TL;DR

UK 2026 Over 7.7 Million Britons Face Worsening Health on NHS Waiting Lists. Is Your Private Health Insurance Your Fast Track to Timely Care and Peace of Mind? The state of the UK's National Health Service is more than just a headline; it's a daily reality for millions.

Key takeaways

- Referral to Treatment (RTT) List: The main list, now at 7.7 million, captures patients waiting to start consultant-led elective care.

- The Longest Waits: Over 400,000 of these patients have been waiting for more than 52 weeks. A further 10,000 have tragically been on the list for over 18 months.

- Diagnostic Bottlenecks: A separate but related crisis exists in diagnostics. An estimated 1.6 million people are waiting for key tests like MRI scans, CT scans, endoscopies, and ultrasounds. This delay creates a backlog even before a patient can be placed on a treatment list.

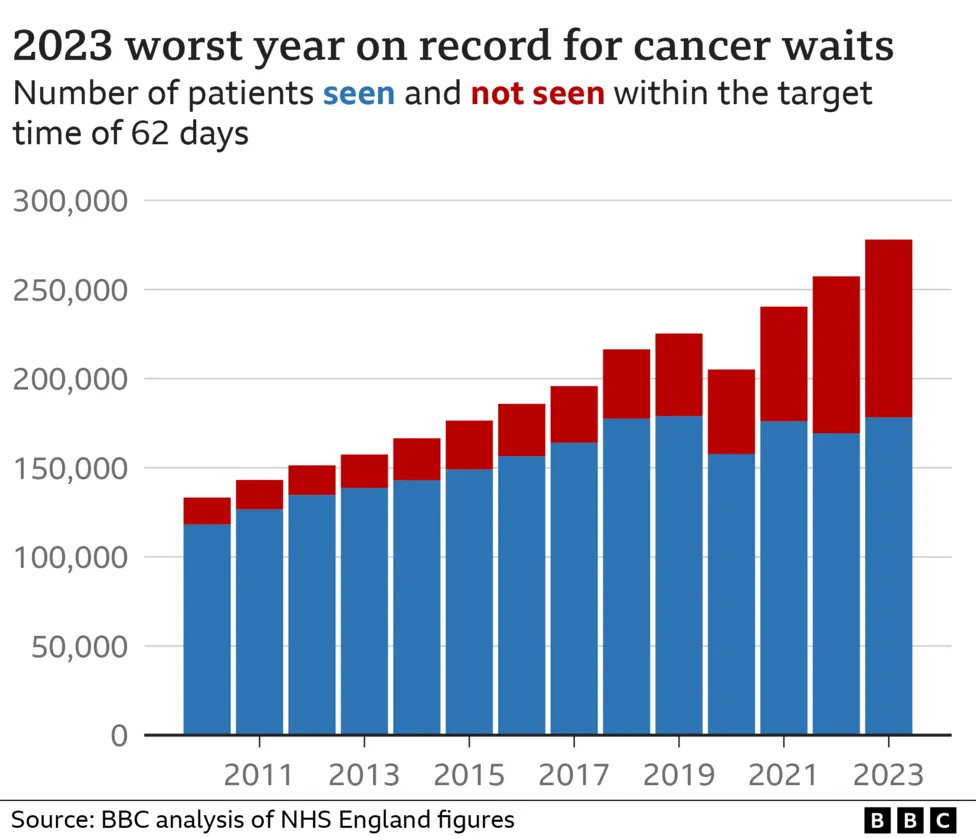

- Cancer Care Targets: Despite being a priority, cancer treatment targets are consistently being missed. The 62-day urgent referral to treatment target continues to be breached, causing immense distress for patients with a suspected cancer diagnosis.

- Physical Deterioration: A knee problem that requires surgery can worsen significantly over a 12-month wait, leading to muscle wastage, increased pain, and a more complex operation with a longer recovery time.

UK 2026 Over 7.7 Million Britons Face Worsening Health on NHS Waiting Lists. Is Your Private Health Insurance Your Fast Track to Timely Care and Peace of Mind?

The state of the UK's National Health Service is more than just a headline; it's a daily reality for millions. As we navigate 2025, a stark and sobering picture has emerged. The total NHS waiting list in England has swelled to a staggering 7.7 million, a figure that represents not just delayed procedures but delayed lives, prolonged pain, and mounting anxiety for a significant portion of the population.

For generations, the NHS has been the bedrock of British society—a promise of care for all, free at the point of use. Yet, the immense pressure on this cherished institution has created unprecedented challenges. The conversation is no longer just about preserving the NHS, but about how individuals can navigate its current limitations to protect their health and wellbeing.

When a simple diagnostic scan takes months, and a "routine" hip replacement is scheduled for a year or more away, the consequences are severe. Health conditions can deteriorate, mental health can suffer, and the ability to work and live a full life can be severely compromised.

This is where Private Medical Insurance (PMI) enters the conversation, shifting from a perceived luxury to an essential tool for many. It offers a parallel path, a fast track to the diagnostics, consultations, and treatments you need, precisely when you need them. This article is your definitive guide to understanding the 2025 NHS waiting list crisis, how private health insurance works as a solution, and whether it's the right choice for you and your family.

The Stark Reality: Unpacking the 2026 NHS Waiting List Crisis

To grasp the scale of the issue, we must look beyond the top-line number. The 7.7 million figure is a complex tapestry of individual stories, each representing a person waiting in uncertainty. Breaking Down the Numbers:

- Referral to Treatment (RTT) List: The main list, now at 7.7 million, captures patients waiting to start consultant-led elective care.

- The Longest Waits: Over 400,000 of these patients have been waiting for more than 52 weeks. A further 10,000 have tragically been on the list for over 18 months.

- Diagnostic Bottlenecks: A separate but related crisis exists in diagnostics. An estimated 1.6 million people are waiting for key tests like MRI scans, CT scans, endoscopies, and ultrasounds. This delay creates a backlog even before a patient can be placed on a treatment list.

- Cancer Care Targets: Despite being a priority, cancer treatment targets are consistently being missed. The 62-day urgent referral to treatment target continues to be breached, causing immense distress for patients with a suspected cancer diagnosis.

The Real-World Impact of Waiting

These are not just statistics; they are roadblocks in people's lives. The consequences ripple out, affecting physical health, mental wellbeing, and financial stability.

- Physical Deterioration: A knee problem that requires surgery can worsen significantly over a 12-month wait, leading to muscle wastage, increased pain, and a more complex operation with a longer recovery time.

- Mental Health Strain: The uncertainty is a heavy burden. A 2025 study by the charity Mind found that 65% of people on long-term NHS waiting lists reported a significant increase in symptoms of anxiety and depression.

- Financial Hardship: For many, waiting means being unable to work. A self-employed builder waiting for a hernia operation or an office worker needing carpal tunnel surgery faces a direct loss of income, putting immense strain on household finances.

NHS vs. Private: A Tale of Two Timelines

The most compelling argument for private healthcare is the dramatic difference in waiting times. While the NHS grapples with its immense backlog, the private sector can offer swift access.

| Procedure/Service | Average NHS Waiting Time (2025) | Typical Private Sector Wait Time (2025) |

|---|---|---|

| Initial Specialist Consultation | 18 - 24 weeks | 1 - 2 weeks |

| MRI Scan | 8 - 12 weeks | 3 - 7 days |

| Hip/Knee Replacement | 50 - 65 weeks | 4 - 6 weeks |

| Cataract Surgery | 30 - 40 weeks | 3 - 5 weeks |

| Hernia Repair | 35 - 45 weeks | 2 - 4 weeks |

Please note these are illustrative averages and can vary.*

The data is clear: what can take over a year on the NHS can often be resolved in under two months through the private system. This is the core value proposition of private health insurance.

Why Are the Waiting Lists So Long? The Core Issues Plaguing the NHS

Understanding the 'why' behind the crisis is crucial. It's not a single failing but a combination of long-term pressures that have culminated in the current situation.

- The COVID-19 Legacy: The pandemic forced the NHS to postpone millions of non-urgent appointments and operations. While the service worked heroically, this created a "care debt" that the system is still struggling to repay in 2025.

- Chronic Staffing Shortages: The UK has fewer doctors and nurses per capita than many comparable developed nations. Years of workforce planning challenges, combined with staff burnout and industrial action over pay and conditions, have left the service critically understaffed.

- An Ageing and Growing Population: As medical science advances, people are living longer, often with multiple health conditions. This demographic shift places a greater, more complex demand on NHS resources year after year.

- Decades of Inconsistent Funding: While NHS funding has increased over time, critics argue it hasn't kept pace with demand, inflation, or the costs of new medical technologies. This affects everything from staff pay to hospital maintenance and the purchasing of new diagnostic equipment.

- Social Care Strain: A significant number of hospital beds are occupied by patients who are medically fit for discharge but cannot leave because there is no adequate social care package available for them in the community. This "bed blocking" prevents new patients from being admitted for treatment.

These systemic issues mean that, despite the best efforts of its dedicated staff, the NHS is unlikely to significantly reduce waiting lists in the immediate future. This leaves proactive individuals looking for alternative ways to secure their health.

Private Medical Insurance (PMI): Your Personal Health MOT

Private Medical Insurance is a policy you pay for that covers the costs of private healthcare for specific conditions. Think of it as a health contingency plan. You continue to use the NHS for emergencies and general GP care, but if you need specialist treatment for a new condition, your PMI policy can give you fast-track access to the private sector.

The Golden Rule: Acute vs. Chronic and Pre-Existing Conditions

This is the single most important concept to understand about PMI in the UK. Failure to grasp this leads to misunderstanding and disappointment.

Private Medical Insurance is designed to cover acute conditions that arise after you take out your policy.

Let's be absolutely clear on what this means:

-

Acute Condition: A disease, illness, or injury that is new, short-lived, and likely to respond quickly to treatment, leading to a full or near-full recovery.

- Examples: Cataracts, a hernia, joint pain requiring a replacement, gallstones, most cancers, a torn ligament.

-

Chronic Condition: A long-term illness that cannot be cured, only managed. These conditions require ongoing, lifelong care. Standard PMI does not cover the routine management of chronic conditions.

- Examples: Diabetes, asthma, high blood pressure, arthritis, Crohn's disease, epilepsy.

-

Pre-existing Condition: Any medical condition, symptom, or ailment for which you have had symptoms, medication, or advice before the start date of your policy. These are also excluded, usually for a set period or permanently.

For instance, if you have been managing high blood pressure with your GP for five years, your PMI policy will not cover your check-ups or medication for it. However, if you develop gallstones two years into your policy (a new, acute condition), your PMI would cover the consultation, scans, and surgery to remove them.

This distinction is fundamental. PMI is not a replacement for the NHS; it is a complement to it, designed to deal with specific, treatable issues quickly. The NHS remains your port of call for accidents and emergencies, and for the management of any long-term chronic conditions.

How Does Private Health Insurance Work in Practice? A Step-by-Step Guide

The process of using your PMI is designed to be straightforward. While it starts with the NHS, it quickly branches off onto a faster, more private path.

Here is the typical patient journey:

-

You Feel Unwell - Visit Your GP: Your journey always begins with your NHS GP. They are the gatekeeper for all healthcare in the UK. You discuss your symptoms, and they conduct an initial assessment.

-

Receive an 'Open Referral': If your GP believes you need to see a specialist, they will write you a referral letter. For PMI purposes, you need an 'open referral', which names the speciality (e.g., Cardiology, Orthopaedics) rather than a specific NHS consultant.

-

Contact Your Insurance Provider: With your referral letter in hand, you call your PMI provider's claims line. You'll provide your policy number and details of your condition.

-

Authorisation and Choice: The insurer checks that your condition is covered by your policy. Once approved, they will provide you with a list of recognised specialists and private hospitals in your area that you can choose from. This is a key benefit – the power to choose your consultant.

-

Book Your Appointments: You can now book your private consultation and any subsequent diagnostic tests (like an MRI or CT scan) at a time and location that suits you. This often happens within days, not months.

-

Receive Prompt Treatment: Following your diagnosis, if surgery or another treatment is required, your insurer will authorise this. You will be admitted to a private hospital, often with your own private room, and receive treatment from your chosen specialist.

-

The Bills are Settled Directly: The private hospital and specialist will send their invoices directly to your insurance company. You don't have to handle large sums of money. The only amount you might pay is any pre-agreed 'excess' on your policy.

Real-Life Example: Meet David

David, a 52-year-old graphic designer, started experiencing severe hip pain. His NHS GP suspected osteoarthritis and referred him for an X-ray, followed by a consultation with an NHS orthopaedic surgeon. The estimated wait time for the initial consultation was 9 months, with a further 12-18 months for a potential hip replacement.

Unable to work effectively due to pain and worried about his mobility, David called his PMI provider. He had his open referral and was given a choice of three local private orthopaedic surgeons. He saw a specialist within a week, had an MRI scan two days later confirming the need for a hip replacement, and was booked in for surgery five weeks after that. He was back on his feet and working part-time within two months of his initial GP visit, instead of facing a potential two-year wait on the NHS.

The Key Benefits of PMI in 2026: More Than Just Skipping the Queue

While speed is the primary driver for most people, the advantages of private health insurance extend far beyond simply jumping the queue.

- Rapid Access to Specialists: As seen with David, you can see a leading consultant in days or weeks, getting a diagnosis and treatment plan in place swiftly.

- Choice and Control: You have a say in who treats you and where. You can research the best consultants for your specific condition and choose a hospital that is convenient and has a strong reputation.

- Comfort and Privacy: Private hospitals typically offer individual en-suite rooms, more flexible visiting hours, and a better staff-to-patient ratio, creating a more comfortable and less stressful environment for recovery.

- Advanced Treatment Options: PMI can sometimes provide access to new drugs, treatments, or surgical techniques that are not yet approved by NICE (National Institute for Health and Care Excellence) or widely available on the NHS.

- Peace of Mind: This is perhaps the most underrated benefit. Knowing you have a plan in place to deal with health scares provides invaluable psychological comfort for you and your family.

- Digital GP Services: Most modern PMI policies now include 24/7 access to a virtual GP via phone or video call. This allows you to get medical advice, prescriptions, and referrals quickly without waiting for an NHS GP appointment.

- Enhanced Mental Health Support: Many comprehensive policies offer excellent mental health pathways, providing fast access to counselling, therapy, or psychiatric support, bypassing long NHS waiting lists for these services.

What's Covered? Understanding the Fine Print of Your Policy

No two health insurance policies are identical. They are built from a core of standard cover with various options and add-ons. It's vital to know what you are and are not covered for.

| What's Typically Covered by PMI | What's Typically Excluded from PMI |

|---|---|

| In-patient & Day-patient Treatment (Surgery, hospital stays) | Chronic Conditions (Diabetes, asthma, high blood pressure) |

| Specialist Consultations (Seeing a consultant privately) | Pre-existing Conditions (Ailments you had before the policy) |

| Diagnostic Scans & Tests (MRI, CT, PET scans) | Accident & Emergency (This remains with the NHS) |

| Comprehensive Cancer Care (Chemo, radiotherapy, surgery) | Normal Pregnancy & Childbirth (Complications may be covered) |

| Mental Health Support (Often an add-on or on comprehensive plans) | Cosmetic Surgery (Unless medically necessary after an accident) |

| Therapies (Physiotherapy, osteopathy after surgery) | Organ Transplants, Dialysis (Usually handled by NHS) |

| 24/7 Digital GP Service (A common feature on most plans) | Experimental or Unproven Treatments |

Levels of Cover

Policies are generally tiered to suit different needs and budgets:

- Basic/Core Cover: This is the entry-level option, primarily covering the most expensive part of private care: in-patient and day-patient treatment. This means it covers you if you need to be admitted to a hospital bed for surgery or treatment. Out-patient consultations and diagnostics may not be included.

- Comprehensive Cover: This is the most popular choice. It includes everything in the core cover, plus out-patient cover. This means your initial specialist consultations, diagnostic scans, and tests are also paid for, up to a set annual limit (e.g., £1,000 or unlimited).

- Optional Add-ons: You can further tailor your policy by adding extras like dental and optical cover, enhanced mental health support, or even international/travel cover.

Understanding these levels is key to finding the right balance between cost and coverage.

How Much Does Private Health Insurance Cost in the UK?

This is the million-dollar question, and the answer is: it depends. The price of your premium is highly personalised and based on a range of risk factors.

Key Factors Influencing Your Premium:

- Age: This is the single biggest determinant. Premiums rise significantly as you get older, reflecting the increased likelihood of needing medical treatment.

- Location: Where you live matters. Premiums are highest in Central London and other major cities where the cost of private treatment is more expensive.

- Level of Cover: A basic in-patient-only policy will be far cheaper than a fully comprehensive plan with multiple add-ons.

- Excess: This is the amount you agree to pay towards a claim. For example, if you have a £250 excess and your treatment costs £5,000, you pay the first £250 and the insurer pays the rest. A higher excess will lower your monthly premium.

- Hospital List: Insurers have tiered hospital lists. A policy that gives you access to all UK hospitals, including expensive Central London ones, will cost more than one with a more restricted regional list.

- Lifestyle: Your smoking status and general health will impact your premium.

Illustrative Monthly Premiums (2026)

To give you a general idea, here are some example costs. These are for illustrative purposes only.

| Profile | Basic Plan (Core Cover, £500 Excess) | Comprehensive Plan (Out-patient, £250 Excess) |

|---|---|---|

| 30-year-old, non-smoker | £35 - £50 | £60 - £85 |

| 50-year-old, non-smoker | £65 - £90 | £110 - £150 |

| Family of 4 (45, 43, 12, 10) | £150 - £200 | £250 - £350 |

The range of options and pricing can be bewildering. This is why using an expert broker is so valuable. At WeCovr, we help you navigate these options, comparing plans from leading UK insurers like Aviva, AXA Health, Bupa, and Vitality to find a policy that fits your budget without compromising on essential cover.

Savvy Ways to Reduce Your Health Insurance Premiums

While PMI is a significant investment, there are several intelligent ways to make it more affordable without sacrificing quality.

- Increase Your Excess: The easiest way to reduce your premium. Choosing a £500 or even £1,000 excess can make a substantial difference to your monthly payments.

- Opt for a 6-Week Wait Option: This is a clever hybrid approach. Your policy will only pay for treatment if the NHS waiting list for that specific procedure is longer than six weeks. As current waits are much longer for most things, this can provide significant savings while still offering a powerful safety net.

- Choose a 'Guided' or 'Expert Select' Option: Many insurers now offer this. Instead of having a completely free choice of specialist, the insurer will guide you to a consultant from a curated list they have vetted for quality and value. This efficiency saving is passed on to you as a lower premium.

- Review Your Hospital List: Be realistic. If you live in Manchester, do you really need a policy that covers treatment in a top London hospital? Opting for a list that covers quality local and national hospitals but excludes the most expensive city-centre ones can save you a lot.

- Maintain a Healthy Lifestyle: Insurers like Vitality actively reward healthy living with lower premiums and other perks. But even with other insurers, being a non-smoker with a healthy BMI will result in a better price.

We believe in proactive health. That's why, in addition to finding you the best policy, WeCovr provides our customers with complimentary access to our AI-powered calorie tracking app, CalorieHero. We believe helping you stay on top of your health goes hand-in-hand with providing the best insurance protection, potentially lowering your long-term costs.

Choosing the Right Policy: Why Expert Guidance Matters

The UK private health insurance market is complex. Each insurer has different underwriting rules, policy wordings, cancer care pledges, and hospital lists. Trying to compare them on a like-for-like basis by yourself is challenging and time-consuming.

This is where an independent health insurance broker provides immense value.

Why Use a Broker like WeCovr?

- Market-Wide Access: We aren't tied to one insurer. We have access to plans from all the major UK providers, ensuring you see the full range of options.

- Unbiased, Expert Advice: Our job is to work for you, not the insurance company. We listen to your needs, explain the jargon, and recommend the policy that is genuinely the best fit for your circumstances and budget.

- No Extra Cost: You don't pay for our service. We are paid a commission by the insurer you choose, which is already built into the price of the policy, so you pay the same (or often less) than going direct.

- Application and Claims Support: We help you with the paperwork and are here to offer guidance if you ever need to make a claim, ensuring the process is as smooth as possible.

The Future of UK Healthcare: A Hybrid Approach?

The challenges facing the NHS are not temporary. They are structural and long-term. This reality is driving a fundamental shift in how Britons view their healthcare. PMI is moving from the fringes to the mainstream, not as a political statement against the NHS, but as a pragmatic personal decision.

The future is likely a hybrid one, where a publicly funded NHS provides excellent emergency and chronic care for all, while a growing number of people use private insurance to bypass waiting lists for elective, acute care. This symbiotic relationship can actually reduce the burden on the NHS, freeing up its resources for the most urgent and complex cases.

PMI is not, and should not be, a replacement for our National Health Service. But in 2025, for those who can afford it, it is a powerful tool for taking back control.

Conclusion: Taking Control of Your Health in an Uncertain World

The NHS waiting list crisis of 2025 is a source of national concern and personal anxiety for millions. Facing the prospect of waiting months or even years for necessary treatment is a deeply unsettling reality that impacts health, work, and family life.

In this environment, Private Medical Insurance has emerged as a viable and effective solution. It offers a direct route to the timely medical care you need, providing not just speed and choice, but invaluable peace of mind.

However, it is a significant financial decision that requires careful thought. You must be crystal clear that it is designed for new, acute conditions and does not cover the chronic or pre-existing conditions that the NHS will continue to manage. Understanding the costs, the levels of cover, and the ways to make it more affordable is paramount.

Your health is your most valuable asset. Don't let it become a waiting game. Explore your options, seek expert advice, and make an informed decision to secure the care and peace of mind you and your family deserve.