Overview of Private Health Insurance Topics

Overview of Private Health Insurance Topics

Private health insurance offers an alternative to the NHS in the UK, providing individuals with quicker access to medical care and additional healthcare options. The cost of private health insurance varies significantly based on several factors, including age, lifestyle choices, family composition, and location. Here, we break down the key factors influencing these costs and provide insights into typical premium ranges.

Average Cost Overview

According to data from the Association of British Insurers, approximately 1.6 million households in the UK have private health insurance. The average cost for an individual private health insurance plan stands at around £90 per month or £1,080 per year. However, this figure is subject to change based on individual circumstances.

Factors Affecting Private Health Insurance Costs

- Age: Age is a primary determinant of private health insurance premiums. Generally, older individuals are more likely to require medical care, making them riskier to insure. For instance, a 30-year-old non-smoker might pay around £42 per month for mid-tier coverage, whereas a 70-year-old could pay upwards of £160 per month for a similar plan.

- Family Composition: Family plans often provide better value than individual plans. Adding partners and children to a policy can result in reduced premiums per person compared to separate individual plans.

- Lifestyle Choices: Certain lifestyle choices, such as smoking, can impact insurance costs. Smokers typically face higher premiums due to increased health risks associated with smoking.

- Location: Private health insurance costs can vary based on geographical location. For example, premiums tend to be higher in densely populated areas like London, where healthcare costs are generally higher.

Age and Insurance Costs

Age plays a significant role in determining private health insurance premiums. As individuals grow older, insurers perceive them as higher risk due to potential health issues. Here's a breakdown of average monthly costs for different age groups (based on a mid-tier plan with a £500 excess):

- 30 years old: £42 per month

- 50 years old: £70 per month

- 70 years old: £160 per month

Family and Insurance Costs

Family plans offer cost-effective options for healthcare coverage. Adding family members to a policy can reduce the overall premium per person. Here are average monthly costs based on family composition (mid-tier plan with £500 excess):

- Couple: £80 per month

- Couple + 1 child (5yrs): £95 per month

- Couple + 2 children (5 + 10 yrs): £105 per month

Lifestyle and Insurance Costs

Lifestyle choices like smoking can influence insurance costs due to associated health risks. Here's a comparison of average monthly premiums for non-smokers and smokers (mid-tier plan with £500 excess):

- 30 years old: Non-Smoker - £42, Smoker - £44

- 50 years old: Non-Smoker - £70, Smoker - £72

- 70 years old: Non-Smoker - £160, Smoker - £165

Location and Insurance Costs

Private health insurance costs can vary by region in the UK. Here's an overview of average monthly premiums for a 30-year-old single person across different regions (mid-tier plan with £500 excess):

- North East England: £36

- Scotland: £38

- South West England: £38

- London: £50

Conclusion

Private health insurance costs in the UK are influenced by various factors including age, family composition, lifestyle choices, and location. While older individuals and smokers typically face higher premiums, family plans and healthier lifestyles can lead to more affordable coverage. It's important to compare quotes from multiple insurers to find a plan that suits individual needs and budgets.

Methodology

The data presented here is based on research conducted by comparing quotes from leading health insurance providers in the UK. The analysis focused on mid-tier plans with a £500 excess, standardising variables to provide average costs for different scenarios. Individual circumstances and changing premium calculations by insurers over time may result in higher or lower premiums than those indicated here, highlighting the importance of personalised quotes for accurate cost estimation.

For a more accurate and tailored analysis, individuals are encouraged to seek advice from experienced advisers, such as those working with reputable insurance brokers like WeCovr. Tap the button below for easy access.

Is It Worth Paying More for Private Health Insurance? Expert Insights from WeCovr

At WeCovr, we understand that selecting the right private health insurance policy is a crucial decision that can significantly impact your overall well-being and financial stability. While a basic plan offers valuable benefits, there are instances where paying a bit more for additional coverage can provide you with enhanced protection and peace of mind. In this comprehensive guide, we'll explore the optional extras available and help you determine when it might be worth investing in a more comprehensive policy.

How Does Private Health Insurance Work?

Before delving into the optional extras, let's briefly revisit how private health insurance operates. Private health insurance grants you access to private medical treatment for acute conditions that arise after you have purchased your policy. You can choose from a range of coverage levels, from a basic "treatment only" plan to more comprehensive options with additional benefits.

Once you've selected your desired policy and paid the agreed-upon premiums, you can easily claim for eligible treatments and medical expenses. Your insurer will provide you with a network of private healthcare facilities where you can receive prompt treatment from experienced medical professionals.

What Does a Basic Plan Cover?

A basic private health insurance policy, also known as a "treatment only" plan, typically includes the following core coverage:

- In-patient and Day-patient Treatment: This covers the costs associated with hospital stays or day-case procedures, such as surgery, at private healthcare facilities.

- Cancer Treatment: Most basic plans include coverage for cancer treatments like surgery, chemotherapy, and radiotherapy.

- Limited Out-patient Care: While comprehensive out-patient treatment is often an optional extra, many policies now include limited out-patient coverage, such as certain surgeries, tests, or scans.

- Mental Health Support: Basic mental health coverage usually provides access to a limited number of counselling or cognitive behavioural therapy (CBT) sessions.

- Virtual GP Appointments: Many insurers offer 24/7 access to virtual GP services, allowing you to book video or telephone consultations at your convenience.

- Health Advice Services: Telephone helplines staffed by medical professionals, such as nurses or pharmacists, are commonly included to provide general health advice.

- Member Perks and Discounts: Most providers offer rewards programmes with perks like discounts on gym memberships, cinema tickets, or holidays to incentivise healthy living.

While a basic plan provides a solid foundation, there are instances where adding optional extras can significantly enhance your coverage and offer greater value for your investment.

What Optional Extras Are Available?

When you opt for a more comprehensive private health insurance policy, you can typically choose from the following optional extras:

- Full Out-patient Treatment: This covers a broader range of out-patient treatments, including consultations, diagnostic tests, and various procedures that don't require hospitalisation.

- Therapies Cover: Separate coverage for physical therapies like physiotherapy, osteopathy, chiropractic care, and sometimes alternative therapies like acupuncture or homeopathy.

- Enhanced Mental Health Treatment: Additional coverage for a wider range of mental health treatments, including more counselling sessions and in-patient or out-patient psychiatric care.

- Dental and Optical Cover: This optional extra can help offset the costs of routine dental check-ups, eye tests, glasses, contact lenses, and certain dental treatments.

- Extended Hospital List: Choosing an extended hospital list gives you access to a broader network of private healthcare facilities, including those in major cities or central London, where treatment costs are typically higher.

- Additional Services for Group Policies: If you opt for a group policy for your business, your insurer may provide additional services to support employee health management, such as educational materials, well-being programmes, and absence management tools.

When Might You Need Optional Extras?

While the decision to add optional extras ultimately depends on your individual circumstances and priorities, here are some situations where investing in a more comprehensive policy may be beneficial:

- If You Require Regular Out-patient Treatment: If you frequently need out-patient treatments, such as physiotherapy or consultations with specialists, adding full out-patient coverage can save you significant costs in the long run.

- If You Live in a Major City or Central London: Opting for an extended hospital list can ensure you have access to convenient private healthcare facilities near your home or workplace, without incurring additional travel costs.

- If You Already Pay for Dental or Optical Care: If you routinely pay for private dental or optical care, adding dental and optical coverage to your policy can help offset these expenses and potentially save you money.

- If You Have a Stressful Job or Lifestyle: For individuals in high-stress environments or with demanding lifestyles, enhanced mental health coverage can provide access to a broader range of therapies and treatment options.

- If You Engage in Certain Hobbies or Activities: If you participate in active hobbies or sports that increase your risk of injury, therapies cover or additional treatment sessions can be invaluable for prompt recovery and rehabilitation.

- If You Value Preventative Care and Well-being Support: Some insurers offer additional well-being services, such as health screenings, fitness programmes, or mental health support, which can be particularly beneficial for those prioritising preventative care.

Conditions Your Private Health Insurance Won't Cover

It's important to note that even with a comprehensive policy, there are certain conditions and treatments that private health insurance typically does not cover. These exclusions may vary among insurers, but some common exceptions include:

- Chronic Illnesses: Private health insurance is designed to cover acute conditions that can be treated with a defined course of treatment. Ongoing management of chronic illnesses like asthma, diabetes, or high blood pressure is generally not covered.

- Pre-existing Conditions: Most policies exclude pre-existing conditions, which are illnesses or conditions for which you sought medical advice or treatment within a specified period (typically five years) before purchasing the policy. However, some insurers may add coverage for these conditions after a symptom-free period.

- Cosmetic and Weight Loss Treatments: Procedures primarily aimed at improving appearance or facilitating weight loss are typically excluded from coverage.

- Addiction Treatment: While some policies may include limited coverage for addiction treatment, many insurers exclude it as a standard exclusion.

- Emergency or Accident Treatment: Private health insurance is designed for planned, non-emergency medical treatment. Emergency or accident-related care should be sought through the National Health Service (NHS).

- Pregnancy and Childbirth: Routine pregnancy and childbirth are often excluded from standard policies, although some insurers may offer additional maternity cover as an optional extra.

- Developmental or Behavioural Conditions: Treatments related to conditions like autism, ADHD, or dyslexia are usually not covered under standard private health insurance policies.

It's crucial to carefully review the policy documentation and discuss any specific exclusions or limitations with your WeCovr broker to ensure you have a clear understanding of what your coverage entails.

Factors That Influence Your Health Insurance Cost

While the level of coverage you choose is a significant factor in determining the cost of your private health insurance premiums, several other factors also play a role:

- Age: Premiums typically increase with age due to the higher risk of developing health conditions.

- Location: Insurers consider the cost of private healthcare in your area, with premiums often being higher in major cities or locations with higher treatment costs.

- Smoking and Lifestyle Factors: Smokers and individuals engaged in high-risk activities or occupations may face higher premiums due to increased health risks.

- Claims History: If you're transferring from a previous health insurance policy, your insurer may consider your claims history, with fewer claims often resulting in lower premiums.

- Number of Claims Paid by the Insurer: The overall claims experience of an insurance provider can impact the premiums they charge, as they aim to balance payouts with premium income.

- Underwriting Method: The type of underwriting method used (e.g., full medical underwriting, moratorium underwriting, or medical history disregarded) can influence the cost of your policy.

By working closely with a WeCovr broker, you can navigate these factors and find a policy that provides optimal coverage at a reasonable cost tailored to your specific circumstances.

Get Expert Guidance from WeCovr

At WeCovr, we understand that choosing the right private health insurance policy is a significant decision that requires careful consideration. Our team of experienced brokers is dedicated to providing personalized guidance and helping you navigate the complexities of private health insurance.

We'll work closely with you to understand your unique needs, assess your risk factors, and compare policies from leading insurers to find the best solution that balances comprehensive coverage with affordability. Our brokers don't charge any fees for their services, ensuring you receive unbiased advice and the most competitive pricing available.

Contact us today to schedule a consultation and take the first step towards securing the private health insurance coverage that best suits your circumstances. With our expert guidance, you can make an informed decision and enjoy the peace of mind that comes with knowing you and your loved ones are protected.

Illustration: Factors Affecting the Cost of Private Health Insurance

[An illustration depicting a thoughtful-looking man examining a calculator. The text on the illustration reads: "What affects the cost of your private health insurance: Your age, Where you live, Your lifestyle, Medical history, Level of cover you choose."]

The cost of your private health insurance premiums is influenced by several factors beyond just the level of coverage you choose. As the illustration highlights, key determinants include your age, location, lifestyle choices, pre-existing medical conditions, and the specific benefits and extras included in your policy.

At WeCovr, our brokers have extensive knowledge and experience in evaluating these factors to help you find a policy that provides comprehensive coverage while remaining cost-effective for your unique circumstances.

Get the Right Coverage at the Right Price with WeCovr

Investing in private health insurance is a proactive step towards safeguarding your well-being and ensuring access to prompt, high-quality medical care when you need it most. While a basic plan provides essential coverage, there are instances where paying a bit more for optional extras can significantly enhance your protection and deliver greater value for your investment.

At WeCovr, we are committed to helping you navigate the complexities of private health insurance and finding the perfect policy that aligns with your needs, priorities, and budget. Our expert brokers will guide you through the available options, explain the benefits and limitations of each coverage level, and provide tailored recommendations based on your unique circumstances.

Don't leave your health to chance. Contact WeCovr today and take the first step towards securing comprehensive private health insurance coverage that gives you the peace of mind you deserve.

Disclaimer: The information provided in this guide is general in nature and should not be considered a substitute for professional advice. Your specific needs and circumstances may vary, and it is essential to consult with a qualified insurance broker or conduct your own research before making any decisions regarding private health insurance coverage.

Comparing NHS and Private Healthcare in the UK

The choice between using the National Health Service (NHS) or private healthcare in the UK involves considerations beyond just financial aspects. This guide aims to elucidate the differences between NHS and private healthcare, helping individuals make informed decisions about their healthcare options.

NHS vs Private Healthcare Waiting Times

Booking appointments with NHS general practitioners (GPs) typically results in waiting periods ranging from a few weeks to up to 18 weeks, depending on the GP practice's workload. While the NHS strives to meet targets for shorter wait times, it may face challenges, particularly for routine procedures like hip replacements. However, for critical issues such as cardiac bypasses, the NHS usually delivers timely and high-quality interventions.

Private health insurance plans often offer access to virtual GPs and expedited appointments with private GPs, enabling faster treatment initiation compared to the NHS.

Comfort in NHS vs Private Healthcare

While the quality of medical treatment remains consistent across NHS and private healthcare, private facilities often provide more comfortable and modern amenities. Private healthcare settings may offer hotel-like facilities, including private accommodation, ensuite bathrooms, and enhanced food options. Patients in private facilities also enjoy fewer restrictions on visiting hours and are more likely to be attended to by the same consultant throughout their treatment.

In contrast, NHS facilities may offer shared amenities, limited visiting hours, and consultations with members of the consultant's team rather than the consultant directly.

Choice of Hospital, Treatment, and Location

Private healthcare offers patients the flexibility to choose their hospital, treatment options, and treatment timing at their convenience. Private consultations typically occur within a week of GP referral, with tests arranged promptly. Conversely, NHS patients may encounter limited hospital choices and face longer waiting lists to see specialists.

NHS vs Private Treatment and Drugs

Private healthcare may offer access to niche drugs that the NHS does not cover due to cost considerations. However, treatment options available through private health insurance depend on the chosen coverage level and benefits. Some complex treatments may only be available through the NHS.

Cost of Private Healthcare vs the NHS

While the NHS provides free treatment to UK residents, private healthcare options include self-payment or using private medical insurance plans. Private health insurance allows for customisation of coverage based on individual needs, with options to adjust excess amounts and payment frequencies to manage costs effectively.

Mixing NHS Treatment and Private Treatment

Private healthcare should complement rather than replace NHS services. NHS remains the primary provider for Accident & Emergency (A&E) services, chronic conditions, and pediatric care. Patients can use private health insurance for additional treatments while retaining access to NHS healthcare.

NHS Patients Requesting Treatment in Private Hospitals

NHS patients have the option to request medical treatment in private hospitals through initiatives like Patient Choices. While NHS GPs may refer patients to NHS consultants, individuals have the right to choose their treatment location, potentially accessing NHS-funded operations in private hospitals.

When is Private Health Insurance Worth It?

Is private health insurance worth it?

Record numbers of people are paying for private healthcare amid frustration at NHS waiting lists and difficulty accessing care. Across the UK last year 272,000 people self-funded an operation or diagnostic procedure at a private hospital – a third more than the year before the pandemic, according to figures from the Private Healthcare Information Network (PHIN). Over double that figure had their treatment paid for using a private medical insurance policy.

What is private health insurance?

Private health insurance offers swift access to private healthcare services, from assessments and diagnosis to treatment and aftercare. It provides the flexibility to choose specialists and may cover mental health support in addition to physical health services.

What does private health insurance cover?

Comprehensive private health insurance typically covers private consultations with specialists, in-patient treatment including surgery, out-patient services such as scans and tests, and physiotherapy. However, it often excludes emergency treatment, maternity care, and chronic conditions like arthritis or diabetes treatment.

Does private healthcare cover pre-existing medical conditions?

Pre-existing medical conditions are usually not covered by private health insurance policies. However, some employer-sponsored schemes may provide cover for pre-existing conditions.

How much does private healthcare cost?

Private healthcare costs can be substantial, with procedures like hip replacement costing thousands of pounds. Private health insurance premiums average around £1,500 per year, varying based on factors such as age, location, and chosen level of cover.

Do I need private health insurance?

The decision to purchase private health insurance depends on individual needs and preferences. Factors to consider include concerns about NHS waiting lists, the affordability of private healthcare, and employment status.

How to choose a private healthcare plan?

Private health insurance can be purchased directly from providers or through comparison websites or brokers. It's essential to evaluate different plans based on coverage, cost, and suitability to find the best option.

Is private health insurance worth it?

Ultimately, the value of private health insurance depends on factors such as concerns about NHS services, waiting times, and personal financial circumstances. While it can offer peace of mind and quicker access to healthcare, individuals should weigh the costs against potential benefits and consider alternative insurance options like critical illness or life insurance.

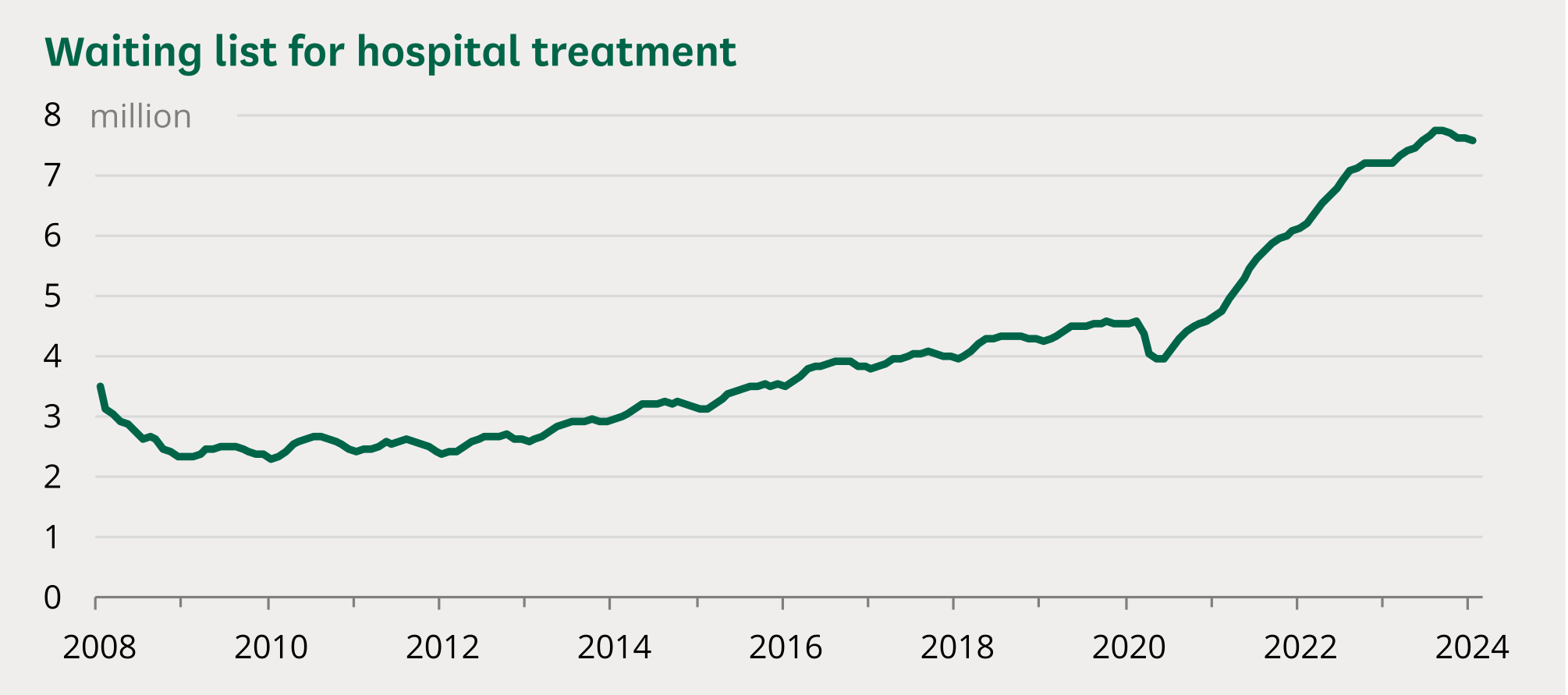

New Statistics Reveal NHS Waiting Times are Longer than Expected

A recent report from the Office for National Statistics (ONS) and the NHS has uncovered that waiting lists for appointments, tests, and treatments within the NHS are significantly longer than previously thought, affecting millions of people across the country.

Key Findings

- 9.7 million individuals are waiting for NHS treatment.

- 1.4 million people have waited over a year for an appointment.

- 7 million are currently awaiting NHS appointments.

- 1 in 5 people in England are on a waiting list.

- 5 million individuals find it difficult to get a GP appointment.

- 670,000 people have been waiting for over 18 months.

How Long Waiting Times Can Impact Us

Long waiting times for crucial medical appointments can have serious effects on individuals:

- Worsening Conditions: Delayed diagnosis and treatment can lead to the worsening of injuries and illnesses.

- Emotional Stress: Uncertainty about appointment times and worsening conditions can cause emotional stress.

- Quality of Life: Living in pain or restricted by health issues can negatively impact one's quality of life.

Exploring Healthcare Options

Considering these statistics, private healthcare can offer quicker and more reassuring options compared to the NHS. Private medical insurance (PMI) is often more accessible and affordable than perceived.

Benefits of Private Healthcare:

- Almost instant access to GPs and specialists.

- No long waiting lists for diagnostic tests and treatments.

- Encourages healthier lifestyles.

Private health insurance is increasingly becoming a choice for many, with 820,000 day cases and inpatients treated privately in 2022, indicating a growing demand for private healthcare.

What's Next?

Private medical insurance is more affordable and accessible than expected, fitting into many individuals' plans better than anticipated. Considering health insurance is essential, especially with extended waiting times within the NHS.

Steps to Consider:

- Prioritise Your Needs: Think about what's important to you regarding healthcare.

- Consultation: Speak with insurance experts to explore suitable options tailored to your needs.

Understanding How Claiming Affects Your Private Healthcare Policy

As a policyholder, one of the primary concerns when it comes to private healthcare insurance is how making claims can impact your premiums and the associated benefits. At WeCovr, we believe in empowering our clients with comprehensive knowledge, enabling them to make informed decisions about their healthcare coverage. In this guide, we'll delve into the intricacies of how claiming on your private healthcare policy affects your no claims discount (NCD) and premium.

What is a No Claims Discount?

A no claims discount (NCD) is a concept familiar to many in the context of car insurance. Essentially, if you don't make any claims during a policy term, you'll be offered a discount on your premium at the subsequent renewal. Conversely, if you do make a claim, your premiums may increase, or your NCD may be removed due to the perceived higher risk.

For private healthcare policies, the NCD functions similarly but with a distinct approach. Instead of starting at a 0% discount like in motor insurance, new policyholders typically receive a higher percentage discount on their base premium. This initial discount serves as an incentive to maintain a healthy lifestyle and avoid unnecessary claims.

How Does the NCD Work for Private Healthcare Policies?

Most private healthcare insurers employ a discount scale to reflect the increase or decrease in your premium based on the total claims you've made in a single policy year. This scale typically ranges from 0% to a maximum discount cap, which varies among providers.

For instance, Aviva's Healthier Solutions policies offer a 14-level NCD scale, with new starters typically receiving a 69% discount on their base premium. This discount can increase up to a maximum of 75% for subsequent claim-free years or decrease depending on the claims made during the policy term.

Benefits of the No Claims Discount

The NCD system in private healthcare policies offers several benefits:

- Cost Savings: By maintaining a claim-free record, you can enjoy discounted premiums, making your healthcare coverage more affordable.

- Healthy Lifestyle Incentive: The NCD encourages policyholders to lead a healthy lifestyle and take preventative measures, as this can help avoid claims and maintain their discount levels.

- Access to Healthcare: Even with a higher premium due to claims, you still have access to private medical care when needed, providing peace of mind and timely treatment.

Protecting Your No Claims Discount

Many insurers offer the option to protect your NCD, typically as an optional extra. This feature allows you to claim on your policy while maintaining your current NCD level and premium cost. Without this protection, making a claim would likely cause you to drop down the NCD scale, resulting in a higher premium at the next renewal.

It's important to note that if you make a claim while your NCD is protected, you may lose the protection, and your NCD will be subject to the standard rules at the subsequent renewal. However, if you remain claim-free for the next policy year, you may be eligible to protect your discount again.

Claims That Don't Affect Your NCD Level

Insurers typically have a list of policy benefits or claim types that won't impact your NCD level. These exceptions can vary among providers, but they often include benefits such as NHS cash benefits, dental and optical cover, and certain therapy or treatment options.

It's essential to review your policy documents and consult with your insurer or broker to understand which claims may or may not affect your NCD level.

The Role of Policy Excesses

When selecting a private healthcare policy, you may have the option to choose a policy excess. An excess is the amount you agree to contribute towards the cost of your treatment, potentially lowering your premium.

Regarding your NCD, most insurers only consider claims where they have to pay out. If your claim amount is equal to or lower than your chosen excess, your NCD level will typically remain unaffected. However, if your claim exceeds the excess amount, and your insurer contributes to the cost, your NCD level may drop accordingly.

Variations Among Insurers

While the concept of NCD is relatively consistent across leading private healthcare insurers, there are nuances and variations worth considering:

- Discount Levels: Insurers offer different NCD scales, with varying maximum discount caps and starting discount levels for new policyholders.

- Claims Cost Thresholds: Some insurers operate on a "per total claims cost" model, where your NCD level is impacted based on the total claims paid out in a policy year. The thresholds for moving up or down the NCD scale can differ among providers.

- NCD Protection Options: The availability and terms of NCD protection may vary, with some insurers offering more comprehensive or flexible options than others.

- Claim Types Affecting NCD: The specific policy benefits or claim types that impact your NCD level can differ among insurers, so it's essential to review your policy documents carefully.

At WeCovr, our experienced brokers stay up-to-date with the latest developments and nuances across various insurers, ensuring that you receive accurate and tailored guidance when selecting a private healthcare policy.

Making an Informed Decision

When considering a private healthcare policy, it's crucial to understand how claiming may affect your premiums and associated benefits. By working with our knowledgeable brokers at WeCovr, you can gain a comprehensive understanding of the NCD systems employed by different insurers, as well as their specific rules and variations.

Our brokers will take the time to assess your individual circumstances, medical history, and preferences, providing personalized recommendations that align with your needs and long-term financial goals. We'll guide you through the process of selecting a policy that offers the right balance between coverage, affordability, and the potential impact of claims on your premiums.

Don't navigate the complexities of private healthcare insurance alone. Contact WeCovr today and leverage our expertise to make an informed decision that safeguards your well-being while minimising the financial implications of claims on your policy.

Conclusion

Navigating the intricacies of no claims discounts and how claiming affects your private healthcare policy can be a daunting task. At WeCovr, we are committed to empowering our clients with comprehensive knowledge and personalized guidance.

Our team of experienced brokers will break down the complexities of NCD systems, policy excesses, and the nuances among different insurers. We'll work closely with you to understand your unique circumstances and provide tailored recommendations that align with your healthcare needs and financial goals.

By partnering with WeCovr, you can make informed decisions about your private healthcare coverage, ensuring that you have access to quality medical care while minimising the potential impact of claims on your premiums and benefits.

Contact us today and take the first step towards a seamless and stress-free private healthcare experience.

Physiotherapy Cover and Benefits

Introduction

Physiotherapy plays a crucial role in the recovery process after serious surgeries such as hip replacement surgery and others, aiding in building strength, mobility, and reducing pain. Private health insurance offers several benefits for accessing physiotherapy, providing flexibility and reduced waiting times compared to NHS services.

Benefits of Private Physiotherapy

Flexibility

- Choose local and convenient locations for treatment.

- Select appointment times that suit your schedule.

Reduced Waiting Times

- NHS waiting times for physiotherapy can exceed 13 weeks.

- Private physiotherapy offers quick turnaround times, often with appointments available promptly after claim approval.

Skipping GP Referrals

- Many insurers allow direct access to physiotherapy without a GP referral.

Frequency of Treatment

- Determine the frequency of sessions that best meet your recovery needs.

- Avoid gaps between appointments experienced with NHS services.

Additional Policy Benefits

- Access to core insurance benefits like cancer cover, digital GP services, and mental health support.

Typical Physiotherapy After Hip Replacement

- NHS usually offers up to two physiotherapy sessions post-hip replacement.

- Private physiotherapy includes a range of exercises to enhance hip mobility and muscle strength.

Examples of Exercises:

- Strengthening exercises like knee bends.

- Stretching exercises to improve hip flexibility.

- Balance training and gait support.

Cost Considerations

Pay-As-You-Go Sessions

- Average pay-as-you-go physiotherapy sessions range from £60 to £200.

- Private health insurance premiums are often comparable to or less than the cost of a few sessions, including core cover benefits.

Physiotherapy Coverage by Top Insurers

Examples of Coverage:

- AXA Health: Physiotherapy included under inpatient cover with optional therapies cover.

- Bupa: Outpatient physiotherapy covered under comprehensive cover with various limit options.

- The Exeter: Core cover includes post-operative outpatient physiotherapy.

- Vitality: Core cover provides up to six sessions, with an option for additional out-of-network sessions.

Benefits Beyond Physiotherapy

- Leading insurers offer a range of additional benefits like cancer cover, dental, optical, and mental health services.

Payment Options

- Premiums can be paid monthly or annually via direct debit, BACS, or cheque.

Frequently Asked Questions

Can I get cover for my pre-existing condition?

Long NHS waiting lists and cancelled or delayed procedures are a common motivation for initial enquiries into Health Insurance. Depending on the condition, it is unlikely it will be covered on your plan. However, different underwriting options may suit your needs. Speak to one of our expert advisors for personalised advice.

What is the difference between the NHS and Private Health Insurance?

As a nation, we are fortunate to have a publicly funded health service, giving everyone access to treatment at little to no cost. Due to increasing pressure on the NHS, many people now face long waiting lists and delayed or cancelled treatment. With private health insurance, you will not face long waiting lists for treatment; in fact, you are likely to be seen within a week or so. Health insurance offers you access to a choice of hospitals and treatment times that suit you, with overnight stays often in a private room.

Conclusion

Private health insurance offers comprehensive physiotherapy benefits, ensuring timely access to treatment and additional coverage for various health needs. Contact WeCovr today for personalised advice and a free, no-obligation quote.

Comprehensive Private Health Insurance Solutions for High-Net-Worth Individuals

Are you an affluent individual in search of a comprehensive private health insurance policy to protect your standard of living? At WeCovr, a customer-centric insurance broking firm, we understand that your financial resources grant you access to top-tier health services. Our seasoned brokers are committed to assisting you in navigating the complexities of private health insurance and securing a bespoke policy that caters to your unique requirements.

Exploring the Value: Why Opting for a New Insurance Policy Makes Sense

Even if you currently possess health insurance, there are compelling reasons to explore alternative options. As your circumstances evolve, your coverage needs may change, and you might discover superior options elsewhere. Here are three scenarios where reviewing your insurance might be judicious:

- Transitioning from a Company Scheme: If you currently benefit from a company health insurance policy, leaving your current job or retiring could mean losing those benefits. Group health insurance plans are typically available only to businesses and offer advantages like medical history disregarded underwriting, which is one of the more expensive underwriting options. It’s unlikely that you’ll be able to retain your existing insurance, and even if you could, the premiums might be prohibitively high for an individual.

- Long-Term Relationship with Your Insurer: If you already have individual health insurance, you may be content with the service provided by your insurance company. However, as you age, your premiums will rise, and even affluent individuals may start feeling the impact. Reviewing your health insurance allows you to explore alternatives and potentially find coverage with similar benefits and services at a lower cost.

- No Previous Private Health Insurance: If you’ve always relied on the NHS for your healthcare, you might now be concerned about longer waiting lists. In such a situation, you may consider using your financial resources to access private healthcare for yourself and your family. Our brokers can assist you in navigating the process of finding suitable coverage.

Factors Influencing Health Insurance Costs

If you’re new to individual health insurance, you might wonder what influences the cost of your premiums. While each insurance company has its unique approach, here are some common factors they take into account:

- Personal Circumstances:

- Age: As you age, the risk of health issues increases, leading to higher premium costs.

- Location: Where you reside can impact the cost, although some insurers’ quotes aren’t tied to specific postcodes.

- Claims History: Insurers examine your claims history if you already have health insurance. If not, they may review your medical history based on the chosen underwriting approach.

- Insurance Options:

- Coverage Selection: Different health insurance policies offer varying benefits and services, allowing customisation to your specific needs. Your coverage choices directly influence the insurance cost.

- Payment Frequency: You can opt to pay premiums monthly, quarterly, or annually. Insurers often provide discounts to customers who pay annually.

- Family Coverage: Including your family in your policy grants them access to private healthcare benefits. Some insurers offer discounts for couples or families, while others include children at no extra cost.

Maximising Health Insurance Benefits

As a financially well-off individual, you have the advantage of investing in more comprehensive health coverage and a wider range of services. Here are some strategies to leverage your wealth and enhance your insurance coverage.

- Choose Unlimited Access to Consultants: A key benefit of health insurance is the ability to select your consultant and receive prompt care. However, unlimited access to private doctors in the UK isn’t always guaranteed; you often need to request it explicitly.

- Introduction of “Guided Consultants”: In recent years, leading providers like Aviva, Axa, Bupa, The Exeter, and Vitality have introduced what they collectively refer to as “guided consultants.” Despite varying names, these consultants operate similarly. Essentially, you agree to access a smaller pool of pre-approved doctors in exchange for a premium reduction (usually around 20%).

- Balancing Budget and Choice: Guided consultants are a viable option for budget-conscious individuals or older policyholders facing high premiums. However, this compromise comes at the expense of one of health insurance’s primary benefits: choice. If your budget allows, we recommend opting for unlimited access to consultants. This ensures you can see any specialist in the UK promptly, which may not always be the case with guided consultants.

- Expanding Your Hospital Options: Each insurer maintains a standard list of hospitals where you can receive treatment. Some providers, such as WPA and The Exeter, offer an extensive hospital network. Others restrict treatments to their private hospitals and clinics. If you reside in a major city like London or Manchester, your local hospitals may be part of your insurer’s premium list, often featuring HCA hospitals known for their central locations and higher costs. it might be worth paying more if your local hospital is on a premium list, allowing you convenient access to it.

- Opt for Unlimited Outpatient Coverage: Outpatient coverage provides access to initial specialist consultations, diagnostic tests, and rehabilitation services, including outpatient physiotherapy. It also allows private healthcare access for non-urgent issues, bypassing long NHS wait times.

- Consider a Community-Rated Plan: Consider a community-rated plan, which doesn’t factor individual claims into premium calculations, benefiting affluent individuals with higher claim frequencies due to age or pre-existing conditions.

Underwriting Options

When transitioning from a group contract to an individual one, the underwriting options change. Group insurance policies typically use a medical history disregarded basis, which doesn’t consider individual medical histories. However, individual health insurance policies cover only conditions that arise after the policy is taken out and exclude pre-existing conditions. You’ll need to choose between two types of underwriting for your individual contract:

- Moratorium Underwriting: With this option, pre-existing conditions are not covered initially. However, after a specified waiting period (usually two to five years), coverage may be extended to those conditions if you remain symptom-free during that time.

- Full Medical History Underwriting: This option considers your complete medical history. It provides more comprehensive coverage but may come with higher premiums.

At WeCovr, as a dedicated insurance intermediary, we collaborate with a diverse group of insurers to ensure that our esteemed clients have access to the most comprehensive and tailored coverage options available in the UK. Our commitment lies in providing personalised solutions that meet the unique needs of each individual, and we take pride in our extensive network of insurance providers.

Top Recommendations for Affluent Individuals in the UK

Let’s delve into our top five recommendations for affluent individuals in the UK, considering their specific requirements and preferences:

- The Exeter: The Exeter distinguishes itself by offering flexible health plans that empower policyholders to customise their coverage. Whether you prioritise specific treatments, services, or wellness programs, The Exeter allows you to tailor your insurance to your unique needs. What sets them apart is their innovative approach to premium calculations. Unlike most insurers, The Exeter gives you a choice between two pricing models: Traditional No-Claim Discount and Community-Rated Scheme. Additionally, The Exeter is the only insurer that provides access to guided consultants, allowing you to seek expert advice when making healthcare decisions. Their commitment to flexibility extends to their benefits and discounts. As a policyholder, you’ll enjoy various perks, and if you wish to add your partner and children to your policy, you’ll receive discounts on premiums.

- Vitality: Vitality distinguishes itself among health insurers by its unwavering commitment to promoting a healthy lifestyle among its valued customers. If you lead an active life and can substantiate it, you’ll reap the rewards in the form of discounts on your premiums. But that’s not all—Vitality goes the extra mile by offering a range of discounts and benefits designed to support your overall well-being. Hospitalisation Coverage, Online GP Appointments, and 24/7 Medical Helpline are just a few of the perks you can expect with a Vitality policy.

- Bupa: Bupa’s flagship health insurance policy offers comprehensive coverage, making it an excellent choice for those seeking robust protection. Direct Access Service, Comprehensive Cancer Care Benefits, Superb Outpatient Cover, and Inclusion of Mental Health Care are some of the features that set Bupa apart. Moreover, Bupa doesn’t impose an upper age limit, allowing individuals up to 70 and 80 years old to secure insurance.

- Aviva: Aviva is a well-established insurance provider that offers comprehensive private health insurance policies. Their health insurance plans are designed to be flexible, allowing you to tailor your coverage to your specific needs. Aviva's private health insurance includes a range of benefits such as prompt access to specialists, diagnostic tests, and treatments. One standout feature of Aviva's health insurance is their 'MyHealthCounts' programme, which rewards policyholders for maintaining a healthy lifestyle. Additionally, Aviva offers a range of optional extras, such as mental health cover and global treatment options, enabling you to further customise your policy.

- AXA Health: AXA Health is another leading insurance provider in the UK, offering a range of private health insurance policies designed to cater to various needs. Their flagship health insurance product, 'Personal Health,' provides comprehensive cover, including in-patient and day-patient treatment, out-patient surgery, and full cancer cover. AXA Health also offers a range of additional benefits, such as access to their 24/7 online GP service, 'Doctor@Hand,' and their 'Heart and Cancer Pledge,' which promises to cover eligible heart and cancer treatment, even if it's not covered by your policy. Furthermore, AXA Health's 'Health@Hand' service provides policyholders with access to a team of nurses, midwives, counsellors, and pharmacists, available 24/7 for professional advice and support.

WeCovr’s Expert Guidance

At WeCovr, we understand that health insurance decisions can be overwhelming. Our experienced brokers:

- Personalised Approach: We take the time to understand your unique circumstances, including personal preferences and financial situation.

- Market Insights: With in-depth knowledge of the insurance market, we analyse available policies.

- Value for Money: Our goal is to identify the policy that offers the best value for your specific needs.

Beyond Selection, our services extend to Application Assistance and Ongoing Support. As your needs evolve, we’re here to review and adjust your coverage accordingly.

Reasons to Review Your Health Insurance Policy

- Nearing Retirement: If you’re approaching retirement, it’s prudent to review your health insurance. Consider the following scenarios:

- Leaving a Company Scheme: When leaving your job, you transition from a company scheme to an individual contract. Unfortunately, the same benefits you enjoyed under the group policy won’t automatically transfer. Reviewing your insurance ensures you maintain adequate coverage.

- Long-Term Insurer Relationship: If you’ve been with the same insurer for years, it’s essential to assess whether your current policy still aligns with your needs. Insurance requirements change over time, and your policy should adapt accordingly.

- Renewal Time: Regularly reviewing your insurance during renewal offers several advantages, including Cost Optimisation and Access to New Options.

- Health Coverage Upon Retirement:

- Employer Group Policies: Most employers provide group insurance policies for their employees. These policies often offer terms and benefits that individual policies lack.

- Limitations Post-Retirement: Unfortunately, you cannot retain your existing group coverage upon retirement due to Cost Considerations. Individual Policies offer flexibility but require Coverage Adjustments.

- Maximising Health Insurance Benefits: Budget Expansion allows you to enhance your health coverage through strategies like Unlimited Outpatient Cover and Consultant Access.

- Additional Services with Health Insurance: Beyond the core benefits, insurers offer supplementary services such as 24/7 Medical Helpline, Online GP Appointments, and Retail Discounts.

Remember that each individual’s situation is unique, so personalised advice is essential. At WeCovr, our experienced brokers guide you through this complex landscape, ensuring you make informed decisions tailored to your specific circumstances.

Private Healthcare in the UK

Your health is your most important asset. UK private health insurance allows you to protect your health and well-being by providing access to private healthcare and breakthrough treatments and medicines.

At WeCovr, we collaborate with market leaders in UK healthcare cover. Our expert advisers ensure a seamless process from start to finish. Our service is free of charge and unbiased — we simply find the best health insurance cover for your needs.

Individual Health Insurance

Is there anything more important than your health and well-being? Health insurance provides access to private healthcare, offering the latest treatments and medicines with minimal delay and superior comfort. We work with leading UK insurers to find the best quotes, allowing you to relax and enjoy peace of mind with the most cost-effective policy.

Business Health Insurance

Ensure your team stays healthy, happy, and productive with a Business Health Insurance policy. We collaborate with top UK insurers to provide the best quotes. Let us simplify finding the perfect bespoke quote for your company's unique requirements with expert advice.

Family Health Insurance

Protect your family's health with the best family health insurance quotes from leading UK insurers. Our expert advisers understand family life and are ready to assist you in finding the most suitable coverage.

Senior Health Insurance

Maintain your health during retirement with over 50s health insurance, covering private medical treatment for acute conditions when you're most likely to need it. Our advisers can find the most affordable and best policies to get you back to health quickly.

Child Health Insurance

Parenthood can be daunting, but health insurance provides peace of mind. Ensure your child has access to breakthrough treatments and medications when needed without waiting.

Doctor Health Insurance

As a medical professional, access to private treatments and checkups is crucial. Health insurance for doctors protects your health and well-being.

The Key Components of Your Private Medical Insurance Policy

A private medical insurance policy typically consists of two elements: core cover (standard) and added extras (enhanced cover). Our experts can guide you through the options and help you choose the best coverage for your needs.

Core Cover

- In-patient Cover: Hospital accommodation, specialist fees, diagnostic tests, scans, X-rays.

- Day-patient Cover: Admitted and discharged on the same day.

- Out-patient Cover: Consultations, diagnostic scans/tests, minor surgical procedures.

- Cancer Cover: Most policies include cancer cover.

- Digital GPs and Health Support: Access to digital GPs and telephone support.

Optional Extras

Enhance your cover with optional add-ons:

- Travel: Includes cover for medical emergencies while abroad.

- Dental: Cover for dental treatments.

- Optical: Cover for eye tests, glasses, or contact lenses.

- Mental Health: Diagnosis and treatment of mental health issues.

- Therapies: Cover for physiotherapy, osteopathy, chiropractic treatment, and other holistic therapies.

Why Compare Health & Life Insurance with Us?

At WeCovr, we help you compare prices and cover from leading UK health and life insurance companies such as Aviva, AXA, and Bupa. Our service is free, independent, and impartial.

Our expert advisers are ready to guide you through the process, ensuring you find the best and most cost-effective quote tailored to your needs.

Health Insurance Guide

Download our comprehensive guide to Private Medical Insurance (PMI) or speak directly to our friendly expert advisers for personalised assistance.

Health Insurance FAQs

Frequently Asked Questions

- What is private medical insurance?

- Can I still access the NHS with private health insurance?

- How much does health insurance cost?

- Can I reduce my premium?

- What are the different underwriting types?

- Am I covered on my holidays abroad?

- What is not covered by Private Health Insurance?

- Can I get cover for my pre-existing condition?

- Do I have to pay an excess when making a claim?

Our expert advisers are available to answer your questions and assist you in finding the right health insurance plan.

WeCovr offers comprehensive private healthcare solutions tailored to your needs. Contact us today for expert guidance and a free quote.

Private Medical Insurance for Company Directors: Your Guide from WeCovr

Introduction

At WeCovr, we understand the unique challenges faced by company directors and business owners. Your success heavily relies on your ability to remain in good health and work efficiently. That's why we're dedicated to providing comprehensive private medical insurance (PMI) solutions tailored to your specific needs.

As an insurance broking firm, our goal is to assist you in navigating the complexities of PMI and finding the best policy that suits your personal and professional circumstances. In this guide, we'll explore the benefits of PMI for company directors, how it works, the different types of coverage available, and the factors that influence the cost of your policy.

The Benefits of Private Medical Insurance for Company Directors

Avoiding NHS Waiting Times

One of the primary advantages of PMI is the ability to bypass long NHS waiting lists for non-emergency treatments. As a company director, time is of the essence, and any prolonged absence due to illness or injury can negatively impact your business operations. With PMI, you can access private healthcare facilities and receive treatment promptly, minimising the disruption to your professional commitments.

Flexibility and Choice

PMI provides you with greater flexibility and choice when it comes to your medical care. You'll have the option to select the hospital, specialist, and treatment dates that best suit your schedule. Additionally, many policies offer private en-suite rooms during your hospital stay, providing a more comfortable and relaxing environment for your recovery.

24/7 Access to Virtual GPs

Most PMI policies include access to a 24/7 virtual GP service, allowing you to seek medical advice and consultations at your convenience. This feature is particularly beneficial for busy company directors who may find it challenging to schedule appointments during regular business hours. With virtual GPs, you can address minor health concerns promptly and receive referrals for further treatment if necessary.

Preventative Care and Well-being Support

Many PMI providers recognise the importance of preventative care and offer well-being services as part of their policies. These services may include health screenings, fitness programmes, and mental health support. By prioritising your overall well-being, you can potentially reduce the risk of developing more serious health conditions and maintain optimal productivity.

How Does Private Medical Insurance for Company Directors Work?

PMI for company directors functions similarly to individual PMI policies, with a few key differences. Here's how it typically works:

- Choosing a Policy: As a company director, you have the option to purchase PMI either personally (individual policy) or through your business (group policy). Our brokers at WeCovr can guide you through the process of selecting the most suitable option based on your specific circumstances.

- Tailoring Your Coverage: PMI policies offer a range of coverage options, allowing you to tailor your plan to meet your needs and budget. You can choose from various levels of in-patient, out-patient, and additional benefits such as dental, optical, and mental health coverage.

- Claiming and Accessing Treatment: Once you have your PMI policy in place, you can easily claim for eligible treatments and medical expenses. Most insurers provide online portals, mobile apps, or dedicated claims hotlines to streamline the process.

- Receiving Treatment: After your claim is approved, you'll have access to a network of private healthcare facilities, where you can receive prompt treatment from experienced medical professionals. Many policies allow you to choose your preferred hospital and specialist, providing you with greater control over your care.

Types of Private Medical Insurance for Company Directors

As a company director, you have several options when it comes to PMI coverage. At WeCovr, we'll guide you through the following choices:

1. Individual Private Medical Insurance

If you're a sole director or want to provide coverage solely for yourself and your family, an individual PMI policy may be the most suitable option. These policies are tailored to your specific needs and allow for greater flexibility in terms of coverage levels and additional benefits.

2. Small and Medium Enterprise (SME) Health Insurance

For businesses with 3 to 249 employees, an SME health insurance policy is typically recommended. These group policies provide coverage for all eligible employees, including company directors. You'll have the ability to determine the level of coverage offered to different employee groups based on seniority or job roles.

3. Corporate Group Schemes

If your business has more than 250 employees, a corporate group scheme may be the most appropriate choice. These comprehensive policies are often arranged by the human resources team to provide coverage for all employees, including directors.

4. Health Insurance Allowance

Some businesses opt for a different approach by providing employees, including company directors, with a personal health insurance allowance. This allowance is added to their pay, enabling individuals to choose the type of policy and benefits that best suit their needs while avoiding the administration of a large group scheme.

What Does Private Medical Insurance for Company Directors Cover?

PMI policies for company directors typically offer a range of coverage options, including core coverage and optional extras. Let's explore the key elements:

Core Coverage

In-patient and Day-patient Treatment

Most PMI policies cover the costs associated with in-patient and day-patient treatments at private hospitals or clinics. This includes hospital fees, specialist fees, medication, and eligible follow-up rehabilitation.

Cancer Care

Given the prevalence of cancer, most policies include comprehensive cancer care as part of their core coverage. This may involve surgery, chemotherapy, radiotherapy, and access to cutting-edge treatments or breakthrough cancer drugs not yet available through the NHS.

Mental Health Support

Running a business can be stressful, and mental health issues can significantly impact your ability to work effectively. Many PMI policies provide counselling or cognitive behavioural therapy (CBT) sessions as part of their core coverage, without the need for a GP referral, allowing you to access support promptly.

Limited Out-patient Coverage

While comprehensive out-patient treatment is typically an optional extra, many insurers offer limited out-patient coverage as part of their core policies. This may include procedures such as cataract surgery or a fixed sum for an initial consultant appointment and diagnostic tests.

Virtual GP Access

As mentioned earlier, most PMI policies provide 24/7 access to virtual GP services, allowing you to book video or telephone consultations at your convenience. Virtual GPs can provide medical advice, issue private prescriptions, and refer you for further treatment if necessary.

Health Advice Services and Resources

PMI providers often include access to health advice helplines staffed by nurses, pharmacists, physiotherapists, or mental health specialists. Additionally, many insurers offer self-help resources and educational materials to support your well-being.

Optional Extras

While core coverage provides a solid foundation, you may want to enhance your policy with optional extras to suit your specific needs and budget. Here are some common options:

Full Out-patient Coverage

Adding full out-patient coverage to your policy grants you access to a broader range of treatments, including consultant appointments, diagnostic tests, and various out-patient procedures.

Therapies Cover

Many PMI policies offer separate therapies cover, allowing you to tailor your coverage to include treatments such as physiotherapy, osteopathy, chiropractic care, and alternative therapies like acupuncture or homeopathy.

Enhanced Mental Health Treatment

While basic mental health coverage provides access to a limited number of counselling or CBT sessions, you may opt for enhanced mental health treatment to ensure access to a wider range of out-patient and in-patient therapies.

Optical and Dental Cover

If you already pay for private dental care and eye tests, adding optical and dental coverage to your PMI policy can be a cost-effective way to access treatments and reduce expenses. These benefits typically cover regular check-ups, glasses, contact lenses, and dental treatments.

Extended Hospital List

Standard PMI policies often come with a hospital list that excludes facilities in locations with higher treatment costs, such as central London. Adding an extended hospital list can give you access to a broader range of private hospitals, including those in major cities, ensuring you can receive treatment closer to your home or office.

Additional Services for Group Policies

If you opt for a group policy, your insurer may provide additional services to help you manage your policy and your employees' health needs. These services can include educational materials, health and well-being programmes, and support for managing absences and return-to-work strategies.

What Doesn't Private Medical Insurance for Company Directors Cover?

While PMI policies offer comprehensive coverage, it's important to understand the limitations and exclusions. Here are some common exclusions:

- Chronic Conditions: PMI policies typically do not cover the treatment of chronic conditions that require long-term monitoring and management, such as asthma, diabetes, or high blood pressure.

- Pre-existing Conditions: If you have sought medical advice or treatment for a condition within a specific period (usually five years) before purchasing the policy, it may be considered a pre-existing condition and excluded from coverage for the first two years. After remaining symptom-free for a specified period, your insurer may add the condition to your coverage.

- Cosmetic and Weight Loss Treatments: Cosmetic procedures and treatments primarily aimed at weight loss are generally excluded from PMI policies.

- Addiction Treatment: Most PMI policies do not cover treatments related to addiction or substance abuse.

- Self-inflicted Injuries: Injuries resulting from intentional self-harm or attempted suicide are typically excluded from coverage.

- Accident and Emergency Treatment: While PMI policies cover planned treatments, they generally do not cover emergency or accident-related treatments, which should be handled through the NHS.

- Pregnancy and Childbirth: Routine pregnancy and childbirth are often excluded from standard PMI policies, although some insurers may offer additional maternity cover as an optional extra.

- Intensive Care: Some policies may exclude or limit coverage for intensive care treatments or impose specific criteria for eligibility.

- Learning Difficulties, Behavioural, or Developmental Conditions: Treatments related to conditions such as autism, ADHD, or dyslexia are usually not covered under standard PMI policies.

It's essential to carefully review the policy documentation and discuss any specific exclusions or limitations with your WeCovr broker to ensure you understand the scope of your coverage fully.

How Much Does Private Medical Insurance for Company Directors Cost?

The cost of PMI for company directors varies depending on several factors, and it's crucial to obtain multiple quotes to find the most suitable option. Here are some key determinants that insurers consider when calculating premiums:

Individual Policy Factors

- Age: Premiums typically increase with age due to the higher risk of developing health conditions.

- Location: Areas with higher healthcare costs, such as major cities, may result in higher premiums.

- Smoking and Lifestyle Factors: Smokers and individuals engaged in high-risk activities or occupations may face higher premiums.

- Level of Coverage: The extent of coverage you choose, including optional extras, will influence the overall cost.

- Underwriting Method: Full medical underwriting, where you provide detailed medical history, can sometimes result in slightly lower premiums compared to moratorium underwriting.

Group Policy Factors

- Number of Employees: While covering more employees may increase the overall cost, it often reduces the cost per individual due to risk-pooling.

- Age and Health Profile of the Workforce: The average age and overall health status of your employees can impact the premiums.

- Industry and Occupation Risks: Businesses with higher-risk occupations or activities may face elevated premiums due to the increased likelihood of claims.

- Underwriting Method: For larger groups (typically over 15-20 employees), insurers may offer medical history disregarded underwriting, which covers pre-existing conditions but is generally more expensive.

Tax Implications and Professional Advice

It's essential to consider the tax implications when your limited company pays for your PMI policy. While the premiums are an allowable business expense and can be claimed against corporation tax, HMRC treats health coverage as a benefit in kind, meaning you'll need to report it and pay income tax on the value of the benefit. Additionally, you may be liable for class 1a national insurance contributions if you provide employee coverage.

To ensure you make an informed decision and understand the net cost to your business, we strongly recommend seeking professional advice from an accountant or financial advisor. They can guide you on the most tax-efficient way to pay for your PMI, considering factors such as your tax bracket, dividend income, salary structure, and whether you plan to add family members to the policy.

Getting Professional Advice from WeCovr

At WeCovr, we understand that choosing the right PMI policy for your business and personal needs can be a complex process. Our team of experienced brokers is dedicated to providing tailored guidance and helping you navigate the intricacies of PMI coverage.

We'll work closely with you to understand your unique circumstances, assess your requirements, and compare policies from leading insurers to find the best solution that meets your needs and budget. Our brokers don't charge any fees for their services, and you'll receive the same pricing as going directly to an insurer.

Contact us today to schedule a consultation and take the first step towards securing comprehensive private medical insurance for you and your business. Our expert advice will ensure you make an informed decision and enjoy the peace of mind that comes with having access to prompt, high-quality private healthcare.

Disclaimer: The information provided in this guide is general in nature and should not be considered as a substitute for professional advice. What is best for you will depend on your personal and business circumstances. We strongly recommend speaking with a financial advisor or conducting your own research before making a decision regarding private medical insurance.

Switching Your Private Health Insurance? WeCovr Can Help

As a leading insurance broking firm, WeCovr understands that choosing the right private medical insurance (PMI) can be a daunting task. With numerous providers and policies available, it's essential to find the right fit for your specific needs and circumstances. That's where our expertise comes in.

Can You Switch Health Insurance Providers?

Absolutely! At WeCovr, we believe in empowering our clients with the freedom to explore and choose the best PMI options. While there may be certain exceptions, such as being in the middle of a treatment for a serious illness like cancer, switching health insurance providers is generally possible.

Benefits of Switching

Switching to a new health insurance provider can offer various advantages:

- Cost Savings: By comparing quotes from multiple providers, you may be able to find a more cost-effective plan without compromising on coverage.

- Enhanced Coverage: Some providers offer more comprehensive plans with a wider range of benefits and higher coverage limits.

- Access to Preferred Hospitals: Switching may grant you access to a broader network of hospitals and healthcare facilities that better suit your preferences.

- Improved Customer Service: If you're dissatisfied with the service provided by your current insurer, switching can open doors to a provider with a better reputation for customer care.

Potential Drawbacks of Switching

While switching can be advantageous, it's crucial to consider potential drawbacks as well:

- New Exclusions: If you've received medical treatment since taking out your current policy, switching providers may result in new exclusions, meaning your new insurer may not cover certain conditions or treatments that your previous provider did.

- Loss of Existing Benefits: Your new policy may offer different perks, discounts, or benefits than your current plan, potentially resulting in a less favourable overall package.

Reasons for Switching

At WeCovr, we understand that each client has unique circumstances and motivations for considering a switch. Some common reasons include:

- Reducing Premiums: If your current premiums have become too expensive, switching providers may offer a more cost-effective solution.

- Improving Coverage Levels: Perhaps your current plan no longer meets your changing healthcare needs, and you require more comprehensive coverage.

- Seeking Better Perks and Discounts: Some providers offer attractive perks and discounts that may appeal to your specific interests or lifestyle.

- Enhancing Customer Service: If you've experienced unsatisfactory service from your current provider, switching can provide access to a company with a stronger customer service reputation.

Our Approach

At WeCovr, we take a personalised approach to assist you in navigating the complexities of switching health insurance providers. Here's how we can help:

- Understanding Your Circumstances: Our experienced advisors will take the time to understand your current situation, medical history, and future healthcare needs.

- Comprehensive Market Analysis: We'll leverage our extensive knowledge of the PMI market to compare policies from various providers, ensuring you have access to the best options available.

- Underwriting Guidance: We'll guide you through the underwriting process, explaining the different options (moratorium, full medical underwriting, continued moratorium underwriting, and continued personal medical exclusions) and their implications for your specific case.

- Unbiased Advice: As an independent broker, we have no affiliations with any particular provider, allowing us to offer impartial advice tailored to your best interests.

- Seamless Transition: If you decide to switch, we'll handle the entire process, ensuring a smooth transition to your new health insurance provider.

Get Professional Advice

Switching health insurance providers is a significant decision that can impact your healthcare coverage and financial well-being. At WeCovr, we encourage you to seek professional advice to ensure you make an informed choice.

Contact us today to schedule a consultation with one of our experienced advisors. We'll provide you with a comprehensive comparison of quotes and guide you through the process of finding the best PMI solution for your unique needs.

Remember, at WeCovr, your health and peace of mind are our top priorities.

Affordable Health Insurance Explained

Private Medical Insurance (PMI), often misconceived as expensive or unaffordable, can actually yield significant savings compared to direct private treatment costs. At WeCovr, we believe there's a suitable health insurance policy for every budget, and we excel at finding the right one for you.

What is Health Insurance?

Health insurance, also known as private medical insurance (PMI), covers the cost of private healthcare services. It complements the NHS by offering reduced waiting times, access to additional treatments, and enhanced comfort through private hospital rooms and consultant choices.

Factors Affecting Health Insurance Affordability

The affordability of a health insurance policy depends on several variables:

- Level of Cover: Basic policies cover essentials, while comprehensive ones include extras. Choose coverage based on your needs and budget.

- Outpatient Cover: Covers diagnostic tests, consultations, and procedures not requiring a hospital bed. Full outpatient cover increases premiums.

- Extra Treatments: Holistic policies may include physiotherapy, osteopathy, etc., adding to premiums. Opt for optional extras based on your likely usage.

- Dentistry & Optician: Some policies include dental and optician cover, impacting premiums.

- Excess: The amount you agree to pay towards a claim. Higher excess lowers premiums.

- Cancer Cover: Includes access to advanced cancer treatments not widely available through the NHS.

- Mental Health Support: Basic cover often includes digital GP access and mental health support. Optional extras expand mental health coverage.

- Underwriting: Full medical underwriting versus moratorium can affect premiums slightly.

- Payment Frequency: Annual payments may cost less than monthly payments.

How to Obtain Affordable Health Insurance

Our expert advisers assist in finding affordable health insurance tailored to your needs:

- Review cover to ensure relevance.

- Consider reduced or local hospital lists.

- Add a waiting period to the plan.

- Choose a higher excess.

Premium Reduction Options

- Cover Review: Ensure you're not paying for unnecessary features.

- Hospital List: Opt for a reduced or local hospital list.

- Waiting Period: Add a waiting period to the plan.

- Higher Excess: Choose a higher excess for lower premiums.

Additional Information

- 6-Week Option: If the NHS can see you within 6 weeks, treatment will be NHS-based. Otherwise, private treatment is covered.

- Payment Methods: Premiums can be paid monthly or annually via direct debit, BACS, or cheque.

- Cancellation: Insurers offer a cooling-off period for cancellation.

Get a Free Quote

Looking for affordable health insurance? Fill in our quick quote form, and our advisers will search for the best policy to suit your needs and budget.

Don't overlook private medical insurance due to misconceptions about affordability. Affordable policies exist, tailored to individual needs and budgets. Contact our expert advisers today to explore your options and secure peace of mind with accessible health insurance.

The Importance of Dental and Optical Cover: A Comprehensive Guide

Introduction

At WeCovr, we understand that maintaining good dental and optical health is essential for overall well-being. Regular check-ups and preventive care can help identify and address potential issues early on, saving you from costly treatments and complications down the line. However, the expenses associated with dental and optical care can quickly add up, making it challenging for many individuals to access the necessary services. That's where dental and optical insurance or cash plans come into play, providing a safety net and helping you save money on these vital healthcare needs.