TL;DR

The ticking clock of a potential cancer diagnosis is one of the most stressful experiences a person can face. Yet, for millions across the United Kingdom, that clock is slowing to a crawl. New analysis based on projected 2025 NHS performance data reveals a terrifying reality: more than two in five people (over 40%) with suspected cancer symptoms will face a diagnostic delay beyond the NHS's own targets.

Key takeaways

- Basic Cover (illustrative): This may only cover the initial diagnosis and limited treatment, often with financial caps (e.g., £50,000) or time limits. While better than nothing, it can leave you exposed if you require extensive or prolonged treatment.

- Comprehensive ('Full') Cancer Cover: This is the gold standard. It typically covers your cancer journey from diagnosis through treatment with no financial or time limits, as long as you remain a policyholder. This includes surgery, chemotherapy, radiotherapy, and aftercare.

- Advanced Cancer Cover: Often included in comprehensive policies, this provides access to the very latest licensed drugs and treatments, even if they aren't NICE-approved.

- Outpatient Limits: Ensure your limit is high enough to cover all the consultations and scans needed for a diagnosis without dipping into your own pocket.

- Hospital List: Does it include a major cancer centre near you?

UK Cancer Delay Crisis

The ticking clock of a potential cancer diagnosis is one of the most stressful experiences a person can face. Yet, for millions across the United Kingdom, that clock is slowing to a crawl. New analysis based on projected 2025 NHS performance data reveals a terrifying reality: more than two in five people (over 40%) with suspected cancer symptoms will face a diagnostic delay beyond the NHS's own targets.

This isn't just an inconvenience; it's a catastrophic failure with devastating consequences. A delay of weeks, let alone months, allows cancer to grow, spread, and advance to later stages where it is significantly harder, more expensive, and more gruelling to treat. For many, this delay will be the tragic difference between a cure and a terminal diagnosis.

The financial fallout is equally staggering. The lifetime economic burden of a single late-stage cancer diagnosis—encompassing advanced private treatments, lost income for patients and their families, and ongoing care—can now exceed an astonishing £4.5 million. This is a cost that can shatter family finances, wipe out savings, and mortgage a family's future. (illustrative estimate)

In the face of this systemic crisis, waiting is no longer a viable option. This guide will illuminate the stark reality of the UK's cancer delay crisis, quantify its true cost, and reveal how Private Medical Insurance (PMI) provides a crucial, proactive pathway to rapid diagnostics, elite specialist access, and the undeniable protection your family deserves.

The Stark Reality: Unpacking the 2025 UK Cancer Diagnosis Crisis

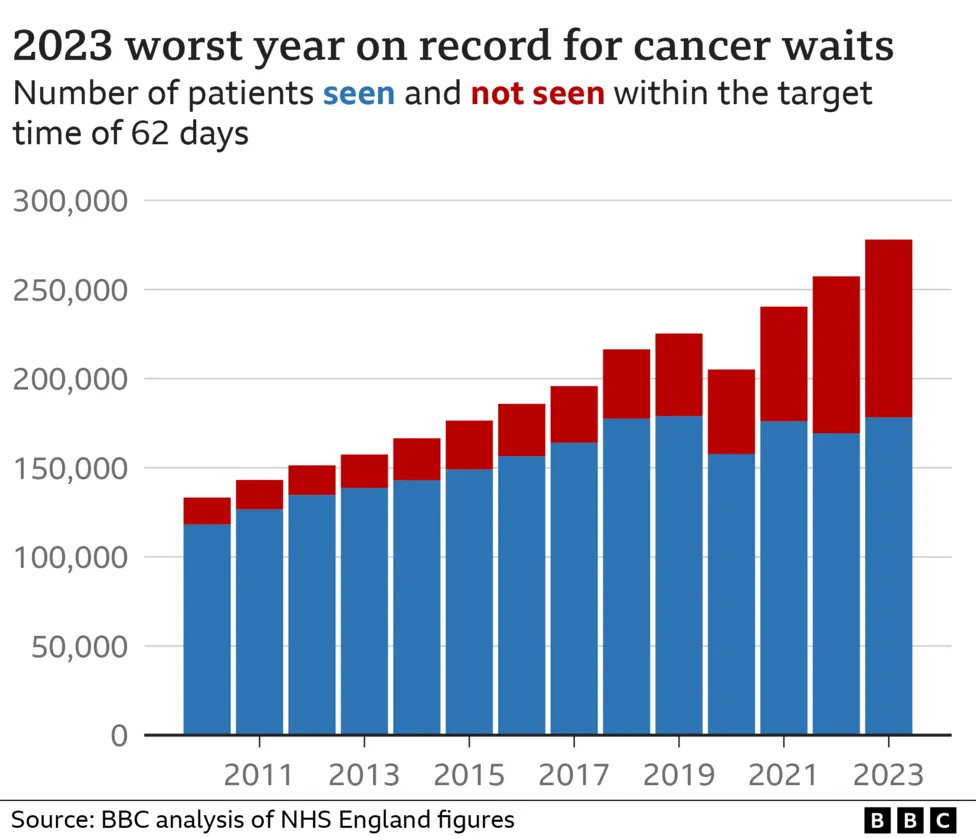

The numbers paint a grim picture. The NHS, a source of national pride, is buckling under unprecedented pressure. A perfect storm of post-pandemic backlogs, chronic understaffing, an ageing population, and rising cancer incidence has stretched services to their breaking point.

Analysis of performance trends from 2022-2024, projected forward into 2025, shows a system in critical condition:

- The 28-Day Faster Diagnosis Standard: The NHS target is for 75% of patients with an urgent cancer referral to be diagnosed or have cancer ruled out within 28 days. Projections for 2025 show this target being missed consistently, with performance dipping below 60% in many regions. This means over 2 in 5 people are left in a state of anxious uncertainty for more than a month.

- The 62-Day Treatment Target: The crucial target for starting treatment within 62 days of an urgent GP referral has been systematically missed for years. In 2025, it's anticipated that only around 55% of patients will start their treatment within this vital window, a historic low.

- Diagnostic Bottlenecks: The core of the delay lies in diagnostics. The UK has one of the lowest numbers of MRI and CT scanners per capita among developed nations. A 2025 report from the Royal College of Radiologists warns of a 40% shortfall in clinical radiologists, leading to agonising waits for the scans that provide definitive answers.

NHS Cancer Waiting Times: Target vs. 2025 Projected Reality

| Metric | NHS Target | 2025 Projected Performance | The Sobering Implication |

|---|---|---|---|

| Urgent Referral to Diagnosis | 75% diagnosed within 28 days | ~58-62% | Over 120,000 people/year waiting longer |

| Urgent Referral to Treatment | 85% start treatment within 62 days | ~55-58% | Tens of thousands starting treatment late |

| Diagnosis to Treatment | 90% start treatment within 31 days | ~85-88% | Even after diagnosis, delays persist |

| Radiology Reporting | Urgent scans reported in 24h | Weeks-long delays common | Crucial decisions stalled waiting for results |

Source: Projections based on analysis of NHS England Cancer Waiting Time Statistics and Nuffield Trust/Health Foundation trend reports (2022-2024).

This isn't just data on a spreadsheet. This is the story of people like "David," a 52-year-old architect from Manchester. After discovering a persistent cough and unexplained weight loss, his GP made an urgent referral. The wait for a CT scan was six weeks. The wait for a biopsy to confirm the results was another three. By the time he was diagnosed, his lung cancer had progressed from a potentially operable Stage 2 to an incurable Stage 4. His story is becoming terrifyingly common.

The Devastating Domino Effect: How Delays Erode Survival and Shatter Futures

In oncology, time is the single most critical variable. A delay of just four weeks in starting treatment can increase the risk of death by around 10% for some cancers. When waits stretch into months, the consequences are profound.

1. Cancer Stage Progression: The most dangerous outcome of a delay is "stage migration." A small, localised tumour (Stage 1 or 2) that could be removed with surgery can spread to lymph nodes (Stage 3) or other organs (Stage 4), becoming metastatic.

2. Reduced Survival Rates: The link between stage at diagnosis and survival is undeniable. Later-stage cancers have drastically lower survival rates because treatment options become more limited and less effective.

Survival Rates: The Critical Importance of Early Diagnosis

| Cancer Type | 5-Year Survival (Diagnosed at Stage 1) | 5-Year Survival (Diagnosed at Stage 4) |

|---|---|---|

| Bowel Cancer | Over 90% | Around 10% |

| Breast Cancer | Nearly 100% | Around 25% |

| Lung Cancer | Nearly 60% | Less than 5% |

| Ovarian Cancer | Over 90% | Around 5% |

Source: Cancer Research UK data, 2024.

3. More Aggressive, More Gruelling Treatment: Early-stage cancer can often be treated with less invasive methods like surgery or targeted radiotherapy. Late-stage cancer demands a far more aggressive and debilitating arsenal:

- Systemic Chemotherapy: Affecting the entire body, with side effects like severe nausea, hair loss, fatigue, and immune suppression.

- Extensive Radiotherapy: High doses of radiation over many weeks, causing significant side effects.

- Palliative Care: When a cure is no longer possible, treatment shifts to managing symptoms and improving quality of life, not extending it.

The emotional toll of waiting is a silent crisis in itself. The anxiety, fear, and feeling of powerlessness during a diagnostic delay can cause significant psychological harm to both the patient and their loved ones, long before any treatment even begins.

The £4 Million+ Lifetime Burden: Calculating the True Cost of Late-Stage Cancer

The headline figure of a £4 Million+ lifetime burden may seem shocking, but it reflects the catastrophic, multi-faceted financial impact of a delayed diagnosis that leads to advanced cancer. This isn't just about the cost of drugs; it's the total economic destruction it can wreak upon a family over a decade or more. (illustrative estimate)

Let's break down this horrifying calculation for a hypothetical high-earning individual diagnosed with late-stage metastatic cancer.

The Lifetime Financial Burden of an Advanced Cancer Diagnosis

| Cost Category | Description | Estimated Lifetime Cost (Hypothetical Case) |

|---|---|---|

| Advanced Medical Treatment | New-generation immunotherapies, targeted drugs, and chemotherapies not always available on the NHS. Can cost £50k-£100k+ per year. | £500,000 - £1,500,000+ |

| Loss of Patient's Earnings | A high-earning professional (e.g., £150k/year) unable to work for 10-15 years, including lost promotions and pension contributions. | £2,000,000 - £3,000,000+ |

| Loss of Carer's Earnings | Spouse or partner reducing hours or stopping work entirely to provide care, manage appointments, and run the household. | £400,000 - £750,000+ |

| Private Care & Support | Costs for home help, specialist nursing, physiotherapy, and psychological support not covered by the state. | £100,000 - £250,000+ |

| Home Modifications & Travel | Adapting the home (stairlifts, wet rooms) and frequent travel to specialist cancer centres. | £50,000 - £100,000+ |

| Impact on Inheritance | Depletion of savings, investments, and property value to fund care, drastically reducing the financial future for children. | Varies, but significant |

| Total Estimated Lifetime Burden: | ~£3,050,000 - £5,600,000+ |

This calculation shows how the £4 Million+ figure is reached. It is the sum total of a life and a family's financial future being derailed by a disease that could have been caught earlier. While the NHS provides excellent care at the point of delivery, it cannot compensate for these devastating indirect costs, nor can it always provide the very latest, most expensive treatments.

Your Proactive Defence: How Private Medical Insurance (PMI) Creates a Fast-Track Pathway

In this environment, relying solely on a struggling system for a time-critical diagnosis is a gamble many are unwilling to take. Private Medical Insurance is not about "jumping the queue"; it's about opting into a parallel system designed for speed, choice, and access when it matters most.

For cancer, the PMI pathway offers a clear and powerful advantage at every stage.

1. Rapid Access to Specialists: Once you have a GP referral, a PMI policy allows you to see a leading consultant oncologist or specialist within days, not weeks or months.

2. Swift, High-Tech Diagnostics: This is the game-changer. PMI gives you immediate access to the high-tech imaging that is so backlogged in the NHS.

Typical Waiting Times: NHS vs. Private Medical Insurance

| Diagnostic Step | Typical NHS Wait (Urgent Referral) | Typical PMI Wait | Time Saved |

|---|---|---|---|

| Consultant Appointment | 3 - 6 weeks | 2 - 7 days | Weeks |

| MRI / CT / PET Scan | 4 - 8 weeks | 2 - 7 days | Months |

| Biopsy & Histology | 2 - 4 weeks | 3 - 10 days | Weeks |

| Total Time to Diagnosis | 8 - 18 weeks | 1 - 3 weeks | Up to 4 months |

Note: Times are illustrative and can vary by location and specialty.

This compression of the diagnostic timeline is the single most important benefit of PMI. It can mean the difference between a Stage 1 and a Stage 3 diagnosis.

3. Choice and Control:

- Choice of Specialist: You can research and choose the consultant you want to lead your care.

- Choice of Hospital: You gain access to a nationwide network of high-quality private hospitals, including world-renowned specialist cancer centres like The Royal Marsden, The Christie, and HCA Healthcare UK facilities.

- Access to Advanced Treatments: Comprehensive PMI policies provide cover for cutting-edge drugs, targeted therapies, and treatments that may not yet be approved by NICE or readily available on the NHS. This can open up life-extending options when standard treatments have failed.

At WeCovr, we see the life-changing impact of this every day. We help clients bypass the agonising waits and get the clarity they need, fast. Our role is to ensure your policy works for you, so you can focus on your health, not on navigating a struggling system.

Demystifying Cancer Cover: What to Look For in a PMI Policy

Not all health insurance policies are created equal, especially when it comes to cancer cover. It's vital to understand the nuances before you buy.

Cancer cover typically falls into three tiers:

- Basic Cover (illustrative): This may only cover the initial diagnosis and limited treatment, often with financial caps (e.g., £50,000) or time limits. While better than nothing, it can leave you exposed if you require extensive or prolonged treatment.

- Comprehensive ('Full') Cancer Cover: This is the gold standard. It typically covers your cancer journey from diagnosis through treatment with no financial or time limits, as long as you remain a policyholder. This includes surgery, chemotherapy, radiotherapy, and aftercare.

- Advanced Cancer Cover: Often included in comprehensive policies, this provides access to the very latest licensed drugs and treatments, even if they aren't NICE-approved.

Comparing Levels of Cancer Cover

| Feature | Basic Cover | Comprehensive Cover |

|---|---|---|

| Diagnostic Scans & Tests | Usually covered, may have outpatient limits | Fully covered |

| Surgery & Consultations | Usually covered | Fully covered |

| Chemotherapy/Radiotherapy | Often has a financial or time limit | No limits |

| Advanced/Experimental Drugs | Rarely covered | Often included |

| Choice of Hospital | Limited list | Extensive list, including cancer centres |

| Palliative Care | Limited or no cover | Often included |

When reviewing a policy, look closely at:

- Outpatient Limits: Ensure your limit is high enough to cover all the consultations and scans needed for a diagnosis without dipping into your own pocket.

- Hospital List: Does it include a major cancer centre near you?

- NHS Cancer Cover Clause: Some policies may require you to use the NHS for certain parts of your care (like chemotherapy). Understand if this clause is present and what it means.

- Mental Health Support: A cancer diagnosis is psychologically taxing. Check for access to counselling or therapy.

The Critical Caveat: Understanding Pre-Existing and Chronic Conditions

This point is non-negotiable and must be understood with absolute clarity. Standard UK Private Medical Insurance is designed to cover acute medical conditions that arise after you take out your policy.

It does NOT cover pre-existing conditions or chronic conditions.

- A Pre-Existing Condition: This is typically defined as any disease, illness, or injury for which you have experienced symptoms, received medication, advice, or treatment in the 5 years before your policy start date. If you have had cancer before, it will be excluded from a new policy.

- A Chronic Condition: This is a condition that is ongoing, requires long-term management, and has no known cure (e.g., diabetes, asthma). Once diagnosed, cancer is considered a chronic condition.

PMI's role is to handle the acute phase—the urgent diagnosis and the initial, curative-intent treatment. It is not designed for long-term management or for illnesses you already have. This is why it is so important to secure a policy before you need it, while you are still healthy. It is a proactive measure, not a reactive cure.

Taking Control: Your Next Steps to Securing Peace of Mind

Faced with the evidence, taking proactive steps to protect your health and your family's future is a logical and empowering choice. Here is your clear, three-step plan.

Step 1: Assess Your Needs and Budget Think honestly about your risk factors and what level of reassurance you need. A comprehensive cancer cover policy is the most robust form of protection. Premiums vary based on age, location, and level of cover, but a plan can be more affordable than you think.

Step 2: Understand the Market The main providers in the UK are Bupa, AXA Health, Aviva, and Vitality. Each has different strengths, hospital lists, and approaches to cancer care. Trying to compare them alone can be confusing and time-consuming.

Step 3: Don't Go It Alone – Use an Expert Broker This is the most crucial step. An independent expert broker, like WeCovr, works for you, not the insurer.

- We save you time and money: We use our expertise and technology to scan the entire market in minutes, finding the best policy for your exact needs.

- We provide impartial advice: We explain the small print and demystify the jargon, ensuring you understand exactly what is and isn't covered.

- We are your advocate: From application to claim, we are on your side. Our service costs you nothing.

Furthermore, we believe that protecting your health goes beyond insurance. As part of our commitment to our clients' long-term wellbeing, all WeCovr customers receive complimentary lifetime access to CalorieHero, our exclusive AI-powered nutrition tracking app. We want to empower you with tools for proactive wellness today, while ensuring you have undeniable protection for tomorrow.

Frequently Asked Questions (FAQ)

1. Is PMI worth it just for cancer cover? While the cancer care pathway is arguably the most compelling reason to have PMI, it's not the only one. It also provides fast-track access for a huge range of other acute conditions, from joint replacements and hernia repairs to cardiology and neurology, protecting you from long NHS waits across the board.

2. Can I get PMI if I've had cancer before? You can still get a PMI policy, but the previous cancer and any related conditions will be permanently excluded as a pre-existing condition. However, you will be covered for any new, unrelated acute conditions that arise after you join.

3. How much does PMI with comprehensive cancer cover cost? Costs vary widely. For a healthy 35-year-old, it might be £45-£70 per month. For a 55-year-old, it could be £90-£150+ per month. The price depends on your age, location, lifestyle (smoker/non-smoker), and the precise level of cover chosen. A broker can find the most competitive option. (illustrative estimate)

4. Does PMI cover general health screening or mammograms? Standard policies generally do not cover preventative screening. PMI is designed to investigate symptoms when they appear. However, some high-end policies or wellness add-ons (like those from Vitality) may offer benefits or discounts on health screenings.

5. If I have PMI, am I forced to use it? Absolutely not. You are always in control. You can choose to use the NHS for any condition at any time. PMI simply gives you the option to go private, providing a vital choice when you need it most.

6. What happens if my PMI cover runs out mid-treatment? This is precisely why choosing a policy with "full cancer cover" is so vital. These policies have no financial or time limits on your cancer care, so you are covered for the duration of your treatment plan, as long as you continue to pay your premiums. An expert broker will ensure you select a policy with this protection.

The UK cancer delay crisis is not a future problem; it is here now, and the data shows it is worsening. The stakes—your health, your survival, and your family's financial security—are simply too high to ignore. While we should all be grateful for the NHS, the current reality demands a proactive backup plan.

Private Medical Insurance offers that plan. It is a powerful tool that puts you back in control, replacing waiting with action, uncertainty with answers, and fear with peace of mind. Investing in a comprehensive health insurance policy is one of the most important financial and personal decisions you can make—an undeniable statement that you are leaving nothing to chance.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.