Empower Your Workforce: Why Offering Private Medical Insurance is a Smart Investment

Executive Summary

Private Medical Insurance (PMI) is becoming an essential tool for businesses to support employee health, boost productivity, and enhance company reputation. This article explores the benefits of offering PMI, including directors' and employees' faster access to healthcare, improved employee satisfaction, and stronger employer branding. We'll discuss how PMI can address long NHS waiting times, provide better healthcare choices for employees, and strengthen your company's brand as an employer of choice.

Introduction: The Value of Private Medical Insurance for Your Workforce

Investing in your employees' health with Private Medical Insurance (PMI) is a game-changer for business directors, your team and your business overall. When you and your colleagues have access to swift, high-quality healthcare, you recover and return to your best selves faster, keeping productivity high and downtime low. Supporting your employees' well-being with PMI not only shows you care but also fuels a more dynamic, resilient, and successful company.

Research from employee benefits company Zest found that 32% of employees rank PMI ahead of other employee benefits.

This highlights the growing demand for comprehensive healthcare support in the workplace. Offering PMI to employees not only meets this demand but also positions your company as an employer of choice.

Long NHS Waiting Hours: Getting Your Workers Back to Work Faster

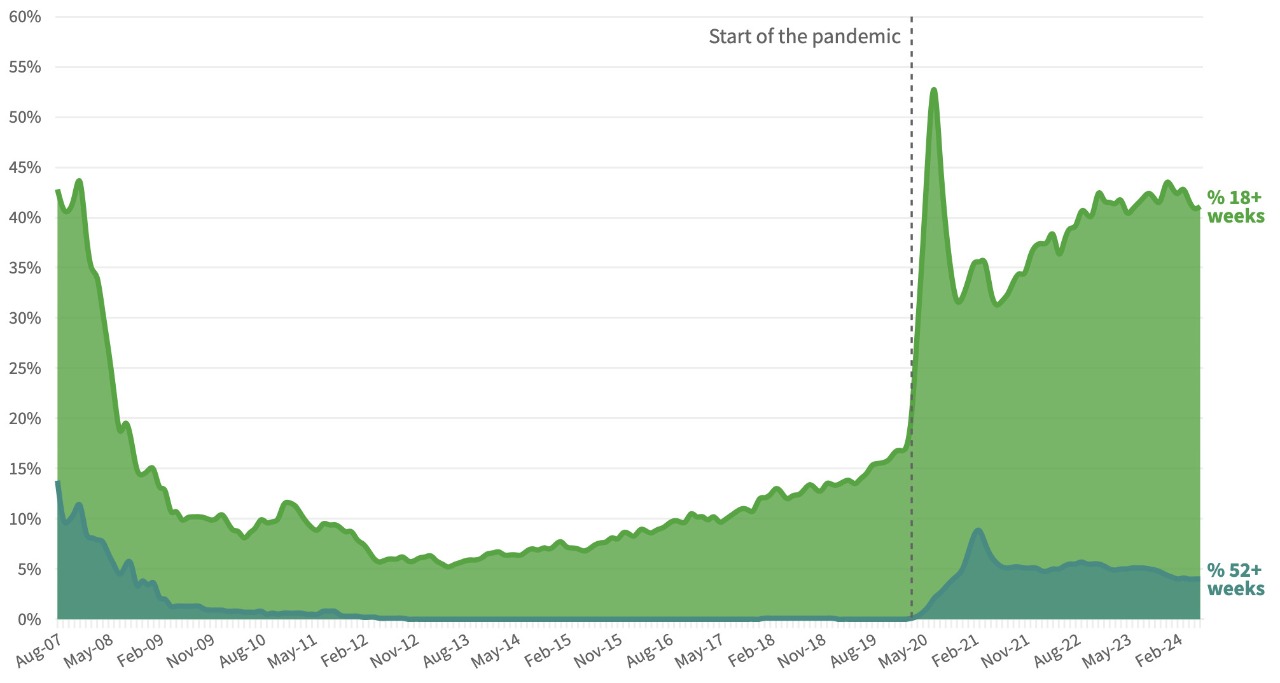

The NHS waiting list has ballooned to 41% of patients being on an 18+ week wait as of June 2024. Steve Sully, regional director at Robert Half, highlighted the impact of these delays, stating, "The NHS issues and subsequent concerns around access to healthcare treatment are clearly playing on the minds of the UK workforce."

Figure 1: NHS England Referral to Treatment Waiting Times (Source: BMA analysis)

Figure 1: NHS England Referral to Treatment Waiting Times (Source: BMA analysis)

Let's face it, waiting for healthcare these days can feel like waiting for a kettle to boil, except it never quite whistles! These lengthy delays can be tough on employees, who find it increasingly difficult to return to work quickly. It can feel like they have been stuck on the bench while everyone else plays the game.

This is where PMI makes a difference. With PMI, employees have quicker access to a range of healthcare services, including:

- Online GP appointments

- Faster specialist consultations

- Prompt diagnostic tests

- Timely treatments

This means they can start their journey to recovery much faster and be back at their desks before the office plant has a chance to wilt.

By offering PMI, you are not just ensuring your team gets the care they need more promptly; you are also boosting their productivity and morale. It's a clear win-win for everyone.

Enhanced Healthcare Options: Empowering Employee Choice

Offering private medical insurance (PMI) provides your employees with significant autonomy and access to a range of benefits that go beyond what the NHS typically offers. With PMI, employees have:

- The freedom to choose their healthcare providers

- Flexibility to schedule appointments at their convenience

- Access to high-quality facilities with private rooms and modern amenities

- Options to select their hospital and treatment options

- Prompt consultations and tests without long waits

- Access to treatments and medications not always covered by the NHS (depending on their insurance plan)

Figure 2: Example of a private room in a Nuffield Health facility

Figure 2: Example of a private room in a Nuffield Health facility

While the NHS provides essential services, private medical insurance empowers employees with a higher level of choice and comfort. By offering PMI, you give your staff control over their healthcare journey, enhancing their overall experience and satisfaction. This means you can be confident that they are receiving excellent care tailored to their needs.

Strengthening Employer Branding and Retention

Private medical insurance provides employees with the assurance that their health needs are well managed, fostering a workplace culture of care and well-being. This not only enhances the work environment but also significantly contributes to employee retention. Many staff members place a high value on healthcare benefits as part of their compensation package, making them less inclined to leave a company that prioritises their health and well-being. After all, when the workplace becomes a second home, you want to make sure it's a healthy one!

Offering private medical insurance is not just about safeguarding your employees' health. It's also about giving your business a reputation boost, as it shows you genuinely value your team's well-being. And who wouldn't want to work for a company that is as committed to their employees' health as they are to keeping the office coffee machine well-stocked?

Implementing PMI: Considerations and Challenges

While the benefits of PMI are clear, there are some factors to consider:

- Cost: PMI can be a significant investment, especially for smaller businesses.

- Coverage options: Deciding on the level of coverage and which treatments to include.

- Employee education: Ensuring staff understand and make the most of their PMI benefits.

- Integration with existing benefits: Aligning PMI with other health and wellness initiatives.

Frequently Asked Questions

-

Q: Is PMI worth the investment for small businesses? A: While costs can be higher for smaller companies, the benefits in terms of employee health, productivity, and retention often outweigh the investment.

-

Q: How can we measure the ROI of implementing PMI? A: Track metrics such as employee sick days, retention rates, and satisfaction scores before and after implementing PMI.

-

Q: Will offering PMI affect our employees' use of NHS services? A: PMI typically complements rather than replaces NHS services, giving employees more options for their healthcare needs.

WeCovr Can Help: Your Partner in Employee Health

Investing in private medical insurance (PMI) is a smart choice for your company. It reduces absenteeism by providing faster access to healthcare, boosts your brand's reputation by showing commitment to employee well-being, and ensures high-quality care for your staff. In short, PMI enhances both productivity and employee satisfaction, making your business a more attractive place to work.

Additionally, WeCovr can guide you through implementing salary sacrifice schemes for PMI, offering potential tax advantages for both employers and employees. Despite changes in tax legislation, salary sacrifice remains a valuable tool for promoting employee well-being and financial security. By sacrificing a portion of their pre-tax salary, employees can fund their health insurance premiums while potentially reducing their National Insurance contributions.

This arrangement not only empowers employees to prioritise their health but also enhances their overall financial well-being. We can help you navigate the complexities of these arrangements, highlighting areas of compliance with current regulations and maximising the benefits for your organisation and staff.

At WeCovr, we are dedicated to offering our customers the best value with the highest quality. Our expert agents will find the ideal package for your business, ensuring you get the most comprehensive coverage within your budget.

Take Action Now

Contact us today for a free consultation and receive a complimentary health benefits analysis for your company. Let us help you take the first step towards a healthier, more productive workforce.

Get in touch with us today - tap on one of the buttons below to get started!

Invest in your employees' health and your company's future today.

Understanding Private Health Insurance: A Comprehensive Guide

Why private medical insurance and how does it work?

What is Private Medical Insurance?

Private medical insurance (PMI) is a type of health insurance that provides access to private healthcare services in the UK. It covers the cost of private medical treatment, allowing you to bypass NHS waiting lists and receive faster, more convenient care.How does it work?

Private medical insurance works by paying for your private healthcare costs. When you need treatment, you can choose to go private and your insurance will cover the costs, subject to your policy terms and conditions. This can include:• Private consultations with specialists

• Private hospital treatment and surgery

• Diagnostic tests and scans

• Physiotherapy and rehabilitation

• Mental health treatment

Your premium depends on factors like your age, health, occupation, and the level of cover you choose. Most policies offer different levels of cover, from basic to comprehensive, allowing you to tailor the policy to your needs and budget.

Questions to ask yourself regarding private medical insurance

Just ask yourself:👉 Are you concerned about NHS waiting times for treatment?

👉 Would you prefer to choose your own consultant and hospital?

👉 Do you want faster access to diagnostic tests and scans?

👉 Would you like private hospital accommodation and better food?

👉 Do you want to avoid the stress of NHS waiting lists?

Many people don't realise that private medical insurance is more affordable than they think, especially when you consider the value of faster treatment and better facilities. A great insurance policy can provide peace of mind and ensure you receive the care you need when you need it.

Benefits offered by private medical insurance

Private medical insurance provides numerous benefits that can significantly improve your healthcare experience and outcomes:Faster Access to Treatment

One of the biggest advantages is avoiding NHS waiting lists. While the NHS provides excellent care, waiting times can be lengthy. With private medical insurance, you can often receive treatment within days or weeks rather than months.

Choice of Consultant and Hospital

You can choose your preferred consultant and hospital, giving you more control over your healthcare journey. This is particularly important for complex treatments where you want a specific specialist.

Better Facilities and Accommodation

Private hospitals typically offer superior facilities, including private rooms, better food, and more comfortable surroundings. This can make your recovery more pleasant and potentially faster.

Advanced Treatments

Private medical insurance often covers treatments and medications not available on the NHS, giving you access to the latest medical advances and technologies.

Mental Health Support

Many policies include comprehensive mental health coverage, providing faster access to therapy and psychiatric care when needed.

Tax Benefits for Business Owners

If you're self-employed or a business owner, private medical insurance premiums can be tax-deductible, making it a cost-effective way to protect your health and your business.

Peace of Mind

Knowing you have access to private healthcare when you need it provides invaluable peace of mind, especially for those with ongoing health conditions or concerns about NHS capacity.

Private medical insurance is particularly valuable for those who want to take control of their healthcare journey and ensure they receive the best possible treatment when they need it most.

Important Fact!

We can look at a more suitable option mid-term!

Why is it important to get private medical insurance early?

👉 Many people are very thankful that they had their private medical insurance cover in place before running into some serious health issues. Private medical insurance is as important as life insurance for protecting your family's finances.👉 We insure our cars, houses, and even our phones! Yet our health is the most precious thing we have.

Easily one of the most important insurance purchases an individual or family can make in their lifetime, the decision to buy private medical insurance can be made much simpler with the help of FCA-authorised advisers. They are the specialists who do the searching and analysis helping people choose between various types of private medical insurance policies available in the market, including different levels of cover and policy types most suitable to the client's individual circumstances.

It certainly won't do any harm if you speak with one of our experienced insurance experts who are passionate about advising people on financial matters related to private medical insurance and are keen to provide you with a free consultation.

You can discuss with them in detail what affordable private medical insurance plan for the necessary peace of mind they would recommend! WeCovr works with some of the best advisers in the market.

By tapping the button below, you can book a free call with them in less than 30 seconds right now:

Our Group Is Proud To Have Issued 800,000+ Policies!

We've established collaboration agreements with leading insurance groups to create tailored coverage

How It Works

1. Complete a brief form

2. Our experts analyse your information and find you best quotes

3. Enjoy your protection!

Any questions?

Learn more

Who Are WeCovr?

WeCovr is an insurance specialist for people valuing their peace of mind and a great service.👍 WeCovr will help you get your private medical insurance, life insurance, critical illness insurance and others in no time thanks to our wonderful super-friendly experts ready to assist you every step of the way.

Just a quick and simple form and an easy conversation with one of our experts and your valuable insurance policy is in place for that needed peace of mind!