TL;DR

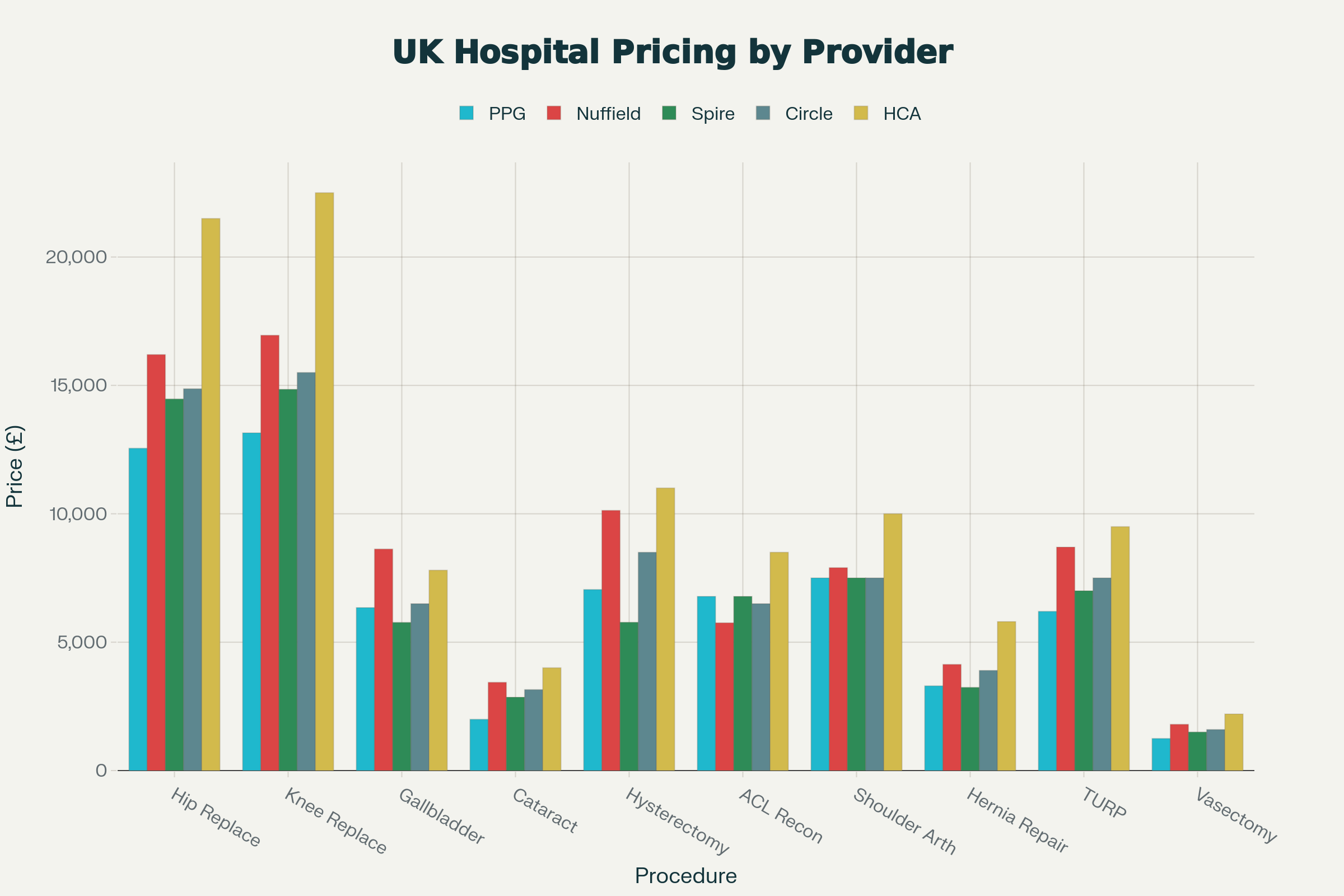

UK Private Hospital Pricing: The Complete Analysis The UK private healthcare market has become increasingly opaque, with patients facing wildly inconsistent pricing for identical procedures. At WeCovr, we investigated the full scale of price variation across the nation's private hospitals, analysed what is driving these costs, and are publishing our findings so that patients, employers, and advisors can make truly informed decisions. What we uncovered is revealing: identical operations cost up to 99% more at premium hospitals than value providers.

Key takeaways

- Value Option (illustrative): Practice Plus Group charges a fixed £12,549.

- National Average (illustrative): Approximately £15,370.

- Regional Premium (illustrative): Spire Healthcare and Circle Health Group average between £14,500 and £16,500 depending on the location.

- London Super-Premium (illustrative): HCA Healthcare UK in Central London quotes £18,000 to £25,000+.

- Real Estate & Overheads: Central London property costs translate directly into facility fees.

UK Private Hospital Pricing: The Complete Analysis

The UK private healthcare market has become increasingly opaque, with patients facing wildly inconsistent pricing for identical procedures. At WeCovr, we investigated the full scale of price variation across the nation's private hospitals, analysed what is driving these costs, and are publishing our findings so that patients, employers, and advisors can make truly informed decisions.

What we uncovered is revealing: identical operations cost up to 99% more at premium hospitals than value providers. London prices command a 22.9% premium over the national average. And over just three years (2022-2025), private healthcare costs have surged 20-24% due to energy crises, labour shortages, and inflation—though the pace is now slowing.

This is our most comprehensive analysis to date, examining 35+ procedures across all major hospital groups, regional pricing variations, historical cost movements, and forward projections. For those considering how to fund their care, understanding these variances highlights exactly why securing the right private medical insurance coverage through an expert broker like WeCovr is essential for long-term financial protection.

The State of UK Private Healthcare

The UK private healthcare market reached roughly £13.8 billion in 2025, yet remains remarkably fragmented. Five major hospital groups dominate the sector, each with a distinct market position: (illustrative estimate)

HCA Healthcare UK operates a network concentrated heavily in Central London (including The Portland, The Wellington, and The Princess Grace), positioning itself as the super-premium provider. Their consultation fees range from £200 to £500+, and their procedures command 30-50% premiums over the national average. This is the destination for complex, high-acuity cases and world-class specialists.

Spire Healthcare runs the most extensive network with 38 hospitals nationwide. They position themselves as a mid-premium provider with pricing 10-20% above the national average. Their strength lies in geographic diversity and a consistent consultant base across all regions, from Manchester to Bristol.

Nuffield Health operates 37 hospitals and uniquely maintains not-for-profit charitable status. This model allows them to invest in integrated wellbeing centres. While they are often a value choice, their pricing in some regions (like Cardiff and Guildford) can rival premium providers. They are highly transparent with published pricing.

Circle Health Group (formerly BMI) operates 50+ hospitals nationwide. Following their acquisition by PureHealth, they are aggressively growing market share through fixed-price packages. Their pricing typically sits 10-20% above the national average, positioned closely alongside Spire.

Practice Plus Group is the market disruptor, operating hospitals primarily in the Southwest and Midlands. Their revolutionary approach involves a flat £95 consultation fee and fixed, transparent bundled pricing that is significantly lower than the market average. They effectively set the "floor" price for self-pay surgery in the UK. (illustrative estimate)

The Price Variation Shock: Up to 99% Differences

Our research reveals startling disparities. For identical procedures performed by qualified consultants, pricing varies dramatically based solely on which hospital group and which region you choose.

Hip Replacement: The £12,000+ Decision

Hip replacement surgery is the benchmark for private pricing. Here is the reality of what you will pay:

- Value Option (illustrative): Practice Plus Group charges a fixed £12,549.

- National Average (illustrative): Approximately £15,370.

- Regional Premium (illustrative): Spire Healthcare and Circle Health Group average between £14,500 and £16,500 depending on the location.

- London Super-Premium (illustrative): HCA Healthcare UK in Central London quotes £18,000 to £25,000+.

The spread: From £12,549 to over £25,000 represents a price difference of nearly 100% for the identical procedure. For a patient willing to travel from London to a regional hub, the savings can exceed £10,000—equivalent to the cost of a small car. (illustrative estimate)

WeCovr Insight: For self-pay patients, this variance is a financial minefield. However, for those with comprehensive private medical insurance, these costs are typically settled directly by the insurer. WeCovr's brokers can help you find a policy that includes access to both regional hubs and premium London facilities, ensuring you aren't restricted by cost when choosing your surgeon.

Knee Replacement & Orthopaedics

Knee replacement follows the same pattern. Practice Plus charges £13,149, while Nuffield averages £16,585 in Bristol, and HCA facilities exceed £22,000. We also found significant variance in soft tissue procedures; an ACL reconstruction can cost £7,049 at a value provider but over £11,600 at major national groups. (illustrative estimate)

Cataract Surgery: The Retail Price War

Cataract surgery for a single eye shows where transparency has disrupted the market. High-street providers and Practice Plus Group charge roughly £1,995 for a standard monofocal lens. In contrast, traditional private hospitals average £2,800–£3,500, and premium London clinics can charge over £4,000 per eye. (illustrative estimate)

The Geography Premium: Why London Costs 23% More

London's private healthcare market operates at a 22.9% premium to the national average. Central London (Harley Street and the West End) commands even higher premiums—up to 40% above the national average for diagnostics and surgery.

Why?

- Real Estate & Overheads: Central London property costs translate directly into facility fees.

- Consultant Concentration (illustrative): The density of world-renowned specialists allows for higher professional fees (£400-£500+ for initial visits).

- HCA Dominance: HCA's significant market share in London limits price competition compared to the regions.

Strategic Insight: A patient in London needing a hip replacement could travel to Spire Manchester or Nuffield Leeds and save £4,000–£6,000, receiving care from top regional consultants in excellent facilities. (illustrative estimate)

WeCovr Insight: Many insurance policies have specific "London upgrade" options. If you live within the M25, WeCovr can advise on whether the additional premium for London hospital access offers better value than travelling to high-quality regional centres like Reading or Guildford.

The Cost Explosion and Current Slowdown

From 2022 to 2024, private healthcare experienced cost inflation of roughly 20-24%.

- Energy: Hospitals are energy-intensive; rising utility costs forced price hikes.

- Labour: Wage inflation for nursing and clinical staff has been a primary driver.

- Supply Chain: The cost of prosthetics and surgical consumables rose by 3-5% annually.

However, 2025 data suggests a moderation. Inflation in the sector has slowed to 4-7%, with some competitive segments (like ophthalmology and diagnostics) actually seeing price deflation due to intense competition.

The Self-Pay Revolution: 33% of Hospital Revenue

One of the most significant structural changes is the growth of self-pay patients. Pre-pandemic, this was a smaller segment; today, it accounts for approximately one-third of private hospital revenue.

- NHS Wait Lists: With NHS waiting times for routine orthopaedics often exceeding 18 months, patients are using savings or finance to "buy time."

- Fixed Price Packages: Hospitals have responded with "all-inclusive" bundles (surgery, stay, aftercare), removing the fear of open-ended medical bills.

- Finance: 0% finance options (e.g., over 10-12 months) are now standard across all major groups, making a £14,000 surgery accessible via monthly payments.

WeCovr Insight: While financing options make self-pay more accessible, a single major surgery often costs more than a decade of insurance premiums. WeCovr helps clients calculate the long-term value of insurance versus self-pay, ensuring you are protected against the unpredictable costs of complex or chronic conditions that fixed-price surgery packages do not cover.

Comprehensive Price Reference: Top 35 Operations (2025)

The following table provides the detailed pricing analysis for the most common private procedures across the UK's leading hospital groups.

1. Orthopaedic Surgery

| Operation | HCA Healthcare (London) | Spire Healthcare | Nuffield Health | Circle Health Group | Ramsay Health Care | Practice Plus Group |

|---|---|---|---|---|---|---|

| Total Hip Replacement | £18,000 - £25,000+ | £14,055 - £14,810 | £15,785 - £16,928 | £14,193 - £16,775 | £14,995 - £15,990 | £12,549 |

| Total Knee Replacement | £19,000 - £26,000+ | £14,588 - £15,500 | £16,585 - £18,923 | £14,888 - £17,350 | £14,995 - £17,446 | £13,149 |

| Knee Arthroscopy | £6,000 - £8,000 | £3,636 - £4,000 | £4,375 - £5,770 | £4,300 - £5,300 | £4,210 - £4,999 | £5,599* |

| ACL Reconstruction | £8,300 - £12,000 | £7,530 - £8,655 | £7,177 - £9,140 | £8,057 - £11,620 | £10,300+ | £7,049 |

| Shoulder Replacement | £15,000 - £18,000 | £13,500 - £15,000 | £14,000+ | £14,200 | £12,990 | £13,669 |

| Rotator Cuff Repair | £7,500 - £9,000 | £7,492 - £7,599 | £7,000+ | £7,500+ | £7,500+ | £6,500+ |

| Carpal Tunnel Release | £2,650 - £3,500 | £2,126 - £2,400 | £1,846 - £3,205 | £1,800 - £2,427 | £2,100+ | £2,427 |

| Bunion Surgery | £5,000 - £7,000 | £4,599 - £5,200 | £5,208 - £7,985 | £5,260 | £5,618 | £4,599 |

| Lumbar Decompression | £11,000 - £15,000 | £8,878 - £10,530 | £9,769 | £12,645 - £13,200 | £10,338 - £12,645 | £9,769 |

| Dupuytren's Fasciectomy | £2,500 - £4,000 | £2,200+ | £1,827 - £3,172 | £2,200+ | £2,400+ | N/A |

*Note: Practice Plus Group pricing for arthroscopy is higher in some lists, but generally bundles more aftercare.

2. General Surgery & Gastroenterology

| Operation | HCA Healthcare (London) | Spire Healthcare | Nuffield Health | Circle Health Group | Ramsay Health Care | Practice Plus Group |

|---|---|---|---|---|---|---|

| Inguinal Hernia Repair | £4,800 - £6,500 | £3,315 - £4,016 | £3,690 - £4,373 | £3,250 - £4,300 | £3,150+ | £3,299 |

| Gallbladder Removal | £6,900 - £8,500 | £7,010 - £8,020 | £8,595 - £9,128 | £7,658 - £8,000 | £7,500+ | £6,349 |

| Colonoscopy | £2,800 - £3,500 | £2,528 - £2,743 | £3,060 - £3,165 | £1,795 - £2,627 | £1,758+ | £2,421 |

| Gastroscopy | £2,000 - £2,500 | £1,831 - £2,163 | £2,295 - £2,455 | £1,720 - £2,241 | £1,500+ | £1,942 |

| Umbilical Hernia Repair | £4,500+ | £3,299 | £3,500+ | £3,200+ | £3,200+ | £3,299 |

| Haemorrhoidectomy | £3,500+ | £3,249 | £2,800 - £4,630 | £3,000+ | £3,000+ | £3,249 |

| Anal Fissure Surgery | £3,000+ | £2,000+ | £2,200+ | £2,183 | £2,000+ | £1,999 |

| Varicose Veins (EVLA) | £3,500 - £5,000 | £3,405 - £4,016 | £2,720 - £4,682 | £3,500+ | £2,609 | £3,489 |

3. Ophthalmology (Eye Care)

| Operation | Spire Healthcare | Nuffield Health | Circle Health Group | Ramsay Health Care | Specialists (e.g. Optical Express) | Practice Plus Group |

|---|---|---|---|---|---|---|

| Cataract (Monofocal) | £2,600 - £3,188 | £3,260 - £4,060 | £2,800 - £3,018 | £2,800+ | £1,995 - £2,995 | £1,995 |

| Cataract (Multifocal) | £3,045 - £3,500 | £4,500+ | £3,895 - £4,400 | £3,500+ | £3,195 - £3,895 | £3,045 |

| YAG Laser Capsulotomy | £749 - £850 | £685 - £800 | £1,030 | £700+ | £695 | £749 |

| Eyelid Cyst Removal | £1,500+ | £1,535 - £1,670 | £1,200+ | £1,000+ | £1,000+ | £3,599 (bundled) |

4. Women's Health & Cosmetics

| Operation | HCA / Portland | Spire Healthcare | Nuffield Health | Circle Health Group | Ramsay Health Care |

|---|---|---|---|---|---|

| Hysterectomy | £10,000 - £12,000+ | £7,948 - £8,894 | £9,780 - £10,752 | £9,074 - £9,900 | £8,500+ |

| Breast Augmentation | £8,000+ | £6,500 - £8,800 | £5,250 - £8,635 | £5,800 - £7,635 | £5,500 - £8,589 |

| Breast Reduction | £10,000+ | £8,840 - £10,000 | £8,685 - £10,959 | £7,200 - £8,500 | £8,500 - £10,870 |

| Abdominoplasty | £12,000+ | £8,500 - £10,000 | £9,600 - £10,600 | £7,052 - £10,934 | £10,934+ |

| Rhinoplasty | £9,000+ | £7,195 - £9,000 | £7,593 - £9,240 | £4,955 - £8,000 | £7,000+ |

5. Diagnostics (Self-Pay)

| Procedure | HCA (London) | Spire Healthcare | Nuffield Health | Circle Health Group | Vista Health / Specialists |

|---|---|---|---|---|---|

| MRI Scan (1 Part) | £800 - £1,200+ | £334 - £700 | £395 - £620 | £450 - £725 | £249 - £380 |

| CT Scan (1 Part) | £600 - £850 | £334 - £662 | £600 - £750 | £600+ | £350+ |

| Ultrasound Scan | £425+ | £200 - £350 | £330 - £440 | £250+ | £150+ |

| X-Ray | £189 - £300 | £100 - £150 | £135 | £120+ | £80+ |

Key Conclusions

For Patients

- Location is destiny: The same procedure costs 30-50% more in London. Geographic flexibility—travelling to regional centres—represents your largest savings opportunity.

- Get transparent quotes: Fixed-price packages are now the standard. Always demand a written quote that includes consultant fees and aftercare to avoid "surprise billing."

- Shop around (illustrative): For diagnostic scans (MRI/CT), using a specialist provider like Vista Health or a value-tier hospital can save you £500+ compared to a premium hospital.

WeCovr Insight: If navigating these price differentials feels overwhelming, contacting WeCovr can simplify the process. We help individuals secure private medical insurance that acts as a financial shield against these high costs, providing peace of mind that you can access the care you need without depleting your savings.

For Employers and Insurers

- Tiered networks: Implementing tiered networks that guide routine procedures to high-value providers can reduce claim costs by 15-25%.

- Self-Pay as a benchmark: The transparency of self-pay pricing creates a new benchmark for negotiating insurer rates.

- Cost moderation: While costs have risen, the stabilization of inflation in 2025 improves budget predictability for corporate schemes.

The market is evolving. Transparency is increasing, and the gap between "value" and "premium" providers has never been wider. For those willing to research and compare, the UK private healthcare market offers exceptional access, provided you know where to look.

About WeCovr

WeCovr is the UK's leading private medical insurance broking firm, specializing in helping individuals, employers, and corporate schemes navigate private healthcare costs and access. Our research team analysed pricing across the entire UK private hospital system—examining 40+ procedures across five major hospital networks, all regions, and three years of historical cost data—to produce this comprehensive analysis.

Whether you're an individual seeking procedure guidance, an employer designing corporate health benefits, or a broker seeking competitive positioning, our expertise and research can help you make better decisions.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.