TL;DR

The numbers are stark, and the conclusion is unavoidable: the UK’s cherished National Health Service (NHS) is facing a crisis of unprecedented proportions. As we head into 2025, new analysis based on current trends from leading health think tanks projects that the total waiting list for elective care in England could swell to a staggering 10 million people. It represents millions of lives on hold.

Key takeaways

- The Post-Pandemic Backlog: The COVID-19 pandemic forced the NHS to postpone millions of non-urgent appointments and procedures. While the health service has been working tirelessly to catch up, the sheer volume of this backlog creates a statistical mountain that is proving incredibly difficult to climb.

- Persistent Staffing Shortages: The UK has fewer doctors and nurses per capita than many comparable developed nations. Years of workforce planning challenges, burnout, and an ageing workforce have created a critical shortage. This is exacerbated by ongoing industrial action, which, while aimed at resolving pay disputes, inevitably leads to cancelled appointments and further delays.

- Growing and Ageing Population: As the UK population ages, the demand for healthcare naturally increases. Older patients often present with multiple, more complex conditions, requiring more resources and specialist time.

- The "Hidden" Waiting List: Official figures don't capture the full picture. They don't include the millions of people waiting for an initial GP appointment, those waiting for a specialist referral, or those in need of community health services. When these "hidden" waits are considered, the true scale of the access problem is even more profound.

- Scenario: A 45-year-old woman finds a lump and is referred by her GP for an urgent scan. The NHS target is two weeks, but due to backlogs, she faces a wait of six to eight weeks. The anxiety during this period is immense, and any delay could be critical.

UK NHS Crisis 2026 10 Million Wait

The numbers are stark, and the conclusion is unavoidable: the UK’s cherished National Health Service (NHS) is facing a crisis of unprecedented proportions. As we head into 2025, new analysis based on current trends from leading health think tanks projects that the total waiting list for elective care in England could swell to a staggering 10 million people.

This isn't just a statistic. It represents millions of lives on hold. It's the parent waiting in pain for a knee replacement, the young professional anxious about a diagnostic scan for a worrying lump, and the grandparent whose quality of life is diminishing while they wait for cataract surgery. This looming reality threatens the very principle of timely healthcare for all, leaving millions vulnerable to delayed diagnoses, prolonged suffering, and potentially worse clinical outcomes.

In this climate of uncertainty, waiting is no longer a viable strategy. The time has come to take control of your health and that of your family. This definitive guide will explore the reality behind the 2025 projections, explain the tangible impact on your life, and reveal how Private Medical Insurance (PMI) has become an essential tool for bypassing the queues and securing the peace of mind you deserve.

The Anatomy of a Crisis: Why 10 Million is a Terrifyingly Plausible Figure

The projection of a 10 million-strong waiting list isn't alarmist speculation; it's a forecast rooted in a 'perfect storm' of pressures that have been building for years. While the NHS has always navigated challenges, the current combination of factors is unique in its severity.

england.nhs.uk/statistics/statistical-work-areas/rtt-waiting-times/), the referral to treatment (RTT) waiting list already stands at over 7.5 million. This figure only includes England and represents individual treatment pathways, not unique patients. The British Medical Association (BMA) estimates the true number of unique patients waiting is closer to 6.5 million. However, the trajectory is clear and alarming.

Let's break down the core drivers pushing this number towards the 10 million mark:

- The Post-Pandemic Backlog: The COVID-19 pandemic forced the NHS to postpone millions of non-urgent appointments and procedures. While the health service has been working tirelessly to catch up, the sheer volume of this backlog creates a statistical mountain that is proving incredibly difficult to climb.

- Persistent Staffing Shortages: The UK has fewer doctors and nurses per capita than many comparable developed nations. Years of workforce planning challenges, burnout, and an ageing workforce have created a critical shortage. This is exacerbated by ongoing industrial action, which, while aimed at resolving pay disputes, inevitably leads to cancelled appointments and further delays.

- Growing and Ageing Population: As the UK population ages, the demand for healthcare naturally increases. Older patients often present with multiple, more complex conditions, requiring more resources and specialist time.

- The "Hidden" Waiting List: Official figures don't capture the full picture. They don't include the millions of people waiting for an initial GP appointment, those waiting for a specialist referral, or those in need of community health services. When these "hidden" waits are considered, the true scale of the access problem is even more profound.

UK NHS Waiting List Trajectory (England)

| Year End (Approx.) | Official Waiting List Size (RTT) |

|---|---|

| 2019 | ~4.4 Million |

| 2021 | ~6.1 Million |

| 2023 | ~7.7 Million |

| 2025 (Projected) | ~9.5 - 10 Million |

Source: Analysis of NHS England data and projections from health policy analysts.

This upward trend demonstrates that without a radical intervention, the system's capacity will continue to be outstripped by demand, making lengthy waits the default experience for millions.

The Human Cost: What a 10 Million Waiting List Means for You

Beyond the headlines and statistics lies the real-world impact of these delays. A long wait isn't just an inconvenience; it can have a profound and lasting effect on every aspect of your life.

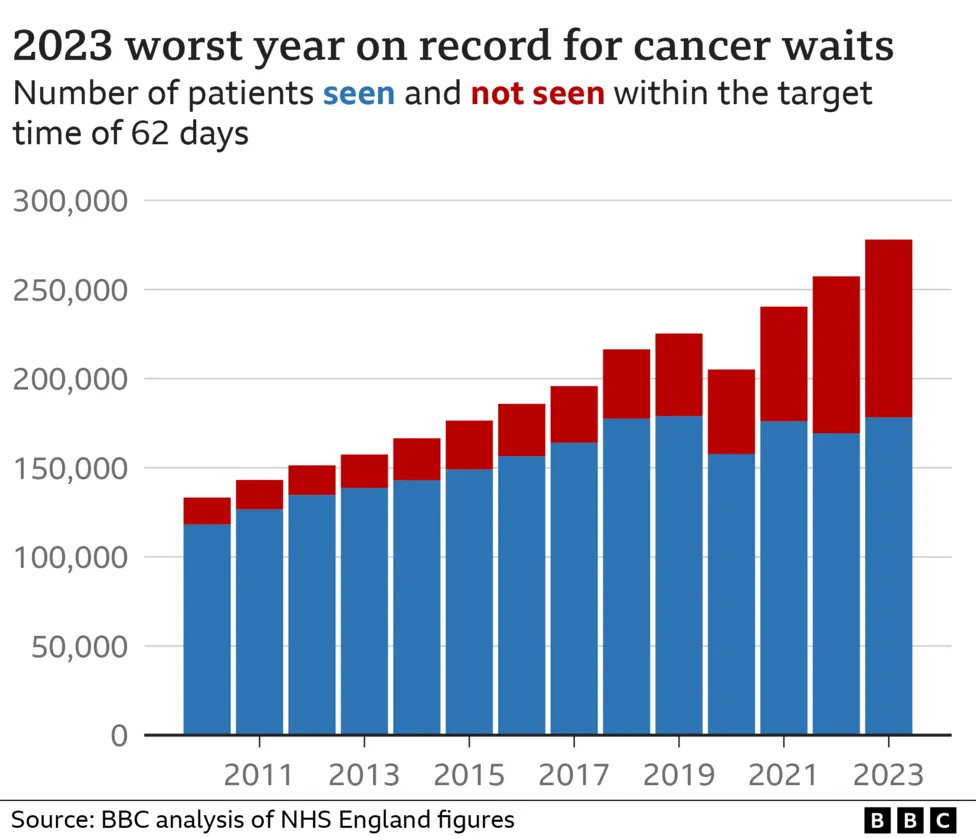

1. Delayed Diagnosis and Worsening Outcomes For many conditions, particularly cancer, early diagnosis is the single most important factor in determining a positive outcome. Waiting months for a diagnostic test like an MRI, CT scan, or endoscopy can allow a condition to progress, potentially limiting treatment options and reducing survival rates.

- Scenario: A 45-year-old woman finds a lump and is referred by her GP for an urgent scan. The NHS target is two weeks, but due to backlogs, she faces a wait of six to eight weeks. The anxiety during this period is immense, and any delay could be critical.

2. Deteriorating Quality of Life Many "elective" or "routine" surgeries are anything but routine for the person experiencing them.

- Hip and Knee Replacements: Waiting in constant pain for joint replacement surgery can lead to loss of mobility, dependence on painkillers, inability to work, and social isolation.

- Cataract Surgery: A condition that can be fixed with a 15-minute procedure can, if left, lead to a loss of independence, an increased risk of falls, and an inability to enjoy daily activities like reading or driving.

3. The Mental and Financial Toll Living with an undiagnosed symptom or chronic pain is incredibly stressful. The uncertainty can lead to anxiety and depression. Furthermore, if your condition prevents you from working, the financial strain on your family can be immense, particularly for the self-employed or those in the gig economy. The Office for National Statistics (ONS)(ons.gov.uk) has reported a significant rise in long-term sickness impacting the UK workforce, a trend intrinsically linked to healthcare access.

The conclusion is simple: relying solely on a system under such immense pressure is a gamble with your health, your livelihood, and your peace of mind.

Private Medical Insurance (PMI): Your Personal Bypass to Swift Medical Care

While the NHS grapples with its systemic challenges, a parallel system exists that offers a solution: private healthcare. Private Medical Insurance is the key that unlocks this system, transforming it from a luxury for the few into an affordable and accessible choice for many.

In essence, PMI is an insurance policy you pay for that covers the costs of private medical treatment for new, acute conditions that develop after your policy begins. It's your personal health fund, ready to be activated when you need it most.

The core benefits are a direct answer to the frustrations of the current NHS crisis:

- Speed of Access: This is the primary advantage. PMI allows you to bypass NHS waiting lists entirely, often reducing the time from GP referral to specialist consultation and treatment from many months to just a few weeks.

- Choice and Control: You have a greater say in your care. You can often choose the specialist consultant you want to see and the hospital where you'll be treated from a comprehensive list provided by your insurer.

- Advanced Treatment and Drugs: Some of the latest drugs, treatments, and surgical techniques may become available in the private sector before they are approved for widespread use on the NHS by NICE (The National Institute for Health and Care Excellence).

- Comfort and Convenience: Treatment is typically in a private hospital with your own en-suite room, more flexible visiting hours, and a quieter, more comfortable environment conducive to recovery.

NHS vs. Private Care Journey: A Typical Comparison (Knee Surgery)

| Stage of Journey | Typical NHS Experience | Typical Private (PMI) Experience |

|---|---|---|

| GP Referral | Referral made to local NHS trust. | GP provides an open referral. |

| Wait for Consultation | Months (e.g., 20-30 weeks). | Days or a few weeks. |

| Choice of Specialist | Little to no choice; assigned by the trust. | You choose from a list of approved specialists. |

| Wait for Diagnostics | Weeks or months for an MRI scan. | Arranged within days. |

| Wait for Surgery | Many months, potentially over a year. | Scheduled within a few weeks at your convenience. |

| Hospital Stay | On a ward with multiple other patients. | Private, en-suite room. |

| Total Time (Approx.) | 12 - 18+ Months | 4 - 8 Weeks |

This table starkly illustrates the value proposition of PMI: it buys you time, choice, and peace of mind when you are at your most vulnerable.

How Does Private Health Insurance Actually Work? A Step-by-Step Guide

The process of using your PMI is designed to be straightforward. While policies vary, the typical patient journey follows a clear path.

- Feel Unwell & Visit Your GP: Your journey almost always starts with a visit to your GP (this can be your regular NHS GP). They will assess your symptoms.

- Get a Referral: If your GP believes you need to see a specialist, they will write you a referral letter. For PMI, this is usually an 'open referral', meaning it doesn't name a specific consultant, giving you flexibility.

- Contact Your Insurer: You call your PMI provider's claims line with your policy details and referral information. They will verify your cover and provide a pre-authorisation number. They will also give you a list of approved specialists and hospitals you can choose from.

- Book Your Appointment: You contact the specialist's secretary, provide your authorisation number, and book your consultation at a time that suits you.

- Diagnosis and Treatment Plan: Following your consultation, if tests or surgery are needed, the specialist will create a treatment plan. You (or the specialist's office) share this with your insurer to get the subsequent stages authorised.

- Receive Your Treatment: You have your scans, surgery, or other treatment at the private hospital you have chosen.

- Bills Are Settled Directly: The insurance company handles the finances. They will settle the invoices directly with the hospital and the specialists involved. You only need to pay the 'excess' on your policy (if you have one).

Navigating the multitude of policy options and underwriting types can feel complex. This is where independent, expert advice becomes invaluable. A specialist broker, like WeCovr, can guide you through the entire market, ensuring you understand every detail before you commit.

Decoding Your Policy: Key Features and Options to Consider

Not all health insurance policies are created equal. They are highly customisable, allowing you to balance the level of cover with the monthly premium. Understanding the key components is crucial to building a plan that's right for you.

Core Cover: The Foundations

- In-patient and Day-patient Cover: This is the foundation of every PMI policy. It covers treatment where you need to be admitted to a hospital bed, either overnight (in-patient) or just for the day (day-patient). This includes costs for surgery, accommodation, and nursing care.

Comprehensive and Optional Extras

- Out-patient Cover: This is one of the most important options to consider. It covers diagnostic tests and consultations that do not require a hospital bed. Without out-patient cover, you would have to wait for these on the NHS or pay for them yourself before your private in-patient treatment could begin. Cover is usually limited to a set amount per year (e.g., £500, £1,000, or unlimited).

- Therapies: This add-on covers treatments like physiotherapy, osteopathy, and chiropractic care, which are essential for recovery from many musculoskeletal injuries and operations.

- Mental Health Cover: Standard policies may offer limited mental health support, but comprehensive add-ons provide more extensive cover for consultations with psychiatrists and psychologists, and in-patient psychiatric care.

- Dental and Optical: This can be added to some policies to contribute towards routine check-ups, treatments, and the cost of glasses or contact lenses.

Key Policy Terms Explained

| Term | What It Means | Impact on Your Policy |

|---|---|---|

| Excess | A fixed amount (e.g., £100, £250, £500) you agree to pay towards a claim, per year or per claim. | A higher excess significantly lowers your monthly premium. It's a way to share a small part of the cost. |

| Hospital List | The list of private hospitals your policy allows you to use. These are often tiered (e.g., local, nationwide, premium London hospitals). | Choosing a more restricted list (e.g., excluding expensive central London hospitals) will reduce your premium. |

| 6-Week Wait Option | A cost-saving feature. If the NHS can provide the in-patient treatment you need within six weeks, you use the NHS. If the wait is longer, your PMI kicks in. | This can dramatically reduce your premium, but it means you don't always get to bypass the queue for less urgent needs. |

| Underwriting | The method the insurer uses to assess your medical history and decide what they will cover. The two main types are Moratorium and Full Medical Underwriting (FMU). | This is a critical choice. Moratorium is quicker but less certain. FMU takes longer upfront but provides absolute clarity on what's covered from day one. |

The Million-Pound Question: How Much Does Private Health Insurance Cost?

This is the most common and important question. The answer is: it varies widely, but it's often more affordable than people assume. The price of your premium is tailored to your individual circumstances and the level of cover you choose.

Key Factors Influencing Your Premium:

- Age: This is the most significant factor. Premiums increase as you get older.

- Location: Living in or near major cities, especially London, can increase the cost due to higher hospital charges.

- Level of Cover: A basic, in-patient-only policy will be much cheaper than a fully comprehensive plan with unlimited out-patient cover and therapy options.

- Excess Level: The higher your excess, the lower your monthly premium.

- Lifestyle: Your smoker status will affect your premium.

Illustrative Monthly Premiums (Mid-Range Comprehensive Policy)

| Profile | Location: Outside London (e.g., Manchester) | Location: Central London |

|---|---|---|

| 30-year-old, non-smoker | £45 - £60 | £60 - £80 |

| 45-year-old, non-smoker | £70 - £95 | £90 - £120 |

| Couple, both aged 55 | £180 - £240 | £230 - £300 |

| Family of 4 (Parents 40, Kids 10, 8) | £150 - £200 | £190 - £250 |

Disclaimer: These are illustrative estimates for a comprehensive policy with a £250 excess. Actual quotes will vary based on the insurer, exact cover, and personal details. The only way to get an accurate price is to get a personalised quote.

Why Use an Expert Broker like WeCovr? The Value of Independent Advice

The UK PMI market is vast and complex, with major providers like Bupa, AXA Health, Aviva, and Vitality all offering dozens of policy variations. Trying to compare them yourself is time-consuming and can lead to you either overpaying or, worse, being underinsured.

This is where an independent broker provides indispensable value.

At WeCovr, we are not tied to any single insurer. Our loyalty is to you, our client. Our role is to simplify the complex and empower you to make the best choice.

- Whole-of-Market Access: We have access to plans and rates from all the leading UK insurers, giving you a complete view of your options.

- Expert, Personalised Advice: We take the time to understand your specific needs, health concerns, and budget. We then translate this into a tailored recommendation, explaining the pros and cons of each option in plain English.

- Saving You Time and Money: We do all the legwork of gathering and comparing quotes. Our expertise ensures you don't pay for cover you don't need, and our relationships with insurers can sometimes unlock better rates.

- A Partner for Life: Our service doesn't stop once you've bought the policy. We are here to help with renewals, and to offer advice if you ever need to make a claim.

Moreover, we believe in a holistic approach to wellbeing. At WeCovr, we believe in proactive health as well as reactive care. That's why our clients get complimentary access to our exclusive AI-powered wellness app, CalorieHero, helping you stay on top of your health goals long before you ever need to make a claim.

The Critical Caveat: Understanding What PMI Does Not Cover

For all its benefits, it is absolutely essential to be clear about the limitations of Private Medical Insurance. PMI is designed to work alongside the NHS, not as a complete replacement. The most important rule to understand is this:

Standard UK private medical insurance does not cover pre-existing conditions or chronic conditions.

This point cannot be overstated. PMI is for acute medical conditions that arise after you take out your policy.

- Pre-existing Conditions: This refers to any illness, disease, or injury for which you have experienced symptoms, received medication, or sought advice or treatment before the start of your policy. Under moratorium underwriting, conditions you've had in the 5 years prior to joining are typically excluded for the first 2 years of the policy.

- Chronic Conditions: This refers to long-term conditions that require ongoing or long-term monitoring and management, rather than a curative treatment. Examples include diabetes, asthma, high blood pressure, and Crohn's disease. The NHS will always manage the ongoing care for these conditions. PMI may cover an acute flare-up of a chronic condition, but not the day-to-day management.

Other Common Exclusions:

- Emergency and A&E services

- Normal pregnancy and childbirth

- Cosmetic surgery (unless it's reconstructive after an accident or eligible surgery)

- Organ transplants

- Treatment for addiction

Understanding these exclusions is key to having the right expectations and seeing PMI for what it is: a powerful tool for dealing with new, unexpected, and treatable health problems quickly and effectively.

The Future of UK Healthcare: Is a Hybrid Model the New Norm?

The projection of a 10 million waiting list by 2025 isn't just a warning light for the NHS; it signals a fundamental shift in how UK residents must think about their healthcare. For decades, most people have relied exclusively on the NHS. The emerging reality is that a hybrid approach—using the NHS for its world-class emergency and chronic care, and PMI for elective, acute treatments—is becoming the new standard for those who can afford it.

Private Medical Insurance is moving from being a 'perk' or 'luxury' to being a core component of a family's financial and personal security planning. It is a pragmatic response to a systemic problem, an investment in health, and a way to reclaim control in an uncertain world.

Don't let your health become a waiting game. The power to choose a different path—one of speed, choice, and security—is available. In the face of a 10 million-person queue, securing your place at the front of the line for treatment isn't just wise; it's essential.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.