upon Tyne: 16.6% below national average

- Northern Ireland: Consistently lower across specialties

- North East England: 14.9% below national average

Premium locations:

- London (various boroughs): 22.9% above average

- Birmingham: Higher than national average for specialist consultations

- Manchester: Premium pricing for specialist services

Leading Private Hospital Groups and Facilities

London's Premier Private Hospitals

HCA Healthcare UK stands as the largest private healthcare provider globally and one of the UK's leading networks. Their facilities include:

- The Wellington Hospital: Advanced cardiac and neurology centres

- The Princess Grace Hospital: 127 private ensuite rooms, seven operating theatres

- London Bridge Hospital: Cost-effective option with state-of-the-art facilities

Specialist Excellence Centres:

- Royal Brompton & Harefield: World-leading heart and lung care

- The London Clinic: 24/7 same-day GP access, over 1,000 support staff

- Moorfields Private: World-renowned ophthalmology services

- Great Ormond Street Hospital: Leading paediatric care centre

Major Private Hospital Networks

Spire Healthcare: 38 award-winning private hospitals with over 3,700 consultants

- Consultation fees: £120-£500 (illustrative)

- Comprehensive treatment pricing varies by location

Nuffield Health: Extensive network with consultant-set pricing

- Variable consultation costs based on specialist experience

BMI Healthcare: Part of the major private hospital landscape

- Regional presence across England

Circle Health Group: Consultation fees from £200 (illustrative estimate)

- Focus on fixed-price transparency

Boutique and Specialist Facilities

Weymouth Street Hospital: Described as "Britain's ultimate boutique hospital"

- Voted London's best private hospital across 12 categories

- Premium luxury facilities with state-of-the-art technology

Cromwell Hospital: Attracts patients from 140+ countries

- Specialises in cancer care, transplants, and robotic surgery

- 99.57% PLACE rating for patient comfort

Private Medical Insurance: Your Gateway to Affordable Private Healthcare

Current PMI Costs and Trends

Private Medical Insurance has become increasingly accessible, with average monthly costs significantly lower than many expect:

- Individual coverage: £79.59 per month (illustrative)

- Couple coverage: £145.77 per month (illustrative)

- Family of four: £166.52 per month (illustrative)

However, these costs are experiencing upward pressure, with PMI costs expected to increase by 12.6% in 2024, outpacing the global average of 10.4%.

Age-Related Premium Variations

Age significantly impacts PMI costs:

- 20-year-old: £28.09 (basic) to £40.80 (comprehensive) (illustrative)

- 70-year-old: £136.98 (basic) to £200.60 (comprehensive) (illustrative)

Geographic impact on premiums:

- London: 22.9% above national average

- Newcastle: 16.6% below national average

- National average 50-year-old: £66.33 (Newcastle) vs £103.61 (London) (illustrative)

Leading PMI Providers

Market leaders by customer satisfaction:

- WPA: Only Which? Recommended Provider of PMI

- Benenden Health: Winner of 'Private Healthcare Provider of the Year' 2025

- Bupa: 2.3 million customers, average £75.35 monthly (illustrative)

- AXA Health: Access to over 250 hospitals

- Vitality Health: Digital-first approach with wellness rewards

The Value of Professional PMI Brokers

Navigating the complex PMI landscape often requires expert guidance. Specialist brokers like WeCovr can arrange comprehensive PMI policies tailored to individual needs, ensuring customers receive appropriate coverage for their chosen private healthcare providers.

Professional brokers offer several advantages:

- Whole-market comparison: Access to all major insurers

- Policy customisation: Tailored coverage based on individual requirements

- Claims support: Assistance throughout the claims process

- Cost optimisation: Potential savings up to 38% through expert negotiation

Self-Pay vs Insurance: Making the Right Choice

When Self-Pay Makes Sense

Self-pay can be cost-effective for:

- Routine consultations: £120-£500 one-off costs (illustrative)

- Minor procedures: Under £3,000 total cost (illustrative)

- Diagnostic tests: £43-£2,000 depending on complexity (illustrative)

- Emergency situations: When immediate treatment is required

Insurance Benefits for Major Procedures

PMI becomes invaluable for:

- Major surgery: Procedures exceeding £10,000 (illustrative)

- Cancer treatment: Comprehensive care pathways

- Chronic conditions: Ongoing treatment requirements

- Multiple procedures: Annual healthcare needs

Cost comparison example over five years:

- Self-pay total: £19,970 (including hip replacement) (illustrative)

- PMI total: £6,550 (premiums plus excess) (illustrative)

- Potential savings: £13,420 through insurance coverage

NHS vs Private: Understanding the True Cost Difference

Waiting Time Comparisons

The stark difference in waiting times represents the primary value proposition of private healthcare:

NHS current statistics:

- Total waiting list: 7.36 million cases

- Over 18-week waits: 60% of patients exceed target

- 52+ week waits: Common for joint replacements

Private healthcare timelines:

- Initial consultation: 1-2 weeks

- Major surgery: 4-6 weeks from consultation

- Diagnostic scans: 1-3 days

- Results and treatment planning: Within days

The Hidden Costs of NHS Delays

Extended NHS waiting periods create substantial hidden costs:

- Lost earnings: Inability to work during prolonged illness

- Deteriorating health: Conditions worsening without treatment

- Mental health impact: Anxiety and depression from uncertainty

- Family impact: Carer burden and relationship stress

Research suggests these factors can create a lifetime personal health bill exceeding £3.5 million when accounting for lost earnings, deteriorating conditions, and eventual private treatment costs. (illustrative estimate)

Industry Trends and Market Projections

Market Growth Trajectories

The UK private healthcare market demonstrates robust growth prospects:

- Current market value: £14.3 billion (2025) (illustrative)

- Projected 2032 value: £18.1 billion (illustrative)

- Expected CAGR: 3.4% (2025-2032)

Driving Forces Behind Growth

Several factors continue propelling market expansion:

- NHS capacity constraints: Persistent waiting list challenges

- Ageing population: Increased healthcare demand

- Medical technology advances: Enhanced treatment options

- Health consciousness: Post-pandemic wellness focus

Emerging Trends

Digital health integration:

- NHS App expansion saving 1.5 million missed appointments

- Telemedicine adoption accelerating

- Digital-first insurance models growing

Employer benefits expansion:

- 55% more likely to apply for jobs offering PMI

- Corporate healthcare spending increasing

- Employee wellbeing prioritisation

Specialist Treatment Costs by Medical Discipline

Cardiology and Cardiac Surgery

Cardiac care represents one of the most critical and expensive private healthcare specialties:

- Initial cardiac consultation: £200-£400 (illustrative)

- Echocardiogram: £225 (illustrative)

- Cardiac catheterisation: £3,000-£8,000 [estimated]

- Heart surgery: £15,000-£50,000+ [estimated]

Leading facilities:

- Royal Brompton & Harefield: World-renowned cardiac specialists

- The Wellington Hospital: Advanced cardiac centres

Oncology Treatment

Cancer care involves complex, multi-stage treatment pathways:

- Initial oncology consultation: £250-£500 [estimated]

- Chemotherapy cycles: £2,000-£10,000+ per cycle [estimated]

- Radiotherapy courses: £5,000-£15,000 [estimated]

- Cancer surgery: £8,000-£30,000+ [estimated]

Specialist centres:

- The Royal Marsden: World's first cancer hospital

- Cromwell Hospital: Integrated Cancer Campus

Mental Health Services

Mental health support has become increasingly important:

- Psychiatric consultation: £300 (highest specialty cost) (illustrative)

- Therapy sessions: £100-£200 per session [estimated]

- Residential treatment: £500-£1,500 per day [estimated]

Fertility and Reproductive Health

Fertility treatments represent significant investment:

- Fertility consultation: £200-£350 [estimated]

- IVF cycle: £4,000-£8,000 [estimated]

- Egg freezing: £3,000-£5,000 [estimated]

Paediatric Care

Children's healthcare requires specialist expertise:

- Paediatric consultation: £200-£400 [estimated]

- Children's surgery: Varies significantly by procedure [estimated]

Leading facility:

- Great Ormond Street Hospital: International paediatric excellence

Understanding What's Included in Private Healthcare Costs

Comprehensive Package Pricing

Most private hospitals offer fixed-price surgery packages that include:

- Pre-operative assessment: Complete health evaluation

- Consultant fees: Surgeon and anaesthetist costs

- Hospital charges: Theatre time, nursing care

- Accommodation: Private room during stay

- Medications: Prescribed drugs during treatment

- Follow-up care: Post-operative appointments

- Physiotherapy: Rehabilitation support when required

Additional Costs to Consider

Potential extra charges:

- Diagnostic tests: May require separate billing

- Complications: Additional procedures if needed

- Extended stay: Beyond standard recovery period

- Premium room upgrades: Enhanced accommodation

Cost Transparency Initiatives

Leading providers emphasise pricing clarity:

- Practice Plus Group: "No hidden costs" guarantee

- All-inclusive pricing: Fixed quotes regardless of complications

- Upfront estimates: Complete cost breakdowns before treatment

How to Choose the Right Private Healthcare Option

Assessing Your Healthcare Needs

Consider these factors when evaluating private healthcare:

Immediate requirements:

- Current health conditions requiring attention

- Urgency of required treatment

- Specialist expertise needed

Financial considerations:

- Available budget for healthcare expenses

- Monthly insurance premium affordability

- Potential for significant future healthcare needs

Lifestyle factors:

- Work commitments and scheduling flexibility

- Geographic preferences for treatment locations

- Family healthcare requirements

Working with Healthcare Insurance Brokers

Professional insurance brokers like WeCovr provide invaluable expertise in navigating complex PMI options:

Broker services include:

- Needs assessment: Comprehensive evaluation of healthcare requirements

- Market comparison: Analysis of all available insurance options

- Policy customisation: Tailoring coverage to specific needs

- Claims support: Assistance throughout the treatment process

- Ongoing review: Regular policy assessment and optimisation

Benefits of professional guidance:

- Cost savings: Expert negotiation and market knowledge

- Comprehensive coverage: Ensuring appropriate protection levels

- Claims efficiency: Smooth processing when treatment is needed

- Peace of mind: Confidence in healthcare coverage decisions

Evaluating Hospital and Provider Options

Key selection criteria:

- Speciality expertise: Relevant medical specialisation

- Facility accreditation: CQC ratings and certifications

- Consultant qualifications: Specialist experience and training

- Technology availability: Advanced equipment and techniques

- Location convenience: Accessibility for treatment and follow-up

- Cost transparency: Clear, comprehensive pricing

Financial Planning for Private Healthcare

Budgeting Strategies

Monthly planning approach:

- PMI premiums: £79.59 individual, £145.77 couple (illustrative)

- Emergency fund: 3-6 months of potential healthcare costs

- HSA considerations: Health savings account options

Annual healthcare budgeting:

- Routine consultations: £500-£1,500 annual allocation [estimated]

- Diagnostic services: £500-£2,000 for comprehensive screening [estimated]

- Emergency procedures: £5,000-£15,000 reserve fund [estimated]

Financing Options

Available payment methods:

- 0% finance plans: Available at many private hospitals

- Payment plans: Spreading costs over time

- Credit options: Healthcare-specific lending

- Corporate schemes: Employer-sponsored benefits

Tax Considerations

Potential tax benefits:

- Corporate PMI: Employer contributions may be tax-efficient [estimated]

- Self-employed expenses: Some treatments may be deductible [estimated]

- Health savings accounts: Tax-advantaged healthcare savings [estimated]

Future Outlook: The Evolution of UK Private Healthcare

Technological Advancement

Emerging technologies reshaping healthcare:

- Robotic surgery: Enhanced precision and outcomes

- AI diagnostics: Faster, more accurate diagnoses [estimated]

- Telemedicine: Remote consultation capabilities

- Personalised medicine: Tailored treatment approaches [estimated]

Market Consolidation

Industry developments:

- PureHealth acquisition of Circle Health: International expansion

- NHS partnership growth: Increased collaboration

- Digital platform integration: Technology-driven services

Regulatory Environment

Evolving healthcare landscape:

- CQC standards: Enhanced quality requirements

- Pricing transparency: Increased cost disclosure

- Patient rights: Strengthened consumer protections [estimated]

Sustainability and Access

Long-term market considerations:

- Workforce development: Training specialist professionals [estimated]

- Infrastructure investment: Hospital and clinic expansion

- Accessibility initiatives: Broadening healthcare access [estimated]

Conclusion: Making Informed Private Healthcare Decisions

The UK private healthcare landscape in 2025 presents both opportunities and challenges for individuals seeking quality medical care. With NHS waiting lists at unprecedented levels and private healthcare costs becoming increasingly transparent, the decision to invest in private medical treatment has never been more relevant.

Key takeaways for healthcare consumers:

- Cost predictability: Private healthcare offers transparent, fixed pricing compared to uncertain NHS waiting periods

- Time efficiency: Significant time savings across all treatment categories, from days for diagnostics to weeks for major surgery

- Quality assurance: Access to leading consultants, advanced technology, and premium facilities

- Financial protection: PMI provides substantial cost protection for major medical expenses

The value of professional guidance cannot be overstated. Specialist PMI brokers like WeCovr offer invaluable expertise in navigating complex insurance options, ensuring individuals and families receive appropriate coverage for their healthcare needs whilst optimising costs and maximising benefits.

As the private healthcare market continues evolving, with projected growth to £18.1 billion by 2032, early investment in appropriate coverage becomes increasingly valuable. Whether choosing comprehensive PMI or strategic self-pay options, informed decision-making supported by professional guidance ensures access to high-quality healthcare when it matters most.

The choice between NHS and private healthcare need not be absolute – many successful healthcare strategies combine both systems, utilising private care for urgent needs whilst maintaining NHS access for routine services. The key lies in understanding your options, evaluating your needs, and making informed decisions supported by expert guidance from specialists like WeCovr who can arrange comprehensive PMI policies tailored to your specific requirements.

Private healthcare in the UK represents not just an alternative to NHS services, but a complement that ensures comprehensive health protection for you and your family. With proper planning and professional support, private medical treatment becomes an accessible, valuable investment in your long-term health and wellbeing.

For personalised private medical insurance quotes and expert guidance on accessing the UK's leading private healthcare facilities, contact WeCovr's specialist advisers who can arrange comprehensive PMI policies tailored to your specific needs and budget.

Sources researched

-

mytribeinsurance.co.uk/knowledge/average-cost-of-private-health-insurance-uk

-

independent.co.uk/news/uk/nhs-employers-b2612685.html

-

policemutual.co.uk/how-much-does-private-healthcare-cost/

-

aon.com/unitedkingdom/media-room/articles/aon-uk-in-unprecedented-era-private-medical-cover

-

nuffieldtrust.org.uk/news-item/how-has-the-role-of-the-private-sector-changed-in-uk-health-care

-

practiceplusgroup.com/private-patient-care/prices/

-

healthcareandprotection.com/global-healthcare-benefit-costs-projected-to-rise-by-double-digits-wtw/

-

abi.org.uk/news/news-articles/2024/112/private-medical-insurance-data-2023/

-

kingsbridgeprivatehospital.com/payment-pricing/treatment-pricing

-

mytribeinsurance.co.uk/knowledge/private-medical-treatment-costs

-

practiceplusgroup.com/knowledge-hub/why-private-healthcare-so-expensive/

-

hcahealthcare.co.uk/self-pay-paying-for-medical-treatment

-

wecovr.com/guides/uk-private-healthcare-costs-self-pay-vs-insurance/

-

go.laingbuisson.com/selfpay6

-

nuffieldhealth.com/hospitals/pricing

-

wecovr.com/guides/the-£35m-cost-of-nhs-waits/

-

ihpn.org.uk/who-uses-private-healthcare/

-

spirehealthcare.com/health-hub/new-to-private-healthcare/ways-to-pay-for-private-medical-treatment/

-

axahealth.co.uk/health-insurance/how-much-does-private-health-insurance-cost/

-

spirehealthcare.com/treatments/prices/

-

premierpmi.co.uk/health-hub/best-private-hospitals-in-london/

-

skycare.uk/travel-advice/private-hospitals-in-the-uk/

-

hoorayinsurance.co.uk/the-best-private-healthcare-providers-in-the-uk/

-

insurancehero.org.uk/blog/best-private-hospitals-london.html

-

londonspecialisthospitals.com

-

hcahealthcare.co.uk/about-us

-

mytribeinsurance.co.uk/best-private-hospital-in-london

-

hcahealthcare.co.uk

-

benenden.co.uk/newsroom/best-private-healthcare-provider-2025/

-

my1health.com/articles/hospitals-uk-for-international-patients

-

cromwellhospital.com

-

ihpn.org.uk

-

phoenixhospitalgroup.com/blog/londons-best-private-hospital/

-

ramsayhealth.co.uk

-

wpa.org.uk/about/which-recommended

-

topdoctors.co.uk/top-10-hospitals/

-

spirehealthcare.com

-

mytribeinsurance.co.uk/treatment/private-hospitals-in-the-uk

-

hcahealthcare.co.uk/locations/hospitals/the-princess-grace-hospital

-

which.co.uk/money/insurance/health-insurance/get-the-best-private-health-insurance-a2BPc9a7R62E

-

iaminsured.co.uk/guide/how-much-do-private-medical-treatments-cost-in-the-uk/

-

thelondongeneralpractice.com/fees/

-

midlandsmassagetherapy.co.uk/understanding-private-hospital-costs-in-the-uk-a-comprehensive-guide

-

newvictoria.co.uk/prices-and-payments

-

bupa.co.uk/healthcare-professionals/for-your-role/consultants/fees-explained

-

phin.org.uk/help/Understanding-your-consultants-fees

-

thelondonclinic.co.uk

-

spirehealthcare.com/help-centre/costs-and-prices/

-

phin.org.uk/help/self-funding-your-private-treatment

-

pmibrokers.com/oxfordshire

-

premierpmi.co.uk/health-hub/how-much-is-private-health-insurance/

-

premierpmi.co.uk

-

laingbuisson.com/press-releases/the-uk-health-cover-market-surges-by-825-million-in-a-year-to-reach-7-59-billion-as-individuals-and-businesses-flock-to-health-and-dental-cover-options/

-

bupa.co.uk/health/health-insurance/understanding-health-insurance/costs

-

intelligentpmi.co.uk

-

ihpn.org.uk/news/new-research-shows-going-private-is-becoming-the-new-normal/

-

medichem-pharmacy.co.uk/how-much-does-health-insurance-cost-in-england-a-2025-guide-to-private-coverage

-

protectiondistributorsgroup.org.uk/find-an-insurance-specialist/

-

go.laingbuisson.com/health-cover-report-20

-

mytribeinsurance.co.uk/knowledge/bupa-health-insurance-cost-uk-pricing-guide

-

santepartners.co.uk

-

equipsme.com/blog/how-many-people-have-health-insurance-uk/

-

connect.avivab2b.co.uk/health/resources/product-support/introduction-to-PMI/

-

statista.com/statistics/683451/population-covered-by-public-or-private-health-insurance-in-united-kingdom/

-

mytribeinsurance.co.uk/best-health-insurance-brokers

-

premierpmi.co.uk/health-hub/private-surgery-costs-uk/

-

practiceplusgroup.com/knowledge-hub/how-much-cost-see-private-consultant/

-

drarunghosh.co.uk/gmg-blog/how-much-does-it-cost-to-see-a-private-consultant/

-

mytribeinsurance.co.uk/treatment/cost-to-see-a-private-consultant-uk

-

phin.org.uk/news/phin-private-market-update-june-2024-united-kingdom

-

kingsfund.org.uk/insight-and-analysis/data-and-charts/key-facts-figures-nhs

-

bupa.co.uk/health/payg

-

which.co.uk/reviews/private-healthcare/article/private-surgery-what-to-know-aEBlD9W36qFr

-

thelondonclinic.co.uk/information-for-patients/how-to-pay/paying-your-own-treatment

-

news.sky.com/story/nhs-waiting-list-increases-for-first-time-in-seven-months-13368251

-

persistencemarketresearch.com/market-research/uk-private-healthcare-market.asp

-

nuffieldtrust.org.uk/qualitywatch/nhs-performance-dashboard

-

laingbuisson.com/press-releases/private-healthcare-market-valued-at-record-12-4bn-as-long-nhs-waiting-lists-continue-to-fuel-demand/

-

abi.org.uk/news/news-articles/2024/9/protection-insurers-pay-out-record-7.34-billion-to-support-individuals-and-families/

-

bma.org.uk/advice-and-support/nhs-delivery-and-workforce/pressures/nhs-backlog-data-analysis

-

custommarketinsights.com/report/uk-private-healthcare-market/

-

the-exeter.com/news/the-exeter-release-2024-claims-statistics-showing-an-increase-in-claims-paid/

-

gov.uk/government/news/major-nhs-app-expansion-cuts-waiting-times

-

teneo.com/app/uploads/2023/01/Independent-Hospitals_The-Next-Challenge_Jan2023.pdf

-

digitalanddata.blog.gov.wales/2023/09/12/chief-statisticians-update-comparing-nhs-waiting-list-statistics-across-the-uk/

-

legalandgeneral.com/landg-assets/adviser/files/protection/sales-aid/claims-magazine.pdf

-

england.nhs.uk/statistics/statistical-work-areas/rtt-waiting-times/rtt-data-2024-25/

-

adviser.vitality.co.uk/health-insurance/claims/

-

england.nhs.uk/statistics/statistical-work-areas/rtt-waiting-times/

-

phin.org.uk/news/private-healthcare-market-update-September-2024-United-Kingdom-phin

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.