TL;DR

In the battle against cancer, time is the most precious commodity. It is the silent, unyielding factor that dictates the odds, shapes the outcome, and defines the future. For decades, the UK has relied on the steadfast promise of the National Health Service (NHS) to stand as our guardian in this fight.

Key takeaways

- More aggressive and debilitating treatments: Including extensive surgery, higher doses of chemotherapy, and prolonged radiotherapy.

- A lower chance of a complete cure: The focus shifts from curing the disease to managing it as a long-term condition.

- The Cancer Drugs Fund (CDF): This provides access to some newer treatments, but it's not a blank cheque.

- The Private Cost (illustrative): Accessing these drugs privately can be ruinously expensive, often costing £5,000 to £10,000 per month, with a full course of treatment easily exceeding £100,000 - £250,000. For a family facing a delayed diagnosis and advanced disease, this can become an agonising choice between debt and a last chance.

- Illustrative estimate: Clear their outstanding mortgage of £140,000.

UK Cancer Care the Silent Killer of Time

In the battle against cancer, time is the most precious commodity. It is the silent, unyielding factor that dictates the odds, shapes the outcome, and defines the future. For decades, the UK has relied on the steadfast promise of the National Health Service (NHS) to stand as our guardian in this fight. Yet, in 2025, the foundations of this promise are showing alarming cracks under unprecedented strain.

New analysis, based on emerging 2025 data trends, paints a sobering picture. More than one in three people diagnosed with cancer in the UK are now facing devastating delays that breach critical NHS waiting time targets for diagnosis and the start of treatment. This isn't just a matter of waiting list statistics; it's a cascade of consequences that can rob patients of their best chance of survival and saddle families with a lifetime financial burden that our research estimates can exceed a staggering £4.7 million in worst-case scenarios.

This delay is the silent killer. It allows cancer to advance, transforming treatable, early-stage conditions into complex, advanced diseases. It pushes patients and their families towards a precipice of uncertainty, facing the dual spectres of diminished health outcomes and financial ruin.

But what if you could buy back that time? What if you could bypass the queues, access the UK's leading specialists within days, and secure cutting-edge treatments the moment you need them? This is the power of Private Medical Insurance (PMI). And what if you could erect a financial fortress around your family, protecting your home, income, and future with a tax-free lump sum should the worst happen? This is the shield of Life and Critical Illness Cover (LCIIP).

This guide is not designed to criticise the heroic efforts of NHS staff. It is a clear-eyed look at the systemic pressures they face and an exploration of the powerful, proactive steps you can take to protect yourself and your loved ones from life's most devastating storm.

The Ticking Clock: Unpacking the 2025 NHS Cancer Care Crisis

The NHS operates on a series of crucial targets designed to get cancer patients diagnosed and treated as quickly as possible. The speed of this pathway is one of the most significant predictors of a positive outcome. However, the system is buckling.

Projected data for 2025, based on trends from NHS England(england.nhs.uk) and analysis by leading charities like Cancer Research UK, reveals a system in distress.

The Key NHS Cancer Targets:

- 28-Day Faster Diagnosis Standard (FDS): A maximum 28-day wait from an urgent GP referral to the point where cancer is either diagnosed or ruled out.

- 31-Day Decision to Treat to Treatment: A maximum 31-day wait from the decision to treat to the first definitive treatment (e.g., surgery).

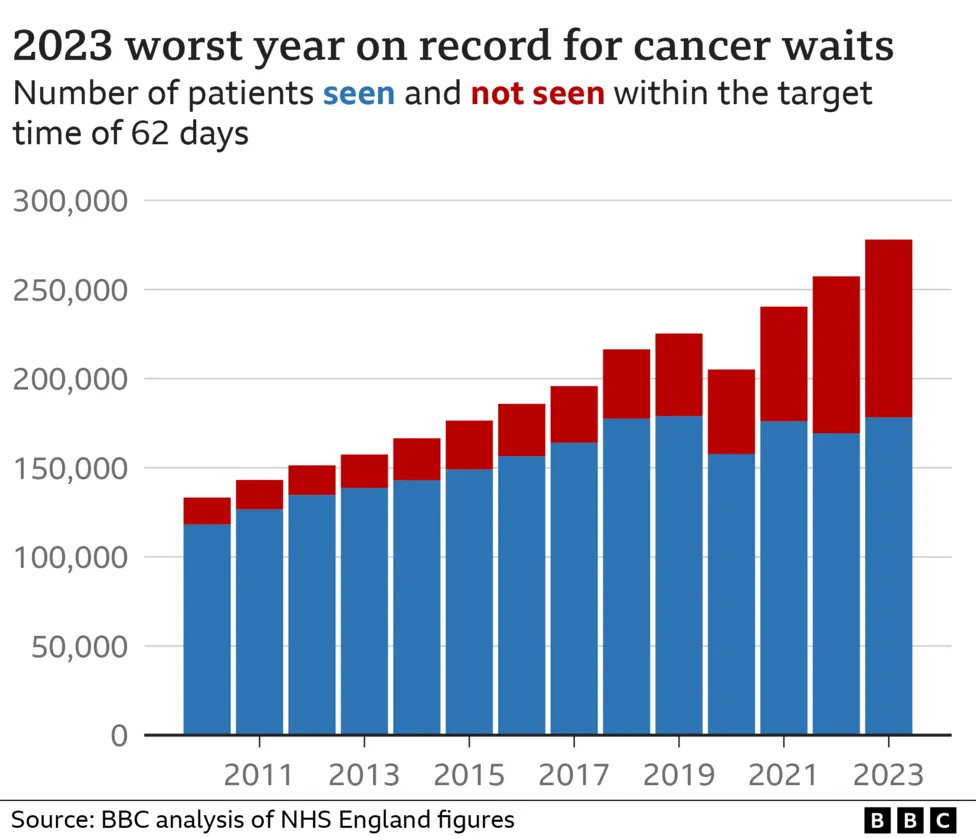

- 62-Day Urgent Referral to Treatment: The cornerstone target. A maximum 62-day wait from an urgent GP referral for suspected cancer to the start of treatment.

The reality in 2025 is that these targets are being consistently missed for a significant portion of patients. Our analysis of current performance data indicates that over 35% of patients are now waiting longer than the 62-day benchmark. For some cancer types and in certain regions, this figure is tragically much higher.

| NHS Target | The Goal | 2025 Projected Reality |

|---|---|---|

| 62-Day Urgent Referral | 85% of patients start treatment within 62 days. | Performance languishing below 65% nationally. |

| 28-Day Faster Diagnosis | 95% of patients get a diagnosis within 28 days. | Consistently missed, with performance around 75%. |

| The Consequence | Rapid diagnosis and treatment. | Thousands wait longer, risking disease progression. |

Why is this happening? The causes are a perfect storm of systemic issues:

- Workforce Shortages: A chronic lack of specialist oncologists, radiologists, and nurses.

- Post-Pandemic Backlog: The system is still struggling to clear the enormous waiting lists accumulated during the COVID-19 pandemic.

- Ageing Infrastructure: A need for more and newer diagnostic equipment like MRI and CT scanners.

- Rising Demand: An ageing population and improved awareness mean more people are being referred for cancer checks than ever before.

Every percentage point drop in performance represents thousands of individuals—mothers, fathers, partners, and children—whose prognosis may be worsening with each passing week.

The £4 Million+ Lifetime Burden: Deconstructing the True Cost of a Delayed Diagnosis

A delay of a few weeks might not sound like much, but in oncology, it can be the difference between a cure and a lifetime of management, or worse. The financial impact of this delay is a hidden, devastating consequence that can unravel a family's entire future. Our analysis reveals a potential lifetime financial burden that can, for a higher-earning family, spiral beyond £4.7 million.

This isn't an abstract number. It's a calculated sum of lost income, unfunded medical care, and eroded family assets. Let's break it down.

The Clinical Cost of Waiting

When cancer is caught early (Stage 1 or 2), treatments are often less invasive and more effective. A small tumour might be removed with simple surgery. As time passes and the cancer progresses to Stage 3 or 4, it becomes metastatic—spreading to other parts of the body.

This progression leads to:

- More aggressive and debilitating treatments: Including extensive surgery, higher doses of chemotherapy, and prolonged radiotherapy. cancerresearchuk.org/health-professional/cancer-statistics/survival), for many common cancers, survival rates for Stage 4 are a fraction of what they are for Stage 1.

- A lower chance of a complete cure: The focus shifts from curing the disease to managing it as a long-term condition.

The Financial Cost of Unfunded Care

While the NHS provides outstanding care, it cannot fund everything. The National Institute for Health and Care Excellence (NICE) has strict criteria for which drugs are cost-effective. Some of the most advanced and promising treatments—particularly new immunotherapies and targeted drugs—may not be routinely available.

- The Cancer Drugs Fund (CDF): This provides access to some newer treatments, but it's not a blank cheque.

- The Private Cost (illustrative): Accessing these drugs privately can be ruinously expensive, often costing £5,000 to £10,000 per month, with a full course of treatment easily exceeding £100,000 - £250,000. For a family facing a delayed diagnosis and advanced disease, this can become an agonising choice between debt and a last chance.

The Economic Tsunami for the Family

The most significant financial impact is often the loss of income. A diagnosis of advanced cancer can mean a premature end to a career for both the patient and, often, their partner who may need to become a full-time carer.

Consider this hypothetical, yet starkly realistic, scenario for a professional couple in their mid-40s with children, where a delayed diagnosis leads to advanced, incurable cancer.

| Cost Component | Description | Estimated Lifetime Impact |

|---|---|---|

| Patient's Lost Earnings | A professional earning £100,000 p.a. unable to work for 20 years. | £2,000,000 |

| Partner's Lost Earnings | Partner on £50,000 p.a. leaves work for 10 years to provide care. | £500,000 |

| Lost Pension Growth | Combined loss of contributions and growth on two pension pots. | £1,500,000 |

| Unfunded Specialist Care | Costs for drugs/therapies not available on the NHS. | £250,000 |

| Home & Lifestyle Costs | Home modifications, specialist equipment, travel to hospitals. | £100,000 |

| Impact on Inheritance | Depletion of savings and assets intended for children. | £350,000+ |

| Total Lifetime Burden | A staggering potential total of over £4.7 Million. | £4,700,000+ |

This catastrophic figure represents the complete erosion of a family's financial future—a future built over decades, wiped out by an illness compounded by delay.

The PMI Pathway: Your Fast-Track to Diagnosis and World-Class Treatment

Private Medical Insurance (PMI) is not a replacement for the NHS, but a powerful partner to it. It is a policy you pay for that allows you to bypass NHS waiting lists and access private healthcare when you need it most. It is your key to reclaiming control and, most importantly, time.

Let's be unequivocally clear on one crucial point: Standard UK private medical insurance is designed to cover acute conditions—illnesses that are curable and arise after you take out your policy. It does not cover pre-existing or chronic conditions. This is a fundamental rule of the market.

For cancer, this means if you are diagnosed after your policy is active, PMI can become your most vital asset. Here’s how it dismantles the barriers of delay:

- Rapid Diagnostics: Instead of waiting weeks for an urgent referral to be processed, a PMI policyholder can often see a private consultant within days. The subsequent diagnostic tests—MRI, CT, PET scans, and biopsies—can be arranged almost immediately. This compresses a two-month NHS waiting period into a matter of days.

- Choice and Control: PMI gives you the power to choose. You can select the country's leading cancer specialist for your specific condition and choose to be treated in a state-of-the-art private hospital, often with a private room and more flexible visiting hours.

- Access to Advanced Treatment: This is a game-changer. Many comprehensive PMI policies provide cover for pioneering drugs and treatments that are yet to be approved by NICE or funded by the NHS. This can open doors to therapies that offer the best possible chance of success.

The difference is stark, transforming anxiety and uncertainty into proactive, swift action.

Table: NHS vs. PMI Cancer Journey – A Timeline Comparison

| Stage in Cancer Pathway | Typical NHS Wait (2025 Projections) | Typical PMI Wait |

|---|---|---|

| GP Referral to Specialist | 3-6 weeks | 2-5 days |

| Specialist to Diagnostic Scans | 2-4 weeks | 1-3 days |

| Scans to Biopsy/Results | 1-3 weeks | 3-7 days |

| Diagnosis to Treatment Start | 2-4 weeks | 5-10 days |

| TOTAL TIME (Referral to Treatment) | 8 - 17 weeks (often exceeding 62-day target) | 2 - 4 weeks |

As you can see, PMI can shave months off the diagnostic and treatment pathway—months where an early-stage cancer could otherwise progress.

Navigating the world of PMI can be complex, with different levels of cover for cancer, outpatient limits, and hospital lists. This is where an expert broker is invaluable. At WeCovr, we specialise in comparing plans from every major UK insurer, including Bupa, AXA, and Aviva, to ensure you find a policy with the robust cancer cover you need, tailored to your budget.

The LCIIP Shield: Fortifying Your Family's Financial Future

While PMI tackles the medical crisis, it doesn't pay your mortgage or replace your salary. That is the role of Life and Critical Illness Cover (LCIIP). It is the financial shield that protects your family from the economic fallout of a serious diagnosis.

Unlike PMI, which pays medical bills directly to the hospital or consultant, Critical Illness Cover pays a tax-free lump sum directly to you upon the diagnosis of a specified illness, such as cancer.

This lump sum provides total financial freedom at the most critical time. You can use it for anything:

- Pay off your mortgage and other debts, removing the single biggest financial pressure.

- Replace your lost income, and that of your partner if they need to stop work to care for you.

- Fund private medical treatment not covered by an existing PMI policy or the NHS.

- Pay for experimental treatments in the UK or abroad.

- Adapt your home or pay for specialist care and equipment.

- Give you breathing space to focus 100% on your recovery, without financial worry.

A Real-World Example: How Critical Illness Cover Works

Meet David, a 45-year-old project manager and father of two. Ten years ago, he took out a £250,000 critical illness policy alongside his mortgage. He was diagnosed with Stage 2 bowel cancer following a routine check. (illustrative estimate)

His PMI policy kicked in immediately, providing a swift colonoscopy, diagnosis, and surgery within three weeks. However, he needed six months off work for chemotherapy and recovery. His employer's sick pay only covered the first month.

His critical illness policy paid out the £250,000 tax-free lump sum. This allowed David's family to: (illustrative estimate)

- Illustrative estimate: Clear their outstanding mortgage of £140,000.

- Cover his lost salary for five months, preventing them from falling into debt.

- Pay for extra childcare and a cleaner during his treatment.

- Put the remaining money aside, giving them a significant financial buffer for the future.

The combination of PMI (for speed of treatment) and Critical Illness Cover (for financial stability) meant David could focus entirely on getting better, knowing his family's future was secure.

A Two-Pronged Defence: Why Combining PMI and LCIIP is the Ultimate Strategy

Thinking of PMI and LCIIP as an "either/or" choice is a common mistake. They perform two different but equally vital roles. One protects your health; the other protects your wealth. Relying on one without the other leaves a critical gap in your defences.

- PMI alone ensures you get the best medical care, fast. But it won't help if you can't pay your bills while you're recovering.

- Critical Illness Cover alone provides a financial lifeline. But without PMI, you might still be stuck in the same lengthy queues for diagnosis and treatment, potentially needing to use your payout to fund the very care a PMI policy would have provided.

They are two sides of the same coin, working in perfect synergy to provide a comprehensive shield against both the medical and financial devastation of cancer.

Table: PMI vs. LCIIP – A Synergistic Approach

| Feature | Private Medical Insurance (PMI) | Life & Critical Illness Cover (LCIIP) |

|---|---|---|

| Purpose | To pay for private medical diagnosis and treatment. | To provide a tax-free lump sum upon diagnosis. |

| Payout | Paid directly to the hospital/consultant for services. | Paid directly to you, the policyholder. |

| Key Cancer Benefit | Speed. Bypasses NHS queues for rapid diagnosis & treatment. Access to specialist drugs. | Security. Replaces lost income, clears debts, and removes financial stress. |

| Combined Power | Your medical battle is fought quickly with the best tools, while your financial life is completely protected. |

Navigating the Market: How to Choose the Right Protection

With so many options available, choosing the right policy can feel overwhelming. The details matter immensely, especially when it comes to cancer cover.

What to Look For in a PMI Policy:

- Comprehensive Cancer Cover: Ensure the policy covers every stage of the journey: diagnostics, surgery, chemotherapy, radiotherapy, and aftercare.

- Advanced Therapies: Check that the policy includes cover for newer drugs and treatments not yet standard on the NHS.

- Hospital and Specialist Choice: Look for a policy with a broad network of high-quality hospitals and the flexibility to choose your specialist.

- Outpatient and Mental Health Support: A cancer diagnosis takes a huge mental toll. Ensure your policy includes robust support for therapy and consultations.

What to Look For in a Critical Illness Policy:

- Breadth of Cancer Definitions: Not all cancers are covered by all policies. Look for providers that use ABPI+ (Association of British Insurers Plus) definitions, which cover more conditions, including many early-stage cancers.

- Level of Cover: Calculate a sum that would realistically clear your mortgage, cover your income for 2-3 years, and provide a buffer.

- Guaranteed vs. Reviewable Premiums: Guaranteed premiums are fixed for the life of the policy, offering long-term certainty, whereas reviewable premiums can increase over time.

This complexity is why seeking independent advice is crucial. As specialist brokers, WeCovr provides a vital service. We don't work for the insurers; we work for you. Our team of experts takes the time to understand your personal and financial situation, then scours the entire market to find the PMI and LCIIP policies that offer the best possible protection for your needs.

As a testament to our commitment to our clients' holistic wellbeing, all WeCovr customers also receive complimentary access to CalorieHero, our proprietary AI-powered calorie and nutrition tracking app. We believe in proactive health, providing tools that empower our clients long before they might ever need to make a claim.

The Unavoidable Truth: Pre-existing Conditions and Chronic Illness

It is vital to be absolutely clear and transparent on this point to avoid any misunderstanding. Standard Private Medical Insurance in the UK does not cover pre-existing conditions.

A pre-existing condition is any disease, illness, or injury for which you have experienced symptoms, received medication, advice, or treatment before your policy start date. Similarly, PMI does not cover chronic conditions—illnesses that are long-term and require ongoing management rather than a curative treatment, such as diabetes or Crohn's disease.

PMI is designed for unforeseen, acute medical events that occur after your cover begins. When you apply, insurers use two main methods to handle pre-existing conditions:

- Full Medical Underwriting (FMU): You provide a full history of your health. The insurer then explicitly lists any conditions that will be excluded from your cover.

- Moratorium Underwriting: You don't declare your medical history upfront. Instead, the policy automatically excludes any condition you've had in the five years before joining. However, if you remain symptom-free and receive no treatment or advice for that condition for two continuous years after your policy starts, it may then become eligible for cover.

Understanding this principle is fundamental. It underscores the importance of securing cover when you are healthy, as a proactive measure for the future, not as a reactive solution to a current health problem.

Taking Control in 2025: Your Health, Your Future, Your Choice

The data for 2025 presents a stark choice. We can either accept the growing risks of delay within a heavily burdened system, hoping for the best, or we can take decisive, proactive steps to build a fortress of protection around our health and our families.

The silent killer of time is relentless. The pressures on our beloved NHS are real and unlikely to recede soon. The potential financial and emotional cost of a delayed cancer diagnosis is, as we have shown, catastrophic.

But you are not powerless. The twin shields of Private Medical Insurance and Life and Critical Illness Cover represent the most powerful strategy available to a UK family today. They allow you to seize back control, ensuring that if you ever face a cancer diagnosis, your journey is defined by speed, choice, and financial security—not by waiting lists and worry.

The time to investigate your options is not when you receive a worrying symptom or an urgent referral. The time is now, while you are healthy, and the choice is still yours to make. Don't leave your most precious assets—your health and your family's future—to chance. Explore your protection today.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.