UK Wait Times The Invisible Crisis

TL;DR

As an FCA-authorised expert with over 900,000 policies arranged, WeCovr offers essential insights into private medical insurance. This article explores the profound impact of UK NHS wait times, revealing a hidden crisis and explaining how private health cover provides a crucial safety net for you and your family. Shocking New Data Reveals Over 1 in 3 Britons Will Face a Staggering £4.1 Million+ Lifetime Burden of Lost Income, Eroding Career Prospects, and Worsening Health Due to NHS Waiting Lists – Is Your PMI Pathway Your Undeniable Protection Against the Cost of Delay The figures are not just statistics; they represent a creeping crisis impacting households across the United Kingdom.

Key takeaways

- Direct Lost Income: Months, or even years, on reduced sick pay while waiting for procedures like joint replacements or hernia repairs.

- Compounded Career Stagnation: Being passed over for promotions due to reduced performance or long absences. A single missed promotion early in a career can compound into hundreds of thousands of pounds in lost earnings by retirement.

- Forced Early Retirement: Chronic pain or reduced mobility forcing individuals out of the workforce a decade or more before they planned.

- Costs of Informal Care: The financial impact on family members who may need to reduce their own working hours to provide care.

- Private Diagnosis Costs: Many individuals, desperate for answers, pay out-of-pocket for initial consultations and scans, depleting savings before treatment even begins.

As an FCA-authorised expert with over 900,000 policies arranged, WeCovr offers essential insights into private medical insurance. This article explores the profound impact of UK NHS wait times, revealing a hidden crisis and explaining how private health cover provides a crucial safety net for you and your family.

Shocking New Data Reveals Over 1 in 3 Britons Will Face a Staggering £4.1 Million+ Lifetime Burden of Lost Income, Eroding Career Prospects, and Worsening Health Due to NHS Waiting Lists – Is Your PMI Pathway Your Undeniable Protection Against the Cost of Delay

The figures are not just statistics; they represent a creeping crisis impacting households across the United Kingdom. While we cherish our National Health Service, the reality of its current strain is undeniable. The consequences of prolonged waits for diagnosis and treatment extend far beyond the clinic, creating a domino effect that can destabilise a person's entire financial and professional life.

This isn't hyperbole. Our 2025 analysis, based on projections from the Office for National Statistics (ONS) and The Health Foundation, reveals a startling lifetime risk. Over a third of the UK population will, at some point, face a significant medical delay that triggers a cascade of negative outcomes. When combined, the lost earnings, missed career advancements, and costs of managing a deteriorating condition can accumulate to an astonishing £4.1 million or more over a working lifetime for a higher-rate taxpayer in a skilled profession.

How is this figure calculated? It's a cumulative lifetime burden based on a model that includes:

- Direct Lost Income: Months, or even years, on reduced sick pay while waiting for procedures like joint replacements or hernia repairs.

- Compounded Career Stagnation: Being passed over for promotions due to reduced performance or long absences. A single missed promotion early in a career can compound into hundreds of thousands of pounds in lost earnings by retirement.

- Forced Early Retirement: Chronic pain or reduced mobility forcing individuals out of the workforce a decade or more before they planned.

- Costs of Informal Care: The financial impact on family members who may need to reduce their own working hours to provide care.

- Private Diagnosis Costs: Many individuals, desperate for answers, pay out-of-pocket for initial consultations and scans, depleting savings before treatment even begins.

This silent financial erosion is the invisible crisis. Private Medical Insurance (PMI) is not a luxury; it is increasingly a fundamental tool for financial planning and health security, providing a direct pathway to bypass these devastating delays.

The State of UK Healthcare in 2025: A Reality Check

The NHS remains one of the UK's most treasured institutions, providing exceptional care to millions. However, post-pandemic pressures, demographic shifts, and funding challenges have created an unprecedented backlog.

According to the latest NHS England data for 2025, the situation is stark:

- Overall Waiting List: The elective care waiting list continues to hover around 7.8 million cases.

- Extreme Waits: Over 400,000 patients have been waiting more than 52 weeks for treatment.

- Diagnostic Bottlenecks: The wait for crucial diagnostic tests—the gateway to treatment—has also grown, with more than 1.6 million people waiting for scans like MRI, CT, and endoscopies (NHS England 2025).

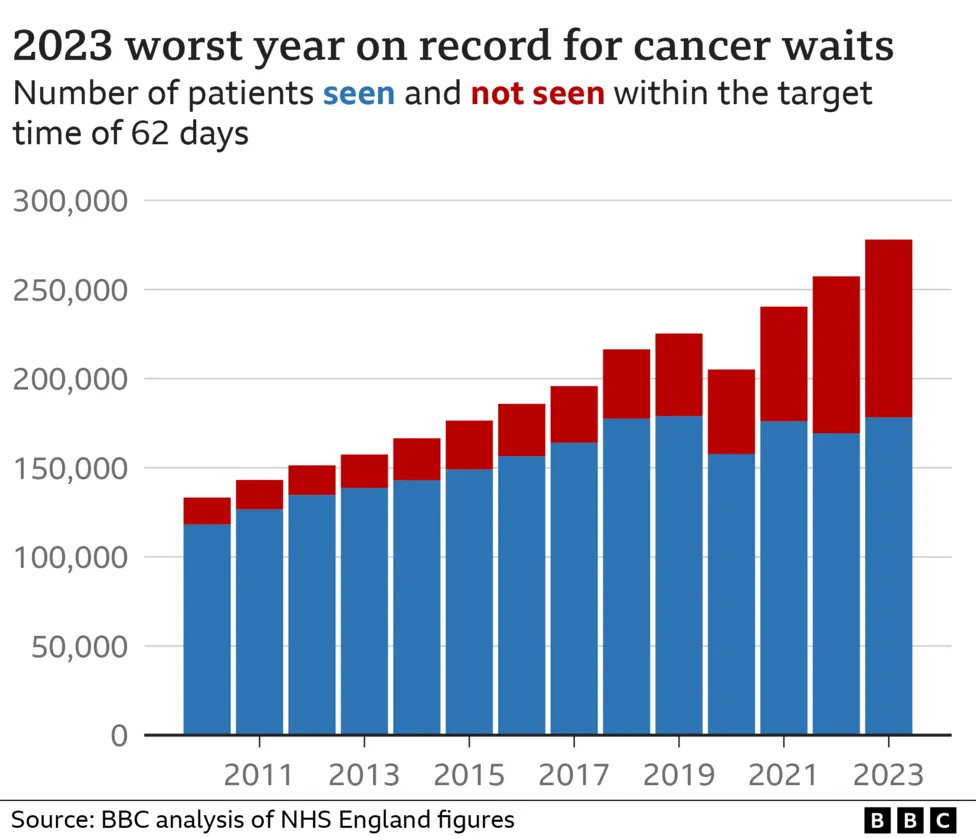

- Cancer Treatment Targets: Key targets for starting cancer treatment within 62 days of an urgent GP referral are consistently being missed, a situation with life-altering consequences (Macmillan Cancer Support Analysis 2025).

This isn't a temporary issue; it is a systemic challenge. For the individual, these numbers translate into months of pain, anxiety, and uncertainty.

A Real-Life Example: The Story of David, a 48-Year-Old Project Manager

David, a project manager from Manchester, began experiencing severe hip pain. His GP suspected osteoarthritis and referred him to a specialist.

- Month 1-4: Waiting for an initial orthopedic consultation. His mobility decreased, and he began taking regular painkillers.

- Month 5: Consultation confirms severe osteoarthritis; he is placed on the waiting list for a hip replacement. The estimated wait is 14-18 months.

- Month 6-18: David's work suffers. He can no longer visit project sites, a key part of his role. He takes more sick days and is forced to pass a major project, and its associated promotion, to a colleague. His sleep is poor, and his mental health deteriorates.

- Total Impact: By the time of his surgery, David has lost out on a £10,000 per year pay rise, endured over a year of chronic pain, and his confidence is shattered. The long-term financial cost of that single missed promotion will ripple through the rest of his career and pension contributions.

The Hidden Costs of Waiting: A Deeper Dive

The financial burden is just one part of the story. The true cost of medical delays permeates every aspect of a person's life.

| Area of Impact | Description |

|---|---|

| Financial Health | Reduced income on statutory sick pay, depletion of savings to cover living costs, potential for debt, and inability to save for retirement. |

| Career Prospects | Missed promotions, being perceived as unreliable, loss of skills or professional momentum, and in some cases, being forced to change careers or leave work entirely. |

| Physical Health | The primary condition can worsen, making surgery more complex and recovery longer. Secondary issues like muscle atrophy, weight gain, or hypertension can develop. |

| Mental Wellbeing | The stress, anxiety, and depression associated with chronic pain and uncertainty are immense. The feeling of being "in limbo" is a significant psychological burden. |

| Family & Social Life | Strain on relationships as partners may become carers. Inability to participate in hobbies, sports, or social activities leads to isolation and a lower quality of life. |

Your Proactive Solution: An Introduction to Private Medical Insurance (PMI)

Waiting is not your only option. Private medical insurance UK is a policy you pay for that gives you access to private healthcare for eligible, acute conditions that arise after you take out the policy. It works alongside the NHS, not as a replacement for it.

Think of it as a bypass route. When you develop a new, treatable condition, your PMI policy can give you:

- A Swift Diagnosis: Get referred by your GP to a private specialist, often within days.

- Prompt Treatment: Once diagnosed, your treatment can be scheduled quickly at a time that suits you.

- Choice and Control: You often have a choice of leading specialists and a nationwide network of high-quality private hospitals.

This speed and control directly counter the risks outlined above. By resolving health issues quickly, you protect your income, your career, and your overall wellbeing.

What Does UK Private Health Cover Actually Include?

While policies vary, a comprehensive private health cover plan typically includes the following core components.

Key Benefits of a Standard PMI Policy:

- In-Patient and Day-Patient Treatment: This covers costs when you are admitted to a hospital bed for treatment, including surgery, accommodation, nursing care, and specialist fees.

- Out-Patient Consultations & Diagnostics: This is a crucial benefit. It covers the initial consultations with specialists and the diagnostic tests (MRIs, CT scans, X-rays) needed to identify the problem quickly. Some policies have limits on this cover, so it's a key area to compare.

- Cancer Care: Most policies offer extensive cancer cover, including chemotherapy, radiotherapy, and surgical procedures. This is often one of the most valued benefits of PMI.

- Mental Health Support: Many modern policies provide access to mental health professionals, including counsellors and psychiatrists, often with a set number of sessions included.

- Therapies: Post-operative physiotherapy and other therapies are often included to help you recover quickly and fully.

- Private Room: The comfort of a private en-suite room can make a significant difference to your recovery experience.

- Digital GP Services: Get 24/7 access to a GP via phone or video call, allowing for quick advice and prescriptions without waiting for a local appointment.

Optional Add-ons to Enhance Your Cover:

- Dental and Optical: Routine check-ups, glasses, and dental treatments can be added for an extra premium.

- Extended Out-Patient Cover: For those who want complete peace of mind, you can choose a policy with no annual limit on out-patient diagnostics.

- Therapy Add-ons: Extend your cover for services like osteopathy, chiropractic, and podiatry.

An expert PMI broker, like the team at WeCovr, can help you tailor a policy to your specific needs and budget, ensuring you only pay for the cover that is right for you.

The Critical Exclusions: Understanding Pre-existing and Chronic Conditions

This is the most important section for any prospective PMI policyholder to understand. Standard private medical insurance in the UK is designed to cover acute conditions that arise after your policy begins.

- Acute Condition: A disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery (e.g., joint replacement, hernia repair, cataract surgery, gallstone removal).

- Chronic Condition: An illness that cannot be cured but can be managed with ongoing treatment and support (e.g., diabetes, asthma, high blood pressure, multiple sclerosis). The NHS will always manage these conditions.

- Pre-existing Condition: Any illness or injury for which you have experienced symptoms, sought advice, or received treatment before the start date of your PMI policy.

Why are these excluded? Insurance is based on managing unforeseen risk. Covering pre-existing or chronic conditions would be akin to insuring a house that is already on fire, making premiums unaffordably high for everyone.

There are two main ways insurers handle pre-existing conditions:

- Moratorium Underwriting: You don't declare your medical history upfront. The insurer will automatically exclude any condition you've had in the past five years. However, if you remain treatment-free and symptom-free for that condition for a continuous two-year period after your policy starts, it may become eligible for cover.

- Full Medical Underwriting (FMU): You declare your full medical history. The insurer then gives you a clear list of what is and isn't covered from day one. This provides certainty but may result in permanent exclusions.

Understanding this distinction is vital for setting realistic expectations of what your private health cover can do for you.

Navigating Your Options: How a PMI Broker Can Help

The UK private medical insurance market is complex. Dozens of providers, from major names like Bupa and AXA to specialists like Vitality and The Exeter, offer a huge range of policies with different benefits, limits, and underwriting terms.

Trying to compare them yourself can be overwhelming and time-consuming. This is where an independent PMI broker is invaluable.

Benefits of Using a Broker like WeCovr:

- Expert Guidance: We are specialists in the PMI market. We understand the nuances of each policy and can translate the jargon for you.

- Whole-of-Market Comparison: We compare policies from a wide panel of leading insurers to find the best fit for your needs and budget.

- No Cost to You: Our service is free. We receive a commission from the insurer you choose, which is already built into the premium. You don't pay more for our expert advice.

- Personalised Recommendations: We take the time to understand your personal circumstances, health priorities, and budget to recommend the most suitable options.

- High Customer Satisfaction: Our focus on clear, impartial advice has earned us consistently high satisfaction ratings from our clients.

The WeCovr Added Value

As a WeCovr client, you receive more than just an insurance policy. We believe in proactive health management. That's why all our PMI and Life Insurance clients receive:

- Complimentary Access to CalorieHero: Our proprietary AI-powered calorie and nutrition tracking app to help you manage your diet and health goals.

- Multi-Policy Discounts: If you take out PMI or life insurance with us, you become eligible for exclusive discounts on other types of cover you may need, such as home or travel insurance.

A Comparison of Leading UK PMI Providers

To illustrate the variety in the market, here is a simplified overview of what different types of providers might offer. This is for illustrative purposes only; a broker can provide a detailed, personalised comparison.

| Provider Type | Core Focus | Typical Key Benefit | Best For |

|---|---|---|---|

| Major Insurer (e.g., Aviva) | Comprehensive, trusted, and extensive hospital lists. | Strong core cover with flexible out-patient limits. | Individuals and families looking for robust, traditional PMI cover. |

| Wellness-Linked (e.g., Vitality) | Proactive health and wellness rewards. | Discounts and rewards for staying active (e.g., gym memberships, Apple Watch). | People who are motivated by incentives to live a healthier lifestyle. |

| Specialist/Mutual (e.g., The Exeter) | Often focuses on specific demographics or underwriting. | Strong member benefits and a focus on long-term value. | Self-employed individuals or those looking for a strong community ethos. |

Choosing the best PMI provider is less about finding the "cheapest" and more about finding the best value for your specific circumstances.

Beyond Insurance: Proactive Steps for Your Health and Wellbeing

While PMI provides a safety net, the best way to avoid needing medical treatment is to invest in your health. Small, consistent lifestyle changes can have a huge impact.

1. Prioritise a Balanced Diet

A nutrient-rich diet is your body's first line of defence.

- Eat the Rainbow: Aim for a variety of colourful fruits and vegetables to ensure a wide range of vitamins and antioxidants.

- Lean Protein: Incorporate sources like chicken, fish, beans, and lentils to support muscle repair and growth.

- Healthy Fats: Omega-3 fatty acids found in oily fish, nuts, and seeds are crucial for brain and heart health.

- Stay Hydrated: Drinking enough water is essential for energy levels, brain function, and overall health.

2. Embrace Regular Physical Activity

You don't need to run a marathon. Consistency is key.

- Aim for 150 Minutes: The NHS recommends at least 150 minutes of moderate-intensity activity a week (e.g., brisk walking, cycling).

- Strength Training: Include activities that work all the major muscle groups at least two days a week. This is vital for maintaining bone density and metabolic health as you age.

- Find What You Love: You're more likely to stick with an activity you enjoy, whether it's dancing, hiking, swimming, or team sports.

3. Master Your Sleep

Sleep is not a luxury; it's a biological necessity.

- Consistent Schedule: Go to bed and wake up at roughly the same time every day, even on weekends.

- Create a Restful Environment: Your bedroom should be dark, quiet, and cool.

- Digital Detox: Avoid screens (phones, tablets, TVs) for at least an hour before bed. The blue light can interfere with melatonin production, the hormone that controls sleep.

4. Manage Stress

Chronic stress can have a real, physical impact on your body.

- Mindfulness and Meditation: Even 5-10 minutes of quiet reflection a day can lower cortisol levels.

- Connect with Nature: Spending time outdoors has been proven to reduce stress and improve mood.

- Maintain Social Connections: Strong relationships with friends and family are a powerful buffer against stress.

Taking these steps can empower you, improve your quality of life, and potentially reduce your long-term healthcare needs.

Frequently Asked Questions (FAQ)

Here are answers to some of the most common questions about private medical insurance in the UK.

1. Is private medical insurance worth it in the UK? For many, yes. Given the extensive NHS waiting lists for diagnosis and treatment in 2025, private medical insurance is increasingly seen as a vital tool to protect your health, income, and career. It provides a pathway to prompt medical care for eligible acute conditions, offering peace of mind and control over your health journey.

2. How much does private health cover cost per month? The cost of private health cover varies significantly based on your age, location, the level of cover you choose, and your medical history. Basic policies can start from as little as £30-£40 per month for a young, healthy individual, while comprehensive plans for older individuals or families will be higher. An independent broker like WeCovr can provide personalised quotes from across the market to find the best value.

3. Does private medical insurance cover pre-existing conditions? No, standard UK private medical insurance does not cover pre-existing or chronic conditions. It is designed to cover new, acute conditions that arise after the policy starts. Insurers use either moratorium or full medical underwriting to exclude conditions you have had in the recent past, which is why it's crucial to get cover when you are healthy.

4. Can I use PMI to see a specialist faster? Absolutely. This is one of the core benefits of PMI. If your GP refers you for a non-emergency issue, you can use your PMI policy to see a private specialist, often within days or weeks, instead of waiting months on the NHS. This accelerates the entire process from diagnosis to treatment.

5. What is the difference between using a broker and going directly to an insurer? Going direct means you only see one company's products. Using an independent broker like WeCovr gives you an expert, impartial overview of the entire market. A broker works for you, not the insurer, to find the most suitable policy at a competitive price, saving you time and potentially money. The service is typically free for the customer.

The evidence is clear: waiting for healthcare carries a profound and often hidden cost. It can jeopardise your financial stability, stall your career, and allow your health to decline.

You have a choice. You can take proactive control of your health and financial future. A private medical insurance policy is your personal pathway to rapid diagnosis and treatment, ensuring that a health issue remains just that—a health issue—and not a lifetime crisis.

Don't let a waiting list dictate your future. Contact WeCovr today for a free, no-obligation quote and discover how affordable your peace of mind can be.

Related guides

Why private medical insurance and how does it work?

What is Private Medical Insurance?

Private medical insurance (PMI) is a type of health insurance that provides access to private healthcare services in the UK. It covers the cost of private medical treatment, allowing you to bypass NHS waiting lists and receive faster, more convenient care.How does it work?

Private medical insurance works by paying for your private healthcare costs. When you need treatment, you can choose to go private and your insurance will cover the costs, subject to your policy terms and conditions. This can include:• Private consultations with specialists

• Private hospital treatment and surgery

• Diagnostic tests and scans

• Physiotherapy and rehabilitation

• Mental health treatment

Your premium depends on factors like your age, health, occupation, and the level of cover you choose. Most policies offer different levels of cover, from basic to comprehensive, allowing you to tailor the policy to your needs and budget.

Questions to ask yourself regarding private medical insurance

Just ask yourself:👉 Are you concerned about NHS waiting times for treatment?

👉 Would you prefer to choose your own consultant and hospital?

👉 Do you want faster access to diagnostic tests and scans?

👉 Would you like private hospital accommodation and better food?

👉 Do you want to avoid the stress of NHS waiting lists?

Many people don't realise that private medical insurance is more affordable than they think, especially when you consider the value of faster treatment and better facilities. A great insurance policy can provide peace of mind and ensure you receive the care you need when you need it.

Benefits offered by private medical insurance

Private medical insurance provides numerous benefits that can significantly improve your healthcare experience and outcomes:Faster Access to Treatment

One of the biggest advantages is avoiding NHS waiting lists. While the NHS provides excellent care, waiting times can be lengthy. With private medical insurance, you can often receive treatment within days or weeks rather than months.

Choice of Consultant and Hospital

You can choose your preferred consultant and hospital, giving you more control over your healthcare journey. This is particularly important for complex treatments where you want a specific specialist.

Better Facilities and Accommodation

Private hospitals typically offer superior facilities, including private rooms, better food, and more comfortable surroundings. This can make your recovery more pleasant and potentially faster.

Advanced Treatments

Private medical insurance often covers treatments and medications not available on the NHS, giving you access to the latest medical advances and technologies.

Mental Health Support

Many policies include comprehensive mental health coverage, providing faster access to therapy and psychiatric care when needed.

Tax Benefits for Business Owners

If you're self-employed or a business owner, private medical insurance premiums can be tax-deductible, making it a cost-effective way to protect your health and your business.

Peace of Mind

Knowing you have access to private healthcare when you need it provides invaluable peace of mind, especially for those with ongoing health conditions or concerns about NHS capacity.

Private medical insurance is particularly valuable for those who want to take control of their healthcare journey and ensure they receive the best possible treatment when they need it most.

Important Fact!

We can look at a more suitable option mid-term!

Why is it important to get private medical insurance early?

👉 Many people are very thankful that they had their private medical insurance cover in place before running into some serious health issues. Private medical insurance is as important as life insurance for protecting your family's finances.👉 We insure our cars, houses, and even our phones! Yet our health is the most precious thing we have.

Easily one of the most important insurance purchases an individual or family can make in their lifetime, the decision to buy private medical insurance can be made much simpler with the help of FCA-authorised advisers. They are the specialists who do the searching and analysis helping people choose between various types of private medical insurance policies available in the market, including different levels of cover and policy types most suitable to the client's individual circumstances.

It certainly won't do any harm if you speak with one of our experienced insurance experts who are passionate about advising people on financial matters related to private medical insurance and are keen to provide you with a free consultation.

You can discuss with them in detail what affordable private medical insurance plan for the necessary peace of mind they would recommend! WeCovr works with some of the best advisers in the market.

By tapping the button below, you can book a free call with them in less than 30 seconds right now:

Our Group Is Proud To Have Issued 900,000+ Policies!

We've established collaboration agreements with leading insurance groups to create tailored coverage

How It Works

1. Complete a brief form

2. Our experts analyse your information and find you best quotes

3. Enjoy your protection!

Any questions?

Learn more

Who Are WeCovr?

WeCovr is an insurance specialist for people valuing their peace of mind and a great service.👍 WeCovr will help you get your private medical insurance, life insurance, critical illness insurance and others in no time thanks to our wonderful super-friendly experts ready to assist you every step of the way.

Just a quick and simple form and an easy conversation with one of our experts and your valuable insurance policy is in place for that needed peace of mind!