👉 Don't delay taking out private health insurance. Get a free consultation to get great affordable cover today!

✅ FREE consultations by our experienced advisers

✅ All the searching and paperwork done for you

✅ Top-notch affordable private health cover and more

✅ Avoid lengthy NHS waiting lists and get back on your feet quicker

✅ Underwritten by UK's leading insurers

Our insurance providers include these major global insurance groups and more:

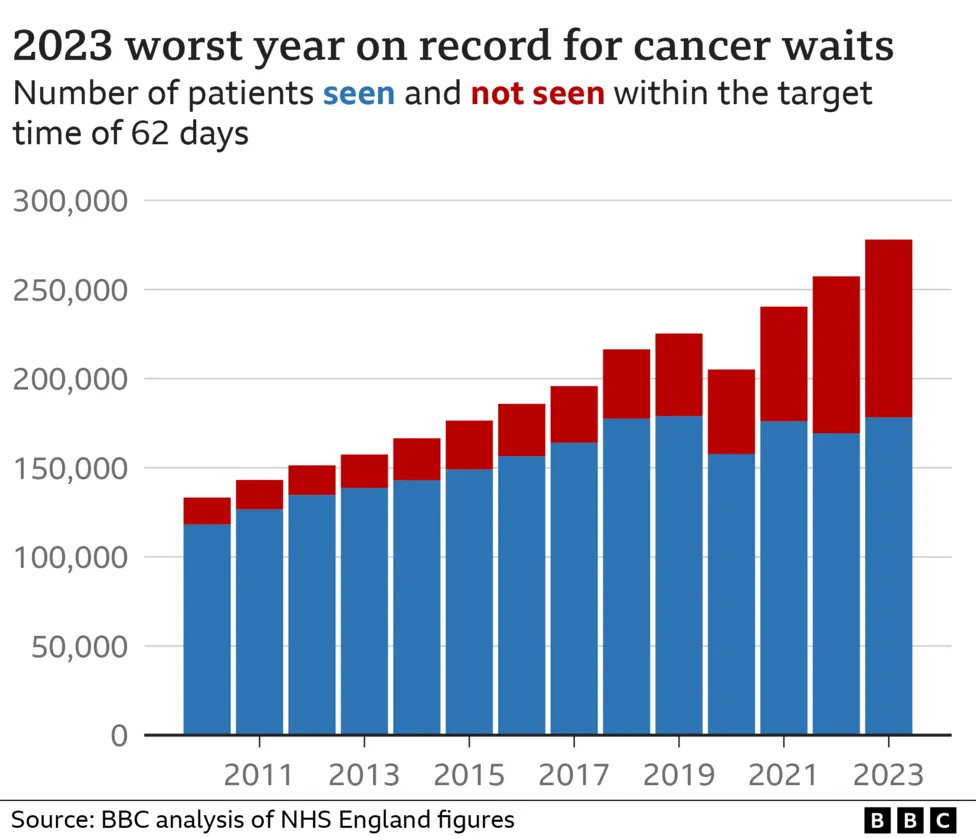

Crisis of Cancer Wait Times in the UK NHS

In 2023, England faced an unprecedented crisis in cancer waiting times, as revealed by a BBC News analysis. The report unveiled alarming statistics, with only 64.1% of patients commencing treatment within 62 days of suspected cancer diagnosis. This article examines the implications of prolonged cancer wait times within the UK's National Health Service (NHS), identifies contributing factors, and advocates for proactive measures to mitigate the crisis.

The Alarming Statistics

- Worst on Record: Cancer waiting times in 2023 reached their lowest point since records began, marking a continuous decline over the past 11 years.

- Patient Impact: Nearly 100,000 individuals experienced delays in life-saving cancer treatments, exacerbating anxieties and uncertainties during an already challenging period.

*source: BBC analysis of NHS England figures

Understanding the Challenges

Several factors contribute to the crisis in cancer wait times:

- Capacity Strain: The NHS faces capacity constraints exacerbated by rising cancer incidence rates and an aging population.

- Resource Allocation: Insufficient resources, including staff and facilities, strain the healthcare system's ability to meet growing demand for cancer care.

Implications for Patient Care

Prolonged cancer wait times have profound implications for patient outcomes and well-being:

- Increased Anxiety: Patients endure prolonged periods of uncertainty, heightening emotional distress and anxiety.

- Delayed Treatment: Delayed access to treatment may compromise treatment efficacy and worsen prognoses for cancer patients.

Systemic Challenges

The crisis in cancer wait times reflects broader systemic challenges within the NHS:

- Workforce Shortages: Staff shortages across healthcare professions contribute to delays in cancer diagnosis and treatment initiation.

- Operational Pressures: Operational inefficiencies and bureaucratic hurdles further impede timely access to cancer care services.

The Urgent Need for Reform

Addressing the crisis in cancer wait times demands comprehensive reform initiatives:

- Investment in Capacity: Increased funding and resource allocation are essential to expand capacity and enhance service provision.

- Streamlined Processes: Efforts to streamline referral pathways and improve care coordination can expedite cancer diagnosis and treatment initiation.

Stakeholder Responses

- Patient Advocacy: Organizations like Macmillan Cancer Support advocate for policy reforms to prioritise cancer care and support affected individuals.

- Government Commitment: NHS England acknowledges the challenges and emphasizes efforts to prioritise urgent cases amidst capacity strains.

Call to Action

The crisis in cancer wait times necessitates immediate action from policymakers, healthcare providers, and stakeholders:

- Policy Reform: Policymakers must prioritise cancer care within national health agendas and implement targeted interventions to improve wait times.

- Collaborative Efforts: Stakeholders across the healthcare continuum must collaborate to address capacity constraints and streamline cancer care pathways.

Conclusion

The crisis in cancer wait times represents a critical juncture for the UK's NHS, underscoring the urgency of systemic reforms to ensure timely access to life-saving cancer care. By prioritising investment, fostering collaboration, and advocating for patient-centered approaches, stakeholders can work together to mitigate the crisis and uphold the NHS's commitment to equitable, quality healthcare for all.

Private Medical Insurance as a Potential Solution

Amidst the challenges facing the NHS, private medical insurance (PMI) emerges as a potential solution to alleviate strain on public healthcare services. PMI offers individuals the option to access timely medical care through private hospitals and clinics, bypassing lengthy wait times prevalent within the NHS.

Both for individuals and whole families, PMI provides peace of mind and expedited access to consultations, diagnostic tests, and treatments, including cancer care. While PMI may not address systemic issues within the NHS, it offers an alternative for individuals seeking prompt medical attention, complementing the public healthcare system and reducing pressure on NHS resources.

Why get private health insurance?

Health insurance allows you get back on your feet quicker:

✅ Avoid long NHS waiting lists of many weeks and get treated faster with private medical insurance, which can be really important for a successful recovery

✅ Get early diagnosis so you can get the treatment you need right away done privately

✅ Business owners can save on their tax bill with private medical insurance

✅ You are free to choose your surgeon or hospital to suit your needs by place and time

✅ You often get a private room with better facilities for your treatment or surgery

✅ With private medical health insurance you gain access to advanced treatments not available on the NHS

Benefits offered by private health insurance

Private medical health insurance is an insurance policy that covers the costs of private healthcare, from diagnosis to treatment. You just pay an affordable monthly premium that covers all or some of the cost of treatment for acute conditions that develop after your health insurance policy has begun.

Our mission is to put you in touch with not only the best, but the most suitable private medical health insurance companies. With even more risk on the rise for personal health today, it makes more sense than ever to have private medical health insurance cover.

👍 Many people are very thankful that they had their private medical health insurance cover in place before running into some serious health issues. Private medical health insurance is as important as life insurance for protecting your family's finances.

Our mission is to put you in touch with not only the best, but the most suitable private medical health insurance companies. With even more risk on the rise for personal health today, it makes more sense than ever to have private medical health insurance cover.

👍 Many people are very thankful that they had their private medical health insurance cover in place before running into some serious health issues. Private medical health insurance is as important as life insurance for protecting your family's finances.

Important Fact!

There is no need to wait until the renewal of your current policy.

We can look at a more suitable option mid-term!

We can look at a more suitable option mid-term!

Why increasing numbers of individuals and families opt for PMI insurance

👉 We insure our cars, houses, bicycles and even bags! Yet our health is one the most precious things we have.

People buy life, critical illness and private medical health insurance for a variety of reasons – easily one of the most important insurance purchases an individual or family can make in their lifetime. PMI insurance is still seen as a luxury in the UK. Indeed, only around 11% of the population has private medical insurance. However, an increasing number of people are taking out private medical insurance due to a number of reasons:

👍 Simply get your affordable private medical health insurance plan in place for the necessary peace of mind! Just tap or click the button below to book a FREE call now! 👇

People buy life, critical illness and private medical health insurance for a variety of reasons – easily one of the most important insurance purchases an individual or family can make in their lifetime. PMI insurance is still seen as a luxury in the UK. Indeed, only around 11% of the population has private medical insurance. However, an increasing number of people are taking out private medical insurance due to a number of reasons:

- Avoid NHS waiting lists and be treated more quickly

- Faster diagnosis (comprehensive cover)

- More access to latest cancer drugs and treatments, some of which may be unavailable on the NHS

- Greater choice over where and when your treatment takes place

- Have a private room should you need treatment in hospital

👍 Simply get your affordable private medical health insurance plan in place for the necessary peace of mind! Just tap or click the button below to book a FREE call now! 👇

Compare private medical health insurance plans suitable for your circumstances from these insurers and more

It's as easy as 1, 2, 3!

1. Complete a brief form

2. Our experts will find and discuss your quotes

3. Enjoy your protection!

Any questions?

Learn more about private health insurance

Who Are WeCovr?

WeCovr is an insurance specialist for people valuing their peace of mind and a great service.👍 WeCovr will help you get your life insurance, critical illness insurance, private medical health insurance, over-50s funeral insurance and senior life insurance quote in no time thanks to our wonderful super-friendly expert partners ready to assist you every step of the way.

Just a quick and simple form and an easy conversation with our FCA-authorised life insurance, critical illness insurance and private medical insurance partner experts and your valuable insurance policy is in place for that needed peace of mind!